Shipping Bonds Take Speed amid Market Turmoil

More shipping companies in Asia are taking a closer look at the variety of bond instruments, ranging from conventional straight bonds to more innovative “dim sum bonds” and perpetual bonds, despite the uncertainties and volatility revolving around the global economy.

Following the successful closing of China Shipping Development’s RMB 3.95 billion (USD 602 million) convertible bond issue in August, another major Chinese conglomerate is planning to tap the bond market in a big way. China COSCO Holdings – the flagship listed entity of COSCO Group is planning to raise not more than USD 2 billion worth of bonds. There are however some distinct differences in strategy between the two largest shipping companies in China. Unlike China Shipping Development whose bond offering was made available exclusively to Chinese domestic investors, China COSCO has clearly international investors in mind. The company will be setting up an offshore wholly owned subsidiary for the offering and provide corporate guarantee for the bonds, subjected to the approval of shareholders. Continue Reading

China Shipping Development Completes Mega Bond Issue

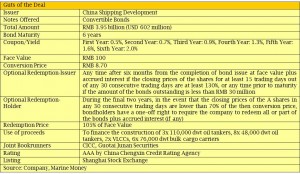

Hong Kong and Shanghai listed China Shipping Development has completed a RMB 3.95 billion (USD 602 million) convertible bond issue that could be the largest convertible offering by an Asian shipping company ever. The oil and bulk carrier division of state-owned China Shipping Group plans to make use of the six year bond proceeds to finance the construction of 19 new buildings – namely three 110,000 dwt oil tankers, eight 48,000 dwt oil tankers, two VLCCs and six 76,000 dwt bulk cargo carriers.

The offering was made available exclusively to Chinese investors and existing holders of its Shanghai listed shares or “A” shares were given preferential rights to subscribe for the bonds. The convertibles pay investors variable coupons ranging between 0.5% and 2% throughout the tenure and will be listed on the Shanghai Stock Exchange. CICC and Guotai Junan Securities were the appointed arrangers. We provide the guts of the deal in the accompanying table.

China Rongsheng Inks Yet Another Massive Credit Facility

China Rongsheng has never failed to impress us with its ability to secure massive credit facilities from international and domestic lenders. Shortly after sealing a USD 220 million syndicated facility led by bookrunner Credit Agricole, the non-state owned shipbuilder has signed a credit facility with Agricultural Bank of China (“ABC”). This is the second credit facility that the shipbuilder has signed with the Chinese lender.

In the latest arrangement, ABC will provide China Rongsheng with a RMB 28 billion (USD 4.4 billion) facility, out of which RMB 20 billion (USD 3.1 billion) will go towards the development of its shipbuilding and marine engineering divisions while the rest of the funds will be used to invest in its machinery division. If we tally up the figures, China Rongsheng has raised USD 6.3 billion of debt so far this year. That is mind boggling, given the weakening industry outlook and severe challenges faced by the shipbuilding industry. To date, China Rongsheng has an orderbook of USD 6.8 billion.

CMB Leasing Signs Leasing Agreement with Hunan Ocean Shipping

China Merchants Bank (“CMB”) Leasing has signed a RMB 800 million (USD 124 million) leasing agreement with Hunan Ocean Shipping for the financing of four 76,000 dwt panamax bulk carriers to be built at CSSC Guangzhou Huangpu Shipbuilding. The transaction is said to be groundbreaking, as this is the very first time that a bank-affiliated ship leasing company has agreed to acquire ships directly from shipbuilder. The ships will be subsequently bareboat chartered to its lessee upon delivery. Hunan Ocean Shipping currently owns 16 vessels of over 203,000 dwt.

STX Pan Ocean Raises USD 384 million Debt

In today’s credit market, banks are increasingly conservative in their lending and as a result, export credit agencies provide the necessary credit enhancement to turn large deals into a reality. South Korea’s STX Pan Ocean has recently been tremendous successful in tapping the two largest export credit insurers in Asia, K-Sure and Sinosure for the financing of three VLOCs and three capsize bulk carriers.

In the first transaction, Norddeutsche Landesbank Girozentrale (“NordLB”) and Banco Santander S.A. have teamed up with K-Sure to provide a pre and post delivery loan facility of up to USD 247.2 million to part finance the acquisition cost in relation to three 400,000 dwt Very Large Ore Carriers presently being constructed by STX Offshore & Shipbuilding. The vessels will upon delivery be bareboat chartered to STX Pan Ocean and will be subject to certain long term time-charter arrangements with Vale International S.A. Continue Reading

GMF Closes Two Shipping Funds

Korean shipping fund arranger Global Marine Financing (“GMF”) has recently launched two time-chartered based shipping funds under the Ship Investment Company scheme (“SIC structure”) in South Korea, together with Mirae Asset Securities. The two ship funds named Badaro No. 17 and Badaro No. 18 have raised about USD 46 million each and will be investing in two 82,000 dwt Kamsarmax bulk carriers that are currently under construction at Sundong Shipbuilding & Marine Engineering. We understand that the structure is highly sophisticated which involves non-deliverable forwards to hedge currency risks and index-floating time charter contracts with the world’s largest grain company, Cargill.

There is an increasing pool of investors in Korea who are taking the view that there are real investment opportunities in the shipping sector. Many of them are willing to invest a significant chunk of equity, which makes projects viable for offshore banks from a loan to value ratio perspective. According to GMF, major investors to the funds include leading Korean institutional investors. Two of GMF’s shareholders, Mirae Asset and Samsung C&T, were not just investors in the two funds but also played vital roles in the deal making process. Mirae Asset Securities raised equity from its excellent network of institutional investors while Samsung C&T was instrumental in sealing the time-time charter contracts with Cargill. Continue Reading

A Shrewd Move? Dongfang Shipbuilder Lists on London AIM

On Monday, news of Dongfang Shipbuilding Group’s debut on the London AIM took the market by surprise, in a deal put together by nominated advisor and broker Northland Capital Partners. Even though the Chinese shipbuilder did not raise any new capital in the public listing amidst all the gloom, this transaction certainly merits some attention. Why would a company list without raising any money, especially during this period of uncertainty?

There are pragmatic reasons for the small Chinese shipbuilder to list on the London AIM. Perhaps the most obvious reason would be that it gives the shipbuilder the ready access to capital markets in the future. As capital becomes increasingly scarce and Chinese lenders prefer to support its larger competitors, some analysts argue say it is astute for a small shipbuilder like Dongfang Shipbuilding to start laying down the groundwork and expand its funding options. Continue Reading

COSCO Corp Suffers Analyst Downgrades

Last week, Singapore listed COSCO Corporation suffered multiple analyst downgrades from major securities houses. Analysts were largely disappointed by the weak 2Q11 net earnings and flagged concerns over demand, risk of order cancellations and delivery delays. BNP Paribas Brenda Lee pointed out that even though turnover in 2Q11 was up 3% year-over-year but net profit was down 53% year-over-year to SGD 31.9 million (USD 26 million). The poor operating performance, attributed largely to sliding margins for offshore engineering, shipbuilding, ship repair and conversion, was also aggravated by a higher tax rate due to lower tax-exempt shipping profits and lower deferred benefits.

CIMB Analyst Lim Siew Khee warned that given COSCO’s lack of experience in turnkey offshore projects (including deepwater drillships, tender rigs and jack-up rigs), margins are expected to remain low. “We fear that a history of provisions for lossmaking contracts in shipbuilding could repeat themselves in offshore as these provisions typically surface after projects have reached substantial completion,” she added. Meanwhile, DBS Analyst Janice Chua pointed out that the Chinese shipbuilder will face rising cost and currency pressure. Based on her sensitivity analysis, every 1% increase in steel cost and RMB appreciation could decrease Cosco’s bottomline by 1% and 2.2% respectively. Recent news of Cosco’s Norwegian client Sevan Marine’s potential bankruptcy also fuelled more fears among investors who were already worried about weak orderbook growth and rising costs. Sevan now accounts for 22% of COSCO’s order book, with 3 deep water drilling rigs.

China Rongsheng Heavy Secures USD 220 million Syndication Loan

Hong Kong listed Chinese shipbuilder China Rongsheng Heavy Industries has successfully closed its first ever overseas dollar denominated syndicated loan transaction of USD 220 million, led by bookrunner Credit Agricole. The successful closing of facility has strategic importance to non-state owned shipbuilder, given the tighter regulations and capital controls imposed by the central government on the Chinese lenders. The Import-Export Bank of China (“China Exim”) played an instrumental role in this syndicated transaction as a guarantor for the facility and according to sources, over 10 overseas banks participated in this deal.

The latest and maiden foray into the international syndication market marks an important milestone in its history as the shipbuilder seeks to diversify its funding sources and reduce its exposure to RMB loans. No other non-state owned shipbuilder in China has been as successful as Rongsheng when it comes to securing debt from the Chinese lenders. In 2010, Rongsheng entered into a number of strategic cooperation agreements with Bank of China, China Eximbank, Agricultural Bank of China and China Everbright Bank with a total credit line of up to RMB 118 billion (USD 18.5 billion)! In June, Rongsheng also inked a RMB 11 billion (USD 1.7 billion) credit line from China CITIC Bank.

Shandong Ocean Investment Signs RMB 20 billion Credit Facility

Chinese State-owned Shangdong Ocean Investment Company (“SOIC”) has signed a RMB 20 billion (USD 3.1 billion) credit facility with Agricultural Bank of China to unlock Shandong province’s potential in the marine sector. According to overseas media reports, the investment company has secured funding commitments of over USD 323 million from various local and foreign financial institutions, and has since placed orders for seven newbuildings of a total 786,000 dwt with a number of Chinese shipbuilders. The ships are scheduled for delivery between September 2011 and October 2013. Earlier in March, the local government-backed firm has also acquired an 82,000 dwt Kamsarmax bulker for its shipping division, Shandong Marine.

The investment firm is currently working on a “blue marine fund” of a target size of RMB 30 billion (USD 4.7 billion) to bolster its financial position. The fund hopes to collect at least RMB 8 billion (USD 1.25 billion) in the first round of fundraising and is waiting for the approval from the National Development and Reform Commission. Proceeds will be used largely to invest in shipping and logistic assets, marine equipment manufacturing, marine bio-resources and eco-tourism.