Evergreen Marine Inks USD 824 million from Taiwanese lenders

Asian banks, including those based in Southeast Asia, continue to have an appetite for shipping and offshore, but capital is likely to be reserved for the domestic names in their respective countries. Taiwan based Evergreen Marine has announced that it has signed a USD 824 million syndicated loan agreement with nine domestic banks to fund the construction of ten 8,000 TEU post-panamax containerships ordered at Taiwanese shipbuilder CSBC Corp for USD 1.03 billion. The syndicated loan, payable over ten years, was arranged by Bank of Taiwan, Land Bank of Taiwan, Taiwan Cooperative Bank, Taipei Fubon Commercial Bank, E.Sun Commercial Bank, and four other undisclosed financial institutions. The ships are scheduled for delivery between 2013 and 2015.

Precious Shipping Signs USD 106 million Shipping Loan

Despite the current turmoil in the financial markets, Precious Shipping has secured a USD 85 million pre and post-delivery term loan facility from ING Bank and DnB NOR Bank for the financing of four new 57,000 dwt supramaxes. The facility will provide financing of up to 80% of the total acquisition cost of USD 106.2 million, a high loan to value ratio in today’s market. Precious Shipping has previously acquired the shipbuilding contracts last December from the Oswal Group Global, a Singapore based company owned by embattled Australian industrialist Pankaj Oswal.

The ships are believed to be the last of a series of nine supramaxes ordered at Yangzhou Guoyu Shipbuilding by Maruti Shipping, established by Mr. Oswal in 2007. In March 2010, Maruti Shipping took the market by surprise when it committed USD 320 million to invest in nine supramax newbuildings. Plans to take delivery of the vessels were unexpectedly derailed earlier this year when allegations were made against Mr. Oswal that he had used funds from his 65% owned Burrup Fertilisers to pay for Maruti’s expenses. Oswal’s Burrup was subsequently placed into receivership when it could no longer service outstanding debt of USD 800 million owed to ANZ. Subsequent reports suggested that Maruti Shipping had attempted to seek loans from major international banks to refinance its ship orders in Singapore, but to no avail. Continue Reading

Sinotrans Shipping Marks Maiden RMB Bond Issue

Sinotrans Shipping Inc has closed the first ever offshore RMB denominated bonds issued ever by a shipping company. The wholly owned listed subsidiary of state-owned Sinotrans & CSC Group was able to generate sufficient demand for the offering, despite the deepening debt crisis in the Western hemisphere. The bookrunners Bank of China (Hong Kong), Bank of China International (“BOCI Asia”), Agricultural Bank of China and Wing Lung Bank were able to price the three year RMB 2.6 billion (USD 408 million) bonds to yield 3.3% within a few hours, and the rapid bookbuilding exercise was deliberate to minimise execution risk amid the volatile markets.

The closing of the offering suggests that there is still appetite for dim sum bonds, although we note that Sinotrans & CSC Group’s very own listed subsidiary in Hong Kong, Sinotrans Shipping Limited, had played a role in the success. Sinotrans Shipping Limited subscribed 10.8% of the total offering or an equivalent of RMB 280 million worth of bonds. According to Sinotrans Shipping Limited, the investment in Sinotrans Shipping Inc bonds will provide a stable return under the current market condition, compared to holding on to excess cash in a low interest rate environment. We would highlight that the guarantor for the notes, Sinotrans Shipping (Holdings), is also a major shareholder of Sinotrans Shipping Limited.

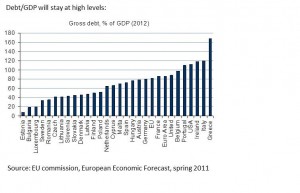

Politicians Can’t Agree on Debt? Neither Can Economists

The global economy is seriously ill, and time is running out for politicians and economists to come up with solutions to solve the problems in the West. In July, the New York Times ran an article discussing the wide ranging disagreements among economists despite decades of intensive research. In short, economists broadly agree that government borrowings must be kept in check, but they cannot reach a consensus over the proper mix of tax increases and spending cuts. The key point of contention lies in whether the government should pay any part of its debts by raising revenue, or solely by spending less during troubled times. Tax increases help reduce budget deficits but have undesirable powerful negative effect on investment and disposable income, resulting in slower economic growth.

The lack of definitive answers simply reflect that economics cannot be as precise a science as physics, and economists will continue to bicker over any solution to the deepening sovereign debt crisis. Andy Mukherjee, a financial columnist in a recent article published in the Straits Times, describes the different camps among economists plainly as either those with Paul Krugman and a few like-minded economists of deep Keynesian persuasion (i.e. the view that countries should focus on stimulating the real economy, and not be overly obsessed with debt reduction), or their enemy. There is no middle ground. Keynesian or not, we were very privileged over the past few weeks to listen to a number of reputable economists here in Singapore and we thank our friends at the Norwegian Business Association, Nordea Bank and RS Platou for the opportunity. To begin with, is the world in a global debt crisis? The economists do not have a consensus. Continue Reading

Courage Marine Completes Dual Listing

Last Friday, Taiwanese dry bulk owner Courage Marine completed its dual listing process in Hong Kong, six years after its IPO in Singapore. Although no additional proceeds were raised through this exercise, the management believes that the dual listing would provide ready access to these different equity markets in Asia Pacific region when the opportunity arises. More than 60% of the company shares were transferred over to the Hong Kong Stock Exchange prior to the dual listing. China’s second-biggest publicly traded brokerage Haitong Securities was the appointed securities house for the secondary listing.

Courage Marine owns and operates nine dry bulk vessels, including one Capesize vessel, four Panamax vessels, two Handymax vessels and two Handysize vessels with a total carrying capacity of approximately 577,000 dwt.

China Rongsheng Heavy Industries Inks Massive USD 1.7 billion Credit Line

We toss around figures like millions and billions so often in our newsletter, but the bulk of the billion-dollar deals really just revolve around China. Just as Yangzijiang concluded a USD 1 billion cooperative framework agreement with Peter Döhle and China Development Bank, another major privately owned Chinese shipbuilder China Rongsheng Heavy Industries has secured a massive RMB 11 billion (USD 1.7 billion) credit line from China CITIC Bank during the same week.

Monetary policy in China is finally normalising after two years of very loose monetary policy and moving forward, tighter regulations and capital controls imposed by the central government will continue to pose challenges for Chinese lenders and affect the liquidity level they have for shipping and shipbuilding. Since 2010, the Central bank has raised the reserve requirement ratio twelve times and according to some industry estimates, as much as RMB 4,140 billion (USD 640 billion) of capital could have already been withdrawn from the market.

The fine-tuning of reserve requirements for individual banks and interest rate hikes have already led to rapidly falling lending and money growth, and we believe the market has not seen the full cumulative impact of the past and possibly further monetary tightening in China. But for now, the credit constraints at the macro-level do not seem to affect the level of support well-established Chinese shipbuilders enjoy from their domestic lenders.

Under such challenging credit tightening conditions, the grant of credit to China Rongsheng Heavy Industries is certainly seen as a vote of confidence in the shipbuilder’s capabilities. RMB 9 billion (USD 1.39 billion) has been earmarked for the construction of a world-class shipbuilding and offshore engineering base and the remaining RMB 2 billion (USD 309 million) will go towards the development of China Rongsheng’s engineering machinery and marine engine building segments.

Stress in financial markets and implications for interest rates

Contributed by Claus Jahn Paulsen, Chief Sales Manager, Nordea Markets Singapore

Uncertainty – the new normal

The world looks more uncertain than ever, from an economic and not least a political perspective, at this moment in time. The US economy itself is providing mixed signals. Hard data still show sluggish growth, but several forward-looking economic indicators are signalling increased danger of the US economy falling back into recession. In addition, political uncertainty is high, demonstrated in the US by the ongoing fight between Democrats and Republicans over the budget and the debt ceiling debate and the subsequent downgrade of US debt by S&P.

Ongoing debt crisis in Europe

Financial markets tend not to like the combination of economic and political uncertainty. This is clearly the case in Europe right now, where a Greek tragedy is unfolding. Austerity measures are the new normal, not only in Greece, but across the whole Euro zone, as politicians struggle to contain the European debt crisis and prevent the crisis from spreading to the core of Europe.

Cautious Mood at Marine Money Asia Week, Singapore

Marine Money Asia week closed last week on a somewhat cautious note, as over 490 participants went home with a less optimistic outlook on the shipping markets, global economy and banking sectors compared to a year before. The message we came away with is that caution rules with difficult shipping markets projected over the next two years which leads to tightening of financing and challenging operational conditions. Demand remains robust but simply overwhelmed by the supply of new vessels and the real “risk” factor of excessive shipyard capacity. Those with access to capital may be able to identify attractive investment potential but structured deals with strong counter parties and term employment are the ingredients in demand.

From Dr. Marc Faber’s assertions that money value is controlled by evil governments from the very beginning and we should all consider holding a little gold in our personal portfolio, to worrisome comments on the European banking crisis and the possible repercussions that it could have on ship financing in this part of the world, and a public comment made by NordLB’s Dr. Klaus Stoltenberg that European banks should expect to own more vessels themselves, there are really not many bright spots in the world we live in today, save offshore oil and gas and LNG sectors. Continue Reading

Sanko Steamship secures post-delivery financing from ING

ING Bank, as commercial lender, and Norwegian export credit agency Eksportfinans ASA, as buyer credit lender, have provided Sanko Steamship a JPY10.98 billion (USD 143.2 million) post delivery financing for the acquisition of three newbuilding platform supply vessels. The platform supply vessels will be constructed at Universal Shipbuilding Corporation in Japan. The Singapore office of Watson, Farley & Williams LLP acted as advisors to the lenders.

DnB NOR looks at Chinese deals

DnB NOR Bank and China Exim bank have jointly provided an eight year USD 147 million term loan to Nan Yi Maritime and Nan Sia Maritime last month. The loan, secured by a first preferred mortgage over the vessels, will be used for the pre and post delivery financing of two VLCCs. In another transaction concluded in August, DnB NOR provided a three year USD 100 million term loan to COSCO Container Lines. This loan is secured in full by a bank guarantee from Bank of Communications and will be used to fund working capital.