Notes from Japan: Sailing into Sunset Waters

Three years of bullish yen have exacerbated the woes of Japanese shipowners who are already struggling with the weak shipping market and soaring operating costs. In the aftermath of the earthquake and tsunami, yen has soared to near record highs amid Europe’s debt issues and uncertainties around United States’ economic recovery. While it may appear counterintuitive that the currency of debt-ridden Japan is treated as a safe bet in times of crises, investors take comfort that 95% of the nation’s debt is consumed domestically, interest rate on it is extremely low and inflation is non-existent. Furthermore, Japan’s very large debt burden has traditionally been financed by very strong household savings, even though the country has seen a significant decline in savings rates over the past decade.

We recently visited several shipping companies, trading houses and banks in Tokyo and found the general mood surprising bleak. The market is bracing itself for a spate of foreclosures in 2012 if the situation does not drastically change. And nobody is confident of any positive change. As yen hovers around JPY 76/dollar, there are increasing doubts that private owners will be able to sustain another year at these rates. A stronger yen bites into the balance sheets of Japanese shipowners who borrow in yen to take advantage of the low interest rates, but earn cash flow in dollars. To make things worse, during the heyday of the shipping boom, most cash flow projections were prepared on the basis between JPY95–100, but this has changed dramatically. As pointed out by a veteran ship financier, “Yen used to hover around JPY110/dollar and reached JPY 90 only twice in history. But now, it is trading around JPY 70/dollar. The impossible has happened.” Continue Reading

Banking Crisis? Not an Issue for BW Group or NOL

2012 is broadly expected to be challenging for both shipping lenders and borrowers. As long as the Euro debt crisis persists and continues to worsen, capital will become increasing scarce. Even shipping companies at the top of the pyramid are busy strengthening their balance sheets and making sure that they have adequate funds to meet capital expenditure requirements in the coming years.

One of the world’s leading maritime companies BW Group has successfully completed a USD 1.5 billion seven-year revolver in mid-November. According to market sources, the proceeds will be used for refinancing and the participants are largely from the previous revolving facility. Pricing is said to be “slightly higher” than the previous revolving facility, although it remains highly competitive in today’s tight market conditions. Continue Reading

Sinosure Introduces Short Term Insurance Products

In ship finance today, there is no doubt that export credit agencies have assumed a much larger role than they used to. Depending on your perspective, China’s extensive support to the domestic shipyards can be seen as either a blessing to shipowners looking to bridge their funding gaps or a nightmare to others who are keeping their fingers crossed that the lack of financing will lead to more vessel cancellations and improve the demand and supply dynamics of the industry. To others, it is arguable if ECAs are really filling the void in the banking sector when they tend to focus on strong companies who have access to commercial debt. But one thing is for certain, China will continue to support her core group of shipbuilders at a time when the industry continues to struggle in new orders against strong competition from Korea. According to Clarksons, state yards are faring better with 100% of the slots taken up in 2012 and 70% of the slots sold in 2013. Small and medium Chinese yards are 85% occupied in 2012 but only 30% of the slots are booked in 2013.

Since 2009, China’s policy bank China Exim bank and export credit agency Sinosure have been working in conjunction with not only domestic lenders, but also with international banks in supporting the sale of ships to developed markets. China Exim Bank for example has helped more than 80 top tier shipping companies worldwide financed over 400 Chinese built vessels with a total commitment of USD 12 billion. Its clients include strong names such as Maersk, Frontline, OSG, OOCL and Diana Shipping.

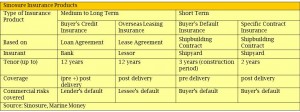

Sinosure has also been stepping up its efforts to support the domestic shipbuilders. Between 2009 and the first half of 2011, Sinosure has underwritten 77 ship finance related insurance policies of over USD 3.8 billion, largely made up of buyer’s credit and overseas leasing insurance. These two key products are mainly suitable for medium to long term projects, with tenors generally not more than 10 years.

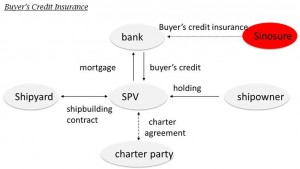

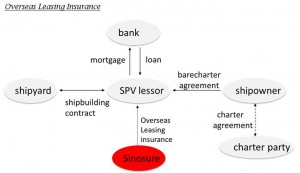

A buyer’s credit insurance insures the claim for repayment of the credit amount disbursed to the shipyard under the credit agreement with the foreign shipowner while overseas leasing insurance on the other hand typically covers both political and commercial risks that may affect the stream of payments due on the leased ship (see accompanying tables). With overseas leasing insurance, lenders can opt for an additional layer of security, by purchasing the right to receive the expected payments from vessels on mortgage insured by Sinosure.

To date, Sinosure has supported Chinese shipbuilders by encouraging lenders to grant loans to their clients and assuming medium or long term credit risks. But lately, the agency has also come up with short term insurance products based on shipbuilding contracts, with the shipbuilders as direct beneficiaries. The buyer’s default insurance for example covers the construction cost of a vessel of up to three years during the pre-delivery phase. This helps the shipyard to mitigate buyer’s risk in the event of a default, and at the same time increases the yard’s chances in obtaining financing from commercial banks.

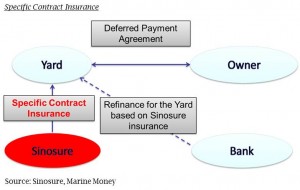

The second short term insurance product – specific contract insurance is also designed to solve pressing issues revolving around on-going shipbuilding contracts. Today, many buyers of post 2007 vessels are having problems in paying the full contracted vessel prices, due to lower loan to value ratios offered by the commercial lenders and the declining asset prices. In these cases, the shipyards may have to unwillingly provide the buyer temporary builder’s credit to their clients to finance the shortfall. Sinosure offers these shipbuilders specific contract insurance that covers buyer’s default risk of up to two years in relation to the deferred payment agreement after the vessel is delivered. With Sinosure’s specific contract insurance, the shipbuilder can even subsequently choose to seek refinancing from commercial banks to improve its liquidity position. This product basically reduces friction between the shipbuilder and its client, and at the same time allows the shipbuilder to transfer the risks in the deferred payment agreement to Sinosure. Both short term insurance products cover up to 90% of the buyer’s credit risk.

KAMCO – A White Knight for Korean Shipping

There are many intrinsic reasons for governments in Asia to formulate policies to support their domestic shipbuilding industry, either through direct loans to the yards or their clients. The shipping sector, however, has in sharp contrast, failed to benefit in the same way, with the exception of South Korea. As a resource-poor country, South Korea recognizes shipping as strategically vital to the nation’s economic wellbeing. During the Asian financial crisis in the late 1990s, cash strapped Korean shipping companies sold 112 ships at distressed prices to foreign buyers and as a result, the country had to grapple with the repercussions from the loss of its national fleet. This painful lesson has strengthened the nation’s determination not to allow history to repeat itself, at a time when shipowners are once again facing huge challenges on multiple fronts including a weaker demand due to the current acroeconomic uncertainly, capacity glut across all vessel types and rising bunker costs.

Armed with the mission to assist in the restructuring or liquidation of distressed assets, Korea Asset Management Corporation (“KAMCO”) has been playing a vital role in alleviating domestic shipping companies from a liquidity crisis. In 2009, the state-run financial restructuring agency established a maritime fund, designed to help shipping companies reduce their capital costs on their vessels. Since then, KAMCO has acquired 27 vessels of over USD 720 million directly from the shipping companies. This strong (and unprecedented) support for the shipping sector has allowed South Korean shipping companies to weather the after-effects of the Lehman crisis. Continue Reading

FSL Gets Refinancing Done in Tough Market

Last Thursday, First Ship Lease Trust (“FSL Trust”) announced that it has Successfully entered into a loan agreement with a syndicate of eight lenders for a six year amortising term loan of USD 479.6 million, secured against its current portfolio of 25 vessels. The new term loan facility will be used to refinance all its maturing bank loans with an outstanding loan balance of USD 483.1 million (refer to Table A). The remaining loan balance of USD 3.5 million will be repaid in cash from FSL Trust’s internal funds.

The new term loan facility is provided by a syndicate of banks led by ABN Amro, Singapore Branch and Overseas-Chinese Banking Corporation (“OCBC”) as mandated lead arrangers and bookrunners. The other mandated lead arrangers are Bank of Tokyo-Mitsubishi UFJ (“BTMU”), UniCredit Bank, Singapore Branch (“UniCredit”), Sumitomo Mitsui Banking Corporation, Singapore Branch, Korea Development Bank, ITF International Transport Finance Suisse (Zurich-based wholly-owned subsidiary of DVB Bank) and KfW IPEX-Bank. Four out of five existing lenders in the maturing revolving credit facilities – BTMU, UniCredit, OCBC and SMBC took positions in the syndication. German bank Helaba is conspicuously missing in the latest line-up, but FSL Trust attracted the strong support from four new lenders (one Asian and three European) in today’s tough credit market. Continue Reading

Shipping in Australia: A Level Playing Field?

Contributed by Jacqueline Bell and Andrew Hopkins, Norton Rose (Asia) LLP

The Australian government has recently announced an ambitious set of policy reforms aimed at reinvigorating the dwindling Australian shipping industry. At headline level the reforms are certainly promising and appear to have been generally well received by the players in the Australian shipping market. Whether the reforms will be sufficiently far-reaching to attract significant international investment in the Australian shipping industry however remains to be seen.

In a shipping market dogged by plunging spot rates and rising fuel costs, shipping companies must limit costs wherever possible merely to stay afloat. Australia’s current cabotage rules are unforgiving, requiring crews working Australian-registered vessels to be paid Australian rates of pay to comply with the country’s Fair Work legislation – cited figures show that a typical Australian container ship pays A$4.06 million in crew costs per year compared to A$1.65 million for a foreign equivalent vessel. In addition such vessels attract the Australia’s standard level of corporation tax on their trade income of 30% and must suffer the added price increase on coastal shipping fuel under the Australian carbon tax regime. It is unsurprising that shipping companies are looking elsewhere to benefit from the cheaper labour expenditure, tax breaks and less stringent regulation of other flags of convenience. Continue Reading

AIM – an alternative means of raising capital

Contributed by Nicholas Hanna, Watson, Farley and Williams Asia Practice LLP

In the current market conditions, shipping companies are struggling to obtain much needed debt finance. Banks are undoubtedly more inclined to lend to large, less-risky companies with strong track records. This results in a gap in the funding of small to medium sized companies which require a certain level of financial backing as well as an injection of capital to withstand the present uncertainties – this is particularly true for companies in the shipping industry.

One way to plug this gap is via private equity houses, seed financing or venture capitalist houses but the cost in equity dilution can sometimes be very high. Another way is by raising funds via capital markets. According to the London Stock Exchange, the most successful of the capital markets is the Alternative Investment Market also known as “AIM”. Arguably, a listing on AIM may be perceived as a pragmatic alternative to debt finance. A listing of this type enables shipping companies to raise funds on admission to market and provides a global platform on which to access further capital in the future. Continue Reading

JBIC offers NYK loan facility

Export Credit Agency, Japan Bank for International Cooperation (“JBIC”) is leading a syndicated loan for mega carrier Nippon Yusen Kaisha (“NYK”) for the acquisition of a LNG carrier. The vessel will be built by Mitsubishi Heavy Industries and will be placed on a long term charter with Tokyo Electric Power Co (“TEPCO”) upon delivery. JBIC has committed JPY 12.6 billion (“USD 162 million”) to the facility, which we understand is not the entire amount. Bank of Tokyo-Mitsubishi UFJ and Sumitomo Mitsui Banking Corp chipped in as participants in this project finance transaction.

The vessel is rumoured to cost NYK JPY 20 billion (USD 258 million). NYK has a 15 year agreement plus an option to extend for another 5 years with TEPCO for the transportation of natural gas into the country.

Standard Chartered finances two OOIL’s boxships

Standard Chartered has agreed to finance two new 13,208 TEU containerships for Orient Overseas (International) Ltd (“OOIL”). Not much detail was disclosed by either party, except that Standard Chartered was the sole arranger for the deal and the two vessels are scheduled to be delivered in 2013. In the press release, Tung Chee-Chen, OOIL Chairman pointed out that the vessels will be the biggest in its fleet upon delivery and OOIL remains convinced that the investment in these ships will ensure its competitiveness and “this is the right time to invest”. During the first half of 2011, the company placed orders for ten 13,208 TEU vessels from Samsung Heavy Industries for delivery in 2013 and 2014.

CSIC eyes RMB 8 billion Convertibles

Buana Listya is not the only company in the maritime space that is mulling over issuing convertible bonds. Chinese state owned shipbuilder, China Shipbuilding Industry Corporation (“CSIC”) is planning to raise not more than RMB 8.05 billion (USD 1.27 billion) worth of convertibles and out of which RMB 3.63 billion will be used to acquire the equity stakes in seven subsidiaries. Another RMB 4.41 billion will be set aside to upgrade the shipbuilder’s ship repair/demolition division, and its capability in constructing sophisticated offshore vessels and larger fuel efficient ships. More details will be announced upon the approval from the country’s regulatory body, State-owned Assets Supervision and Administration Commission of the State Council.