BLT Subsidiary Launches USD 147 million IPO

Investor sentiments worldwide may be jittery but this has not dampened Berlian Laju Tanker (“BLT”)’s ambition to list its subsidiary Buana Listya Tama on the Indonesia Stock Exchange. Right after the completion of a USD 93.5 million sale & leaseback agreement with Standard Chartered in March and a USD 685 million refinancing package with six lenders (DnB NOR, Nordea, Standard Chartered, ING, NIBC and BNP Paribas), the chemical tanker owner and operator is now setting its sights to enhance its liquidity position even further by selling up to 7.26 billion new shares or close to 40% of the enlarged share capital in its wholly owned subsidiary Buana Listya.

The objectives for the spin-off are straight-forward. By itself, BLT is already a listed company on the Indonesia Stock Exchange and Singapore Exchange, and the listing of its subsidiary Buana Listya will give the group financial flexibility and the access to the capital markets for debt and equity funding via two separate listed entities. The spin-off will also allow the group to

streamline its operations and better position itself for the domestic and international markets. BLT will focus its resources on growing its business as a provider of global seaborne transportation of liquid cargoes mainly the chemical sector (other than Indonesia) while Buana Listya will focus primarily on energy related shipping services serving the oil, gas, FPSO and FSO and chemical sectors throughout Indonesia. And this clear mandate to expand business within Indonesia is exactly what makes Buana Listya an attractive investment. Continue Reading

Private Equity: A Global Update and an Asian Perspective

During the recent Marine Money conference in Hong Kong, we had the pleasure to listen to Julian Proctor, Managing Director at Tiger Group Investments who gave an insightful update on private equity. He asserts that the amount of capital traditional private equity has invested in shipping over the last 15 years is less than the amount the KG market has invested in one single year. But over the past 24 months, an aggregate of USD 3 – 3.5 billion was committed to the industry, an absolute U-turn compared to the last 15 years. There are three broad explanations for this development.

During the 2008/09 crisis, there was a perception among investors that valuations were cheap.

- There was also a flurry of distressed investors who believed that banks would dislocate and sell assets at distressed valuations (this would be the wrong strategy to follow over the past 24 months in his opinion).

- There are an increasing number of investors beginning to follow the developments in the shipbuilding industry. There is a belief that a potential crisis is brewing in the shipbuilding sector that will eventually lead to sharp declines in newbuildings. Continue Reading

Shipowners, Capital & Long-Term Strategy

Here is a perennial question that never gets answered. When will shipowners ever practice self discipline and stop flooding the market with new vessels? The panel of shipowners at Marine Money’s Hong Kong conference provided us with some food for thought.

For the dry bulk sector, Mr. Klaus Nyborg, CEO at Pacific Basin Shipping, believes that the industry is simply too fragmented. “It is a business where there are few barriers to entry. One of the factors that I am most concerned about is the fact that many investors typically rely on the spreadsheet to decide whether it is a good or bad investment. In shipping especially the volatile dry bulk and tanker markets, the spreadsheet doesn’t work… This ‘accretive to earnings’ mindset is very dangerous.”

“We should not bank on any kind of discipline. There has never been discipline and there will never be discipline. All you have to do as a Chinese shipyard is to go to a potential buyer, offer him 5% less than his buddy next door, throw in 80% export finance and boom! There are another 6 ships,” added Mr. Philip Clausius, President & CEO at FSL Trust Management.

As for the container shipping sector, shipowners order vessels for a completely different set of reasons. “I don’t think there are too many ships. There are too many the wrong types of vessels operated by the wrong people…certain segments in the container fleet will not fulfil the full 25 years of economic life. They are too small for the major trades, too big for the smaller trades and horribly inefficient,” said Mr. Kenneth Cambie, Executive Director and CFO of Orient Overseas (International) Limited.

“Maersk has put the game changer with their 18,000 TEU vessels. By 2015, you got to have big ships that are over 10,000 TEUs to ply the Asia-Europe trade. There are very few points of differentiation in this business… and the access to debt capital is increasingly a differentiating factor and a barrier to becoming a meaningful player because of these big ships. It is going to become very clear over the next six to nine months – who is in the game and who isn’t,” he added.

“The substantial orderbook in the container shipping sector in the next three to five years will replace a part of the fleet built prior to 2000, where efficiency and economy of scale play a really important part. The Maersk’s announcement of showing 40% efficiency gains, from our own modelling, is pretty accurate. And when you are burning USD 100,000 to USD 150,000 worth of fuel a day, those are big numbers… Efficiency is an enormous driver and is one of the few areas that you can achieve competitive advantage. You will also need a low cost of capital to stay in the game,” explained further by Mr. Graham Porter, Chairman, Tiger Group Investments.

One thing can be certain. Shipowners will be placing a greater emphasis on ordering better quality ships that are more fuel efficient and the outlook for the shipbuilding sector may not be that gloomy after all.

Management Buyout at BP Shipcare

As the industry braces itself for overcapacity across all major shipping segments, layup is increasing seen as an efficient way to manage the shipping cycle with savings of up to 80% against operating costs, according to Gavin Kramer, Managing Director at International Shipcare (see accompanying table).

In terms of costs, the average cost of layup for a large vessel (i.e. a VLCC) is around USD 1,500 per day, against current operating costs which can exceed USD 10,000 per day. Once the vessel is in a cold laid-up, there will be major savings in fuel costs because very little fuel is consumed. International Shipcare runs its own generators on the vessel for two or three hours daily so as to ensure relative humidity is maintained. Owners can also expect their insurance premiums to reduce by as much as 50%. In addition when the ship is laid up, the owner can take the opportunity to carry out preventive maintenance, conduct pre-docking preparation, and upgrading that will help to ensure long term preservation of the asset. And perhaps even more importantly, reactivation can be performed at relatively short notice allowing vessels to be placed back in the market to meet the improved market conditions or take advantage of employment opportunities at short notice.

International Shipcare is born following the completion of a management buyout of BP Shipcare Sdn Bhd led by Mr. Kramer and two other former BP executives. It has been a leading ship lay-up and marine services facility based in Labuan, Malaysia, for 35 years and is the oldest established layup facility in Asia today.

“Right here and right now, we believe there are opportunities in our business and this is supported by the level of enquiries we are getting in the market,” said Mr. Kramer. Andrew Lockie, Director at International Shipcare, added that the market is expected to be weak due to oversupply trickling through over the next two to three years. “We had a poor market in 2009 and the number of ships that were laid up with International Shipcare trebled to 49. Dry bulk is now having a tough time… this is quite closely followed by tankers.” International Shipcare currently has a mixed bag of 20 ships under its care – LNG carriers, FPSO conversions and car carriers and is seeing more enquires for smaller offshore support vessels and out of contract FPSOs Traditionally, shipowners have often viewed layup facilities as “graveyards” for their assets but as more and ships are being delivered to the marketplace, more owners will have to rethink about their strategy and positioning. Laying up vessels could well be an effective way to adjust market exposures during periods of low earnings

ICON Builds Relationship with MISC

Even as the tanker market outlook remains soft, the market for financial deals in this segment continues on. MISC, the largest tanker operator in Asia Pacific, has just closed on four tanker sale leaseback transactions worth a total USD 167 million with New York based ICON Capital. AET, a subsidiary of MISC, sold two 2002 built VLCCs, Eagle Vermont and Eagle Virginia, to ICON Capital and took the vessels back on bareboat charter for 7 years at an undisclosed rate. Two other 1994 built aframax tankers “Eagle Otome” and “Eagle Subaru” were also sold to ICON on a similar arrangement. In total, the sale and leaseback transaction allowed MISC to book a disposal gain of USD 33 million, which forms a part of the company’s medium and long term fleet rejuvenation strategy through the phasing out of older vessels.

ICON has participated in numerous maritime transactions with shipping companies that include ZIM, Wilh. Wilhelmsen, Teekay and TOP Tankers and this is not its first foray in Asia. Way back in 2008, ICON Leasing Fund Ten and Fund Twelve purchased four double hulled aframax product tankers – Eagle Auriga, Eagle Centaurus, Eagle Carina and Eagle Corona from affiliates of the maritime investment fund Global Skipholding 1 for USD 162.8 million. These vessels were funded with USD 52.8 million in cash and USD 111 million with loan facilities provided by Fortis and DVB Bank. These vessels were “Hell or High Water” bareboat chartered to AET for a term of seven years and will have approximately 5 years of remaining useful life when they come off charter. In 2009, ICON Leasing Fund Twelve purchased a 51% stake in a

300-man accommodation and work barge from Singapore listed offshore marine services provider Swiber Holdings for USD 19.1 million.

STX Pan Ocean Acquires Heung Kook Bank

In a rather unusual development, STX Pan Ocean has made an offer to acquire all the outstanding shares in Heung Kook Mutual Savings Bank that it does not already own. The largest dry-bulk shipping line in South Korea will be paying KRW 34 billion (USD 31 million) to STX Construction and Bulim Mutual Savings Bank for their 65.6% and 18.8% equity stakes in the Busan based Heung Kook Bank. This will effectively increase the company’s stake in the bank from 15.6% to 100%.

Explaining the reason behind the acquisition, STX Pan Ocean said that the bank will “enhance the efficiency across its businesses and management, and strengthen the competitiveness in ship financing market.” But what this exactly means remains unclear and the market will need more clarity on the potential synergies the shipping company can derive from the acquisition of a local bank. Continue Reading

HSBC on China

We had the pleasure of listening to Ms Donna Kwok, a leading Greater China economist from HSBC on “Inflation and the RMB” during Marine Money’s 4th Annual Hong Kong Ship Finance Forum last Friday. One of the salient points Ms Kwok pointed out was her view that the RMB could be fully convertible by 2015-2017 at the earliest. And if that materialises, it could alter the ship financing landscape in Asia.

Shipping has always been a dollar business, but over the past few years, China has been making progressive steps in liberalising its currency. Driven by the shortage of and reluctance to lend in USD, Chinese commercial banks are increasingly receptive to the idea of lending foreign shipping clients in RMB, especially if they have cash flows in RMB. But before shipowners will bite the bait, a couple of conditions will have to be present: shipbuilding contracts need to be

denominated in RMB, and the market has to offer more competitively priced interest rate swap products for owners to hedge their currency risks – and RMB has to be fully convertible in order for that to happen. Continue Reading

Korean Commercial Banks and Ship Finance

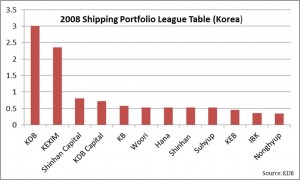

The Korean ship finance market is vibrant and filled with a diverse pool of capital providers including foreign banks, export credit agencies, domestic commercial banks, leasing companies, institutional investors such as insurance companies and pension funds, shipping funds and asset management companies. Korean commercial banks in particular have always played an important role in financing the domestic shipping sector, but there have been very few mentions in the major press of their strategies and the amount of capital they provide to the industry. A presentation by Mr. Hyun Yong Sok, Shipping Finance Team Head at Korea Development Bank (“KDB”), offers us some insights.

According his presentation titled “Shipping Finance Market and its Diversification”, he believes that the shipping finance exposure of Korean financial institutions stood at USD 12 billion as at May 2009. According to a survey conducted by the bank in 2008, KDB leads the pack with a shipping book in excess of USD 3 billion while other commercial lenders typically carried shipping loan portfolios of less than USD 1 billion (see accompanying chart). The survey may

not be up-to-date but it is the best profile we have seen so far and it is still very much reflective of the current appetite Korean banks have for shipping. Commercial banks in Korea are largely not major ship financiers and remain very much domestically focused.

Tapping Export Finance – The Danish Way

Over the past year, Danish owners have been extremely successful in tapping export credit agencies to help finance a part of their orderbooks in Asia. In a transaction that has recently come to light, J. Lauritzen had signed a USD 267 million export credit financing agreement with BNP Paribas last November. The transaction was structured by the French bank, who also managed to rope in two other mandated arrangers, Société Générale and Bank of China.

The ten year facility was also backed by China’s Export Credit & Insurance Corporation (“Sinosure”), which agreed to provide buyer’s credit insurance on 95% of the commercial exposure for the ten year loan. Proceeds will be used to finance the acquisition of five product tankers and two gas carriers that are currently being constructed at Guangzhou Shipyard International and Yangzhou Kejin Shipyard respectively. The Singapore office of Watson, Farley & Williams LLP advised the syndicate of international lenders. Continue Reading

Japanese Regional Banks Put Words Into Action

Japanese mega banks are generally perceived to have limited room for fresh shipping loans, having aggressively financed domestic shipowners during the shipping heyday. The sharp appreciation of Yen against the greenback, rising operating costs incurred by shipowners and a number of foreign charterer defaults in recent years have further restrained their appetite for shipping loans in a country where shipping capital is likely to remain short in supply

in the coming years.

For a number of foreign shipowners who have a substantial new-build order list with shipyards in Japan, the mega banks roped in Japan Bank for International Cooperation (“JBIC”) to jointly finance a number of ships across various asset classes. In a typical transaction, the commercial bank would co-finance 50% of the vessel cost with JBIC, and the Nippon Export and Investment Insurance (“NEXI”) would provide export credit insurance. And to make lending even more palatable, the commercial banks are given the first cut on loan repayments. In many cases, the commercial lender will have its loans repaid within the first six years (out of a 12 year loan repayment period). Continue Reading