Far East Horizon Unmasks Ship Leasing Ambition

Large public listings are usually accompanied by great fanfare, but one particular company with huge ambition to become a significant capital provider to the shipping industry evaded our radar and concluded its low profile IPO in March. When Far Eastern Horizon (“FEH”), the financial leasing unit owned by the Sinochem Group went on its roadshow for its Hong Kong listing, investors were quick to place enough orders to cover the entire book.

Investors clearly liked FEH’s pedigree parentage. Not only was the controlling shareholder one of the largest state-owned conglomerates in China and a Global Fortune 500 corporation, three other strategic and reputable investors – KKR Future Investments (an affiliate of KKR Asian Fund), Techlink (an affiliate of Government of Singapore Investment Corporation) and TML (an affiliate of CICC Fund) were already significant shareholders in the company prior to the IPO. The three parties had ploughed in USD 160 million in FEH in September 2009 and their investments added weight to the company’s credentials. Six cornerstone investors Sun Hung Kai Properties, Value Partners, Hillhouse Capital, Prime Capital, Owl Greek Asset Management and OZ Management Fund committed a total of USD 250 million to the offering, accounting for 38% of the total deal size. Continue Reading

KoFC Launches Green Ship Program

These days we’ve noticed everyone seems to like the term “green shipping”. Every time it comes up as a topic for a program or article the financial and owning communities nod their heads in approval. Whether or not anyone actually knows what it means, or is willing to spend their own money to get there, has been less clear.

Among the more concrete arguments and analyses we have seen have been hard numbers from the class societies showing how bunker fuel, and therefore fuel efficiency, can impact costs. The two accompanying tables from a presentation made by Mr. Vincent Li, Head of Maritime Consulting at Germanischer Lloyd, demonstrate the growing proportion of operating expenses going to pay for bunker fuel, and also show the expected implementation dates of a slate of new environmental measures set to come into effect. The message is clear: the status quo will not be sufficient to stay competitive in the future. Continue Reading

Singapore business trusts – is this the time for ship owners to consider this innovative structure?

For some years now Singapore has had a unique structure called a business trust, which is a hybrid combining elements of a company with elements of a unit trust.

Whilst the business trusts launched up until the beginning of 2011 have been relatively small scale and have not had the same market recognition outside Singapore as their more established cousin, the real estate investment trust (REIT), this has recently changed with the spin off by Hutchison Whampoa of its port assets into a business trust in March 2011 and the subsequent US$6 billion initial public offering of that entity on the Singapore Stock Exchange (SGX). This listing, together with several other high profile potential business trust launches in the pipeline, has increased the profile of this structure with sponsors and investors in both the shipping and infrastructure sectors globally and has also lead directly to the Hong Kong Exchange considering whether to adapt its listing rules to permit the listing of business trusts there. Continue Reading

Arthur J. Gallagher Acquires Singapore Outfit

NYSE listed and London based risk management and insurance brokering company, Arthur J Gallagher, has acquired ITI Solutions – a Singaporean specialist insurance broker in marine cargo, trade credit and political risk, to grow its presence in Asia. Terms of the acquisition were not disclosed under an agreement between both parties.

Following the acquisition, ITI Solutions will trade under the name Gallagher Singapore led by Freddie Lim, previously CEO of ITI and staffed with an initial team of 10 professionals. In a press briefing, Mr. Lim said that ITI was established when he observed that there were no insurance brokers to assist a growing number of commodities traders who were moving away from traditional balance sheet financing towards trade financing. “The banks providing trade financing have very specific insurance requirements and we wanted to help the traders secure the financing so that they can get their deals done,” he added. Continue Reading

UASC Goes for French Tax Structure Loan Facility

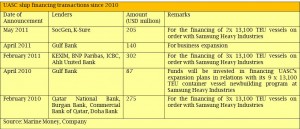

Last Sunday, United Arab Shipping Company (“UASC”) announced the conclusion of a USD 205 million French Tax structure term loan facility with Société Générale Corporate & Investment Banking (SG CIB) and Korean Export Credit Agency (“KSURE”), for the financing of two 13,100 TEU vessels out of the nine it had ordered at Samsung Heavy Industries in 2008. The term loan facility is made up of a combination of a lease and export credit, covered by KSURE. This follows several more transactions over the past year, largely relating to the nine

ships ordered, that show a notable degree of creativity and adaptability in securing attractive finance from a range of sources. These transactions are summarized in the accompanying table for your reference.

Boxes Financed!

Orchid Container Finance, a company under major container box lessor Florens Container Corporation S.A., has secured a five year USD 198 million term loan at 185 bps above LIBOR for the sale and lease back of steel dry bulk containers and general purpose containers. The Singapore office of Watson, Farley & Williams were the advisers to the lenders ING Bank N.V., Singapore Branch and DBS Bank Ltd, Hong Kong Branch. Headquartered in Hong Kong, Florens Container Corporation is one of the world’s largest container box lessors.

Uni-Asia Launches USD 25 million Rights Issue

Singapore listed Uni-Asia Finance Corporation has proposed a one for two renounceable non-underwritten rights issue of 156,597,600 new ordinary shares at an issue price of SGD 0.20 (USD 0.16) for each rights share. The offering is expected to raise SGD 30.9 million (USD 24.9 million) for the structured finance arranger and alternative-asset investor and proceeds will be used to invest primarily in ships and real estate assets. The issue price of SGD 0.20 is a 20% discount to the closing price of the last trading day before the announcement was made. The rights shares will, upon allotment and issue, rank pari passu in all respects with all other existing shares.

Key shareholders Yamasa Co., Ltd (“Yamasa”), Evergreen International S.A. (“Evergreen”), and Founders Corporation (“Founders”), who collectively hold approximately 33.32% of the total issued shares, have all irrevocably undertaken to subscribe and pay for all their entitlements of the rights shares. In addition, Yamasa has also agreed to purchase additional unsubscribed rights shares. Under the take-over code in Singapore, a whitewash wavier will however be required from other existing shareholders, should Yamasa choose to increase its shareholding in Uni-Asia from the current 19.53% to any level over 30% and not extend a general take-over offer for all the remaining shares. Provenance Capital is the appointed manager for Uni-Asia’s non-underwritten rights issue. Continue Reading

Wan Hai Opts for Domestic Liquidity

Wan Hai Lines brought its massive bond issue into fruition and successfully raised TWD 10.4 billion (USD 360.3 million) from its two domestic bond issues in May. In the latest offering, Wan Hai sold TWD 2.9 billion (USD 100.5 million) of six year unsecured domestic corporate bonds at a fixed annual interest of just 1.75%. The bonds were issued at par with a face value of TWD 1 million.

The company was also able to complete the issuance of the first batch of corporate bonds in the same month. The first batch of notes that filled Wan Hai’s coffers by TWD 7.5 billion (USD 259.8 million) was made up of two tranches – TWD 3 billion worth of five year bonds at an annual coupon rate of 1.65% and another TWD 4.5 billion worth of seven year bonds at an annual coupon rate of 1.85%. The bonds were structured with staggered maturity dates to ensure that not too many bonds will come due at the same time and put a strain on company finances. All proceeds will be used to repay existing bank debt and purchase vessels.

Demand for corporate debentures remains healthy in Taiwan due to the abundance of liquidity among retail investors and the island’s low interest rate environment. This works to the advantage of the local shipping companies in the country as they are expected to seek more funds to finance their current shipbuilding programme.

High Bunker Prices Hurt 1Q Earnings

In the last few months, bunker prices have risen sharply at the back of upward pressure on oil prices and once again undermine shipowners’ ability to break even on their operating expenses. Last week, STX Pan Ocean, Hapag-Lloyd and Neptune Orient Lines (“NOL”) have all warned investors that ever rising bunker prices will continue to hurt their results, moving forward.

South Korean shipper STX Pan Ocean reported a larger than expected first quarter loss of USD 48.5 million in 2011, due to lower freight rates and high fuel costs. Gross margin was adversely hit by a 36.4% increase in bunker fuel cost, up to USD 341 million compared to the same quarter last year, which can be attributed to the increase in both price and consumption of fuel (see accompanying table). In its presentation slides, the company said that the high bunker price was a “major negative factor” for the poor 1Q11 results. And even though its long term contracts are tied with the bunker adjustment factor (“BAF clause”) to cover the hikes in the cost of oil, short-to-medium term COAs do not, and hence the company will have to grapple with increases in bunker prices on the latter. Continue Reading

Asian Liners Get Their Game On

Soaring bunker prices have motivated container liners to re-examine their strategy with a renewed focus on operating efficiency, cost reduction and high fleet utilisation. When market leader Maersk Lines announced its plans to pay USD 1.9 billion for 10 new generation 18,000 TEU vessels, it totally changed the rules of the game and has to some extent prompted other major carriers to look into ordering larger and fuel efficient vessels. Today, there appears to be some form of consensus among liner companies that they would need big ships that are over 10,000 TEUs to ply the Asia Europe trade by 2015 and possibly the Trans-pacific trade by 2020 to stay in the game. At the same time, some liner companies have also expressed their intention to build and own vessels to replace chartered-in vessels, so as to maximise their ability to manage excess capacity. During the shipping downturn, liner companies have realised that the decision to layup or sell vessels becomes much easier if they own the ships themselves.

At Marine Money’s conference in March, Kenneth Cambie, Executive Director and CFO of Orient Overseas International (“OOIL”), told delegates that he believes that container shipping is entering a watershed and it will be clear over the next six to nine months who is in the game and who isn’t. He reckoned that those players with the access to capital will be ordering larger ships and preparing themselves for 2015. The spate of newbuilding orders and the seeming lack of capacity discipline among liner companies have sparked market concerns, but while we leave the arguments and controversies to the industry experts, we agree with Mr. Cambie that the access to capital has become increasingly important to survival and in this aspect, Asian liner companies have the competitive advantage. Continue Reading