What Makes a Winner?

By George Weltman

In dissecting a winning performance, one can attribute success to a multitude of factors. On an individual basis, skill, strength and stamina are physical standouts. In team sports, teamwork, coaching and strategy are critical compnents. Some of the most successful athletes say half the game is mental. It is no surprise therefore that flexibility, focus and an ability to bounce back are essential characteristics. Then there are the wild cards, luck and breeding. And, ultimately, it is just the fact of having fewer losses, which makes a winner.

Performance, however, cannot be measured in a vacuum. It must have context, which in this case is the markets, both financial and shipping. And what a year it was. Early in the year, signs of the financial markets imploding became apparent. Initially, shipping markets did not feel a tremor. Financing for ships remained available through most of the year, although syndication all but disappeared by year-end. Later on shipping felt the impact as cargos slipped or were cancelled due to the apparent drying up of trade credit. Clearly no one at that time understood the depths of the problem, which only became apparent towards the end of the year.

Think about the scariest roller coaster ride you have ever been on and you can empathize with the owners of dry bulk vessels. In the span of a year, the proxy for shipping rates, the BDI, went from approximately 6,000 to 11,000 and then sank to all time lows of around 500. The collapse resembled the premise of the movie, “The China Syndrome”, which posits the core of a nuclear reactor falling through the earth. And, it was in fact the shutdown of China itself, after the Olympics, and the resulting cessation of demand, which triggered the shipping collapse. Prices of commodities collapsed, high cost inventory sat unused at dockside and shipping stocks, the invesstors’ proxy for commodities, collapsed.

In the meanwhile, tanker owners floated along enjoying an excellent year that included a rather spectacular summer. Oil prices remained high, reaching a peak in July of $147/bbl, but then crashed to $35 by the end of the year due to supply growth and the collapse of demand. The supply of vessels was kept in check by the contango trade and the expectation of the soon to arrive single hull phase-out. Or, so we thought. Margins between delivered and future prices of oil narrowed and owners began to focus on flag-state exemptions for the phase-out. The situation became worrisome but soon was under some semblance of control as the oil oligopoly took control of supply driving the price of oil upwards despite ever increasing inventories.

Superior Results in the Face of Global Calamity

By Jim Lawrence

So we come to the celebration of yet another year of public shipping company financial results. And odd as it is to write the word, celebrate, given the current shipping markets, it is the appropriate word to use. 2008’s financial results document a glorious performance run. It may be the end of the run for a moment but nonetheless a glorious moment in time.

Our annual ranking of the 100 most important public shipping companies gives us great pleasure. The results plainly say in black and white how our friends, colleagues and the industry have fared. Management is well aware of the many contributions made by their staff ashore and at sea in order to achieve top positions in Marine Money’s Rankings and so are we when we offer our enthusiastic congratulations to our Top Ten performers.

2008 was an odd year to say the least. On the one hand the world’s financial system came perilously close to collapse. Trade credit dried up. Banks lost trust in each other. China cooled down after its marvelous Olympics. Oil prices soared then plunged and the same happened across the commodity spectrum. Charterers, shipyards and owners felt anxiety for the first time in years. Shipping securities collapsed like a ton of bricks.

Total Return to Shareholders a measure many would argue is the only one that matters, or they would argue that in a good market, produced a shocker. Only three out of 100 companies had a positive return. A further stunning but not surprising related bit of news was the massive, massive erosion of the industry’s market cap.

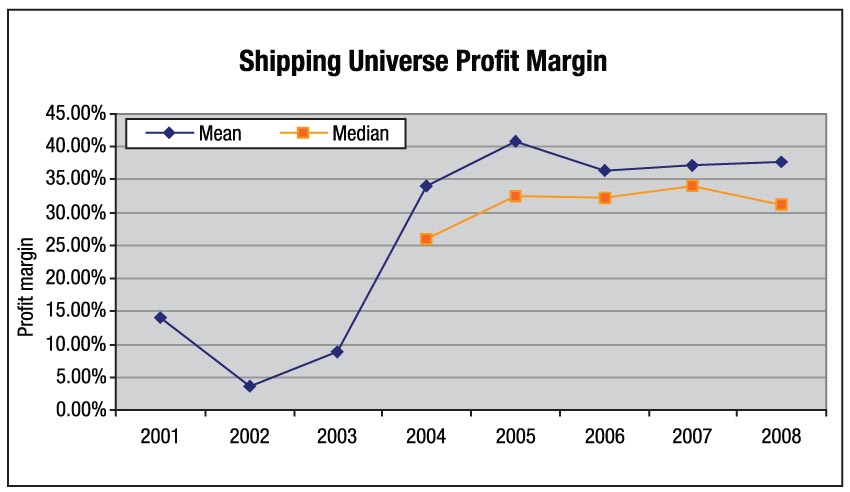

Yet when another generation looks back at 2008 it will be chronicled in the pages of annual reports as an enormously profitable year for the vast majority of the industry. Profit Margins paralleled the freight market and some companies delivered all time high results.

Pride in Accomplishment

I like stepping on board an airplane, which has affixed to the side of its door a sticker stating “Voted the Best Airline in the Business by…” It tells me they care and I firmly believe they will get me safely across the globe.

At Marine Money we are proud of the work it takes to parse the thousands of numbers necessary to develop the Rankings. George Weltman is an animal when it comes to the enormous attention to detail required to make the apples to apples comparisons. His love of accounting is second only to his love for his family and when he is in Rankings mode even they may slip a standing level.

So it is not surprising then when we feel some pride in seeing the acknowledgement we provide by Rankings, placed in winning company’s Annual Reports, flashed on screens at investor presentations, or posted on websites. We know that those super achievers will deliver their cargoes safely and generate returns to their investors.

Observations from the Lists

Do anything long enough and patterns begin to become clear. Companies like Kirby, Grindrod, Frontline, NATS , SEACOR, Norden, Mitsui and NYK to name just a few show up year after year in the top 20% of companies ranked. A testament to any number of important characteristics, but delivered over time, again and again.

The Ranking lists evolve as household names go private, merge or are taken over: London and Overseas Freighters, OMI, IMC, ICB, P&O, Argonaut, Anangel American, Benor. It is the natural order of the marketplace and we expect that by the time it’s done 2009 will be no different.

Each shipping cycle has its Aries or USSLP, those companies that either have gone bankrupt or may shortly. Aries market cap has reached $9 million. Nortankers and BT Shipping struggled in the early 90s. Nortankers collapsed almost immediately; BT gave up the ghost only after a gentlemanly run. BurWain Tankers, a shipyard trying to be an owner, now where have we heard that recently, collapsed in the mid 90s. Name a HY Bond issuer from the late 90s. They are almost all gone. But at one time they were all in the Rankings.

A Final Congratulations

As you read on and review the winners and others, it is important to remember that the names and numbers on the page are the result of enormous effort. First and foremost by the 1000s of men and women at these shipping companies around the world, who pulled together to achieve something special.

Our congratulations to each and every one of you.

Then there is the work of the Marine Money team, George Weltman, Cari Koellmer, Rodricks Wong, Nora Huvane, Sofia Vassilakis, Mike McCleery and CMA intern Mary-Irene Alexandrakis. My thanks to each of you.

The 2009 Shipping Banker Survey

Introduction

Last year’s cover for this issue showed a figure (a well-dressed banker, of course) being squeezed in a pair of pliers. We did not realize how prophetic that message was. The credit crisis was clearly having its effect on the financial markets “… as a series of life-threatening problems within many of the world’s great financial institutions was unveiled. This led to a dysfunctional credit market that in important respects soon turned non-functional.”1 Meanwhile, the economy seemed to move along as the year progressed in a steady state not yet realizing it was in recession.

The shipping world, however, was in a non-parallel universe. Driven by commodity demand as well as the perception that shipping was a proxy for those that wished to play in these markets, the physical market, charter market and shipping shares reached into the stratosphere. The capital markets were quiescent, with a few deals done here and there, but lending continued despite the disappearance of the syndication market early on. Club deals quickly replaced syndication and bilateral deals, of course, continued. The market was following the thoughts of that great philosopher, Alfred E. Neuman, of Mad Magazine fame, who said: “What, me worry?”