“Waddya say? Deal of the century?” – Mergers & Acquisition Award

By George Weltman

In nominating Navios Maritime Acquisition for a deal of the year award, one of our favorite investment bankers wrote, “At the beginning of 2010, NNA had cash and gumption. At the end of 2010, the company had a fleet of 22 tanker vessels. Waddya say? Deal of the century?” While we think the deal is a winner, we would, however, not go quite so far as it is both early in the century and the client has yet to reach her prime. We would however concede that it was an encore performance by the 2009 Dealmaker of the Year, Angeliki Frangou and her team at Navios.

The transaction had its beginnings in 2008, when Navios Maritime Holdings formed Navios Maritime Acquisition Corporation (“NNA”), a SPAC, to pursue opportunities in the shipping industry at an attractive point in the cycle. Subsequently the company raised $253 million in gross proceeds in an IPO for a war chest and began to hunt for the right deal. Then, the company went radio silent.

Generally, oil and gas projects have little difficulty being financed these days, but when there is a rig purchased out of bankruptcy, a non-recourse structure and a PEMEX contract, things become interesting. As they say, you can’t tell the players without a scorecard, so we will begin with a discussion of the principal parties to the transaction and there are a few, but then again that’s why it’s a structured transaction.

By Rodricks Wong and Nora Huvane

In 2009, when the shipping industry was facing its biggest crisis in decades, one particular Korean financial institution saw the urgency to come up with financing solutions for its core clients. Against this challenging backdrop, Korea Development Bank (“KDB”) brought in co-investors Daewoo Shipbuilding and Marine Engineering, STX Pan Ocean and Dongbu Insurance, and launched its very own USD 800 million shipping fund program. Over the course of last year, KDB concluded a number of transactions under this shipping fund program, and for all the success and creativity demonstrated, we hand out the structured finance award in the East to KDB.

Have a Seat. This is Going to Take a While – Structured Finance Award West

By George Weltman

Generally, oil and gas projects have little difficulty being financed these days, but when there is a rig purchased out of bankruptcy, a non-recourse structure and a PEMEX contract, things become interesting. As they say, you can’t tell the players without a scorecard, so we will begin with a discussion of the principal parties to the transaction and there are a few, but then again that’s why it’s a structured transaction.

Controlled by the Garza Family, Grupo R, a Mexican conglomerate, has 45 years of experience in Mexico in drilling, construction, installation and operation of various assets within the energy, industrial and transportation sectors. Through Industrial Perforadora de Campeche S.A. de C.V. (“IPC”), Grupo R is one of the leading offshore drilling contractors and is the leading onshore drilling contractor in Mexico.

More than “Stayin’ Alive” – “Restructuring” Award

By George Weltman

This time around it wasn’t so much over-leveraging but over-ordering, which has kept this category around for another year. Nevertheless, the story is much the same. Booming markets driven by the Chinese growth story and a suspension of belief in cyclicality led to what, with poetic license, we may term the order book from hell. With few exceptions, ship owners, as the markets boomed, ordered every type and every size vessel. Fleet growth was nearly exponential with the portion of newbuildings not only exceeding the portion of the fleet 20 years and older, but becoming a substantial portion of the entire existing fleet. Naturally, with the orders, financing commitments were essential. The recurring theme of constrained and rationed capital appears here too. The owners with the right stuff were served, while others used their cash, built up over the period, to make the down payments with the expectation of getting funding at delivery. And then there were those owners who sought the best deals in greenfield shipyards, putting little down and hoping for a great deal. And as night follows day, the market collapsed as the ships were ready to deliver. Owners were left to restructure their order books with both shipyards and banks.

Public Debt Award Asia

By Rodricks Wong

In 2010, while the bond market continued to improve the overall availability of capital for the shipping industry, another form of highly customised debt security was also gaining popularity in Asia. At least five shipping and related companies issued medium term notes (“MTNs”) of over USD 1.1 billion to refinance/repay debt or finance new vessels last year. Although MTNs are not very different from conventional bonds in many aspects – non-callable, unsecured, senior debt with fixed coupons and investment grade ratings, they offer issuers great flexibility in terms of structure and documentation.

Mission “Near” Impossible – Public Debt Award U.S.

By George Weltman

Talk about an obstacle course. A financial investor assumes control from U.S. Shipping Partners LP, its bankrupt co-investor in a joint venture, a start-up U.S Jones Act company, which has undertaken a major newbuilding program and has two 49,000 DWT product carriers on the water with three more to be delivered. Being built in the U.S., the vessels are the most expensive of their type in the world with an en bloc construction cost of $750 million and as the coastwise trade for petroleum products had virtually disappeared, the appraised value at the time was $560 million. In fact, the market is so bad that, in addition, to the bankruptcy of its co-investor, which is now controlled by its main creditors, OSG felt the need to take private its U.S. flag operator, OSG America.

Nevertheless, the new owning entity, American Petroleum Tankers needed $275 million to complete the last two newbuildings and refinance the existing senior secured facility. To assist in raising the capital, the financial sponsors, Blackstone Group and Cerberus Capital Management retained Credit Suisse and UBS, who together decide to offer highly structured five-year secured high yield bonds. As they headed into the roadshow, the Deepwater Horizon had been leaking for a week and Greece was burning, making for a difficult pricing environment. In fact, between the start of the roadshow and pricing the stock market as measured by the S&P 500 fell 5% and high yield spreads had widened 142 bps. On a positive note the ships were brand new and had charter coverage for a good portion of the tenor of the notes. As a result of the careful structuring by the banks, the notes were rated B1/B+, which is about a notch higher than the corporate ratings of Caa1/B-.

“The Russians Are Coming, the Russians Are Coming” – Public Debt Award Europe

By George Weltman

With share prices depressed and monetary policy favoring de minimis interest rates, it is not surprising that borrowers found the bond market attractive. In the short view, it may be viewed by shipping companies as an alternative funding source, a stop-gap for the shortfall in bank lending, but in the long-term it will prove to be complementary to the historically favored bank loans and an intrinsic part of the CFO’s tool chest as he carefully manages the liability side of the corporation’s balance sheet.

As one might expect, nominations in this category were extensive. The year began with Teekay’s $450 million blowout offering, led by J.P. Morgan, Citi and Deutsche Bank, which due to investor demand was upsized by 50% and achieved very competitive pricing. Later that year, its daughter company, Teekay Offshore, with the assistance of DnB NOR Markets, crossed borders into Norway to access its bond market raising NOK 600 million in a three year unsecured bond, its first bond issue. Also in Norway, J. Lauritzen, like A.P Moller Maersk did last year, moved beyond exclusive bank financing in its inaugural five-year NOK 700 million unsecured notes issue, led by Nordea. In one of the largest deals of the year, A.P. Moller Maersk issued its second unrated bond in the amount of EUR 500 million paying a coupon of 4.375% for 7 years. That deal was led by HSBC, Barclays, BNP Paribas, Danske Bank and RBS.

The Financial Crisis Is Over? – Bank Debt Award

By George Weltman

Last year at this time, we were looking back at 2009 in wonder. We marveled as the void in bank lending resulting from the financial crisis was filled by the capital markets, ECAs and the Asian banks, which happily escaped the Western flu. And it was not temporal, all continued to be key players in 2010 and have solidified their critical roles moving forward. In fact, it is safe to say that where the shipping industry historically “banked” on the banks for capital, in today’s brave new world, multiple funding sources are requisite. Moreover, it became clear that public companies with access to the capital markets had a real competitive edge.

Existing capital sources grew and alternative capital sources evolved in this Darwinian world. Aiding and abetting lenders, ECAs became a critically important financing tool backstopping the bank’s commercial lending by not only insuring risk, but providing funding as well. For better or worse, they stepped in to finance the newbuildings for which no finance was available. But like the banks, they were choosy as evidenced by continued delays, deferrals and cancellations, which happily plagued the order book. Self-interest and constraint were evident, despite their main purpose of fostering exports. Even financing of Western owners was selective.

Dealmaker of the Year George Economou, Chairman and CEO, DryShips

By Jim Lawrence

We admit right at the start to a little jealousy about this award. It is a fact that the deserving recipient spoke at our first Marine Money conference. He had 3 or 5 ships at the time, which was about the same attendance we had at New York’s India House that day. He was looking to raise additional funds to purchase more ships. This was 20+ years ago, but even then his timing was impeccable. Well, Marine Money is still running ship finance conferences, but our Award Winner is managing several billion dollar businesses, employing thousands, and delivering sophisticated ships and offshore services to some of the best brands in the world.

Despite the fact that George Economou has built a fortune for himself and many others, his energy for making deals and his charm have only increased with his success – and his hair is still blond and his eyes smile when you see him. .

In all seriousness, no matter what one may think of some of his transactions and, as with most successful people there are opinions out there, for the year 2010 there is no more deserving recipient of Marine Money’s Dealmaker of the Year Award than George Economou, Chairman and CEO of DryShips. Hardly a day went by that he was not hard at work creating solutions to problems, taking advantage of opportunities, working closely with his bankers, communicating with his investors, inspiring his management team, selling his visions, and creating a whole host of activity for a transaction hungry community of professionals who themselves were working hard to survive the storm.

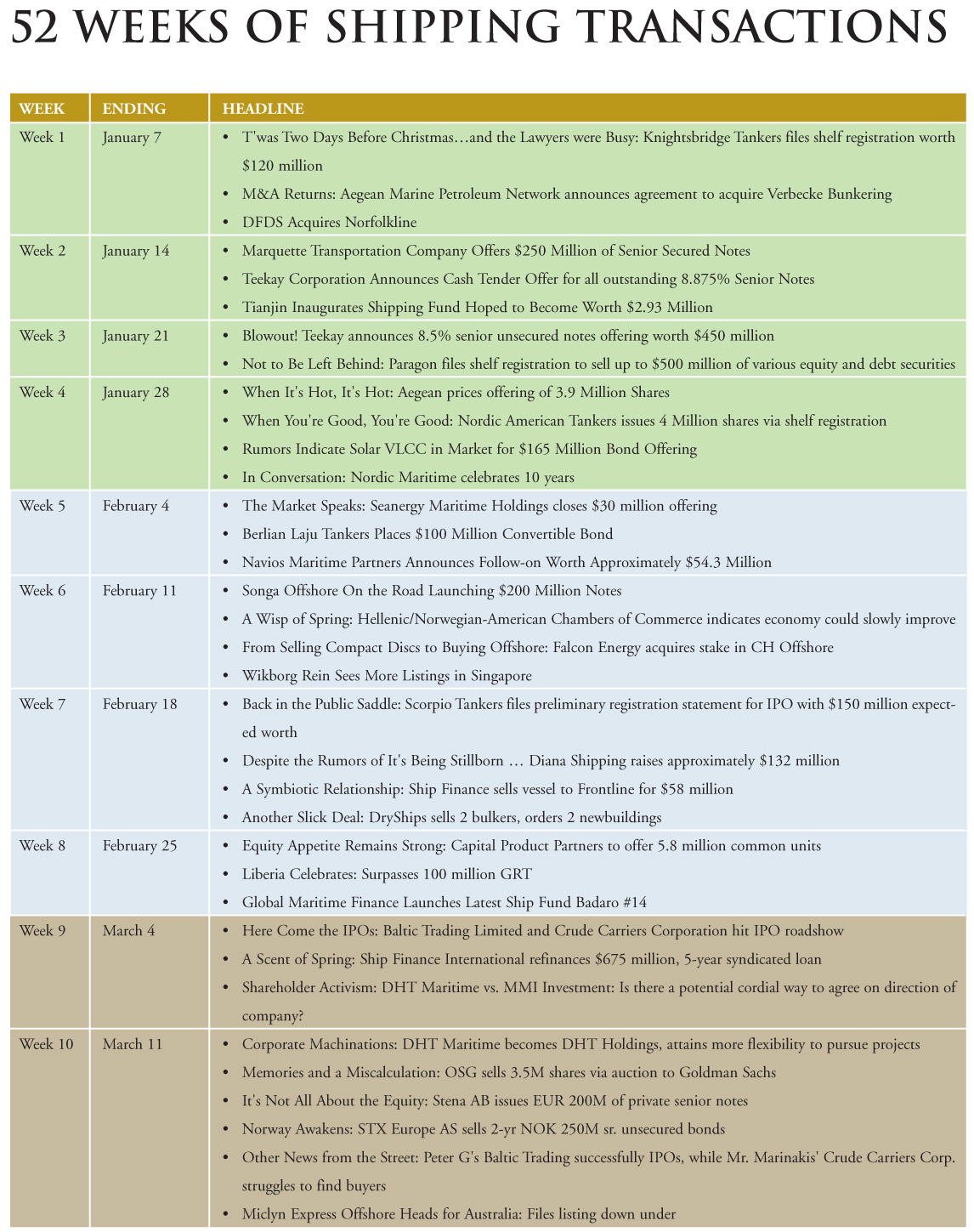

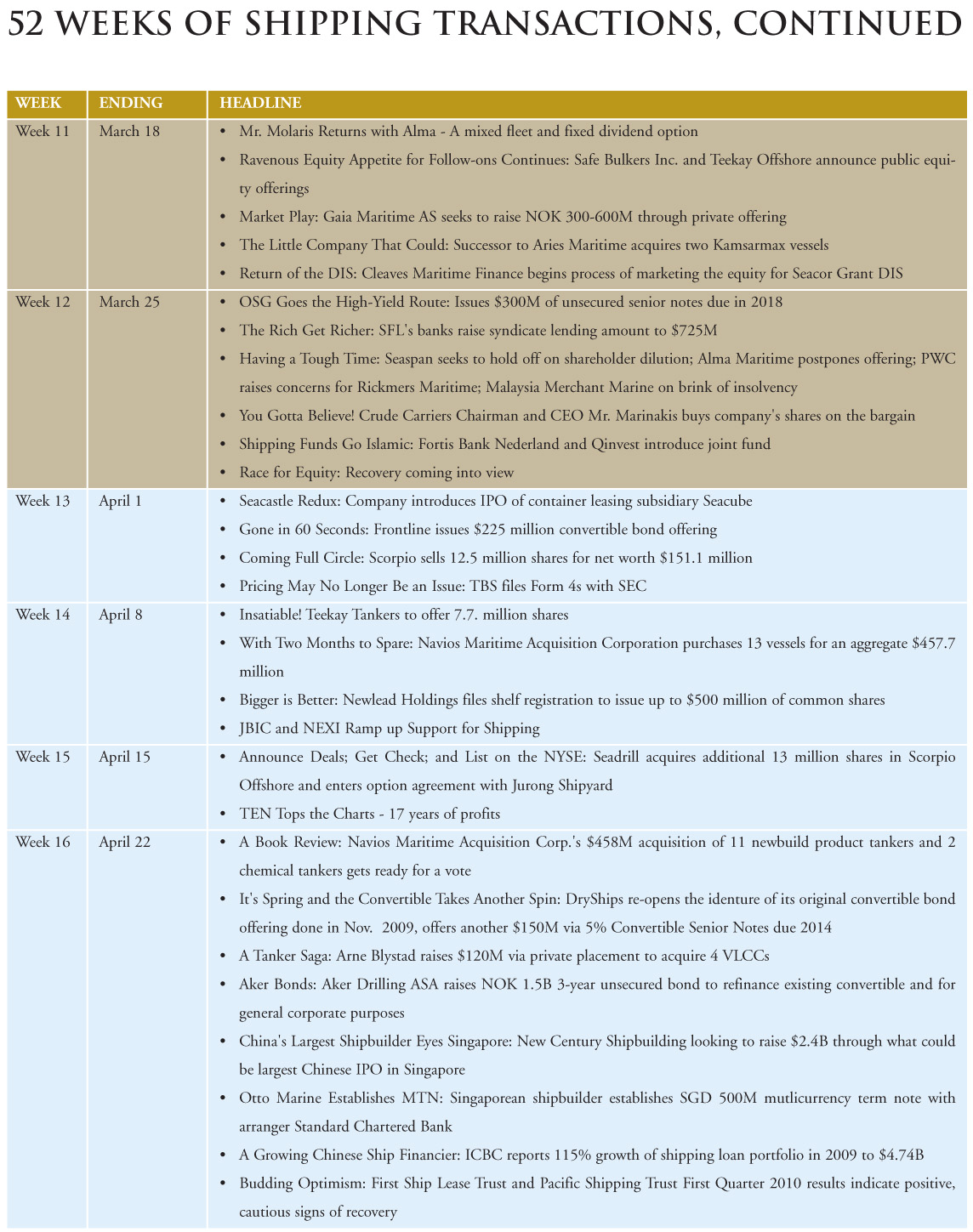

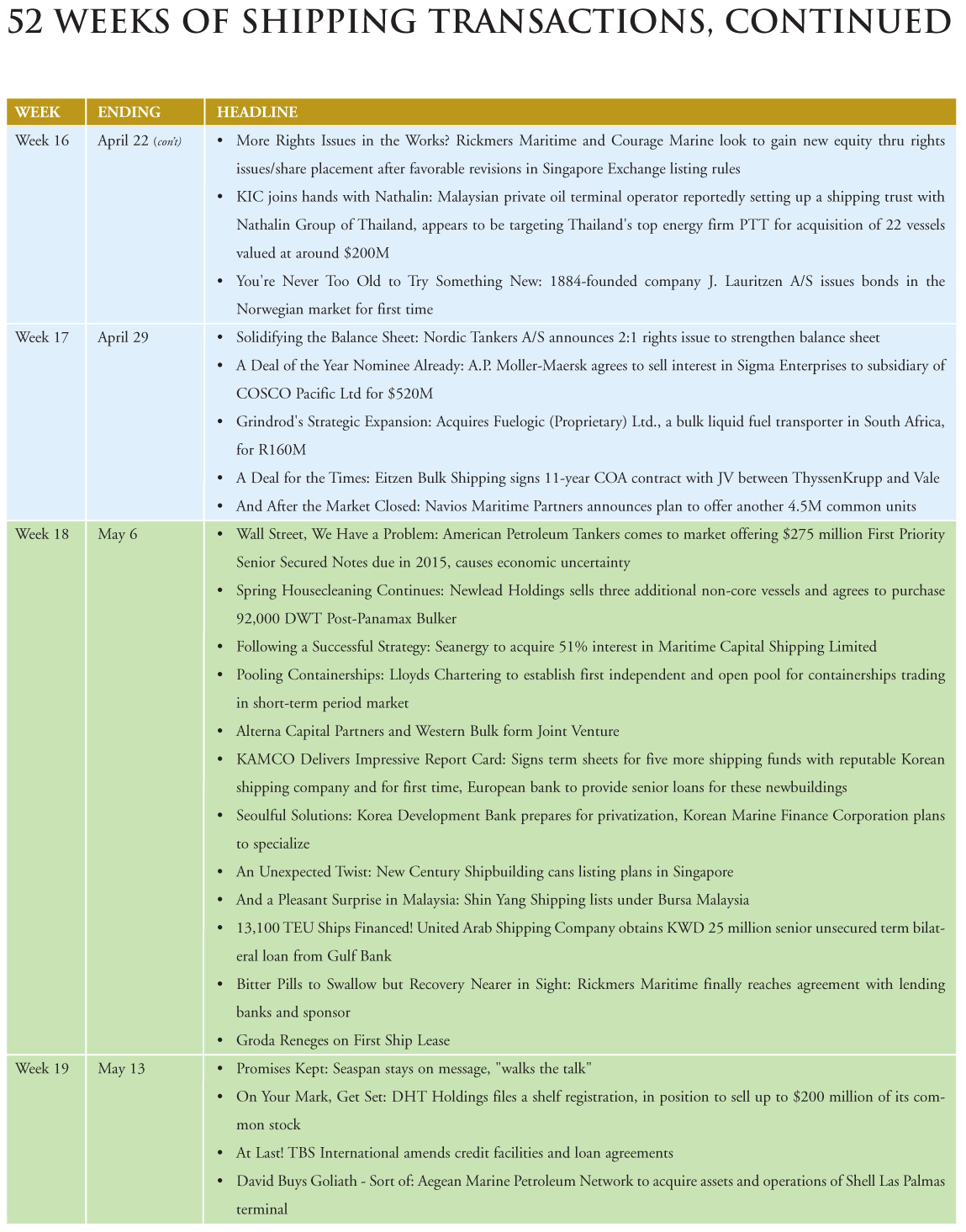

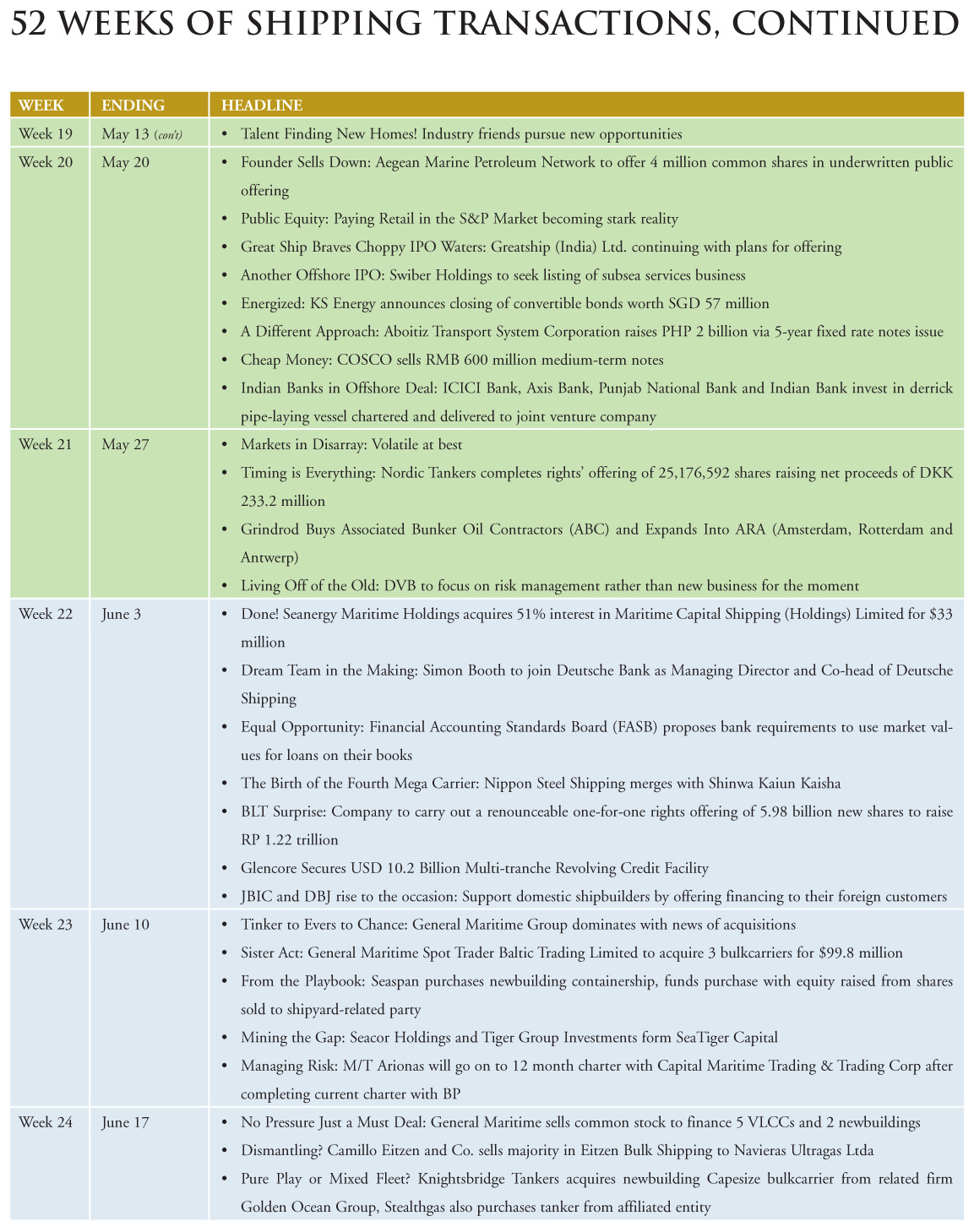

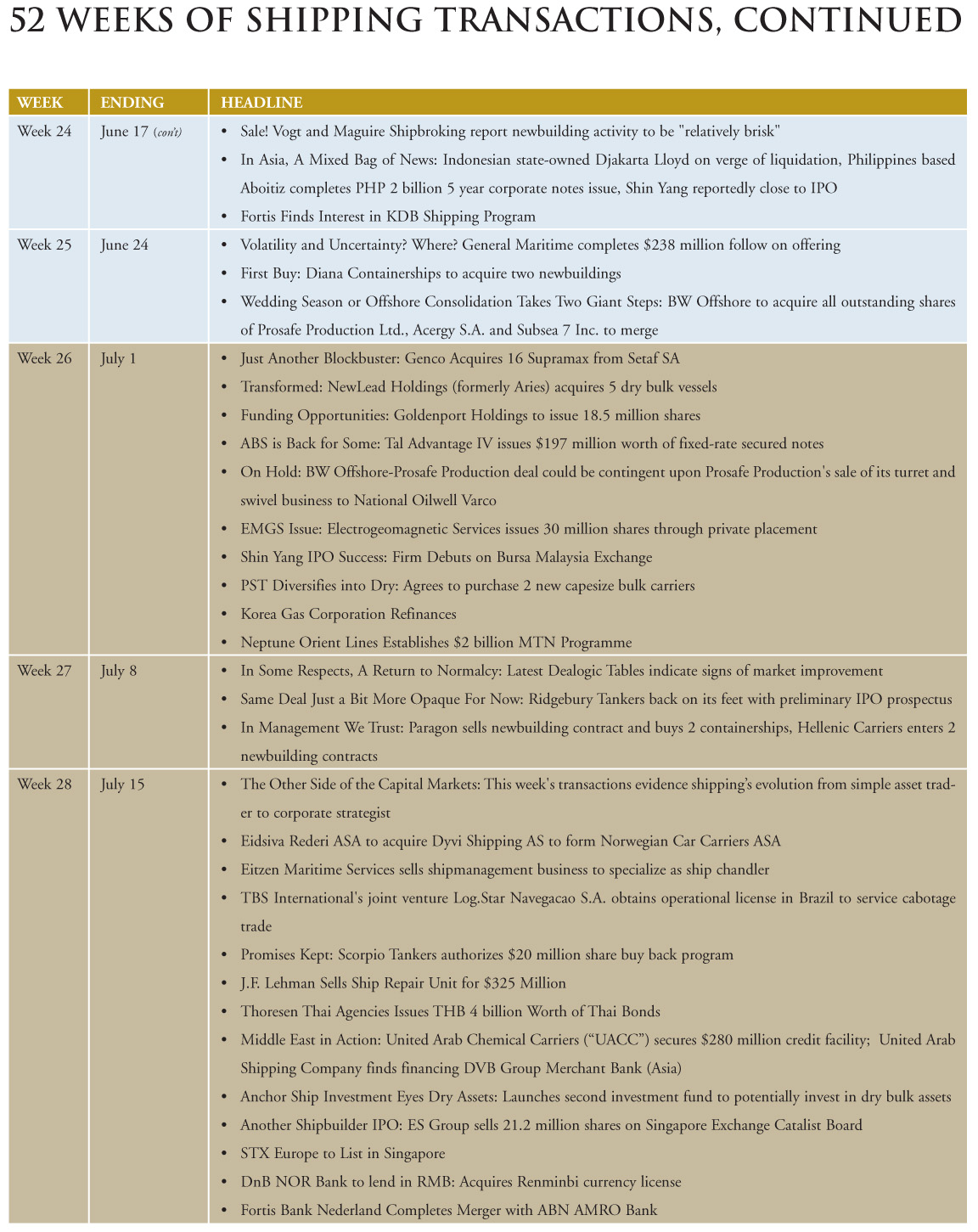

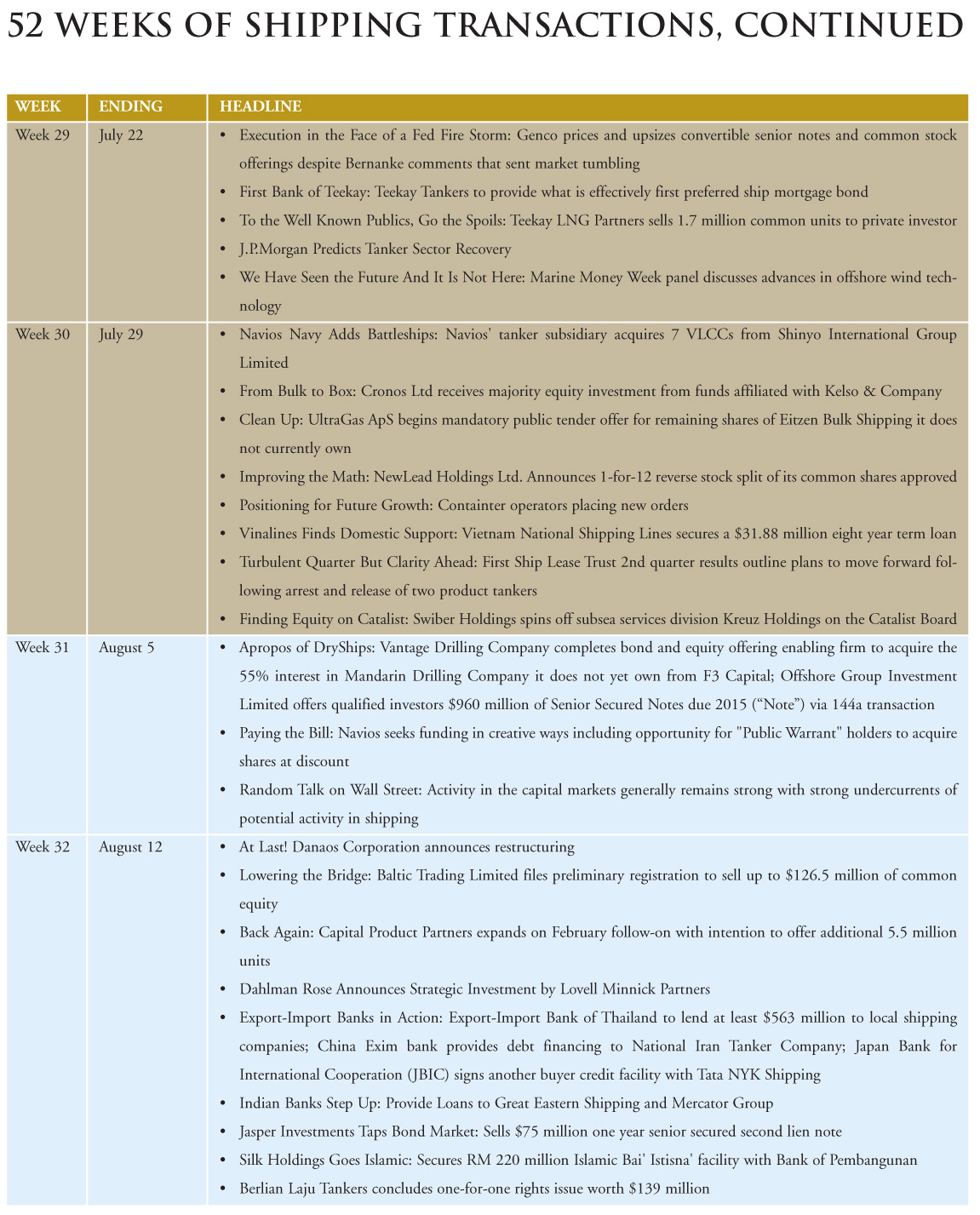

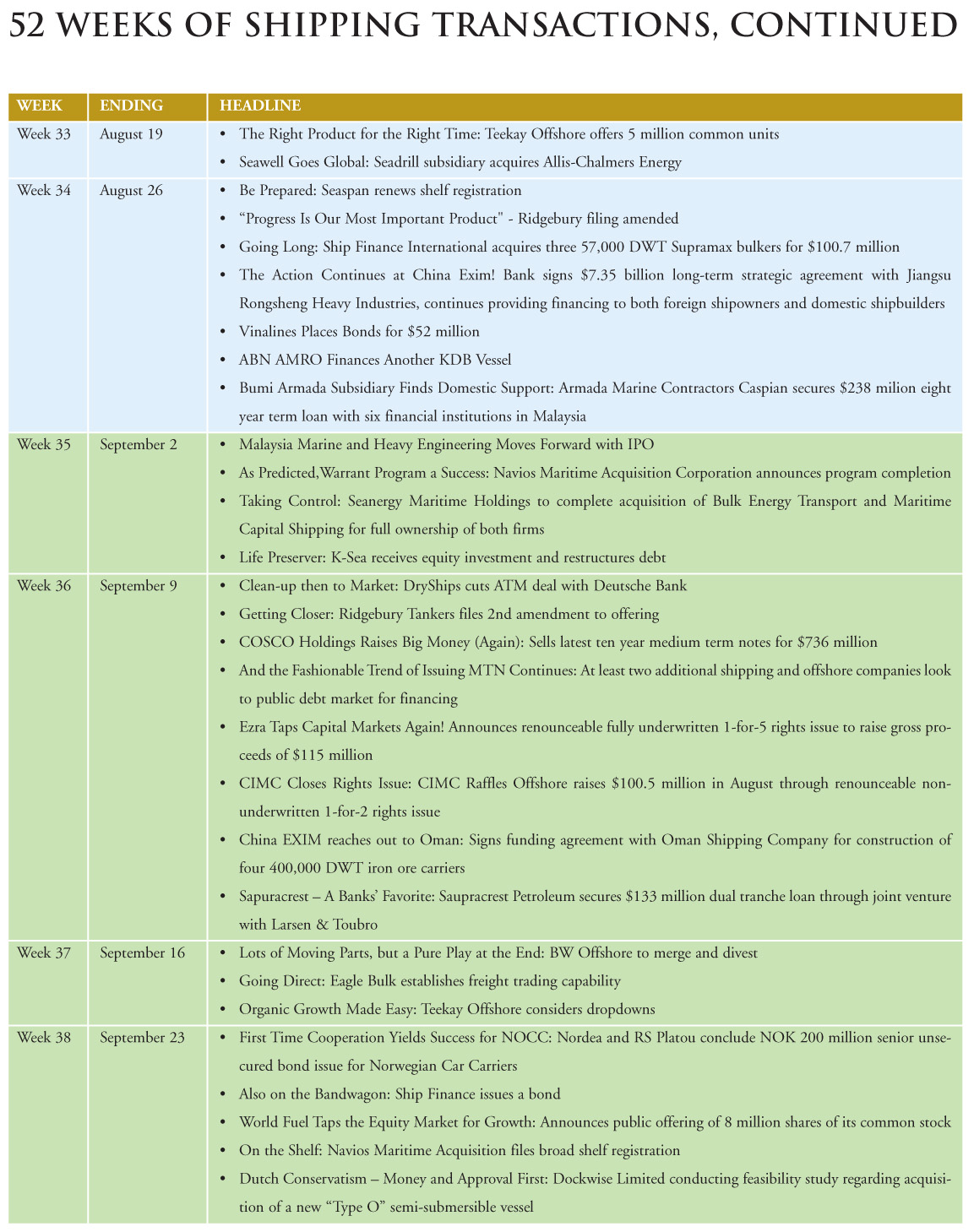

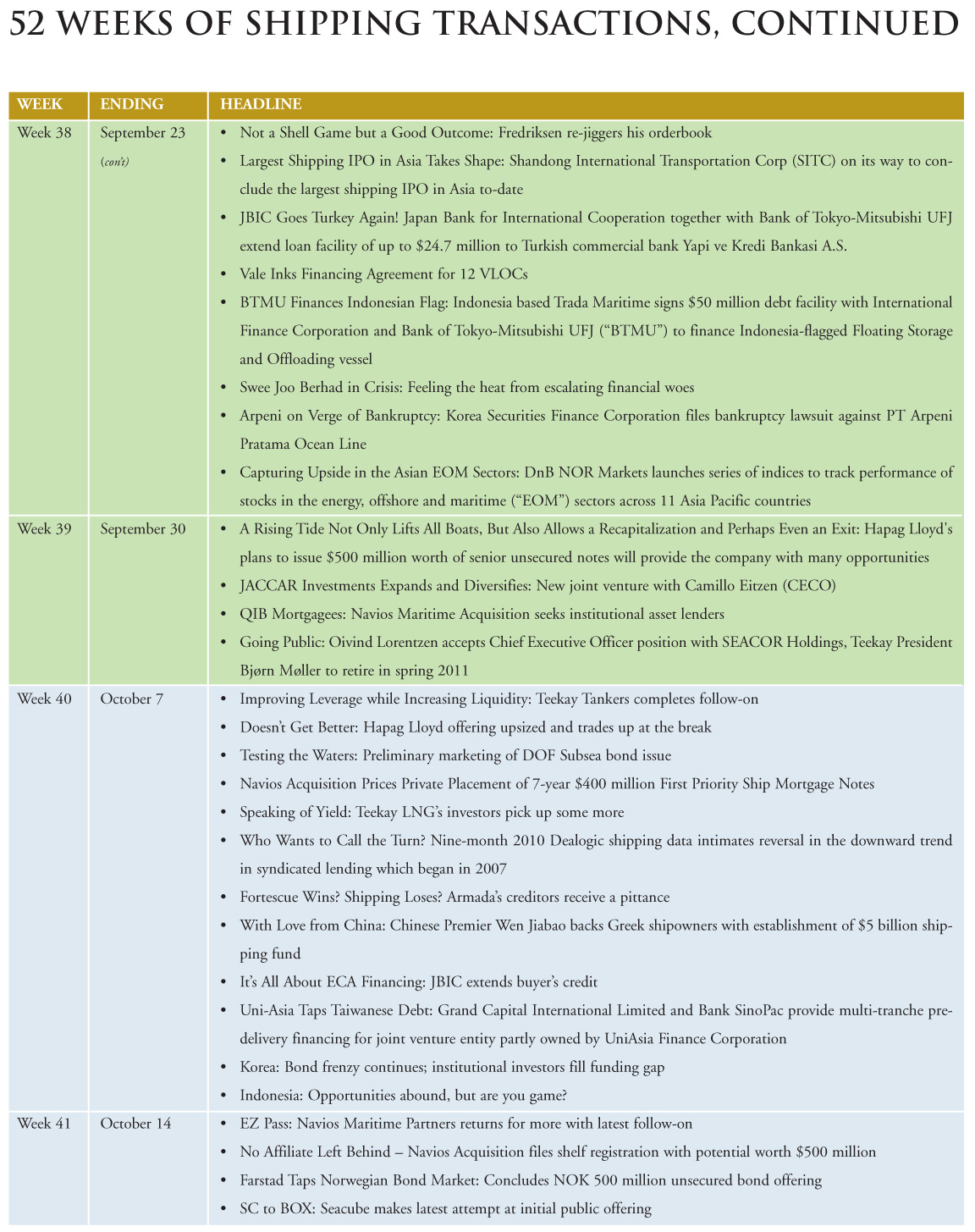

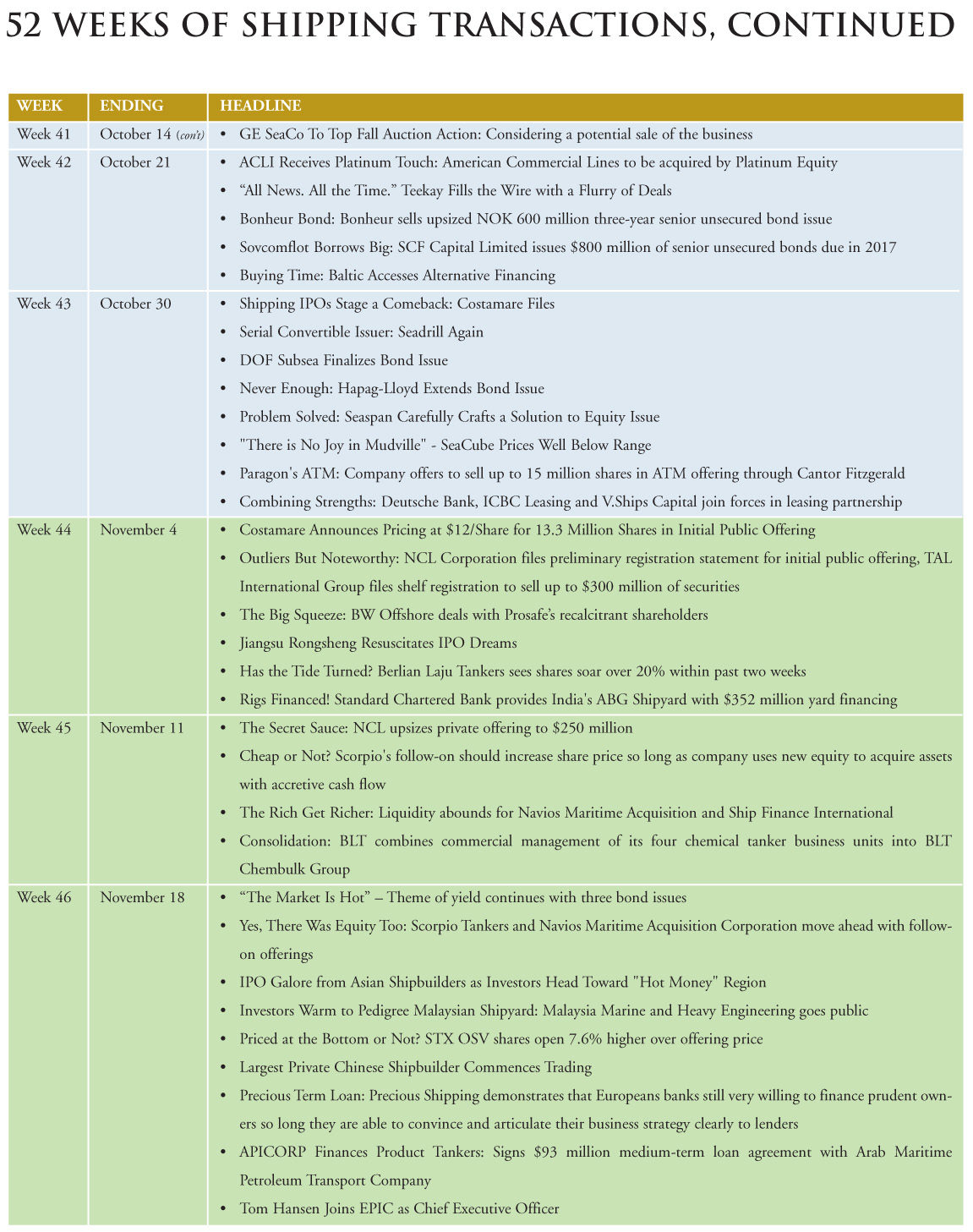

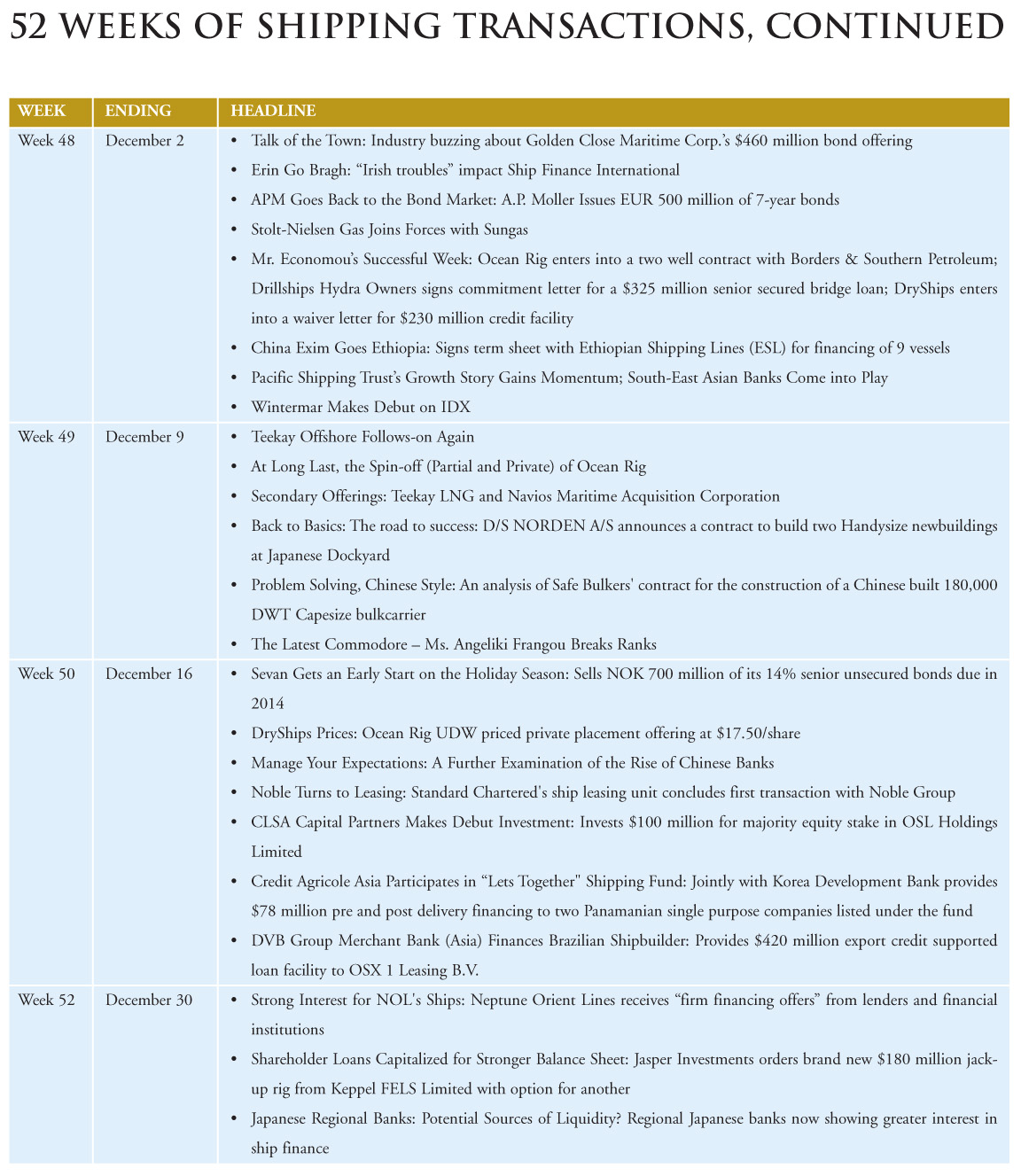

52 Weeks of Shipping Transactions