CMA CGM Replicates Hapag-Lloyd Bond Model

Last week, CMA CGM S.A. successfully offered through a private placement, a $909 million equivalent dual tranche senior note issue, which, in many respects, closely resembled structurally last year’s Hapag-Lloyd bond issue led by Deutsche Bank. The offering consisted of a $475 million 8.5% tranche due in 2017 and a EUR 325 million 8.875% tranche due in 2019. Proceeds of the offering will be used to refinance the company’s existing Euro and Dollar denominated bonds and for general corporate purposes. Key terms are shown below in the Guts of the Deal.

One Way to NY, Please – Part II

We were prescient in awarding Globus Maritime Limited a special editor’s choice award this year recognizing its move to NY. In that article, we mentioned that others would do well to follow. In a recent press release, the management of one is clearly feeling the pressure:

Too Early to Tell

A quarter does not make a year, but it’s off to a good start. Dealogic’s latest league tables arrived last week in the new format implemented in Q4 2010, which provides totals for syndicated marine finance loans and then breaks them down into their constituents, shipping and offshore service loans. This is in line with the Norwegian lending focus, disadvantaging pure shipping banks, although these we would guess are few and far between these days, as diversification is a key risk management tool. Data, for this period, is broken down and provided for all three categories, whereas for the last quarter only offshore was broken out. We have come around to this way of thinking and will focus mainly on the totals rather than the individual sectors, although we will mine the latter for interesting data when it appears.

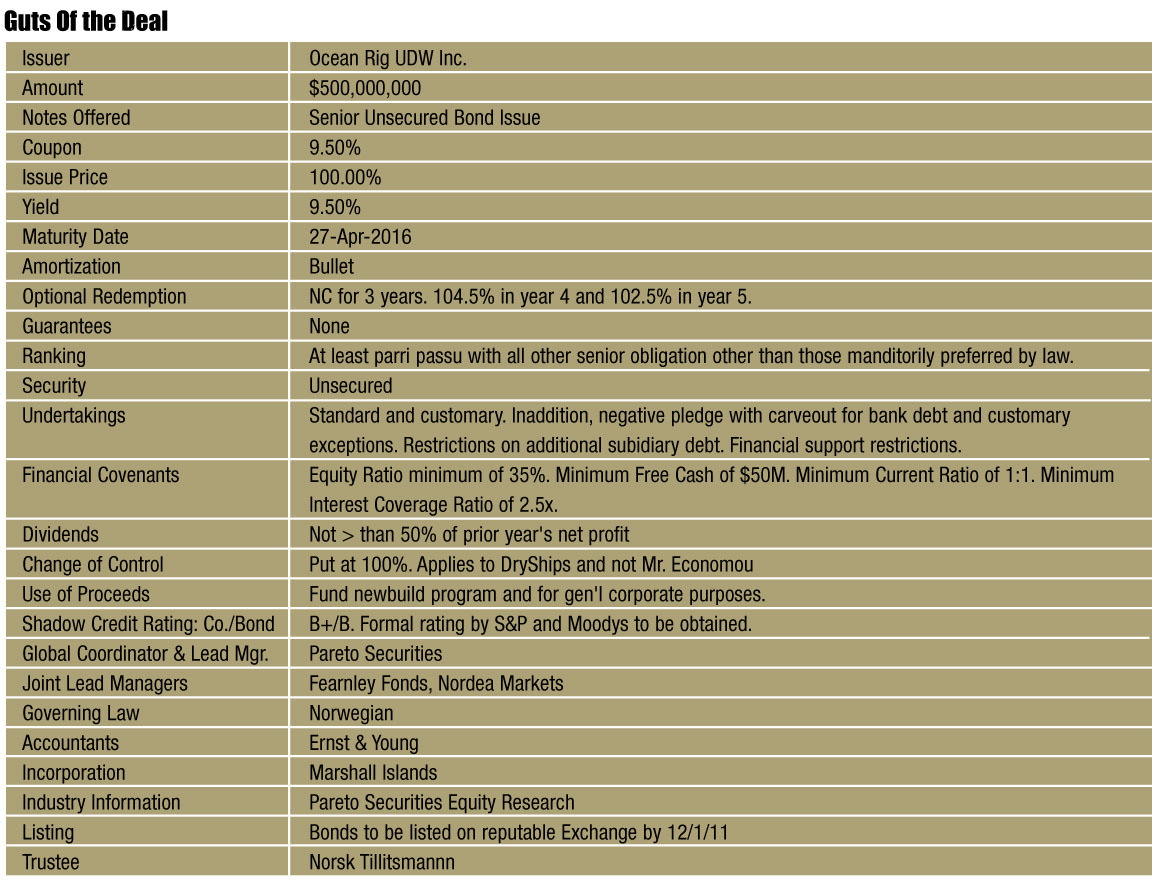

Ocean Rig’s Debt Feast – Banks and Bond Market Provide Support

It’s been a very busy and productive month for Ocean Rig UDW Inc. as it has finally fully funded its current capex program. First, the company arranged a new $800 million syndicated secured term loan facility to partially finance the construction costs of the Ocean Rig Corcovado and Ocean Rig Olympia. The facility has a five year term based upon a 12 year amortization and bears interest at LIBOR plus a margin. The facility is led by Nordea and ABN AMRO and includes in the syndicate GIEK, DVB Bank, Deutsche Bank and National Bank of Greece. A portion of the proceeds of the loan will be used to repay the $325 million bridge loan used to partially finance the Corcovado.

In addition, the company restructured its $1.1 billion secured credit facility led by Deutsche Bank which is secured by the Ocean Rig Poseidon and Ocean Rig Mykonos. The parties have agreed to reduce the maximum availability from $562 million to $495 million for each rig. Ocean Rig has also agreed to provide an unlimited recourse guarantee and will be subject to certain financial covenants. This guarantee is in addition to the existing Dryships’ guarantee. With a contract now in place, full drawdowns will be permitted for the Poseidon. For the Mykonos, the company has up to one month prior to delivery to execute an acceptable drilling contract in order to draw down on its facility.

After putting these deals to bed, the company then announced its intention to offer, through a private placement, $500 million of senior unsecured bonds in the Norwegian market. While on the roadshow, the company met some resistance from investors and had to sweeten the terms. The coupon range went from 8.25%-8.75% to 9.00%-9.50% with the call options also increasing. Year 3’s call went from 103.5% to 104.5%, while year 4’s call increased 50 bps to 102.5. The company has also undertaken to have the bonds rated by both Moodys and Standard & Poors and to list the bonds publicly on a reputable exchange.

Yesterday, DryShips announced that it had priced the $500 million of the senior secured bonds due in 2016 at 9.5%, the top end of the adjusted range. The bonds were priced at par with the proceeds to be used to fund the group’s newbuilding program and for general corporate purposes. With substantial bank debt ahead of it, these unsecured bonds had to be priced right as well as carefully structured to protect the bondholders. In addition to tight financial covenants, the company has various undertakings including a negative pledge and covenants that restrict funds flow within the group as well as dividends. More detail is provided in the Guts of the Deal attached.

Ocean Rig is a pure play ultra-deepwater driller, with a superior asset base, including two harsh environment semisubmersible drilling rigs and, by the end of the year, four premium drillships with options for four more.

In its credit analysis of the company, Nordea highlights as credit positives:

- Modern and competitive fleet of ultra-deepwater units

- Experienced deepwater driller and harsh environment operator, which has operated in 12 countries over the past nine years.

- Strong market outlook

- Modest credit profile

Credit challenges include:

- Exposure to a highly cyclical industry

- High newbuilding activity

- Limited cash flow visibility

- Significant committed capital expenditures as well as the possibility of the exercise of the options

- Risk of increased leverage.

On a preliminary basis, the company was given shadow rating of “B+” with the bonds one notch lower at “B.”

The global coordinator and lead manager was Pareto Securities and the joint lead managers were Fearnley Fonds and Nordea Markets .

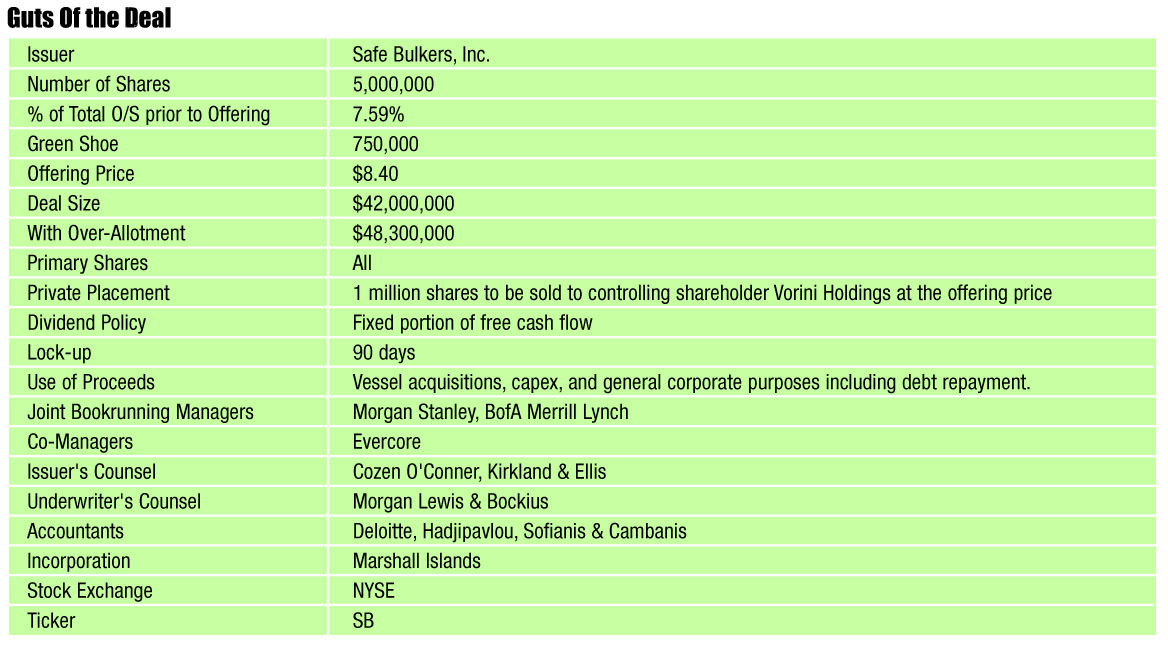

Equity Sales Continue – Navios Maritime Partners and Safe Bulkers Follow-on

While the Golar LNG Partners IPO was a surprise, the prevalence of follow-on offering is not. Last week, Teekay LNG and Navios Maritime Partners LP (“Navios Partners”) successfully concluded their offerings and they were joined this week by Safe Bulkers Inc. While there is nothing that indicates that the window is closing, there nonetheless seems to be a rush to offer.

Golar Partners Prices While Parent fills Warehouse?

Was it a vote for shipping, for the MLP structure, or Mr. Fredriksen? At the end of the day, it does not matter as the first shipping IPO of 2011 met with strong demand and priced above its range. Last week, Golar LNG Partners LP (“GMLP”) priced its initial public offering of 12 million shares at $22.50, above the stated range of $20 to $22 per share. Total gross proceed were $270 million, which could increase to $310.5 million if the green shoe is exercised in full. The limited partners own a 30.1% interest in the company with Golar LNG Limited owning the 2% GP interest as well as a 67.9% limited partner interest. The final details of the transaction are shown in the Guts of the Deal below.

Coco Mowinckles and the Piggy Ride

By Matt McCleery

When the dozen dogs flushed a covey of grouse from the underbrush, a British shipping banker nicknamed Yoda (so named for his uncanny resemblance to the 800 year old Jedi Knight in Star Wars) hoisted his rifle and pushed the scope deep into his sunken eye socket. As he followed the birds skyward, he found it difficult to maintain focus. He had been travelling for more than four weeks and killing birds in the soggy highlands of Scotland with a group of rowdy shipowners was just about the last thing he wanted to do. All he really wanted to do was climb under the flannel duvet in his coastal cottage in Devonshire and go to sleep for a long time. But that wasn’t an option; whether the market was high and he was originating new loans or the market was low and he was busy amending and extending the loans he had made during the high market, there was always plenty for a shipping banker to do.

Simple?

Shipping does not have to be overly complicated if you take a view on the markets. Precious Shipping has been providing future revenue data to its friends and investors for years, the data and commentary have spanned market cycles and warrants attention for its thoughtful approach. The approach is simple; it is the discipline that is required which makes PSL a hard act to follow.

John Fredriksen as Investment Banker – Norwegian Bond Offering

As part of the capitalization of North Atlantic Drilling, the company issued to Seadrill a $500 million 7-year bond with a coupon of 7.75%, which was structured utilizing the standard Norsk Tillitsman terms. It, therefore, should then come as no surprise that in announcing the closing of the acquisition by NADL, Seadrill also declared that it intends to resell the bond in the market.

TAL Also Prices

Just after the market closed last Thursday, TAL International Group announced that the underwritten public offering of its shares was priced at $36 per share. With the shares closing at $36.29 on March 28th, the day the offering was announced, the discount was a nominal 0.8%. The shares traded down 0.89% closing Friday at $35.68 on volume of 4.2 million shares. The final terms are shown in the Guts of the Deal shown herein.