EMGS Issue

Also, last week, Electromagnetic Geoservices ASA (“EMGS”) entered the market with a private placement of its shares despite the many concerns associated with the problems in the U.S. Gulf.

The private placement contemplated an issue of up to 30 million shares, corresponding to 24% of the current number of outstanding shares, with the subscription price set through a book-building process. That process began on the 21st of June and concluded the following day. The placement was successful with the company receiving orders for 28 million new shares with the subscription price set at NOK 7 per share giving gross proceeds of NOK 196 million (~$30 million). Proceeds will be used for general corporate purposes, including working capital for a recently awarded contract.

On Hold

Yesterday, Prosafe Production extended its letter of intent to sell its turret and swivel business to National Oilwell Varco (“NOV”). As a consequence of BW Offshore’s voluntary offer to acquire all the outstanding shares of Prosafe, NOV had requested the extension until after the offer had been concluded and the future ownership structure clarified.

ABS Is Back For Some

In the first intermodal container ABS term financing since 2007, TAL Advantage IV, a wholly owned subsidiary of TAL International issued $197 million Series 2010-1 Fixed Rate Secured Notes. Rated “A” by S&P, the Notes were issued at par with an annual interest rate of 5.5% have a scheduled maturity date of July 20, 2020 and a final legal maturity of July 21, 2025. The net proceeds will be used to purchase containers and for other general business purposes.

Meeting Its Obligations

In order to satisfy its obligations under the registration rights agreement, General Maritime announced yesterday that it had commenced an exchange offer to exchange up to $300 million principal amount of newly issued 12% Senior Notes due 2017 (“Series B Notes”), registered under the Securities Act of 1933 for a like principal amount of its privately placed outstanding 12% Senior Notes due 2017 sold in November 2009 (“Series B Notes”). The notes are identical in all material respects except that the Series B notes have been registered with the SEC and will not contain terms that restrict transfer or registration rights. The offer will not affect debt levels nor will the company receive any proceeds from the exchange.

Funding Opportunities

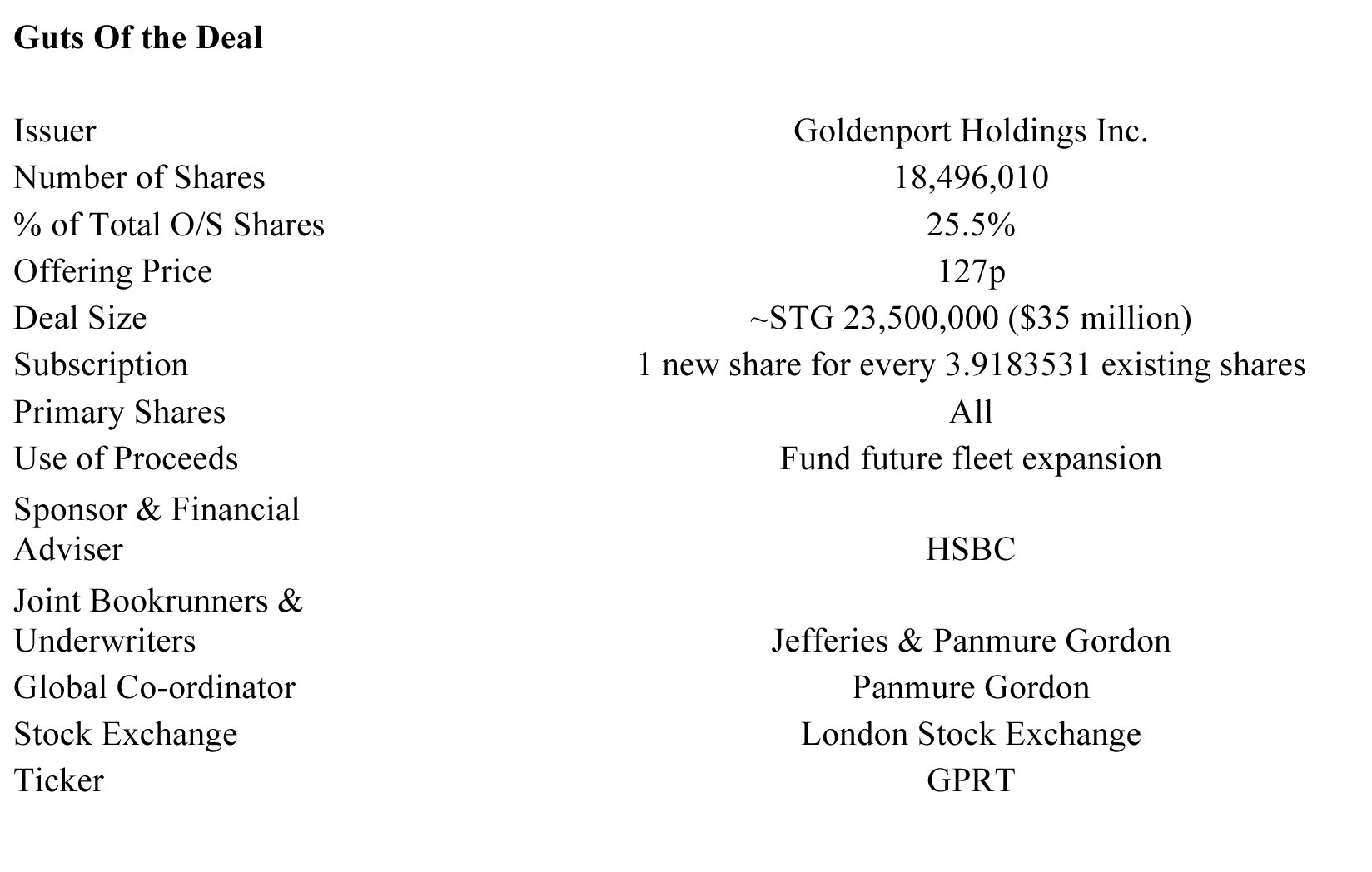

Last week, Goldenport Holdings Inc. announced a share issue by way of a “placing and open offer” to raise approximately STG 23.5 million or $35 million. The company intends to issue ~18.5 million shares at 127 pence per share, a discount of 1.55% from the prior day’s closing price. In order to demonstrate their commitment as well as to maintain their share position, Captain Paris Dragnis, the founder and CEO of Goldenport, along with certain directors have irrevocably undertaken to acquire approximately 7.5 million shares or approximately 40.7% of the offering. Seeing opportunities based upon the economic recovery and improving shipping fundamentals, the company intends to use the proceeds to fund future acquisitions. Assuming a conservative 50% leverage, the company will have at least $70 million of capacity to go shopping. Jefferies and Panmure Gordon are the joint bookrunners and underwriters with HSBC acting as Sponsor and Financial Adviser. The deal is expected to close on July 20th.

Transformed

The shipowner, formerly known as Aries, has transformed itself and in our estimation has achieved critical mass. It may be small cap by definition but its growth trajectory is unparalleled. Since the company began the process of recapitalizing in the 4th quarter of last year, NewLead Holdings Ltd has acquired 17 new vessels, including five newbuildings, while divesting inefficient non-core vessels and exiting the container sector. Unlike its peers, it has adopted a strategy of focusing on two diverse sectors, dry bulk and product tankers, rather than being a pure play, thereby minimizing to an extent portfolio risk.

Just Another Blockbuster

Marry opportunism with an ability to perform and the world is your oyster. Even in these uncertain times Peter G. and his team have a proven capability to perform and hence deals continue to find them. This has been the theme of the past few weeks as Genmar and Genco have made major acquisitions. Last Friday, it was Genco’s turn again and they found a willing seller in Setaf SA, a wholly owned subsidiary of Bourbon, a company, which is mainly focused on the offshore industry, although it had a dry bulk business for diversification.

Earning’s Season – A Few Surprises

The big surprise is that there is no obvious trend, or blaring headlines like “the market stinks”, or “shares take a beating”. Truth is each result is a mini-story and for close followers of the sector, there was value to be had. Offshore and containers, with Seaspan leading the way, arguably outperformed their bulk market peers, which is no surprise. The biggest hit went to Horizon Lines whose saga of woe pre-ordained the collapse of its stock price in tandem with its EBITDA. Kirby and newly acquired K-Sea both performed well. What follows is a snapshot of those that reported thus far.

We Have Seen the Future and LTV is Part of It

While unfair to single Eagle Bulk Shipping in particular, they happened to be in the news last week as a result of a disagreement with their bank with respect to the calculation of covenants. In his report titled “Covenant Dispute arises as Asset Values Double-Dip”, Citi’s Christian Wetherbee noted that Eagle disclosed “Friday that the agent for its $1.2 billion credit facility with The Royal Bank of Scotland has deemed that the company had been in compliance with the original collateral maintenance covenant (130% fleet value/loan value) for two consecutive quarters (2Q10 and 3Q10), thus reinstating the original vessel value covenant of the facility. This becomes an issue as the agent also noted that as of March 31, 2011, Eagle was no longer in compliance with the covenant due to the recent downturn. Eagle is disputing the claim and was only notified of the compliance and subsequent breach recently.”

Marinakis Consolidates Within – Premium plus Fair Value

In a surprise move, Capital Products Partners L.P. (“CPLP”) and Crude Carriers Corp. have agreed to merge with CPLP as the surviving entity.

The transaction is structured as a unit- for- share transaction with Crude Carriers shareholders receiving 1.56 CPLP common units for each Crude Carriers share. Based upon yesterday’s CPLP closing price of $11.27 the transaction values Crude Carriers shares at $17.58, a premium of 35.3% to its closing price of $12.99. Moreover, based upon vessel appraisals received by the Company from independent shipbrokers as of March 31, 2011, the $17.58 per share transaction value paid to Crude Carriers is in excess of the company’s per share Net Asset Value.