Marine Money Top Performers: A Look at Share Performance of the Best of the Best

We wanted to build a list of companies which we thought today represented a good investment profile: a virtual portfolio at this trough moment. We began by taking those companies that had been most frequently in the Top Twenty of Marine Money’s annual Ranking of public companies in both the category of overall performance and financial strength over the past 5 years.

The Top Twenty (24 actually due to ties) from both those categories from the past 5 years – Boom to Bust years you could say – follow. We provide only their share price performance for that period. If a rising tide lifts all boats a waning tide leaves many high and dry and it does not seem to matter terribly if you were #1 or not on the list – except perhaps to Kirby and Seacor, two superior share performers through the crisis.

The Story in Bonds

The story in Bonds is a bit more cataclysmic as the sell off has pushed yields higher. While the yields may be a harbinger of problems to come, and this as a warning cannot be taken lightly, what we have here is an industry whose credit standing looks like the nations of the EU.

We exaggerate, but can CMA CGM really be a 23% yield? The company’s August 3rd press release stated “we believe we are prepared for such conditions.” But that was August 3rd, a week before the melt down began in earnest. Short sellers, like distressed bond market players have a nose for underlying problems often before others perhaps should, or admit. Risk and reward aplenty below.

The Bad News…and The Good News

The bad news is that our industry is suffering from the double blow of weak global demand and surplus tonnage. Like all cycles, this one will pass, but the landscape of participants, from owners to investors to lenders, will change.

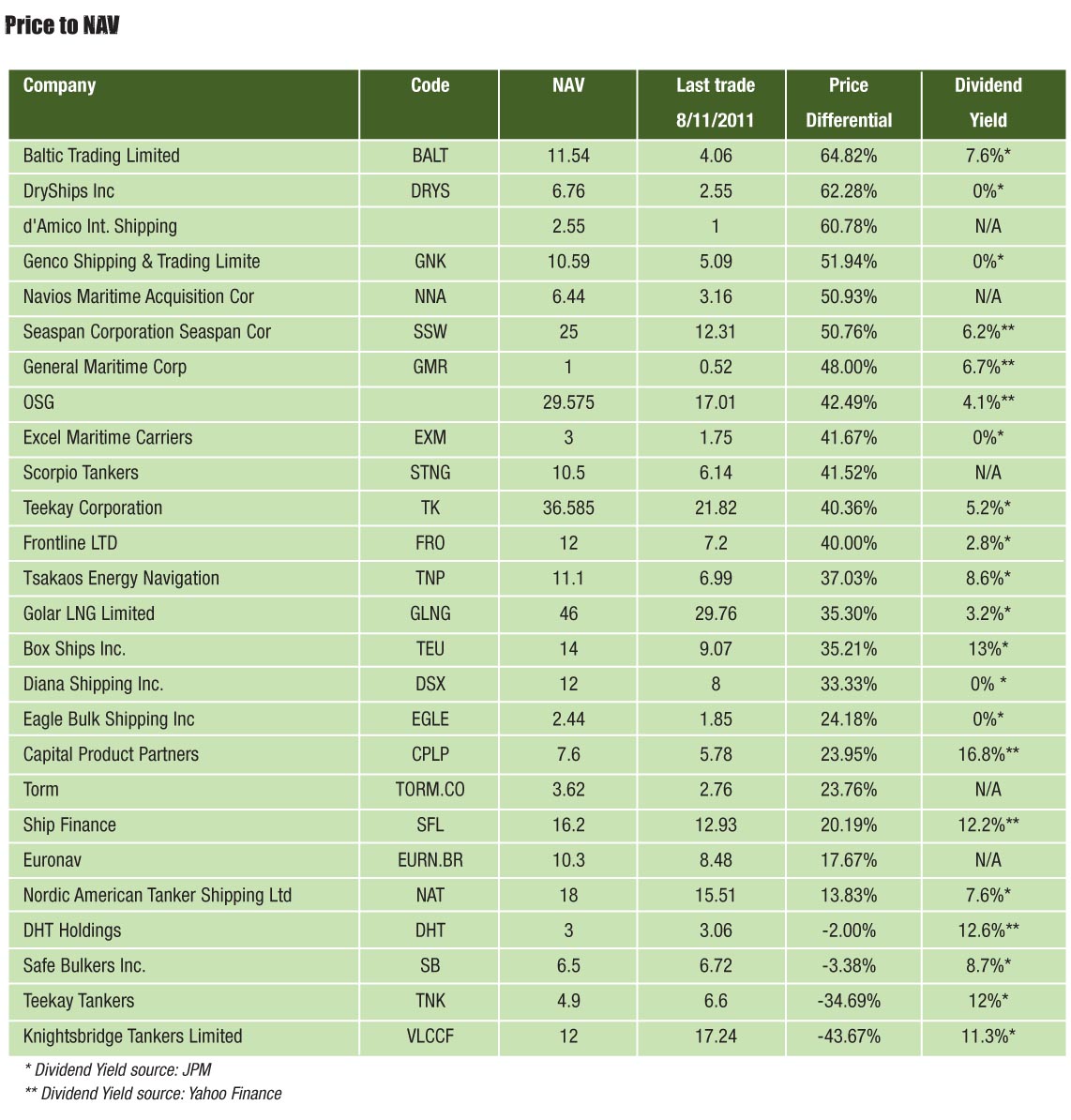

The good news is that the current correction in ship values, and the valuation of the public companies that own them, is setting the table for the next round of capital appreciation.

DRYS dividends out 2% of OCRG – further increasing liquidity in OCRG

With chaos all around team DRYS remains a bastion of clear thinking value creation when it announced after Freshly Minted was published last week that its Board of Directors had approved the partial spin-off of its interest in the Company’s majority-owned subsidiary Ocean Rig UDW Inc., of which DryShips currently owns approximately 78% of the issued and outstanding common stock.

An Overview of What Shipowners Want, Need & Expect From Their Banks and Banking Relationships

A survey was conducted by Marine Money for ABN AMRO whose findings were presented at the 24th annual Marine Money Week in June. Gust Biesbroeck, the Managing Director & Global Head of Transportation for ABN AMRO, spoke eloquently about the most important conclusions from the survey in his speech, “Debt Capital Markets: What Shipowners Want, Need & Expect from their Banks & Banking Relationships”.

The survey was global. Owners surveyed were based in Asia, the Middle East, Europe, the Americas and South Africa. While there were many intriguing findings, this article will discuss the three most important discoveries found through the survey.

Eagle Bulk Gets its’ Own Knowledgeable Investor

Oaktree Capital, the seasoned shipping industry player has reported last week that it had purchased 4,900,000 shares of Eagle Bulk through a number of its’ controlled funds. The purchase equates to 7.8% of Eagle shares. The investment is just one of several the group has made in shipping, the most notable perhaps being its close and profitable relationship with Peter Georgiopoulos and General Maritime.

V.Ships Delivers for Exponent and Gets New Long Term Shareholder

Culminating a great investment with V.Ships, Exponent and V.Ships management have concluded a $525 million dollar sale of the global shipmanagement and outsourcing giant to Canadian pension fund Ontario Municipal Employees Retirement Scheme, (Omers). The transaction was managed by Lazard who advised Exponent. The sale price equates to a roughly 55% return for Exponent which bought into V.Ships in 2007.

Evercore’s Chappell Weighs in on Collateral Benefit

Evercore’s Jonathan Chappell quickly weighed in on the possible valuation of the assets in the Diamond S acquisition which he pegged at $36 to $37 million apiece. 30 ships divides into the reported purchase price of $1.2 billion at $40 million. The difference between Mr Chappell’s $37 million and the $40 million is attributable to the value of the charters. This is, in Evercore’s view, good news for Scorpio Tankers. While it seems highly unlikely Diamond S’ Mr Stevenson bought the ships to help out his old OMI partner Robert Bugbee, CEO at Scorpio, the valuation did enable Evercore to increase their NAV estimate for Scorpio from $9.94 to $10.30 per STNG share.

Diamond S and Gorgeous Suite of Private Equity Players Capture Cido MRs

Some might call it tripling down, others: Just what it takes to run a business for a bear market…

When Diamond S Shipping announced that it had entered into a definitive agreement to acquire the stock in companies that own 30 medium-range refined product carriers to add to its fleet of ten tankers under construction in Korean shipyards, reaction ranged from “the Cido ship deal sure was a long time coming” to just plain jealousy.

But students of true contrarian investing may have noticed something different, and important: an investor base for Diamond S take shape just the way one might dream.