AMA Looks to Germany – An Investment in Lloyd Fonds

Last week, Lloyd Fonds AG approved a resolution to increase the company’s capital through the issuance of up to 15 million new shares at a price of EUR 1/share. While the offering contains full subscription rights, the transaction is effectively underwritten by AMA Capital Partners LLC through its investment vehicle, ACP Fund V LLC (“ACP”), which has agreed to subscribe to all the new shares not yet acquired up to 49.9% provided that it obtains a minimum stake of at least 30 percent. The offer is also conditioned upon the release, by regulatory authorities, of AMA from its obligation to submit a takeover bid and that an agreement is reached with the banks on the final release compensation payable. A portion of the proceeds from the issue are to be used to settle the liability release agreement signed with the banks in April 2010 successfully and conclusively marking the successful completion of the company’s restructuring efforts. The company can now look forward to a future with renown investor AMA, who gains an insider’s peek into the German market.

65% Leverage on Newbuild Tankers – DryShips Taps the Syndicated Loan Market

On Wednesday, DryShips Inc. announced that they entered into a $141 million syndicated secured term loan facility with Korea Eximbank and ABN AMRO Bank to partially finance the construction costs of two Aframaxes, Belmar and Calida and two Suezmaxes, Lipari and Petalidi. With this financing in place, the next four tankers scheduled for delivery in the first quarter 2011 and the first half of 2012 are fully financed, leaving five tankers from the 12 tanker newbuilding order closed in December 2011 to be financed. Martin Korsvold of Pareto suggests that the leverage ratio is approximately 56% of cost or 65% of the value of the vessels and as he notes this is highly favorable given the very difficult tanker and banking markets.

Stolt-Nielsen Continues Consolidation in Terminals

On Monday, Stolt-Nielsen Limited announced that it had reached a provisional agreement, subject to final contract, with Den Hartogh Holdings B.V. to acquire the bulk-liquid storage terminal in the Port of Moerdijk. The terminal consists of 30 stainless steel tanks with a total capacity of 17,720 cbm. On site, there is also a drumming operation, three warehouses, a jetty with a draft of 8.4 meters and a tank container storage depot. Located on 10 hectares of land, of which only half is currently in use, the facility offers room for future expansion. The new incremental capacity, located in the Antwerp-Rotterdam-Amsterdam range, fits nicely into the company’s inter-European coastal tanker and inland barging services. The transaction is expected to close on December 31, 2011.

C-Gas or B-Gas, it still gets an A – The Acquisition of Eitzen Gas

Last Friday, Camillo Eitzen & Co. ASA (“CECO”) announced that the sale of Eitzen’s owned semi-re fleet, its 100% interest in Eitzen Gas A/S and the back to back lease of five pressurized LPG vessels to B-Gas Limited, an investment company established by Pareto Project Finance AS, had been concluded on terms materially similar to those announced in July. It is the nearly the end of CECO’s adventure in gas, which will leave them with a book profit on this transaction of $12 million and a 20% interest in Eitzen Ethylene Carriers, which will be acquired by Jaccar Holdings by the end of this month.

The transaction, structured as a Norwegian IS Partnership, was carefully crafted and placed as a club deal with Bergshav and two Norwegian shipping investors. Under the terms of the transaction, B-Gas, acquired 9 x 100% owned semi-ref LPG vessels ranging in size from 1,760 to 3,125 cbm with an average age of 17.8 years. The owned fleet is traded under a mix of time charters and COAs in the northern European premium market.

On Bears and Balls

Some thoughts by Johnny M. Kulukundis

A few years ago, at the height of the heady dry cargo boom and with a decline in the tanker market only an imperceptible glimmer on the horizon of a newbuilding delivery graph, I had the pleasure of playing golf with my father. It was the Connecticut Maritime Association’s Spring Golf Outing, a boisterous and very oversubscribed affair, with over seventy shipping foursomes. Cart loads of euphoric, very well paid and quite self-satisfied shipping professionals tearing around the Connecticut course, sporting shirts and caps emblazoned with the logos of their various brokerage firms, operating companies, ownership operations or chartering organizations.

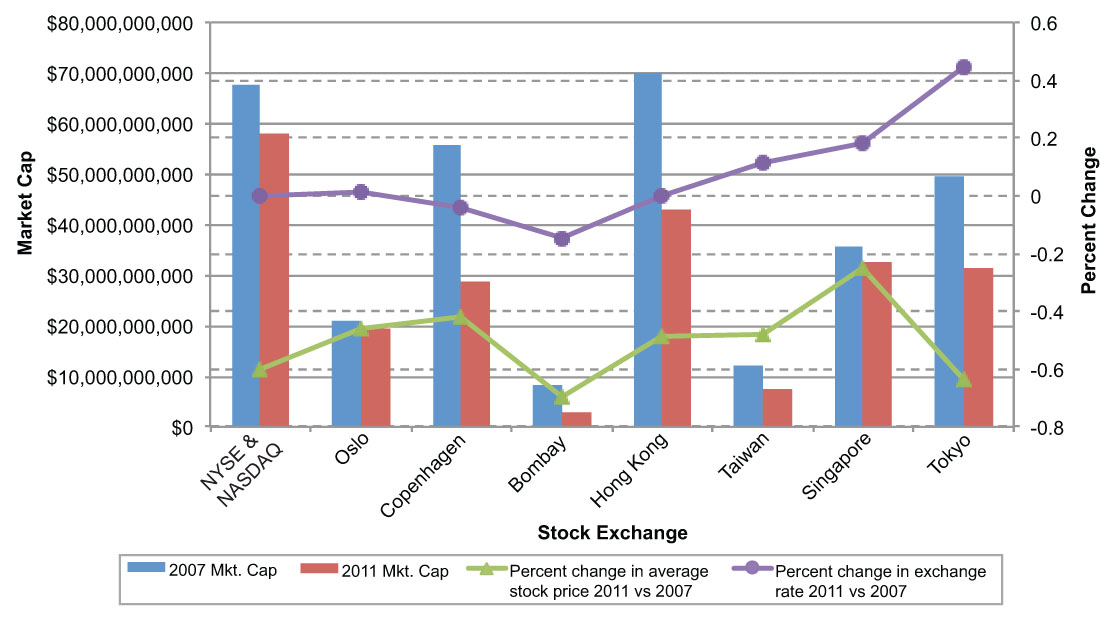

Equity Erosion, less than might be thought

A quick comparison of the market caps of some 130 publicly traded shipping companies in December 2007 versus last week 2011, made us pause. If as many S&P sorts say over a cocktail asset values have dropped 70% from their highs then the overall fall in the industry’s market cap (2007: $320,743,932,619 versus 2011: $224,285,753,201) should be some surprise. Not that a fall of 30% is any cause for celebration. But a closer look shows the devil is in the details with some markets much harder hit than others. The performance of the dollar against local currencies was sometimes painful multiplier to the losses, but sometimes mitigating factor. So Japan’s shipping company market cap value slipped nearly 40%, but the yen appreciated 44.5%. As glass half full sorts, there must be a screaming buy somewhere….at some point.

Six Month Reprieve – Eagle Gets Relief from a “Technicality”

Back in April, Eagle Bulk Shipping Inc. disclosed a disagreement between its lenders and the company concerning the interpretation of two modified covenants contained in the third amendatory agreement to the revolving credit facility. Under the revised terms, the net worth covenant was amended from a market value to book value measurement with respect to the value of the fleet and the facility’s EBITDA to interest coverage ratio was reduced, with these changes to stay in effect until the company is in compliance with the facility’s original covenants for two consecutive accounting periods.

According to the lender’s interpretation of information provided by Eagle, the company was in compliance with the original covenants for the second and third quarters of 2010, allowing the lenders to reinstate the original covenants. Eagle’s management disagreed with the interpretation of the original covenant calculation used by the lenders and therefore deemed itself not in compliance for those two quarters, further suggesting that the amended covenants therefore should therefore remain in place.

Lots of Moving Parts Managed Nicely – Polarcus Re-capitalization

As the industry has moved away, voluntarily or not, from the simplicity of bank lending, as its primary funding source, borrowers, with the assistance of their advisors, have become far more sophisticated and used the liability side of the balance sheet as a palette for the many possibilities in financing structures. The multi-tiered capital structures that result may be warranted in an effort to achieve the lowest cost of capital possible or simply a necessity to access capital wherever one can find it. Nevertheless, whatever the motivation, these structures add a level of complexity given the number of stakeholders with their own unique incentives, thereby creating risk should Murphy’s Law apply.

Polarcus Limited, a pure play marine geophysical company, is a case in point. In recent presentations the company has included the following slides, which highlight its capital structure and the impact of the recently undertaken recapitalization of its balance sheet including a refinancing of its bank debt, an amendment to its 2nd lien bond issue and a private placement of equity.

The End? – Saga Sells the Rest of Its Fleet

Pressured by its bank syndicate, Saga Tankers ASA announced on Wednesday that, as a result of a substantial decline in vessel values as well as the continuing weak freight market, it agreed to sell its two remaining vessels, Saga Agnes and Saga Julie, to a first class Greek owner. With values in free fall, the company’s banks were pressing the company to issue new equity in order to alleviate the likely breach of its minimum value clause. Believing that in today’s market that the issuance of equity could only be concluded on terms that would be unattractive to shareholders and the resulting financial structure would remain precarious based upon the market outlook and the revised loan terms dictated by the banks, the company declined and instead disposed of the vessels in order to secure the remaining shareholders’ value.