Trico Makes $810 million Bid for DeepOcean

Last week Trico, which only relisted in 2005 after undergoing a restructuring, announced the acquisition of 51.5% of Oslo listed DeepOcean and the intent to offer NOK32 per share for all remaining shares, valuing the company at $810 million. The offer price represents a 28% premium to DeepOcean’s May 15 closing price of NOK 25 per share, an amount that can be taken as a sign of strong interest by Trico in making a complete acquisition. Correspondingly DeepOcean’s management and board have recommended the offer to their shareholders.

Transaction Report

It was great news for the equity markets this week when Safe Bulkers got out its Merrill Lynch and Credit Suisse- led IPO. While the deal did price $1.00 below its $20-$22 target range, it’s been so long since we’ve seen any shipping IPOs that the very fact of a new deal getting done is a good sign. But the real interest this week was in the oil market, and Marine Money could not have asked for a better time to host its 10th annual Norway Ship & Offshore Finance Forum. The gathering was full of those hearty souls that will shape the next generation of oil production and discovery, financing and building machines to pull oil out of 12,000 feet of water, through thousands of miles of crusted salt, and anywhere else it can be found. The gathering formed the epicenter of the activity that is the focus of the better part of the world’s citizens.

Safe Bulkers Files for IPO

It’s been awhile since we have seen a Greek dry bulk company file for an IPO in the United States. To us the IPO filing by Safe Bulkers is a comment not only on the robust state of the dry bulk market, but also the perception that the US equity markets are returning to life as a meaningful source of capital for global business.

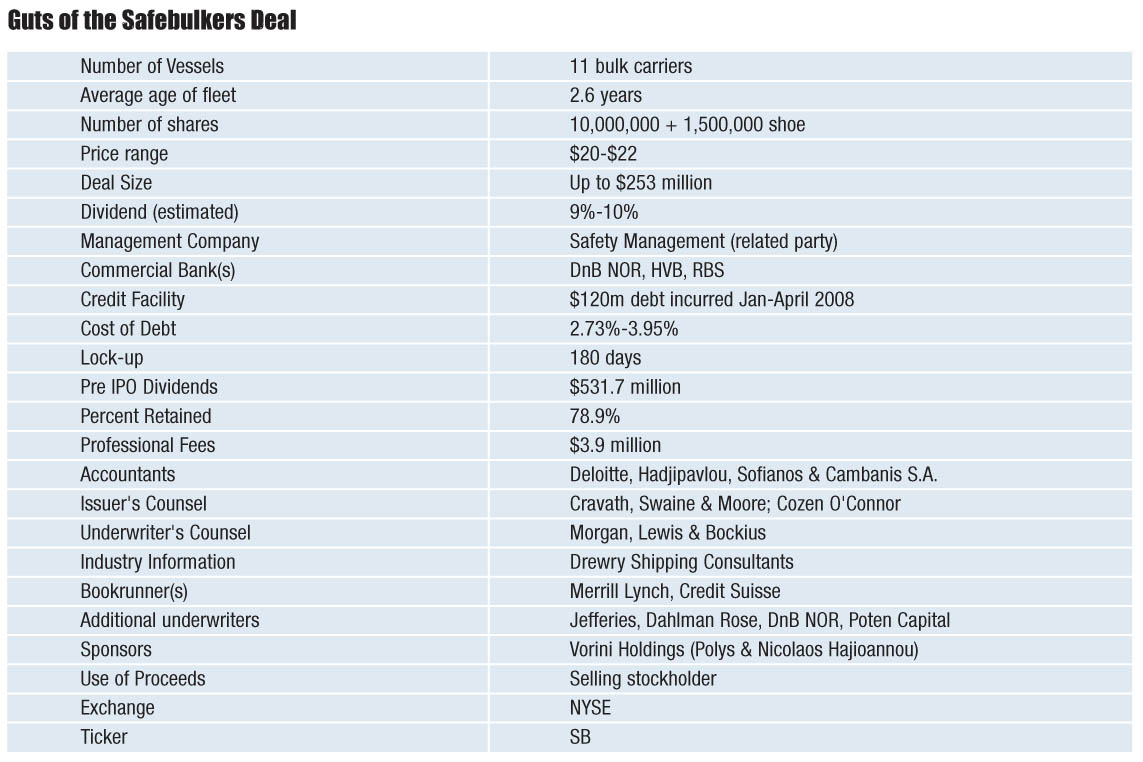

Very briefly, Safe Bulkers is a dry bulk shipping company owned by Vorini Holdings, which in turn is controlled by Polys and Nicolaos Hajioannou. The company currently owns a fleet of 11 Japanese-built bulk carriers with an aggregate carrying capacity of 887,900 dwt and average age of 2.6 years. The fleet comprises panamax, kamsarmax and post-panamax class vessels. Safe Bulkers has also contracted for eight newbuildings to be delivered between 2008 and 2010, which include four post-panamax vessels, two capesize vessels and two kamsarmax vessels. The vessels are operated on a mix of spot and time charters. Management services will be provided by related party Safety Management.

Merrill Lynch and Credit Suisse are working as bookrunners on the offering, while Jefferies, Dahlman Rose, DnB NOR and Poten Capital will join as underwriters. Safe Bulkers is looking to raise as much as $253 million through the sale of 10,000,000 shares with a 1,500,000 share over-allotment option at a price of $20-$22 per share. The 10,000,000 shares represent a stake of approximately 20% in the company and all proceeds will go to the selling shareholder, Vorini Holdings. Potential IPO buyers are being enticed with a dividend yield of 9-10%.

Safe Bulkers has a wide range of credit facilities in place, but most recently between January and April of 2008, the company took out loans from DnB NOR, HVB and RBS totaling $120 million. All were swapped to fix rates that range from 2.73% to 3.95%.

Correction

In our article entitled Pac Basin Private Placement, the correct amount of the offering was HK$2,144 million.

The Wall Street Journal’s Shipping Analysts Of the Year

For a Wall Street analyst the annual Wall Street Journal Best on the Street rankings is like an AcademyAward, only worth more, certainlyto those investors who bought basis the winning analysts picks.

This year Scott Burk at JPMorgan, but Bear Stearns when his picks were made (JPM acquired Bear Stearns in a sub-prime fire sale last March) came out number one in the Industrial Transportation classification. Doug Mavrinac of Jefferies & Co came in second and Omar Nokta with Dahlman Rose grabbed the third spot.

Branding

Last week, Deutsche Bank (“DB”) announced that Schiffshypothekebank zu Lubeck (“SHL”), its former wholly owned subsidiary, was merged into the bank. Under the new name of Deutsche Shipping, SHL’s activities have been merged with the global ship financing operations of DB.

The activities of Deutsche Shipping will have an even broader global scope in the future. Besides operating in their traditional markets in Germany and Scandinavia, the company is set to expand its activities to southern Europe and Asia. Continue Reading

Committed!

Despite HSH Nordbank’s lack of success with its IPO, JC Flowers, according to the Financial Times, is preparing to inject about €300 million of fresh equity into the bank in order to maintain its interest at current levels (26.6%) while the bank prepares for an IPO when market conditions improve. “HSH’s public sector shareholders are also putting more capital into HSH, which is raising about €1.26 billion in fresh funds to strengthen its capital base after absorbing substantial write downs (approximately €1.3 billion) in 2007 in the wake of financial market turmoil. A second capital contribution will see JC Flowers and other owners contribute €962 million in ‘mandatory convertibles’ which will be turned into equity during an IPO or by 2010 at the latest.” An IPO is now expected next year at the earliest.

In Debt

While the equity markets appear to have returned to life, the debt markets continue to face harder times. Significant increases in bank funding costs are translating into significant spread increases for customers, though the drops in base interest rates mean that all this still does not necessarily mean higher all-in borrowing costs. More important than rate increases have been rising bank standards, which have forced less established companies without existing banking relationships to look harder for capital.

Restis Returns

Having flirted with the US equity markets with withdrawn IPO Golden Energy and later with a potential deal with Excel-sponsored SPAC Oceanaut, the Restis family is once again looking at ways to bring public equity into its shipping business. This time it is through the acquisition of six dry bulk carriers by SPAC Seanergy Maritime for an initial $395 million. There is also a potential earn- out worth $43 million if certain EBITDA hurdles are met. The initial consideration comprises $367 million in cash and $28 million in the form of a 2-year promissory note. The vessels have an average age of 10.5 years and comprise two handysize carriers, two supramax vessels, and two panamax vessels. Maxim Group acted as financial advisor to Seanergy on the deal, while Loeb & Loeb, Vgenopoulos and Partners and Broad and Cassel all provided legal advice. We look forward to further exploring this very interesting transaction as it continues to develop.

Genco, TBS Tap the Equity Markets

TBS International successfully priced 3,400,000 common shares at $51 this week to raise $173.4 million in an offering led byJefferies and Banc of America as join book-running managers and Dahlman Rose as joint lead manager. Of these shares 2,000,000 (worth approximately $102 million) were sold by the company while the remaining 1,400,000 were sold by selling shareholders in what is understood to be their first sell-out since the company went public in 2005. The trajectory ofTBS’ share price over the past three months, as shown in the Follow-ons & Share Prices graph, leaves little reason to wonder why the selling shareholders might consider this an appropriate time to divest some of their holdings. The move wasn’t too painful for shareholders, either, representing a file-to-offer discount of a relatively modest 3%, with the shares having since rebounded.