Navios Comes Full Circle

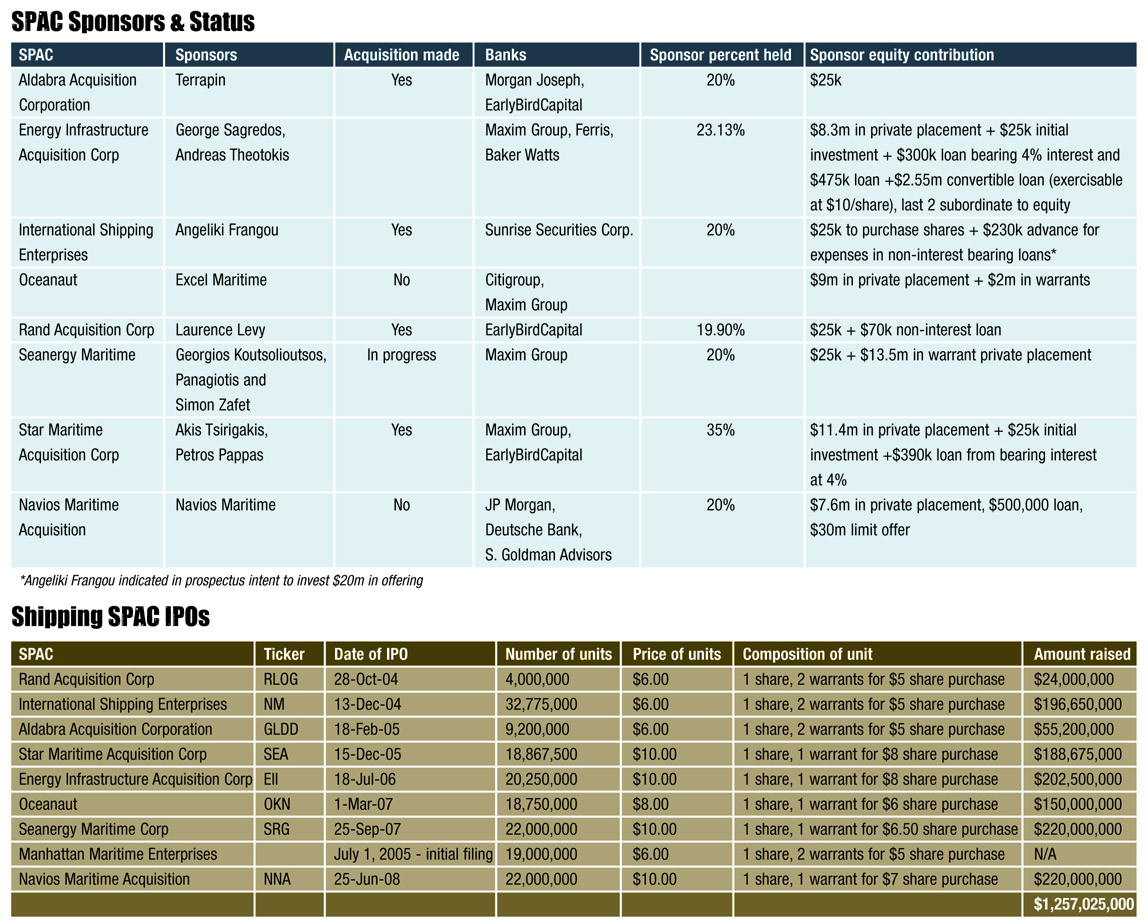

Less than 10 days after making its first public F-1 filing, SPAC Navios Maritime Acquisition Corporation successfully priced its 22,000,000 unit IPO at $10.00/unit to raise gross proceeds of $220 million. The deal timetable was ultimately compressed and the deal well oversubscribed by a mix of SPAC investors, shipping fundamental investors, and those who have been following Navios. Units had traded up a half a percent at close today to $10.05 in pleasant contrast to the Dow’s 358 point fall.

The successful issue of the SPAC in itself is evidence of an improved market, and good news for First Class Navigation, which is understood to be currently in the market with a $125 million SPAC. However there is clearly more to it than that. More and more it’s been the “who” mattering as much as the “what” in shipping deals, and nowhere is this more important than a SPAC – where the “who” or the “jockey” is exactly the part of the deal investors bet on. Angeliki Frangou’s success with the International Shipping Enterprises SPAC and its subsequent Navios acquisition and her sharpened roadshow skills no doubt were major forces behind the deal’s success, particularly as both SPAC and shipping investors are familiar with her track record and her story.

As to the specifics of the deal, Navios Maritime Acquisition Corp (“NMAC”) is seeking to acquire one or more assets or operating businesses in the marine transportation and logistics industry, with a primary focus on businesses outside the dry bulk sector. Though some speculation has circulated regarding the use of NMAC as a way to spin out Navios’ logistics operations, the conflicts inherent between the two public companies are too deep to make such a deal attractive or likely, and it should be interesting to see what kind of target with which NMAC emerges.

JP Morgan and Deutsche Bank are acting as joint bookrunning managers on the offering, while S. Goldman Advisors is also participating. A 3,300,000-unit over-allotment option remains outstanding. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo and Fried, Frank, Harris, Shriver & Jacobson are acting as counsel to the underwriters while Reeder & Simpson is acting as counsel for the issuer.

Each unit in the offering consists of one common share and one warrant to purchase a common share at a price of $7.00. Sponsor Navios Maritime Holdings committed to purchase 7,600,000 warrants at $1.00 each simultaneous with the closing of the offering, amounting to a $7.6 million investment or about 3% of the company’s value. The sponsor is also making a $500,000 loan and will hold a 20% stake in NMAC. Backing up the deal’s credibility, NMH and NMAC CEO Angeliki Frangou entered into an agreement with JP Morgan and Deutsche Bank to place limit orders for up to $30 million of NMAC common stock to purchase any shares of our common stock offered for sale (and not purchased by another investor) at or below a price equal to the per-share amount held in our trust account as reported in our initial preliminary proxy statement filed with the SEC relating to the company’s initial business combination, until the earlier of (1) the expiration of the buyback period or (2) the date such purchases reach $30 million in total. She also agreed to vote all such shares in favor of NMAC’s initial business combination.

For a SPAC, of course, the IPO is just the beginning. Much like a private equity firm that has a new fund ready to invest, the real excitement should lie in the months (or year) ahead.

Transaction Report

As the conference season officially ends and the summer officially begins in the Northern Hemisphere, the deal market shows no signs of going on vacation. Angeliki Frangou successfully priced her second shipping SPAC in the US, the Oslo high yield market has picked up some of its lost momentum, and a certain Mr. Fredriksen continues to make sure the shipping deal market never gets too boring.

Faster Than a Speeding Bullet, More Powerful Than a Locomotive, and Able to Leap Tall Buildings in a Single Bound”

No, we are not talking about Superman, but if that was your guess you were close. In fact, we are referring to John Fredriksen, who may be, in financial circles, more powerful than Superman. On Wednesday, Frontline announced the acquisition of five suezmax tankers and the intention to partially finance them with a private placement of new shares. The private placement was successfully completed today in less than 24 hours.

The five double hull suezmax tankers were purchased en bloc at a purchase price of $240 million from Top Ships Inc. The vessels were built in the period from 1992 to 1996 and will be delivered between June and August 2008.

Continue Reading

Feeling the Love?

Last week, Seaspan Corporation (“Seaspan”) held its Second Investor and Analyst Luncheon at New York’s Palace Hotel and just looking at numbers of guests one can term it a huge success. It appeared to us that not only had the numbers doubled but, in addition, the hotel staff had to roll in additional tables as unplanned for guests arrived in the midst of the presentation.

The story is consistent and unchanged. Mr. Gerry Wang started off describing Seaspan by listing four key bullet points. It is the largest and fastest growing independent containership charter owner. Not just a leasing company, Seaspan is an active asset manager with strong technical expertise, which is applied to operations as well as shipbuilding and design. In an attempt to provide some differentiation from the pack, Mr. Wang characterizes Seaspan as a globalization and infrastructure play that is focused on growing distributable cash flow.

And the Wharf Rat says…

In last week’s “Wharf Rat,” a shipping bulletin written by Urs Dür of Lazard Capital Markets, a different view of BDI was posited. Mr. Dür suggests that investors may be focusing too much on the BDI, which represents only the dry bulk spot market, not the term dry bulk charter market. “While estimates vary greatly, approxi-mately 25% – 40% of the dry bulk fleet is operating spot at any one time…. Thus when BDI moves up or down, it has no near-term impact on the term charter (contract) market for dry bulk ships.”

Pick Your Poison

Last week, we discussed in some depth Dahlman Rose’s new dry and wet shipping indices composed of the bulk of the shares trading on the New York exchanges. In these turbulent times, we frankly prefer the diversification as well as a hand on the wheel that these products offer.

Nevertheless, for those who want a more pure play and are not adverse to roller coaster rides, Imarex presented their new Baltic Exchange Dry Index (“BDI”) Futures product at the JPMorgan Shipping Futures Teach-in last week. Investors, today, can invest in dry bulk shares, trade FFAs or trade commodity related ETFs to play in the commodity growth story. Imarex envisions the BDIFutures as a complementary tool. BDIFutures is an index futures contract based upon the BDI and can be traded on direction, as a hedge against dry bulk equities or as a spread against FFAs.

DnB NOR Markets Takes Master Marine to Market for EUR 60 million Bond

After an unprecedented surge in Norwegian high yield volume from 2004 to 2007, the market, as with many debt markets, fell off dramatically in the first half of 2008. As oil prices continue to surge, however, offshore projects in particular have managed to attract investors and the high yield market for these deals in Oslo appears to be gaining some momentum, if at higher prices than in the not so distant past.

Deal of the year – 2002 Private Equity

The shipping industry is constantly bemoaning that there isn’t an adequate supply of private equity – but the reality is whenever we see decent deals emerge that have economics that can support equity returns, whether by purchasing real business franchises or making opportunistic asset plays, and if good management is there and personally invested, so is third party equity. So our sense is that there isn’t less equity available, there is less “dumb equity” available.

For this award we considered infusions of third party equity into operating companies, the equity portion of sale/leaseback transactions, as well as speculative bulk shipping investments. We included equity investments that are both realized and unrealized.

The Marine Money Private Equity Deal of 2002 Award goes to Fortis and Royal Bank of Canada for the work they did for Seabulk. Although this deal could have fit into various interrelated categories including; bank loan, balance sheetrestructuring/recapitalization and the infusion of substantially all the company’s equity, we decided to consider it in the area of private equity because that is the component of the transaction that impressed us the most.

Passage

On a somewhat somber note, we observed, as we walked by 383 Madison Avenue, that the Bear Stearns name had been removed in its entirety, a victim like Arthur Andersen, if anyone recalls, of the financial follies of our times. The new signage brought back the old brand J.P. Morgan & Co. under which the investment bank will operate. While we wish JP Morgan good luck, we hope the Bear Stearns employees all land on their feet in these tough times.