The Political Side

We had another interesting conversation with a political outsider who knows the insanity of the inside. The talk in Washington these days, in the midst of the energy crisis, is the problems of the truckers and the airlines that are seeking relief from high-energy costs. On the other side are the railroads and shipping companies that are pleading with the government to allow market forces to work and avoid a bailout thereby beginning the shift to energy efficiency. Keep an eye on this debate.

Ship Finance Books $68 million on Vessel Sales

Sometimes doing good deals isn’t just about finding attractive acquisitions, even for public companies that act as lessors and focus on stable long-term returns. For example Ship Finance International this week entered into an agreement to sell two suezmax tanker newbuildings under construction in China with delivery scheduled for 2009. At a price per vessel of $111 million, net of construction costs and broker commissions SFL expects to recognize a book profit of $34 million per vessel upon their delivery to the new owner.

In the Eyes of the Analysts – Seaspan

Amidst the flood of 2nd quarter analyst reports, we found two comments on Seaspan that we thought were intriguing. First, Justin Yagerman of Wachovia Capital Markets reported that during the quarter Seaspan looked at $3 billion of deals without coming to terms. We wonder if this reflects concerns about credit quality, an issue Seaspan has commented on previously.

Suspended – U.S. Shipping Partners L.P. Investors Forego Dividend

After making 14 regular quarterly distributions, totaling $6.14, to its limited partners through the 1st quarter of this year, U.S. Shipping Partners L.P. (“USLP”) announced on Wednesday that it in light of its review of strategic alternatives and its negotiations with its lenders to amend certain financial covenants under its senior credit facility that it will not pay a distribution on its units for the quarter ended June 30, 2008. Payments to the GP and subordinated units have been suspended since the 4th quarter of 2007.

Market Talk – The Alternative View

Much has lately been written and spoken about banks, the liquidity issues they face today and the resulting potential impact on the funding of shipping projects. Yesterday, we talked to a well-placed banker who provided a far more optimistic view of the market. While the public side is struggling, there is a fair amount of activity on the private side despite the appearances of a quiescent summer. With five fantastic years of results, strategic players, as opposed to the sponsor groups, are well capitalized to do deals today. Moreover, for these players, in particular, there is funding availability as the shipping specialist banks in Scandinavia and Germany maintain their market presence. And, finally, he noted asset prices are becoming less expensive. Look for a “Fall” awakening!

No Surprise But Perhaps a Bit Worrisome

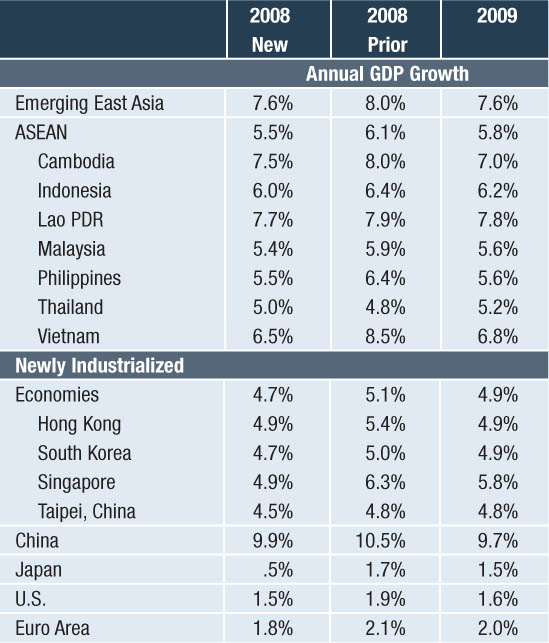

Bloomberg’s Shamim Adam wrote this week that “Asia’s developing economies will expand at a slower than expected pace this year as easing U.S. growth weighs on exports and accelerating inflation crimps consumer spending, the Asian Development Bank said. East Asia may expand 7.6% in 2008, less than a December estimate of 8%…Next year’s growth is also estimated to be 7.6%.”

In nominal terms, these numbers are not significant in and of themselves. However, the threat of inflation is pressing. Record fuel prices and commodity costs have fueled inflation across Asia and there are few signs that price pressures will subside soon, the ADB said, predicting inflation in the region will average 6.3% this year more than double the average in the 10 years to 2006 and ease to 4.6% in 2009. “Rapidly rising inflation threatens to dampen consumer spending and risks a wage-price spiral that could derail the regions recent solid growth.” This increase in inflation has led to tightening monetary policies by the central banks.

It is always welcome to have numbers and we include herein a table of the estimated annual GDP growth for the region for your perusal.

Just a Matter of When?

Although we do our best to report on the happenings in the financial world as it relates to shipping, our knowledge of how bankers and owners come to grips in choosing the correct capital product is at best unclear. It is no surprise that the commercial banks lending activities, as we have reported, continue to slow down as the credit crisis continues. The same holds true for the equity markets, which are also struggling except for follow-on offerings from MLPs and full dividend payout companies. Yet as we continue to report in this issue no one is issuing or has issued high yield debt. Clearly, there is an appetite in the market for yield. Should the investment bankers be dusting off the old prospectuses from the late 1990s? Surely we would not deny that it is expensive but certainly at today’s freight rates it is affordable and with no amortization it remains attractive. In fact, we noted with interest that Norwegian borrowers have tapped the market for short-term borrowings in effect bridging themselves to more permanent financing. Hmmm! A secured bond paying say 9.5 to 10%, now that’s not a bad trade.

Voting With Their Feet

Early last year there was much press on the globalization of the stock exchanges and how the New York exchanges would decline in importance. The revolution has faltered and some of it is attributable to the inability of companies to achieve the valuations that can be obtained in NY. We hear this complaint constantly from owners listed on smaller regional exchanges.

So it came as no surprise to us that Premuda and now Navigazione Montanari are preparing to de-list their shares leaving d’Amico International as the sole publicly listed company in Milan. Was it solely valuation? Who knows for sure? After all, the three companies remained under the control of the founding families who were accustomed to controlling their destinies. Moreover, the old shipping model, before capital markets, provided expansive growth via leverage with a modicum of equity. Throwing off the yoke of public reporting and going back to their roots may have suited them particularly when they weren’t getting value.

Credit Outlook

The credit crisis in most respects is beyond our ken. Thankfully that is not the case for Nordea’s Mr. Morten Heiner Pedersen who last month in his Credit Strategy Outlook presented, in a concise and understandable manner, the key factors involved and their implications, both positive and negative, for the future. We have tried our best to summarize the key points below.

The liquidity facilities made available by the Federal Reserve, European Central Bank and the Bank of England have eased the liquidity crisis as planned. The decision to make the facility available to primary dealers was instrumental in easing concerns. Both the ECB and BoE provided supplementary facilities.

Continue Reading

Dry“Rigs” Credit

Despite lingering clouds in the credit markets, Mr. Economou’s DryShips announced on Monday the closing of a $1.125 Billion senior secured credit facility jointly arranged by Deutsche Bank AG – Global Principal Finance, London and Dexia Credit Local, New York Branch for the financing of the two ultra-deep water drillships to be constructed at Samsung Heavy Industries. Based upon an estimated construction cost of $800 million each, the loan to value is approximately 70%. The drillships are scheduled to be delivered in the 3rd quarter of 2011 and will be operated by the newly acquired Ocean Rig.