Flavor of the Week

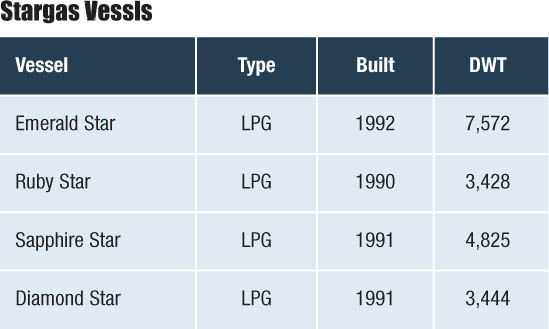

Based upon recent S&P reports, Norwegians are finding the LPG segment an attractive investment. DnB NOR is reported to have entered into a sale-leaseback transaction with Stargas. DnB has agreed to purchase the following vessels for $70 million en bloc and lease them back to Stargas under a 7-year bareboat charter.

Exmar also announced that it sold the Carli Bay, a 25,000 cbm LPG built in 1998, to ABG Sundal Collier. The sales price was $49.5 million resulting in a capital gain of approximately $20 million.

We assume all are destined for K/Ss.

Liberty Makes Move on ISH

On Monday, after accumulating 5.5% of the outstanding shares of International Shipholding Corporation (“ISH”), Projection LLC, a wholly owned subsidiary of Liberty Shipping Group LLC (“Liberty”) submitted its formal proposal to acquire all the shares of ISH at a purchase price of $25.75 per share, payable in cash, which represents a total enterprise value of $308 million. The price represents a 27% premium over the company’s closing stock price on August 29th of $20.25 per share. After the announcement the stock traded up to $24.31and closed at $23.73 up 17.19%. The offer was based solely upon public information and Liberty indicated a willingness to adjust the price based upon non-public information. The proposal is subject to due diligence.

Chris Weyers & Scott Burk – Bankers Move On

We also note the following friends who have found new positions:

Chris Weyers has left Fortis to join FBR Capital Markets as a Managing Director. He can be reached at (212) 457-3314 or cweyers@fbr.com.

Finding life after Bear Stearns, Scott Burk has accepted a position as Lead Ocean Shipping Analyst at Oppenheimer & Co. Scott can be reached at (212) 667-7402 or scott.burk@opco.com.

We wish them all good luck in their new positions.

Career Path

What do Morten Arntzen, Peter Evensen, Jeff Pribor and John Wobensmith have in common? They all began their careers as bankers and have moved over to the ownership side. Clearly, the owners are recognizing the value of banking experience or, perhaps, they are less expensive once brought in house?

Add to that list, Peter Knudsen, formerly head of Project Finance and Asset Lending and now the General Manager of Nordea’s Singapore Branch, who has accepted the position of CEO of Camillo Eitzen & Co. ASA.

Umm! Peder’s been there two weeks already, is this an opportunity for him?

Credit Crisis?

Based upon the data provided below, albeit incomplete, it does not appear that the credit crisis has impacted shipping loan volumes in Germany. Granted data from key players, such as HSH Nordbank, HVB and Deutsche Shipping, is missing, the numbers show that the balance of the banks have nearly equaled or exceeded last year’s total volumes in the first half of the year.

Seacastle Sells – Why?

We were somewhat puzzled by a recent report in the trade press that Seacastle had sold for $41.4 million the CSAV Peru (Laura S), a 2,470 TEU containership built in 1998, which they had purchased 18 months ago for approximately the same price. Market sources attribute the sale to the fact that it was a smaller ship and did not fit the profile of its mainly Panamax fleet. Moreover, the company is reported to have earned $7.5 million in charter hire during this period although how much profit was earned is unknown.

Continue Reading

Seanergy – 3rd Time’s the Charm

In contrast to the Oceanut transaction, Seanergy Maritime Corp. can rightfully say, “been there done that” as shareholders finally approved its transaction to acquire 6 bulk carriers from the Restis family this week. It has not been an easy road for the company as we have previously documented. The shareholder vote was deferred three times necessitating the Restis family to increase its investment twice. Ultimately, Restis affiliates owned beneficially 10,114,761 shares, representing 35.4% of the company’s outstanding shares, which amount excludes 2,750,000 shares with respect to which affiliates of the Restis family have shared voting power but do not have dispositive power. Their position was solidified by George Koutsolioutsos, Seanergy’s Chairman, who increased his beneficial ownership to 8.4% of the outstanding shares exclusive of an additional 3,190,000 shares over which Mr. Koutsolioutsos has shared voting power.

Oceanaut Takes Out Its Checkbook

With little time and no specificity in its investment guidelines, other than it be in shipping, Oceanaut Inc., Excel Maritime’s sponsored SPAC, announced, on Monday, that it had found its deal and will follow the footsteps of its sponsor and invest in drybulk but with a difference. It is the intention of the parties that Oceanaut will serve as Excel’s exclusive long-term charter dry bulk vehicle focusing on charters of 4 to 10 years.

The company has entered into definitive agreements to purchase four drybulk vessels from Irika Shipping S.A. for a total consideration of $352 million. The acquired vessels, which aggregate approximately 279,000 DWT, include three Panamax vessels and one Supramax vessel, which are described above together with their prospective employment.

A.P. Moller – Maersk A/S and Brostrom AB Announce Engagement

Yesterday, Brostrom AB, one of the leading logistics companies serving the petroleum and chemical industry, announced that A.P. Moller-Maersk A/S (“APM”), through its wholly owned subsidiary, Maersk Product Tankers AB (MPT”), had made a public offer to the shareholders of Brostrom to sell their shares for cash consideration of SEK 57 per share, a premium of 23.6% relative to the volume weighted average closing price of the B-share for the three month period prior to today’s date and a premium of 10.1% relative to Tuesday’s closing price. The offer values the share capital of the company at approximately SEK 3.62 billion. The offering price will be increased by 6% per annum from the date occurring two months after the announcement until the offer is declared unconditional.

Continue Reading

The Week in Review

A few weeks ago, we quoted a banker friend who warned us that come September activity would begin to pick up. He was wrong by a few days. But he was correct in hinting it would be significant. This week saw A.P Moller make an offer to acquire Brostrom’s in a major consolidation move. SPACs, too, were active as one found a deal to propose while another closed its deal. Finally, hard data shows that shipping at least in Germany appears to be immune to the credit crisis.