FSL Shareholder Increases Investment

Normally, we leave the reporting on Asian companies to our associates; however we were sufficiently perplexed by the report that American International Assurance Company, Limited, an AIG affiliate, had increased its shareholding in First Ship Lease by acquiring an additional 1.49 million shares. After all, as a WSJ headline highlighted the situation, “AIG Increases Borrowings While Racing to Sell Assets.” We suppose business must go on, despite the bailout, and at a yield of 26% it certainly is an attractive investment. But given the overall situation is this what AIA should be doing with excess liquidity albeit an insignificant amount in the scheme of

And Now For the Bad News

Also on Monday, Svithoid Tankers, a Sweden based operator of smaller, modern product and chemical tankers, announced that the company will apply for insolvent liquidation after being unable to come to terms with several of its creditors, bond holders, convertible holders and shareholders to resolve its immediate liquidity shortage. According to Nordea’s Credit Research, total debt amounted SEK 876 million as of the 2nd quarter 2008, consisting SEK 641 million of bank debt, priority claim, and SEK 235 million of bond debt. As of the same period, the book value of the fleet was SEK 1.042 million, although management claims its market value amounted to SEK 1.142 million. The fleet consists of 11 tankers of which four are wholly owned with the remainder partly owned or bareboat chartered. In addition, the company has five tankers on order for delivery in 2008 (1) and 2009 (4).

Euronav & OSG Credit Facility

On Monday, OSG and Euronav jointly announced a $500 million senior secured loan to finance the acquisition of TI Asia and TI Africa, both built in 2002, by joint venture companies equally owned by Euronav and OSG and the conversion of the ships into FSO service vessels. The vessels are scheduled to deliver to Maersk Oil Qatar on the Al Shaheen field offshore Qatar and start operations respectively in July and September 2009.

Continue Reading

New York Conference Outtakes

As a preview for next week, we decided to cover some of the more interesting early highlights of the conference. In his welcome to the conference, Hamish Norton of Jefferies got a laugh when he made the point that Jefferies was now the largest investment bank in the U.S. He also pointed out that Jefferies having avoided the sub prime mess was well capitalized and ready to assist the industry. With respect to the industry, he commented that we were back in the good old times of shipping, however the good news is that there is an investor base which understands shipping and we don’t want to lose them.

In the Ring with Mohammad Ali

After being pummeled like a punching bag the last few weeks with new problems, disclosures and half-baked solutions to the financial crisis, approximately 250 (seating capacity of 180) of shipping’s cognoscenti gathered at the Harvard Club for Marine Money’s New York Finance Forum to glean some words of wisdom as to what the future might bring. Never before had the financial and shipping markets collapsed simultaneously. We watched as the government’s best and the brightest, throwing good money after bad, attempted to accomplish what Hans Brinker’s finger in a dike did. Trillions of dollars later, “too big to fail” made a mockery of capitalism and had Karl Marx laughing from his grave. After agreeing to buy toxic instruments or guaranteeing debt didn’t work, we followed the British example and nationalized the banks. For the moment, this solution appears to be holding but it created a tab that future generations will work forever to pay off.

Continue Reading

3rd Quarter Report Card

Last week, Dealogic published its 3rd quarter scorecard measuring the performance of the syndicated loan market for shipping transactions. Below we have reproduced their tables showing the Top 20 Mandated Lead Arrangers and Bookrunners for the nine-month period. As far as first and second place are concerned there is no surprise as Nordea and DnB Nor continue to battle it out with Nordea taking top honors as bookrunner and DnB Nor in first place, by the closest of margins, as mandated arranger.

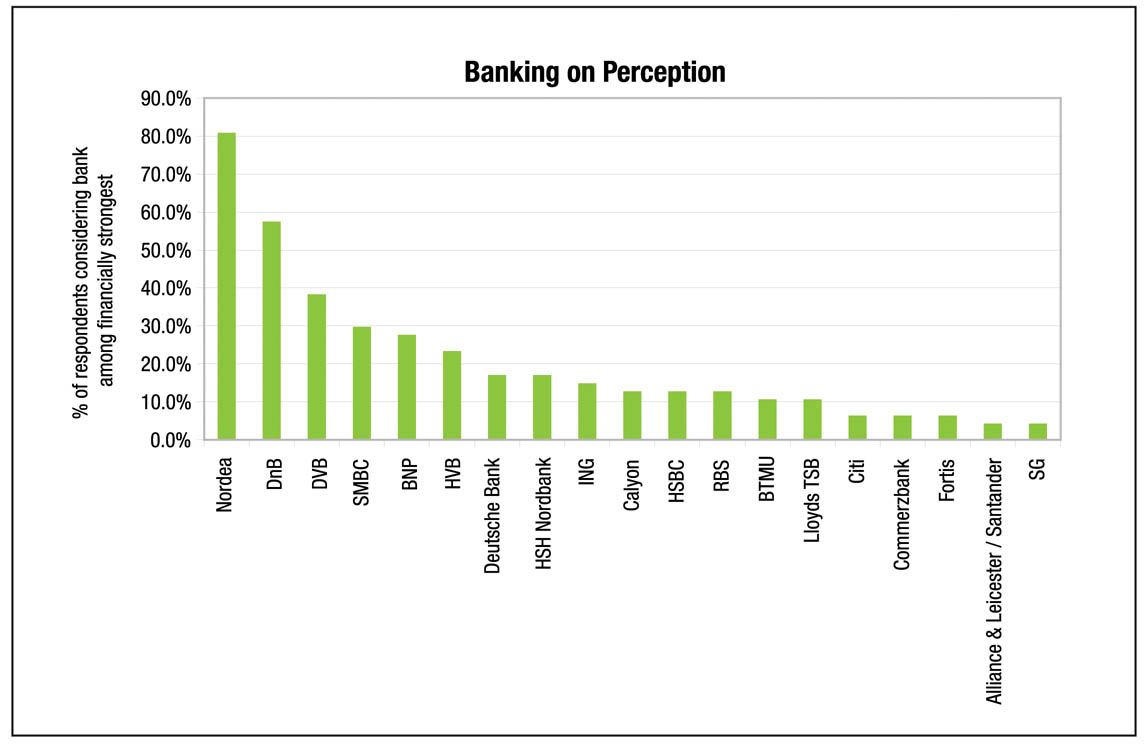

Banking on Perception

Finally, and perhaps most importantly we asked the respondents to name the 5 strongest shipping banks today. The following graph contains few surprises with the Scandinavian banks, Nordea and DnB, in the first two positions and DVB, SMBC and BNP filling out the top five.

Strong market share and an aversion to sub prime contribute to a positive market perception.

Affirmation – Marine Money’s Banking Survey

Given our daily dose of the global macro economic crisis, Marine Money sought to uncover how the ship financing industry was faring. To that end, we created an unscientific but highly informative survey and are grateful to the many who responded to our questions. Although the results affirm how difficult it is, there remains a touch of optimism. You will find below the results for a select number of the questions from the survey, portrayed graphically, for your perusal with some broad commentary included.

Safe Haven No More

For weeks, we have been puzzling over the markets’ indiscriminate punishment of all the shipping shares. Surely, one cannot separate this sector from the rest of the market so for that reason they cannot be exempt from the broad downturn. However, viewed as a proxy for the commodity markets, this sector, in particular, has largely been pummeled by the slowdown in China with a resulting decline in demand and prices for commodities. This has translated into falling charter rates and a not so severe decline in asset values as of the moment.

Continue Reading

Enormous Crowd Joins the 10th Annual Marine Money Greek Ship Finance Forum

Marine Money’s dynamic duo, Kevin Oates and Mia Jensen hosted a staggering crowd of 400 delegates, or friends as President Matt McCleery called the guests in his opening remarks while on the screen behind him flashed the face of the famous iconic Greek ship-owner Aristotle Onassis and his quote ending: “Be a friend to your friends”