“Confused, Incomplete, or Inconsistent Owing to Market Instability”

The catchy title is a quote from an article in Monday’s Financial Times by Daniel Thomas and Jennifer Hughes. It refers specifically to a qualifying clause commercial property valuers are currently inserting in their valuations creating increased uncertainty for investors. “In a sharply falling market in which most transactions involve distressed assets, the valuers say they are having difficulty in setting reliable prices. Normally, they rely on recent transactions for comparable benchmarks.”

However, as usual, accountants are getting nervous and expressing concerns about the growing use of caveats and disclaimers on valuations. “Auditors will need to consider carefully the nature of the uncertainty in the valuation, the disclosures made in the financial statements and other circumstances affecting the company.” An alternative view suggests that “auditors should not worry as this is not a qualification of accounts; it is an additional piece of advice.”

The parallels to the shipping universe are unmistakable. However, in our case, brokers have just stopped giving valuations due to legal consequences they have suffered in the past. However for the first time in the shipping space the numbers of public companies, which are potentially exposed has increased exponentially. The cost of going public just went higher or when accountants sneeze their clients may catch cold.

No More Netting

Reading many of the analyst reports, we were always intrigued by the use of net debt in leverage calculations. Perhaps it made comparisons between companies easier. But the underlying assumption that cash would be used on a dollar for dollar basis to pay down debt as implied was always a question mark. Surely this is highlighted by today’s dry bulk earnings, which are currently below cash breakeven rates. With insufficient cash to meet voyage and operating expenses no less debt service, the cash on hand is making up the shortfall. We suppose you can make the case for the use of net debt in good times, however, as we were all rudely reminded recently the shipping cycle never left us. Either it unexpectedly returned, due to a short-lived new paradigm, or we suffered from “Extraordinary Popular Delusions and the Madness of Crowds.” Charles Mackay, the author of that text, has a painful prognosis: “Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one!”

In any event, cash in shipping gets you through the bad times and allows one to exploit opportunities. No matter what bankers may believe it is not there for them.

“Erin Go Bragh”

Despite a reasonable starting time of 10 AM, the delegates to the 2nd Annual Marine Money Dublin Ship Finance Forum filed in early ever ready to meet old friends and make new contacts. If there was one single takeaway from this conference for us it is the fact that the Irish people are happy, warm, smart, blunt and can charm your pants off. This is what makes it a great business center, not all the fancy tax stuff. Notwithstanding my frivolous view, keep up the good work, Jim; it does really make a difference. As we usually do, we have extracted below insights and comments that in our prejudiced or self-serving view we thought were useful or interesting. We are faced with our usual problem of so much to choose from and so little space.

Heard on the Streets of Dublin

We headed into Dublin enjoying the beautiful mix of both Georgian and new architecture in an extraordinarily clean town. We had appointments with a full gamut of experts, including bankers, owners, accountants and lawyers, all of whom provided us with insights into shipping generally while further explaining how Ireland fits into the puzzle.

The Old Sod

Ireland is the home sod to many generations of Americans and we were fortunate enough to be treated to a beautiful sunny day with blue skies on the occasion of our first visit. Our taxi driver was surely amazed as apparently the spring and summer had been quite wet this year. Unfortunately, as we rode into town, we saw that Dublin has not escaped the economic crisis. The streets were quiet in the early Sunday morning, as one would expect, but the number of for lease signs on the new office blocks was unexpected. And then as you might anticipate by mid-afternoon the sky turned gray and the rains came. We stayed inside and began to look forward to our pre-conference appointments.

Marine Money in Seoul, with KDB and Miami with DVB

Marine Money is deeply grateful to our partners, all our vital sponsors, speakers and attendees. We have seen the beneficial impact of our Marine Money gatherings around the globe this fall as the economic challenges besetting nations are tackled on a micro level by the world’s most experienced international traders – the shipping industry and its capital sources. Watching the machinations of a single industry find its way forward as we have in Ireland, Greece, New York and Singapore, fills us with confidence that our corner of the global financial malaise will be well dealt with. We salute all our readers, delegates, sponsors and valued partners for standing up to challenges which daily seem to bring other industry’s to the government trough.

The week of November 17 sees Marine Money and a community of owners, financiers and industry professionals gathering in both Seoul, Korea and Miami, Florida, USA. In keeping with the recent global events large turnouts are set for both locations. Korea, in partnership with KDB, Korea Development Bank, will see more than 200 owners, shipyards and international financial professionals congregate to examine the best ways forward in a difficult market. While in Miami, with partner DVB Bank, a cross section of the Americas will gather to explore ways ahead.

Letters of Credit

There has been much talk these days about the inability of receivers to obtain L/Cs and hence the slow down in cargo movements. We posit the following question to our readers. Could the issue also lie in the unwillingness of New York banks to confirm the L/Cs? Historically, the intervention of the NY banks has been a key credit support to these transactions.

Third Quarter Earnings Season

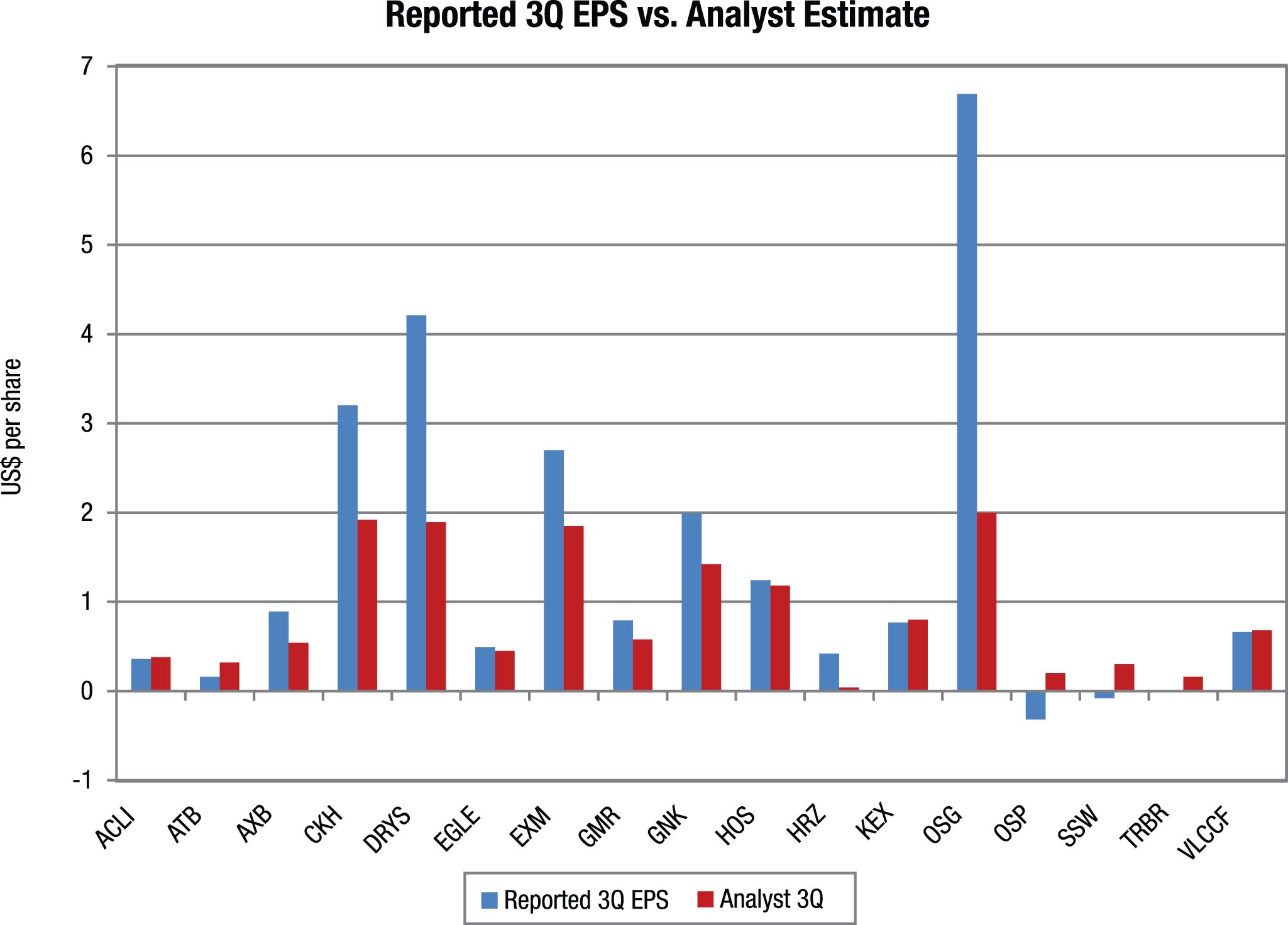

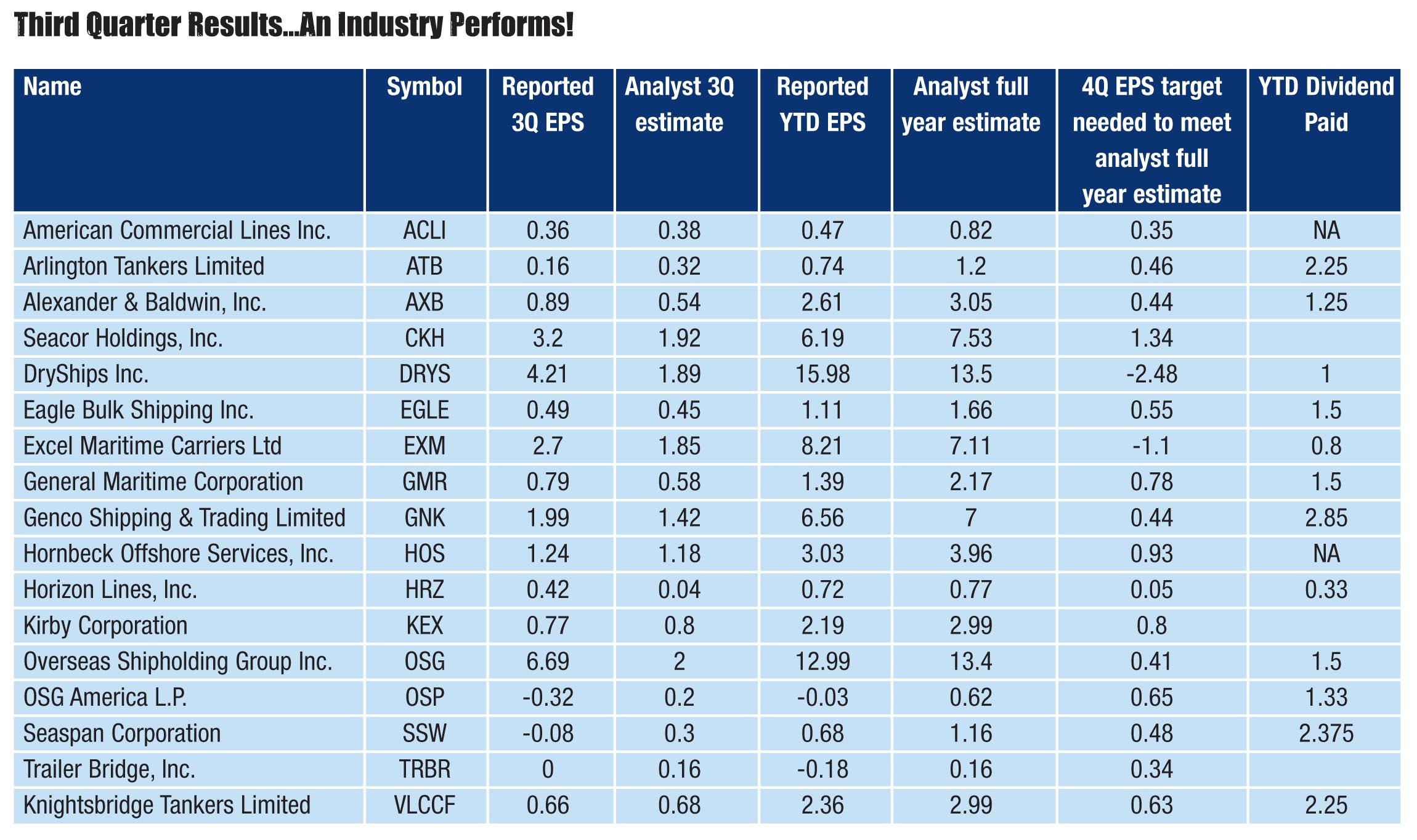

The third quarter was of course an entire world ago, pre global economic meltdown, when China was still expected to roar back after its great Olympics before orders were cancelled and charterers began handing back ships and FFA settlement days loomed like an executioner. So it may come as no surprise to our readers that company after company has reported earnings and dividends in line with financial analysts predictions. We tip our hat to the stewards of these companies, especially OSG and Eagle where earnings and then subsequent conference calls accomplished what we had hoped for, clear, confident and distinguishing attributes. Companies like Torm and OSG are on their way to their best years ever and Eagle has earnings visibility stretching way forward while DRYS is selling at a .69 P/E in other words for less than its ‘08 earnings.

Be Prepared

Yesterday, DryShips filed a prospectus supplement in which they announced that the company had entered into a sales agreement with Cantor Fitzgerald & Co. in which they could offer and sell up to 25 million common shares from time to time. Sales of common stock under this prospectus supplement may be made in sales deemed to be “at-the-market” equity offerings as defined in Rule 415 promulgated under the Securities Act of 1933 including sales made directly on or through the NASDAQ Global Market, sales made to or through a market maker and in negotiated transactions at market prices. Cantor Fitzgerald will earn a fee of 3% of the gross proceeds that are sold in “at-the-market” offerings and 4% of the gross proceeds from negotiated transactions. Proceeds will be used for working capital, capital expenditures, repayment of indebtedness, for general corporate purposes and, as needed, to enhance our liquidity and to assist us in complying with our loan covenants and to make vessel conditions if market conditions warrant. (Our emphasis.)

Hope for the best but prepare for the worst.

Digging Out

Hindered by the financial crisis, Odfjell has been working on ways to strengthen its balance sheet, which was severely weakened by the retroactive tax imposed by the Norwegian government on participants in the original tonnage tax system. The company’s tax on the previously untaxed amount is approximately $213 million payable over 10 years. On a present value basis, this equates to $140 million which charge was taken against last year’s earnings.