The 2008 Global Credit Crisis – Is shipping likely to revert to the 1980’s model?

On November 13th more than one hundred and fifty shipping practitioners, bankers and investors listened to an all-star cast of current and former ship owners, brokers, shippers, maritime arbitrators and maritime attorneys at a CMA luncheon in Stamford, CT.

Moderator Ray Burke of Burke & Parsons, introduced the first speaker, John Bamford, Senior broker at Simpson Spence & Young (USA) who summarized the present situation as: “We are in a state of temporary chaos.” Today’s time charter rates for dry cargo vessels could double and still be 50% of what owners need to make profits again. He suggested that even after the rates start moving it could take 12-18 months longer to bring the supply/demand picture into some semblance of neutrality. On a more hopeful note, he suggested that the fall out from the settlement of October FFA contracts was far less stressful than expected. Still, the physical markets will produce more casualties before things start to improve. On the supply side of the equation, John thought the consensus among brokers was that 30-35% of the fleet on order would be cancelled and some of the new “Greenfield” shipyards would not actually be built.

Continue Reading

A New Perspective

We are very grateful to Imarex’s Mike Reardon for introducing us last week to his colleague from Singapore, Jeffrey Landsberg. Mr. Landsberg suffers from a keen interest in the bulk markets and unlike Mike he focuses more on the physical market. This week we publish for the first time his weekly newsletter, which we will continue to do on a regular basis. We believe that the views of both Messrs Reardon and Landsberg are extremely valuable and a worthy addition to our publication. We hope you find them as useful as we do.

Shipping on the Global Stock Markets

In contrast to the views of our banker friend expressed earlier, private shipping companies clearly saw benefits to going public. Among many reasons for a public listing are to extend capital sources, provide acquisition currency, and allow liquidation of family holdings. At our Dublin conference, Mr. Andrew Meigh, Managing Director of Clarkson Investment Services, provided a superb historical overview of the public markets. For perspective, we have incorporated his graphs, which illustrate the global number of publicly listed shipping companies and the capital raised, the combined market capitalization of publicly listed shipping companies and the number of companies listed on major shipping exchanges. Finally, there is a list of the publicly listed shipping companies together with their market capitalization.

Legal Question

We include below a definition of force majeure for your consideration together with a question of applicability that follows the quote.

“Force Majeure literally means “greater force”. These clauses excuse a party from liability if some unforseen event beyond the control of that party prevents it from performing its obligations under the contract. Typically, force majeure clauses cover natural disasters or other “Acts of God”, war, or the failure of third parties–such as suppliers and subcontractors–to perform their obligations to the contracting party. It is important to remember that force majeure clauses are intended to excuse a party only if the failure to perform could not be avoided by the exercise of due care by that party1.”

Can one make a cogent legal argument that this applies to the credit crisis and more specifically to sale and puchase or newbuilding contracts? Let the lawyers, principals and financiers opine. Responses will be incorporated in an article in our January Survival Guide. Please email your thoughts to gweltman@marinemoney.com.

Christmas Comes Early!

In conjunction with its reporting third quarter earnings on Tuesday, DHT Maritime (“DHT”) announced that its Board of Directors has decided, after considering the strong operating results for the first three quarters of the year and the company’s current robust liquidity position, to increase the dividend by $0.05 (20%) to $0.30 for the third quarter of 2008. We expect this is a special dividend and does not change the current fixed dividend of $0.25.

The solid earnings release and dividend increase is a very strong sign in this economy and investors reacted favorably by pushing the share price up over 11% to $5.15 on heavy volume on the day of the earnings release. DHT convincingly bucked the general market trend, as most of the peer group was lower.

The incremental “cost” or cash flow impact of rewarding shareholders was a manageable sum of $1.75 million, in light of its contractual revenues and cash position of $52.6 million adjusted for the debt repayment (see below). Nevertheless, this is most welcome news amongst the plethora of bad news these days.

First of Many?

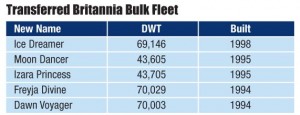

We hope not. But last week D/S Norden A/S (“Norden”) entered into an agreement to manage five Handymax and Panamax dry cargo vessels formerly owned/controlled by Britannia Bulk. Through the intervention of Nordea Bank, the following vessels have been privately sold to an investor group, which transaction included financing from Nordea:

Norden will assume responsibility for both technical and commercial management of the vessels on behalf of the new owners.

Bankers to Bare Themselves

Given overall credit concerns these days, we welcomed the news of bankers opening their tents and becoming even more transparent. DnB NOR was the first to announce that it will host a conference to discuss the credit quality of its shipping loan portfolio on Monday. We understand that Nordea will soon follow with a presentation of its own. Given these banks exposures to the shipping sector, this move will hopefully calm the markets.

Good Weather Brings Hope?

While news of snow in New York circulated, one would surmise we were basking in the sun in Miami. That was not the case as we found ourselves in a windowless ballroom amidst serious presentations although rumor has it that it is sunny and 78 degrees outside. However despite the overriding gloom there were welcome glimmers of hope.

Conference Chairman, Aurelio Fernandez-Concheso of Clyde & Co. opened the our conference noting that in the five year history of the Latin American conference, there were never such circumstances as we now find ourselves in. Rattling off the bad news, Mr. Fernandez-Concheso mentioned that the credit agencies have lowered expectations for the sector from stable to negative emphasizing excessive tonnage and decreasing demand. He reminded us that it’s not all about bulk. Liner companies are operating at 80% of capacity with 70 ships laid up. Car carriers are faring worse. And he estimates a 40% reduction in lending to top it off.

Pre-conference Chatter in Miami

From Dublin to London to Miami, it is a good life working for Jim and Matt, at least in terms of frequent flyer miles. Leaving a rather brisk New York in the mid-20s, we arrived in Miami for the 5th Annual Marine Finance Forum – Latin America and Caribbean. The weather as you might expect was beautiful. And following tradition, Lorraine bought us lunch poolside under the guise of our assisting her with the conference. As if Lorraine ever needed assistance. We’re convinced it’s just a ploy to keep us out of the way. Nonetheless, we felt useful and got a good meal under balmy skies and 65-degree temperatures that had the locals bundled up.

Continue Reading

Fleet Street Extra

On our way back from the Dublin Conference, we stopped for a short visit in London where we had an opportunity to talk to some veteran shipping bankers. The general consensus is that we are in for a rough year. Banks will likely be constrained through 2009 as they strive to improve their capital ratios either by shrinking assets or raising capital or both. In the interim, the banks will in all likelihood be working out deals at current low prices. And, finally, under news we hoped never to hear, the broad staff cutbacks at banks might work their way down to the shipping departments.