Surviving the Downturn: The extended role of the ship manager

By Alex Vicefield, V.Group

Third-party ship management has come a long way from it’s roots of the 1970’s – growing up in a time of tonnage over-supply, the ship manager was tasked from the outset to provide value to and protect it’s clients from a hostile market. Just as war has acted as a catalyst for innovation, a sustained low in the freight markets did the same for modern ship management; developing a product, which would ensure that outsourcing was a competitive, useful and problem-solving option. Moving into the boom markets of more recent years, the manager’s function evolved to meet the demands of owners and operators with wider and more specialist needs and to face the crucial industry issues, which have arisen as a result.

In recent months, a convergence of problems, notably global banking illiquidity, falling stock markets, a sharp slowdown in trade and tightening trade finance, have precipitated an unprecedented fall in the freight markets and in turn, vessel values and scrap prices. For many people involved in the shipping industry, these have created a great deal of uncertainty.

Continue Reading

The Purchase of Credit Insurance: Prophetic in hindsight or just good risk management?

By Nick Maddalena, Director, Seacurus Ltd.

In October 2006, Seacurus wrote an article for Marine Money entitled ‘Charterers’ Impact on Forecast revenues’. Words such as ‘unprecedented’ and ‘highly volatile’ were used to describe the bulk sector and yet the charter market continued to increase exponentially. The meteoric increase in hire rates encouraged a number of owners to charter in tonnage solely for the purpose of chartering the same vessel out at a higher rate in order to make a profit. Yet too few owners bought protection against counterparty default believing that they would be able to charter the vessel for an even higher amount if the counterparty failed to pay. But surely the market was unsustainable?

Two years ago it was recognised by a number of market commentators that the principle of supply and demand of basic commodities was not sufficient explanation for the rise in charter rates in the bulk sector; there had not been a significant enough change in economic fundamentals to warrant the increase. Yet the market continued to rise for almost two more years. The reason for the crash is understood now, but at the time was unexpected as it occurred somewhat earlier than anticipated. The drop off in Chinese demand for iron ore after the Beijing Olympics couldn’t compete with the bursting of the credit bubble, symbolised by the spectacular failure of a 150 year old financial institution in the US. A shock wave went through the western banking system and the resultant lack of liquidity meant that cargoes wouldn’t be shipped and still aren’t. This has lasted long enough for the lack of confidence in the market to get a firm hold. The FFA paper losses in Q4 2008 have become a self-fulfilling prophecy. It would have been inconceivable even 12 months ago to imagine that the industry would be discussing the possibility of clearing both paper and physical payment obligations in order to avoid a potential crisis. Asset values have also plummeted and in certain cases are rumoured to be in danger of triggering the loan covenants of the borrower.

Continue Reading

Something for the Weekend Sir? – An Insurance Survival Guide for Bankers

By Peter Mellet, Managing Director, BankServe Insurance Services Ltd.

The shipping market is going to produce a variety of tests over the coming weeks and months for bankers. These will come in many forms including plummeting values, third party creditor arrests, payment defaults and not least insurance issues. An owner’s insurances are in many ways a good health check and a quick way of gauging the current financial position of the borrower. Looking at the underwriting security used can be thought of as taking blood pressure, size of deductibles as temperature and heart rate the state of premium payment. The borrowers P&I club is like taking a blood sample for examination – are they charging unbudgeted supplementary calls? (more than just a blood sample!!) as is the case with the London and UK Clubs, whilst the American Club and the West of England are rumoured to be waiting in the wings. As Groucho Marks once said “I wouldn’t want to be a member of any club that has me as a member”. Most banks do not use to the full their hard won rights under the letters of undertaking issued to them by owners’ brokers and in particular they rarely seek information as to whether owners are up to date with premium payment. A simple enquiry will tell an awful lot – if premium isn’t being paid then are bunker suppliers receiving what is due to them? Will crew wages have been settled? Owners’ brokers are reluctant to go running to banks with notices of cancellation for non payment of premium until they have exhausted all other options – after all they are the owner’s agent, not the bank’s and causing an additional headache for their client at a time when freight income has gone through the floor will potentially end a long standing relationship. It has been said in the past that when things are going well shipping banks are unwelcome guests at the party. Conversely when there is premium to be paid they are the first to be invited. Banks should now be dusting off their insurance files, making sure that they have letters of undertaking and getting out their insurance stethoscope to see how their patient is coping with the epidemic. Increasing deductibles and changing underwriting security at renewal for less well rated (but cheaper options) is a sure sign that something is brewing. These measures may put off the evil day but will only result in the bank catching the same bug as the owner – one case during the mid 1990’s saw a huge fleet insuring with underwriters that had no money and a deductible of USD 750,000.

Of course there will be cases where the illness is terminal and the owners’ brokers bite the bullet by issuing notices of cancellation. Our friends in the mutual P&I world will not be far behind, particularly as the spectre of unbudgeted supplementary calls is now raising its ugly head and the respective managers of the clubs in question can see some unpleasant questions coming from the shipowner board about debt management. Much in the same way as it always seems to rain when you arrange a cricket match then these notices of cancellation always seem to expire on a Friday, Saturday or Sunday – is this just an unfortunate coincidence or a deliberate ploy. For some reason people always think they need something for the weekend and the pressure that a two day period, when cover can’t be bought, seems to often have the desired effect of banks making Friday decisions which they regret on a Monday. Is there a survey out there that concludes that over 50% of vessels sink on Saturday or Sunday? Do collisions happen whilst the crew are checking football results on a Saturday afternoon? Who knows? All we can advise is that before paying any money to owners’ underwriters and in particular mutual P&I clubs a process of reflection and thought is required rather than panic and cheque book.

Dealing with the question of hull premium is relatively easy and is pure economics – how much will it cost to arrange alternative cover and how much is due to underwriters. Are there outstanding claims that need to be collected from underwriters – if so that will result in premium being effectively paid anyway by deduction from claim proceeds. One major consideration if hull premium is to be paid must be to ensure that there is no owner’s discount included in the payment. Owners’ brokers may be rebating a percentage of premium paid to their client and it would be galling in the extreme to find that payment of sums due means a cash payment to a defaulting borrower!

Mutual P&I on the other hand is a minefield and needs to be addressed very carefully using every one of the 14 days notice that banks should receive if cover is to be cancelled for non-payment of calls. The main reason for this is a rule included in a number of the main stream club rule books which enables them to cancel the entry retroactively if cover is cancelled for non payment of calls when due and demanded. It must be stressed that the purpose of this article is not to debate the rights and wrongs of this clause – all that is intended is to make buyers aware of what they may or may not get.

The typical process will involve a note from the respective P&I club manager giving the bank 14 days notice of intention to terminate an entry. The rash lawyer acting for the mortgagee might respond by asking how much needs to be paid to keep the entry in force, but that is the wrong question. The right question is how much will be due if all of the vessels in the fleet leave the club in 7 days time. Some may already have learned the hard way and found how different these two answers can be. The first question may bring a reply of USD 100,000 – the second question may produce a response of USD 700,000. The reason for the huge disparity is the way that P&I calls are made. If foreclosure is inevitable then by definition vessels will be sold to recover amounts due under the loan. That means change of ownership and that means that vessels will leave the P&I club that they are in. On leaving a club release calls will be charged which represent a total of all unpaid advance, supplementary and unbudgeted supplementary calls, plus a loading of perhaps 25%. On the day that the first question is asked there may only be the balance of an advance call due – hence the apparently reasonably priced reply. Don’t be fooled; release calls will follow foreclosure. If those release calls are not paid then some clubs are able to cancel cover retroactively back to the commencement of the owner’s entry. This means that if the bank, having asked the first question, paid USD 100,000 to “secure cover” but didn’t pay the balance of USD 600,000 then the first USD 100,000 would have been completely wasted. Retroactive cancellation would have wiped out anything that was in force. A complicated issue yes but impossible no. There will of course be times when P&I clubs should be paid – all we ask is that people know what the real bill is and enter the process knowingly with no surprises at the other end. There are alternatives to panic buying and by understanding the issues bankers can at least enjoy their two days off knowing that they have everything they need for the weekend and that Monday will bring no surprises.

Peter Mellet is the Managing Director of BankServe Insurance Services Ltd. He can be reached at +44 20 7374 5104 or peter.mellett@bmsgroup.com.

A Perfect Storm

By Erik A. Lind & Andrew Hampson, Tufton Oceanic

Tufton Oceanic is positioning itself to capitalise on a rise in distressed opportunities, which it believes will come from cash strapped investors and depressed values that have been fuelled by a combination of the credit crunch and adverse supply and demand economics. Owners and other capital providers in need of liquidity will be forced sellers in these adverse market conditions and opportunities are already being presented that show significant upside potential.

Tufton Oceanic, a leading fund Manager in the maritime and offshore oil service sector, is setting up a new fund that will focus on such distressed opportunities. The “Oceanic Distressed Fund” will be looking to invest into debt instruments, equity opportunities and vessel assets where the sellers are looking to raise liquidity in order to cover existing commitments, to deleverage or simply to restore cash balances. Whilst Tufton expect all shipping segments to experience downturns in rates and prices over the next two years some will recover more quickly than others and the severity of the troughs will also vary. Tufton expect to have their fund ready during the first half of 2009 to take advantage of these situations.

The Oceanic Distressed Fund has a target size of US$500 million, and the launch is scheduled for Q1 2009 with a view to commence investing in the first half of 2009 over an 18 month period. The life of the fund will be 4 years with the Fund Manager having an option to extend for a further 1-2 years. The majority of the returns will be back ended, as the strategy is to buy “distressed” and sell in a recovered or recovering market once the targeted annualised return of 25% to investors has been met.

Tufton’s investment universe will continue to focus on its traditional industry sectors of the maritime and offshore oil service industries. Investment opportunities will be sought in the following instruments:

Debt: senior, mezzanine and bond investments

Equity: public to private, private investments, secondaries and limited partnerships

Assets: second-hand sales and shipyard contract re-sales

Continue Reading

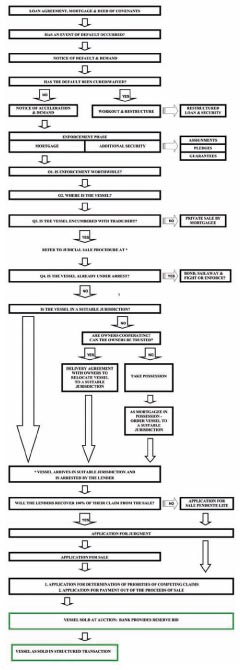

Mortgage Enforcement Flow Chart

By Watson, Farley & Williams LLP

New Procedural Rules Could Make Panama the Perfect Place for Ship Mortgage Foreclosures

By Francisco Linares, Partner, Morgan & Morgan, Panama City, Panama

Panama has always been an ideal spot to arrest ships. With major trade routes passing through the Panama Canal and an increasing number of calls at the major ports in Balboa and Cristobal, Panama enjoys a steady, healthy flow of oceangoing vessels through its jurisdictional waters. In addition to this, Panama’s maritime procedural law makes it possible to arrest ships quite expeditiously. This procedural framework is currently in the process of being revised by Panama’s Legislative Assembly. There are new features in this reform project that will be of particular interest to marine creditors and debtors alike, carrying obligations secured by means of preferred naval mortgages recorded on vessels of any nationality. This article will highlight some key aspects of the mortgage foreclosure process under the revised rules of procedure, presently being considered by the Panamanian legislature.

Continue Reading

Perfecting and Enforcing Your Security

By Helen Noble, Partner, Matheson Ormsby Prentice

We have heard today about shipping as an investment and the returns that can be achieved by investing in shipping. A constant theme, not unsurprisingly, is the current global financial crisis. I do not wish to add to the ‘doom and gloom’. However given the current climate I am sure all will agree ‘Perfecting and Enforcing your Security’ is a suitable and apt topic. I am not being negative but pragmatic about the impact the current climate has and will continue to have on ship lending and on transactions already concluded.

For new deals the level of security required by lenders will be greater and the perfection of such security will need to be far more stringent perhaps dare I suggest than it may have been at the height of market.

I would like to outline to those present (and perhaps those less familiar with shipping investment), the types of security that can be considered for a specific transaction and how such security can be realised in the event of default. Obviously this aspect may have particular relevance to concluded deals which are now of concern due to the economic downturn but I hope will also demonstrate to anyone considering investment in shipping that deals can be secured in various ways and in the event of a default there are positive steps that can be taken to protect investment.

Continue Reading

Ship Mortgage Enforcements – Preserving Your Security?

By Bill Amos, Partner, Ince & Co., Hong Kong

This article considers the options available to ship finance banks when their borrowers default. To place matters in context, there are a number of comparisons to be made between the current crisis and previous shipping downturns.

For those of us in Asia the last downturn we experienced was 2003’s SARS-related crisis, which was short-lived and regional. A vessel could be re-possessed and re-positioned from Asia to Europe and be operated profitably. In marked contrast, the present recession is a global phenomenon.

In the past, the shipping market cycle was not always in synch with the wider economy, often managing to experience “bust” when other sectors were booming. The October 2008 collapse in the dry bulk market exactly coincided with the free-fall of stock markets worldwide.

Previously, a ship finance “work out” (as they are sometimes euphemistically called) would often see the mortgagee bank utilise a nominee company to buy back the ship from a court sale, so as to avoid a “fire sale”. The method required the multi-million dollar purchase price to be paid into court. Whether that degree of liquidity can be restored and maintained within the present banking system remains to be seen.

And lastly, for older tonnage, there was always the scrap buyer – whereas, at the time of writing, the demolition market has also collapsed.

Amidst all this doom and gloom, any lender faced with a struggling borrower has to bear in mind the cyclical nature of the industry.

Continue Reading

The Shipping Slump

By Jean Richards, Secondwind Shipping Ltd

Restructuring, Repossession and Realism

History does have a way of repeating itself and some of us are old enough and experienced enough to remember the shipping slump of the 80’s. For others the shipping industry has only ever been an amazing bull market and the current downturn has come as a nasty shock. Some might just be old enough to remember the few high profile repossessions which took place at the end of the 90’s but these were mostly connected to failed bond deals. In the 80’s repossession by means of arrest and judicial auction sale was only too common and it remains to be seen whether those times are with us again.

Whatever the severity of the market the arrest and repossession of a shipping asset must be the strategy of last resort; only to be tried when restructuring and mediation between owner and lenders/ investors has failed.

Why do restructuring strategies ever fail?

a) because financiers and owners fail to face the severity of the market

b) because financiers and owners fail to face the duration of the slump

c) because financiers and owners fail to produce realistic cashflows

d) because financiers and owners procrastinate in the decision making process with the result that they are forced to chase the market down

Continue Reading

Public Companies and Unrealistic Shareholders – How to survive 50% yields

By Gary Wolfe, Partner, Seward & Kissel LLP

Perhaps the most amazing consequence of the recent precipitous drop in the drybulk markets and the related drop in the stock prices of the publicly traded drybulk companies has been the extraordinary yields at which the full and high dividend payout companies are now trading. As of this writing, Yahoo Finance shows one of the full dividend payout companies as trading at a 73% yield while one of the partial dividend companies is trading at “only” a 60% yield.

In this context, some investors have demanded assurances from the full and partial dividend payout companies that their dividends are “sacrosanct”. At the same time, when the prices of their shares have fallen as much as 90%, company managements have begun to ask themselves why they should not take their companies private.

The common, unstated factor, in both the amazingly high yields currently prevailing in the market and the attraction of going private is that shares of publicly traded drybulk and container shipping companies are trading at a fraction of net asset value (NAV). That is what makes them potential targets for either going private or unfriendly acquisitions. The “absurd” relationship of NAV to current cash flow is also reflected in the high yields that the full and partial dividend payout companies are producing.

Continue Reading