Even Economic Interests Can Be Sold – The Innovation Award

We received many worthy nominations in this newly added category. Many of the transactions were highly structured transactions that contained slight nuances creating slight differences from deals in the past. Some were hybrids, which combined traditional ship finance with export finance and leveraged finance. And still others equated innovation with overcoming market or credit barriers. In choosing the winning transaction for this category, we judged the nominees against a simple standard, the definition of innovation. Merriam-Webster defines innovation as “the introduction of something new” and only one transaction fit that definition in our view.

The first time award for innovation goes to DnB NOR Markets for its creative sale of a large portfolio of dry bulk timecharter contracts (the “Portfolio”) for Bunge Ltd., a leading global agribusiness and food company (“Bunge”). The portfolio consisted primarily of Kamsarmax vessels that were chartered in with an average duration of approximately 2.5 years. The Portfolio exceeded the Bunge’s own tonnage requirements and the charter-in rates were deep in the money.

DnB NOR Markets developed an innovative structure for Bunge to monetize the Portfolio and simultaneously unwind related hedges. DnB NOR conducted a limited auction towards both strategic and financial buyers. The deal possessed certain complexities that made for a challenging closing. It was important to identify buyers that were willing to: 1) recognize and quantify a historical trading premium for Kamsarmax vessels versus Panamax vessels; 2) apply the Kamsarmax premium to the forward curve; 3) enter into forward freight agreements to establish a “market neutral” transaction. Also challenging was assessing and quantifying the operational risks associated with acquiring a portfolio of contracts.

The primary valuation methodology centered on a discounted cash flow analysis with the key variables being forward rates, IRR, and applicable Kamsarmax premium to forward curve.

The Portfolio was purchased by a financial buyer, Global Maritime Investments Ltd., a UK based shipping hedge fund. The economics of the transaction for both parties held firm even during the subsequent dry bulk market collapse.

This transaction like most great deals solved a problem for one party and presented an opportunity to another. A job well done to DnB NOR for its extremely creative solution.

“Rollin’ on the River” – The Project Finance Award

Of the new categories we added this year, this one, in particular, was long overdue. Project finance transactions are the outliers in terms of today’s credit philosophy that focuses mainly on the cash flows and balance sheets of the borrowers. In contrast, project financings are generally structured around a singular contractual cash flow obligation from a third party and the creditworthiness and balance sheet of that cash flow source. In these transactions, the borrower is often a single purpose company and there may or may not be credit support in the form of guarantees or additional security from the project sponsors. Following the theme, loans too are generally non-recourse. Although collateral is a secondary source of repayment in both types of transactions, its role is more significant in a project financing given the limited recourse. In the shipping space, bilateral loans are more likely to have project finance content based upon a long-term charter. Currently, the energy sector seems to be a richer breeding ground for these types of transactions.

The nominees for this award cover a gamut of projects and all were worthy, making the choice of a winner extremely difficult. HSH Nordbank, as mandated lead arranger, nominated the loan to a KG formed by MPC Capital for the financing of nine 13,100 TEU containerships which will go on long-term charter to Hanjin Shipping Co. when delivered between April 2011 and June 2012. The $1.1 billion loan included as syndicate members Calyon Credit Agricole and Dresdner Kleinwort, as joint lead arrangers and HVB and Deutsche Schiffsbank as co-arrangers.

In the energy sector, West LB, with its very strong presence in Latin America, proposed it’s financing of the La Muralla III drilling platform. This limited recourse project financing has a tenor of 7.5 years, including a 2.5 year construction period, and will support the construction of a deepwater semi-submersible to be operated by Industrial Perforadora de Campeche, a subsidiary of Grupo R, under a long-term contract to Pemex. The total project cost is $793 million of which $584 million is debt financing arranged by West LB and BBVA Bancomer. The participants include: Banamex, HSH Nordbank, Unicredit, NordLB, Dexia, NATIXIS, Alliance & Leicester, CIC and Standard Chartered.

Another energy deal involved the financing of two drillships owned by a 50-50 joint venture of Transocean and Pacific Drilling, a company controlled by the Ofer family. Upon delivery, the rigs will enter into five-year drilling contracts with India’s Reliance Industries. The joint venture secured financing from DnB NOR and Fortis, as joint bookrunners and lead arrangers, in the amount of $1.265 billion against a delivered cost of $1.5 billion. The banking syndicate includes: BNP Paribas, Commerzbank, Deutsche Schiffsbank, HSH Nordbank, Royal Bank of Scotland and SE Banken. In addition, Transocean is also a participant to the tune of $595 million.

One complex and carefully structured transaction, however, stood out as the perfect example of this type of financing in both form and substance. In this instance, the project involved the transportation of iron ore products by tug and barge convoys from Brazil to Argentina on the Hidrovia Parana Paraguay (“HPP”) waterway. Approached by an existing client, SCFCO Holdings, a 50-50 joint venture between Seacor Holdings and InterBarge Partners LLC (a consortium owned by Argenmar S.A. and two Latin American investment funds (Horizon Capital and Bearing Capital), Bank of Ireland was asked to arrange a $58.1 term loan facility for the asset owning entity of SCFCO Holdings. The proceeds of the loan would be used for the purchase, refurbishment and positioning of four tug and barge convoys to service a ten year contract, awarded to InterBarge (the holding company’s operating entity) to transport iron ore and pig iron on behalf of a Brazilian mining company from Corumba in Brazil to Rosario and San Nicolas in Argentina. With the mines located close to the banks of the HPP waterway, the only available modes of commercial freight transport are by truck on a highly inefficient road network or by shallow draft barges along the waterway. The new convoys will bring needed efficiency to the cargo movements.

The economics of the region are compelling. Currently, the annual iron ore production of all mines in Corumba aggregates 4.5 million tons. Of that amount, the current volume of iron ore shopped on the HPP is 3.5 million tons, with growth constrained by the supply side fundamentals of available tug and barge tonnage. These movements were forecasted to rise to over 16 million tons by 2011 following infrastructure investments by Rio Tinto and increasing production in general. However, given today’s economic climate, these numbers may be somewhat optimistic.

The transaction provided a number of challenges to BOI, which had to be dealt with. In the first instance, country risk in the region coupled with the quality of the local flag registries provided limited comfort to international banks. The HPP is an inland waterway that runs through Argentina, Bolivia, Brazil, Paraguay and Uruguay. Although there remains some operating risk in these waters, it is greatly mitigated by the “Agreement on River Transport through Panama-Paraguay Waterway, 1992” which essentially classifies the HPP as international waters. As a result InterBarge could operate using international flags, which in turn allowed the bank to perfect its security by registering the barges in a jurisdiction with a tried and tested maritime law. The barges were registered in Liberia and are dual flagged in Bolivia to aid crewing measures, minimize local taxes and comply with HPP requirements. With day-to-day barge operations managed by InterBarge in Argentina, the lenders also needed to mitigate their exposure to Argentine country and currency risks. This was easily accomplished by directing charter hire payments paid in dollars to an operating account at BOI in Dublin. Lastly, the structure of the transaction was strengthened by a letter of credit, confirmed by an international bank, to support the charterer’s obligations under the terms of the charter.

For a banker an ability to replicate a deal is the essence of a relationship. BOI was able to follow this transaction with another $30 million facility to finance the acquisition and positioning of two further tug and barge convoys to service five-year contracts with another charterer. It doesn’t get any better.

We congratulate the Bank of Ireland not only on a well-structured transaction but also its efforts to develop new markets while expanding their product offerings in this region to meet the needs of their customers.

Shifting Risk – Export Credit Deal of the Year

By Dan Oliver

The 2007 party in shipping continued into the first half of 2008 with charter rates soaring to new heights. But storm clouds were already visible as the credit crunch closed its grip on the global economy and debt financing became more difficult. Bank syndicates grew in size, fees expanded, margins widened, and covenants tightened. When the music stopped in the second half of 2008, equity markets quickly identified which firms had well-structured debt and cashflows and mercilessly punished those that did not.

The worst aspect of the credit crunch for the shipping sector has been the collapse of trade finance. The export driven economies of Asia and Latin America offer the best hope for global growth, but these regions have also seen the steepest drop in credit availability and the sharpest rise in cost, crimping global trade and sending the dry bulk index down 98%. The problem is there are fewer banks now than at the beginning of 2008 – major players such as the Royal Bank of Scotland, Fortis and Wachovia have been nationalized, bought outright or scrapped – and the survivors are nervous, focusing on balance sheet reduction. By November, the World Trade Organization estimated that trade finance demand outstripped supply by $25 billion.

Government backed credit agencies stepped up efforts to loosen credit in the fourth quarter. The World Bank tripled its trade-finance program to $3 billion, the U.S. Export-Import Bank set up a $2.9 billion facility, and the Federal Reserve opened $30 billion in swap lines to Brazil, Mexico, South Korea, and Singapore. High margins have also attracted opportunistic hedge funds and boutique investment banks. Nevertheless, the World Bank estimates that trade will contract next year for the first time since 1982.

A New Award

We created the Export Credit Deal of the Year Award to recognize a transaction that overcame the unprecedented market dislocations to keep ships operating and goods flowing. Rising to the challenge were several companies that succeeded in closing long-term, innovative export credit financings preparing them to weather the downturn. To highlight a few, Citibank arranged $335 million in debt for Awhilco Offshore to finance a semi-submersible drilling rig, featuring the first such financing by the Export Import Bank of China. Natixis arranged a $372 million facility for Emarat Maritime to finance seven Aframax Tankers, partly insured by the Korea Export Insurance Corporation. And, as late as November, Stena raised $850 million to finance an ice class drill ship fully insured by the KEIC, the largest transaction ever for both parties.

After surveying the heroic efforts by BNP Paribas, Natixis, Fortis, and others, we chose Stolt-Nielsen’s $625 million term loan facility featuring a KEIC guarantee to finance eight 43,000 DWT parcel tankers as the Export Credit Deal of the Year. We congratulate Fortis, Citibank and Deutsche Bank, which acted as joint bookrunners in the transaction, for creative use of government backed export credit to close a newbuilding financing in this adverse environment.

Jacob Stolt-Nielsen, inventor of the modern parcel tanker, founded Stolt-Nielsen S.A. in 1959 and built it into a liquid tanker powerhouse. Over the ensuing decades, Stolt diversified from tankers into terminals and containers and has become a leading provider of fully integrated bulk liquid chemical logistics ranging across edible oils, acids, and specialty chemicals. The company operates a fleet of 158 parcel tankers, product tankers, river tankers and barges totaling 2.3 million DWT at an average age of 14.3 years. By 2008 revenues had climbed to $2 billion with net income at $178 million.

The main demand driver for vegetable oil transportation for the past few years has been China, as in so many other commodity markets. In 2007 the growth in China’s imports of vegetable oil rose 24% year on year, and the first half of 2008 saw an 11% rise. Back in 2007, in what seems like a different age, Stolt ordered eight sophisticated parcel tankers from SLS Shipbuilding Co., Ltd of Korea to anticipate any updrafts in the market. The vessels are fully double-hulled and will feature a combination of 24 stainless steel and 15 coated tanks each. In addition, they will meet both Marpol Annex I and Annex II cargo requirements and will have IMO I, II, and III capability. They are scheduled to be delivered between June 2010 and April 2012.

The facility finances pre- and post-delivery for 80% of the loan to contract value, with a 16-year term including 12 years post-delivery. Stolt agreed to pay the first 20% of the contract value and utilized the 95% insurance policy on political and commercial risks from the KEIC to reduce the risk weighted capital. The shipbuilding contracts will be supported by refund guarantees issued by banks including: ABN Amro, Hana Bank, and Kookmin Bank. Although the banking sector is currently focused on deleveraging and asset reduction, the Stolt facility attracted a syndicate of 10 institutions committed to the long-term success of the business.

The Stolt transaction sets the current tone of the market: experienced players with the depth to ignore the volatility of spot prices are able to plan strategically for the long-term. The facility completed Stolt’s existing newbuilding financing requirements, totaling $1.24 billion, and the truly dedicated financing institutions were able to ally with a proven industry leader with a long-established business model.

The transaction also demonstrates that sub-sectors within shipping, such as the Chemical Tanker and Offshore & Oil Services Industries, continue to attract capital for established, well run companies. Steadied by the transaction, Stolt had the confidence to gobble up Taby Group, a smaller competitor, and speed the consolidation that will stabilize the industry.

We applaud the collaborative efforts of Fortis, Citibank and Deutsche Bank in maintaining the flow of capital to deserving companies. The Stolt financing gives confidence that the shipping industry will survive its toughest challenge in decades and will emerge meaner and leaner.

Being Global, Going Local – The Leasing Award

In the shipping business, if you are going to pay taxes, you ought to think about leasing. This is particularly true of the liner companies and industrial shipping companies, where vessels are thought of as holes in the water to be filled rather than as trading assets. More often than not the vessels involved are not standard commodity type ships but high capital cost units giving even more incentive to use other people’s money. Finally, as long-lived assets are involved, long-term funding for 100% of the cost is generally available, which when combined with tax benefits brings down the daily cost to very reasonable levels.

As attractive as leasing is for the lessee, it is equally attractive to the lessor/owner who receives not only the tax benefits but also gains a long-term asset generating interest income as well as the potential in certain instances of residual upside depending on structure. As in all financings, the credit quality of the lessee is critical and must not be overlooked. This is particularly true in leasing where the lessor is the owner of the vessel and there is no collateral cushion whatsoever.

This year’s nominees have taken the leasing concept and moved it into a new plane by diversifying funding and adding optionality. In many respects they have taken on the lessons of the aircraft leasing business, which pioneered many of these structures.

Of the three nominations we received, each had a special spin of its own, making the choice very difficult.

In the first instance, Odfjell completed the sale and operating lease of the chemical tanker, MT Bow Sky (40,005 dwt / built 2005), in a transaction structured and arranged by MDT, the London based arranger specializing in shipping, aircraft and rail finance. Odfjell sold the vessel for $84.5 million and in turn entered into an eleven year operating lease with a UK subsidiary of nabCapital, the institutional banking and capital markets division of National Australia Bank Limited. nabCapital was able to deliver substantial value to Odfjell via a very competitive charter rate for the vessel by applying the revised UK cross border leasing rules. The ship will continue in the Odfjell Tankers Pool and will continue to be managed by Odfjell. The successful conclusion of this transaction, which resulted in a net gain of $32 million, will go a long way in repairing the damage done to the group’s equity by the Norwegian retroactive tax imposed last year.

In another transaction, The Royal Bank of Scotland (‘RBS’) provided the Hong Kong based Orient Overseas Containers Line (‘OOCL’) with 100% financing for two 4500 TEU container vessels for a total consideration of $126 million. The financing was based upon two complex risk positions which required deep understanding and risk management structuring, with an appropriate combination of both loan and lease finance. RBS has previously provided lease based facilities to OOCL but due to a combination of legislative and accountancy based changes, was required to develop a broader product capability for this client. The first consideration was the status of UK Leasing, which had becoming unavailable or no longer attractive to OOCL at the expiry of the initial lease period. To that end RBS managed to increase the optionality for the client to ensure that, notwithstanding any potential changes to UK tax legislation, the Lessee has the ability to roll its lease commitments into a pre-agreed loan financing. Additionally, RBS structured the pre-delivery period to ensure that a further element of sub-participation was available to facilitate a broadening of the client’s banking group while remaining compliant with the tax legislation surrounding UK Leasing. The deal team was able to structure the facility in such a manner to ensure that an acceptable risk position was held by RBS while delivering all the key objectives of OOCL.

Perhaps lacking the complexity of the RBS transaction, Citi’s delivery of a tailored seven-year sale and operating leaseback transaction for four 6,039 TEU containerships for Wan Hai Lines Ltd. captured this year’s award. As an outsider, Citi structured the transaction with a total cost of $300 million to appeal to the local Taiwanese senior debt market during a period of significant USD illiquidity. And the needs of the client were not forgotten. The structure provides the lessee with maximum operating flexibility including flagging in Singapore. Withholding tax risk was minimized for both the lenders and lessee. And, significantly, the lessee group was able to maintain a significant economic interest in the vessels through a pre-determined purchase option mechanism at the end of the lease term.

The key drivers for the transaction was the transfer of a significant portion of the residual risk to the RVG provider, optimal pricing that was achieved through a maximized senior debt profile, and low withholding tax risk.

It was a very difficult choice, as all three institutions were each deserving of accolades for what they delivered to their clients. For us, knowing the difficulty of penetrating the Taiwanese market was the critical factor in presenting the award to Citi.

The Gang that Could Shoot Straight – Follow-on Award

The sale of a follow-on offering of shares may be either easy or difficult. The follow-on lacks the hype and hoped for jump of an IPO. It’s historic performance, good or bad, has already been established. The analysts have dissected and modeled the company from which they have derived a target price. The facts are there for all to see.

Perhaps more importantly, purchasers know that they are buying at the bottom of the capital structure and the likelihood is that they are paying a higher price than the existing shareholders. And, once issued, the shares tend to drop in price as a consequence of dilution. The follow-on may also include a secondary offering with existing shareholders cashing out, which may give one even further pause. Returns whether dividends or growth are uncertain. Welcome to capitalism or the world’s largest casino.

Of course, this is all irrelevant in the midst of a stock market boom. In those times, anything sells, even tulip bulbs. Yet for all the reasons enumerated above, we believe Mr. Market remains somewhat discerning in both good and bad markets when it comes to follow-on offerings.

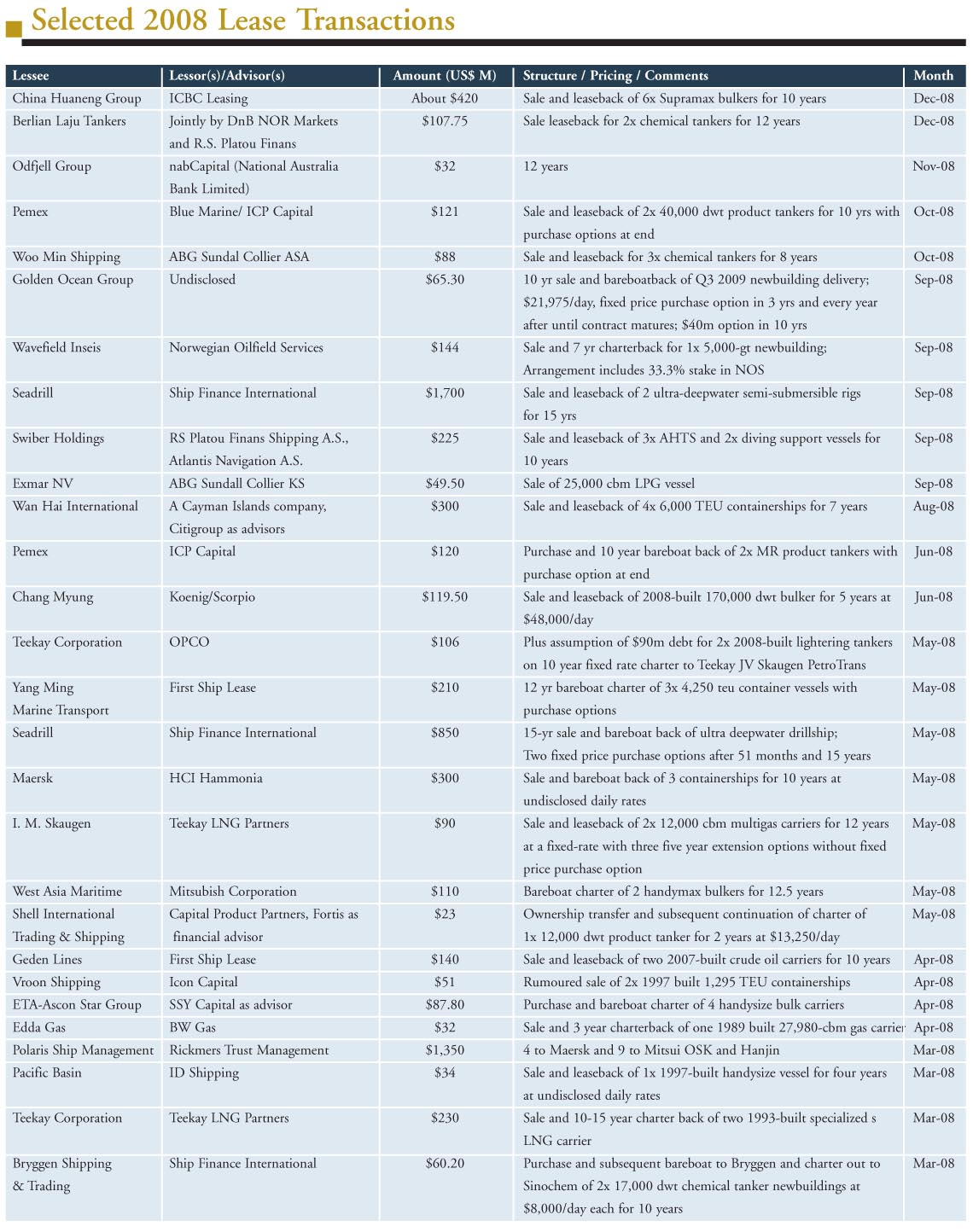

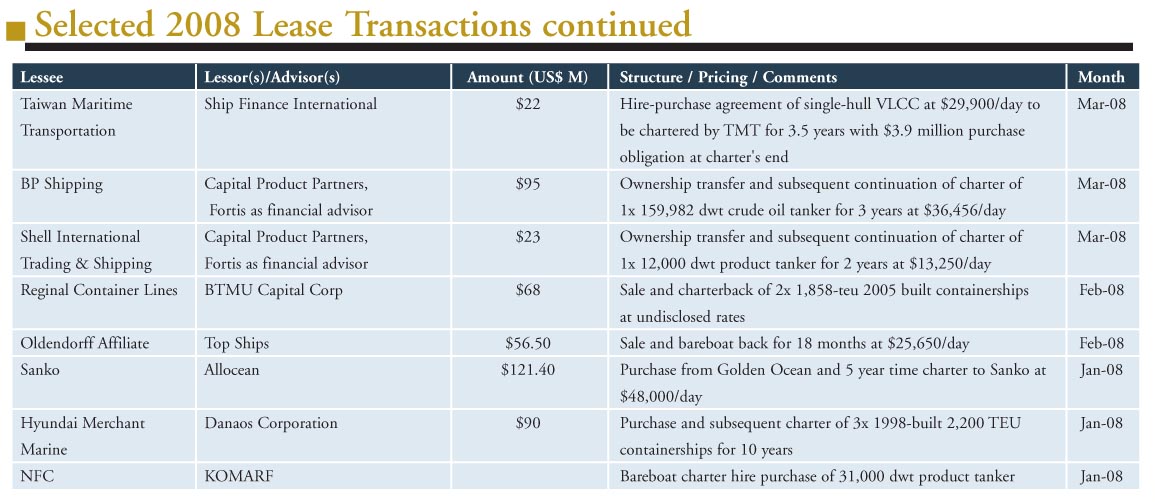

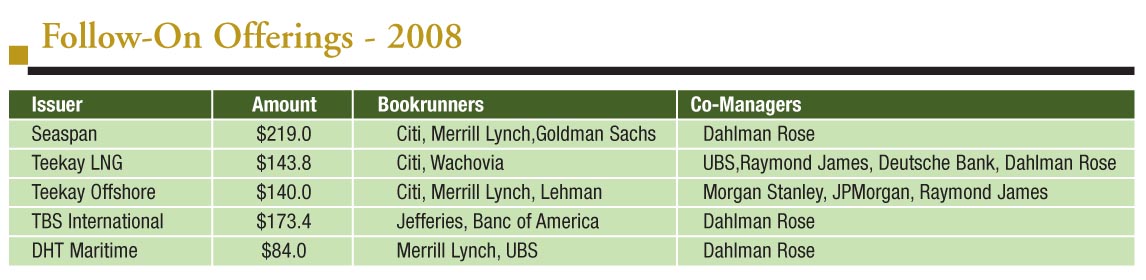

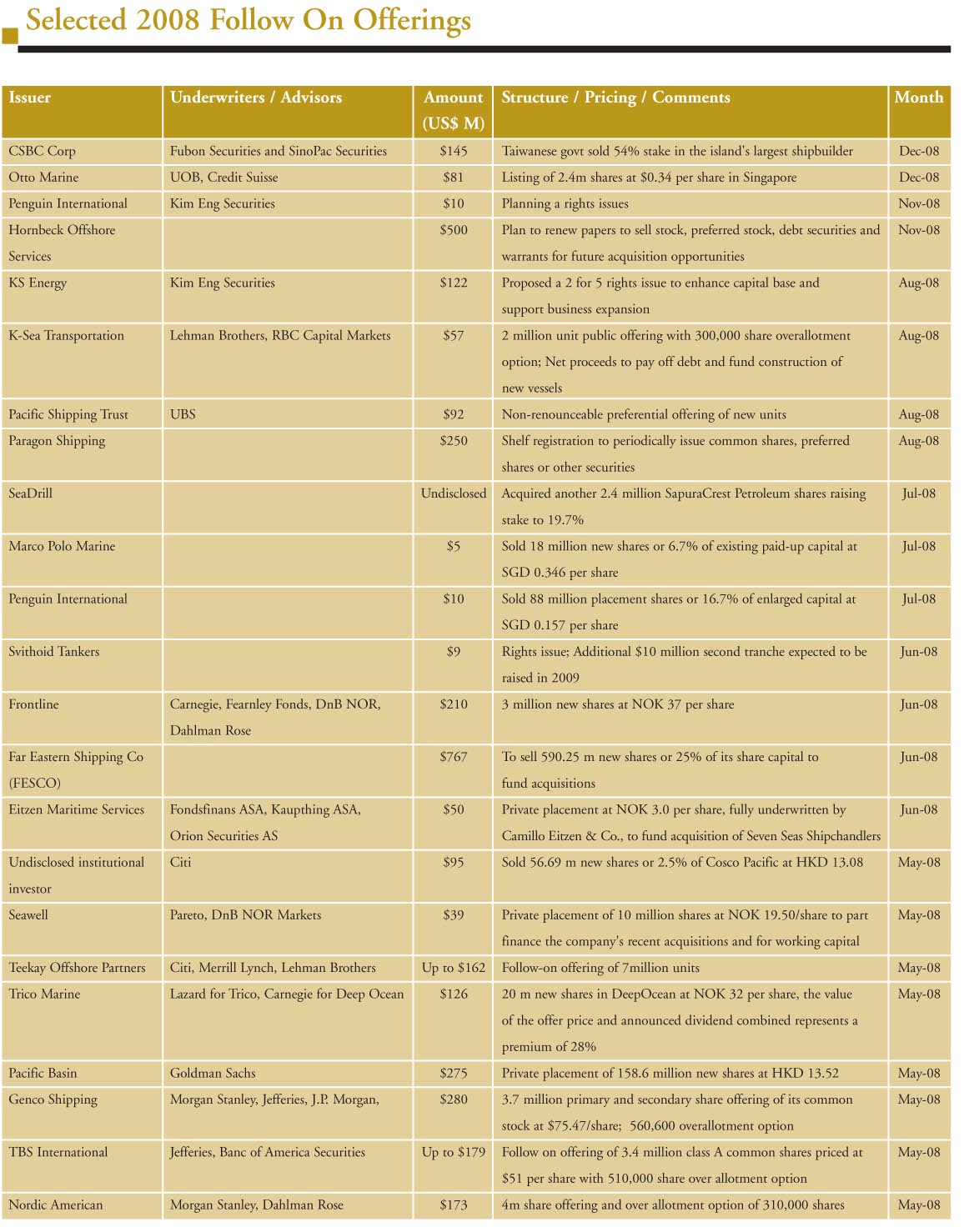

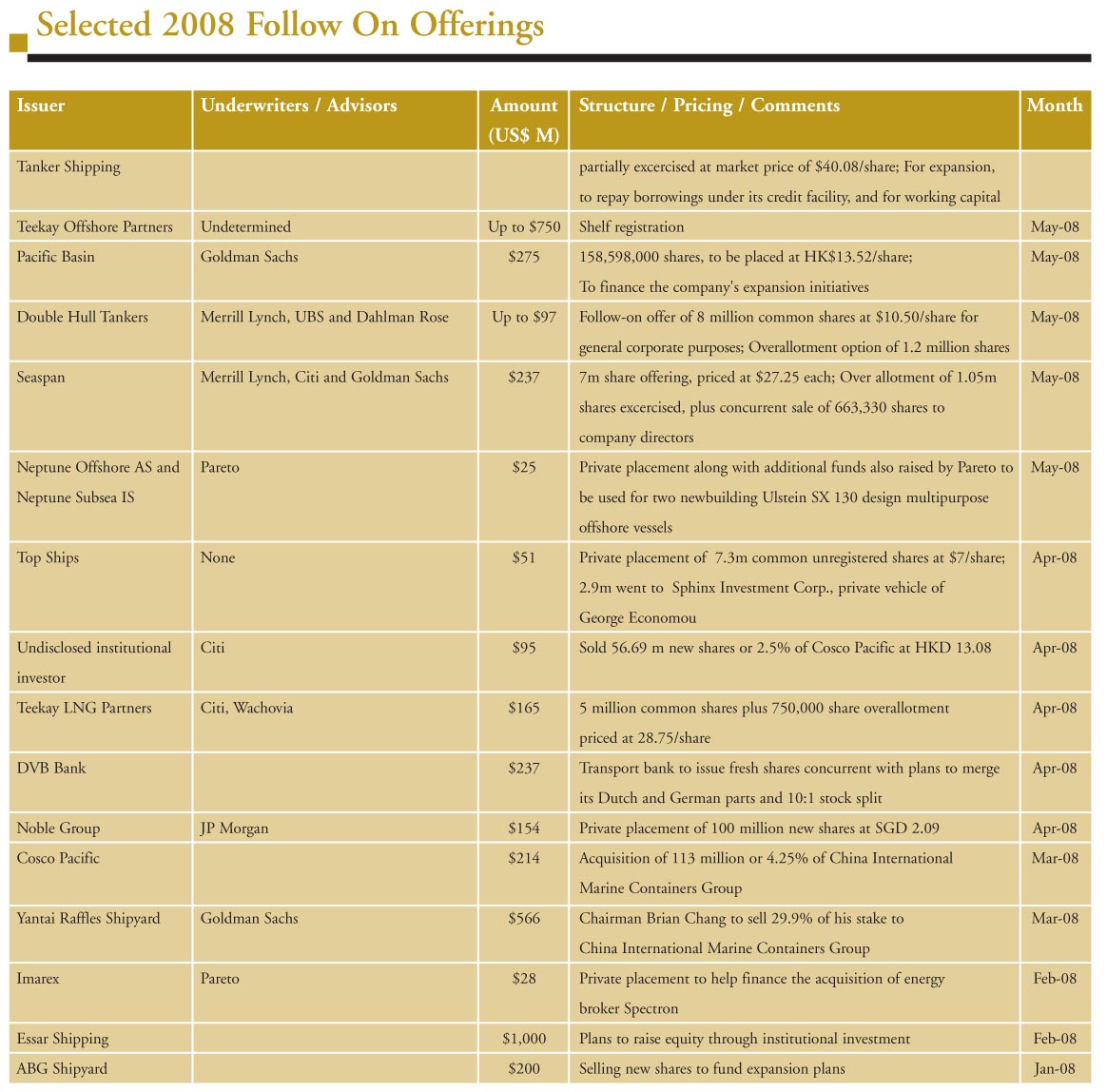

This year’s nominees fell into two groups (see chart below). The first group, or the regulars, comprises those companies, which are predominantly the dividend payers. All or at least most of their internally generated cash is distributed to the shareholders. To finance their built-in growth these companies, which retain little or no cash, are regular visitors to the debt and equity markets. The latter, of course, serving to restore the equity ratio to acceptable levels. Among the issuers who fall into this category were Seaspan, last year’s winner in this category, Teekay LNG and Teekay Offshore. These companies are characterized by sound and conservative business models built around long-term visible revenues, cost effective operations and well-regarded sponsors. These companies not only have a credible story they tell it well, as they should given their regular presence on the road.

Selling shares has its own special terminology when it comes to measuring success. These include: launch to offer discount, new accounts, conversion rates and amount oversubscribed. By all measures, every one of these offerings was successful and the efforts of the bookrunners and managers should be applauded.

Each of the second group, in contrast, presented its own unique challenges for the underwriters. This group comprises TBS International and DHT Maritime and each has an interesting story.

As it promotes itself, TBS is a ocean transportation services company, which offers a mixture of liner, parcel and bulk services as well as a charter service with a focus primarily on non-containerized cargos. Among the freight handled are a multiplicity of “dry” cargos, including: containers, breakbulk, RoRo, project and bulk. TBS went public in June 2005 with its shares subsequently benefiting not only from a remarkable turnaround in its fortunes but also the perception that it was a dry bulk company like those measured by the BDI. Of course, only in the broadest sense is TBS a dry bulk company. Nonetheless, this perception can cut both ways as we have seen.

TBS International’s offering was its first follow-on since going public and the first dry bulk offering since November 2007. The follow-on offering consisted of both primary (2 million shares) and secondary (1.4 million) shares. The transaction was executed in a challenging market environment with a decrease in the BDI as well as the broad market prior to pricing. In this instance, the sale of secondary shares did not have a significant impact on the sale. The company’s share float was small and management had not sold shares in the IPO or subsequently. And, perhaps even more importantly, the insider shares sold, although a significant part of the offering, represented only a small portion of each of their holdings leaving them with sufficient skin in the game.

Jefferies and Banc of America, as joint bookrunners and Dahlman Rose were more than up to the challenge. The offering was sold at $51, a premium to the share price before the deal was announced, which all things considered, is quite remarkable.

DHT Maritime’s offering of 9.2 million shares was led by Merrill Lynch and UBS with Dahlman Rose also participating. Priced in line with charter adjusted NAV at the time, the proceeds were needed to meet a $75 million year-end debt payment. This transaction offered two key challenges. The first obstacle was the fact that the company is in effect a one trick pony due to its dependency on a single charterer, which is not all that bad as it is OSG. OSG had already relinquished its ownership position in 2007. But no matter how strong an operator and credit OSG is, there is always comfort in diversification. The second challenge arose from the company’s decision to change its dividend paying policy from full to partial payout. As one might expect the reduction in yield did not please shareholders who drove the price down. Now, after disappointing shareholders earlier in the year, the company was going back for more. Although disconcerting, there was logic behind this. First and foremost, the company would retain cash to fund its growth while paying a more than reasonable dividend. Future growth would now be funded by debt and internally generated cash, minimizing dilution. Moreover the dividend at the new level was secure as it was based upon OSG’s contractual payments and did not depend on profit sharing.

Although the share price fell after the offering, the company’s decision was affirmed as the price came back about 120 days after the offering as investors recognized the strong visible earnings coupled with a healthy balance sheet with more than sufficient liquidity.

DHT’s management and its bankers are to be commended on this successful offering and their decisions, which stand them in good stead today as investors’ focus has switched from diversification and growth to credit quality.

Success in the second instance, is measured simply by getting the deal done. On the basis of that measure, this year’s follow-on deal of the year award is shared by the outliers, TBS and DHT whose successful marketing overcame adversity.

Astute Selling, Smarter Buying – The Equity Linked Award

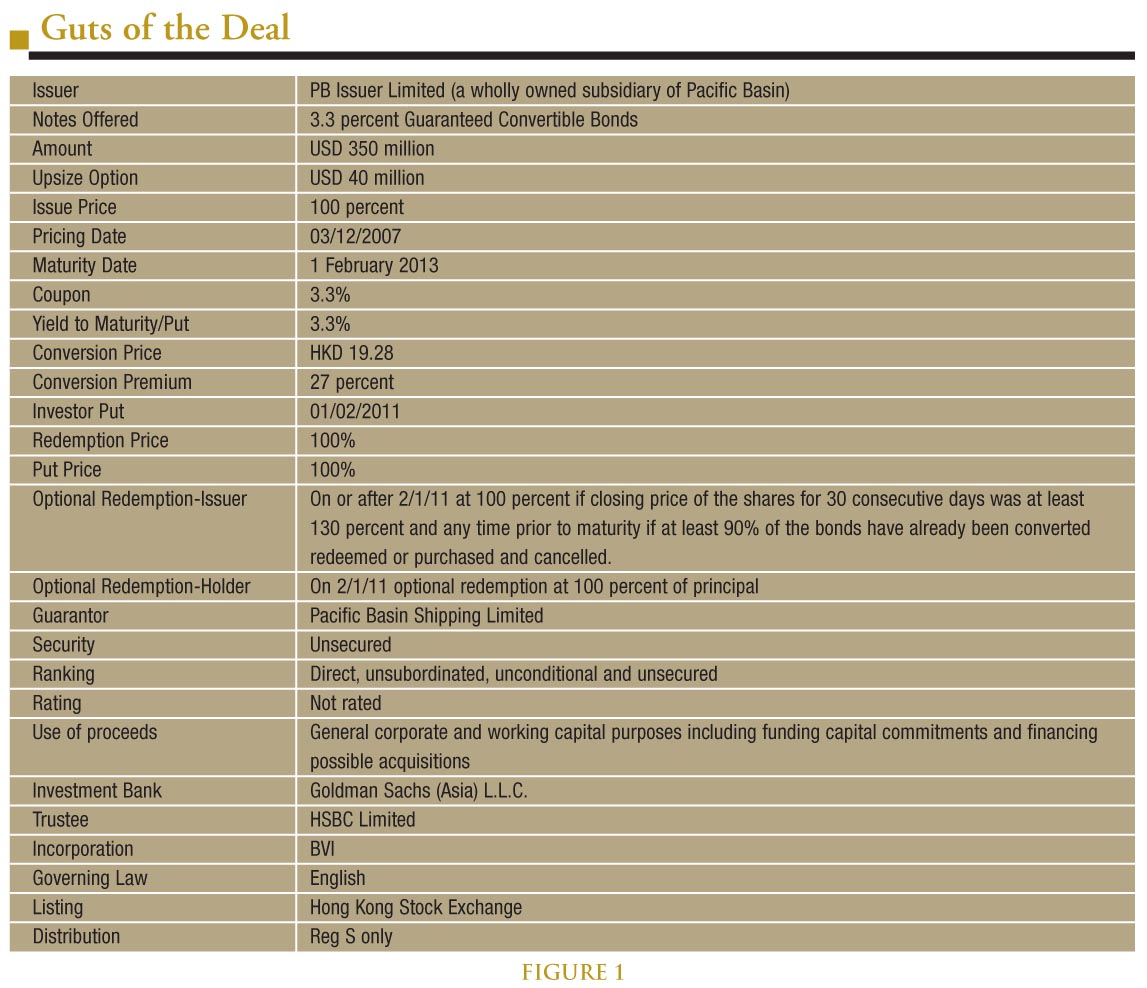

2008 was an unexciting year for any equity linked offerings of any sorts, let alone shipping and offshore convertible bonds. The dearth of activities in this category reflects the many challenges that our winner had to overcome in order to close this transaction that stood out in terms of value creation for the client. Among the nominees considered, this year’s award goes to Goldman Sachs as the sole bookrunner of Pacific Basin’s USD 390 million 3.3% Guaranteed Convertible Bonds due in 2013.

In late December of 2007 when the financial debacle had began to unfold from a housing crisis to a credit crunch, Pacific Basin took the challenge and launched its convertible offering – the largest by an Asian shipping company ever and the second largest convertible offering by a Hong Kong issuer since the beginning of 2006. The main terms of the offering in Figure 1 show its many virtues. Raising USD 390 million with the overallotment exercised for 5 years at a fixed 3.3% on an unconditional and unsecured basis is remarkable especially in such tough market conditions.

Rather than selling common shares at a discount to market value, the convertibles provided Pacific Basin the potential to issue shares at a premium to today’s current value and at the same time lowered the company’s fixed costs of borrowing by offering lower upfront yields to the bond investors. The low cost financing from the convertibles was a function of the 3.3% coupon which was substantially lower than Pacific Basin’s average borrowing cost of 6% and this translates into an annual saving of 2.7% or USD 52.7 million over the five-year life of the bonds.

In addition to the cost savings, the unsecured convertibles have no financial covenants and therefore provided the issuer the full flexibility for future financing. There are also no restrictions on the use of proceeds, broadly defined for general corporate purposes, capital expenditure and working capital. Furthermore, the issue attracted a different investor base than the company’s traditional pool of investors, preserving funding capacity from existing shareholders and investors for the future.

The bonds are convertible into ordinary shares at an initial conversion price of HK$19.38 which represents a premium of 27% over the closing price the subscription was signed. Assuming full conversion at the initial conversion price, the bonds will be convertible into 157,511,047 shares representing 9.90% of the issued share capital as of the date of the announcement and 9.00% of the issued share capital incorporating the new issuance.

In order to prevent premature dilution by irrational investors, a contingent conversion feature was structured in such a way that the conversion rights may only be exercised if the daily closing price of its share exceeds 20% of the conversion price for five consecutive days during the period nine months after the closing date and ending on 3 November 2010. This restricted conversion feature effectively ensured that any potential conversion would not prematurely dilute the existing company shareholders. Convertible bondholders will receive only a fixed, limited income until conversion and therefore existing shareholders should gain from an increasing operating income if the company does well. An issuer call after February 2011 subject to a 130% trigger was also structured into the transaction.

This deal clearly demonstrated the astuteness of both the company and its banker in seizing the last few windows of opportunity before recessionary fears took hold in earnest. The transaction was executed when shares of Pacific Basin was at 81% of its all time high and the offering was eventually priced at the top end of the marketing range, well above the stock’s all time high. This translated into an effective 2008 P/E of 10.8x, which as Figure 2 shows compares very favorably against its competitors. With the orderbook being oversubscribed multiple times, the issue generated very high demand from investors who saw this as an opportunity to participate in the volatile dry bulk shipping sector with a protected downside.

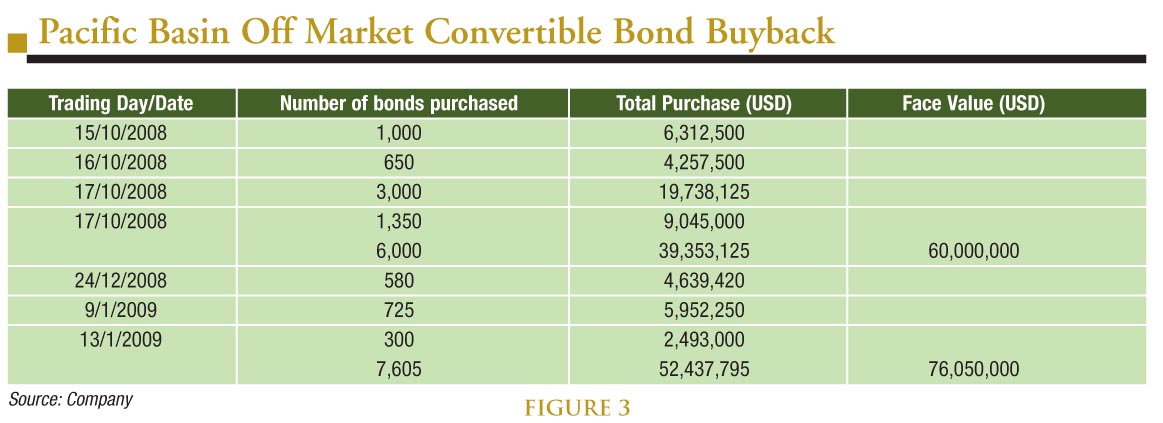

Lately, the global market turmoil has created opportunities for Pacific Basin to retire the convertible bonds early at a very attractive price. Over a 4 day execution period between 14 October and 17 October 2008, the company was able to buy back convertible bonds worth USD 60 million at face value for USD 39.35 million or an average price of only 65.6%. This off-market buyback exercise immediately created USD 22 million of net present value for the company. At the time of publication, we noticed that Pacific Basin has bought back and cancelled USD 76.05 million convertible bonds at around 20-35% discount and we expects the management to continue to do so given its current strong balance sheet. All these transactions will save the company around USD 23.6 million at the time of redemption on the amount repurchased.

Analysts at DnB NOR have recently pointed out that Pacific Basin remains one of the best positioned companies from a balance sheet, financing and cash flow perspective and the company has no additional financing needs between 2009 and 2011. We say this is one shipping company with a strong corporate vision and shrewd capital management.

Citi & Deutsche Bank Excel – Mergers & Acquisition Award

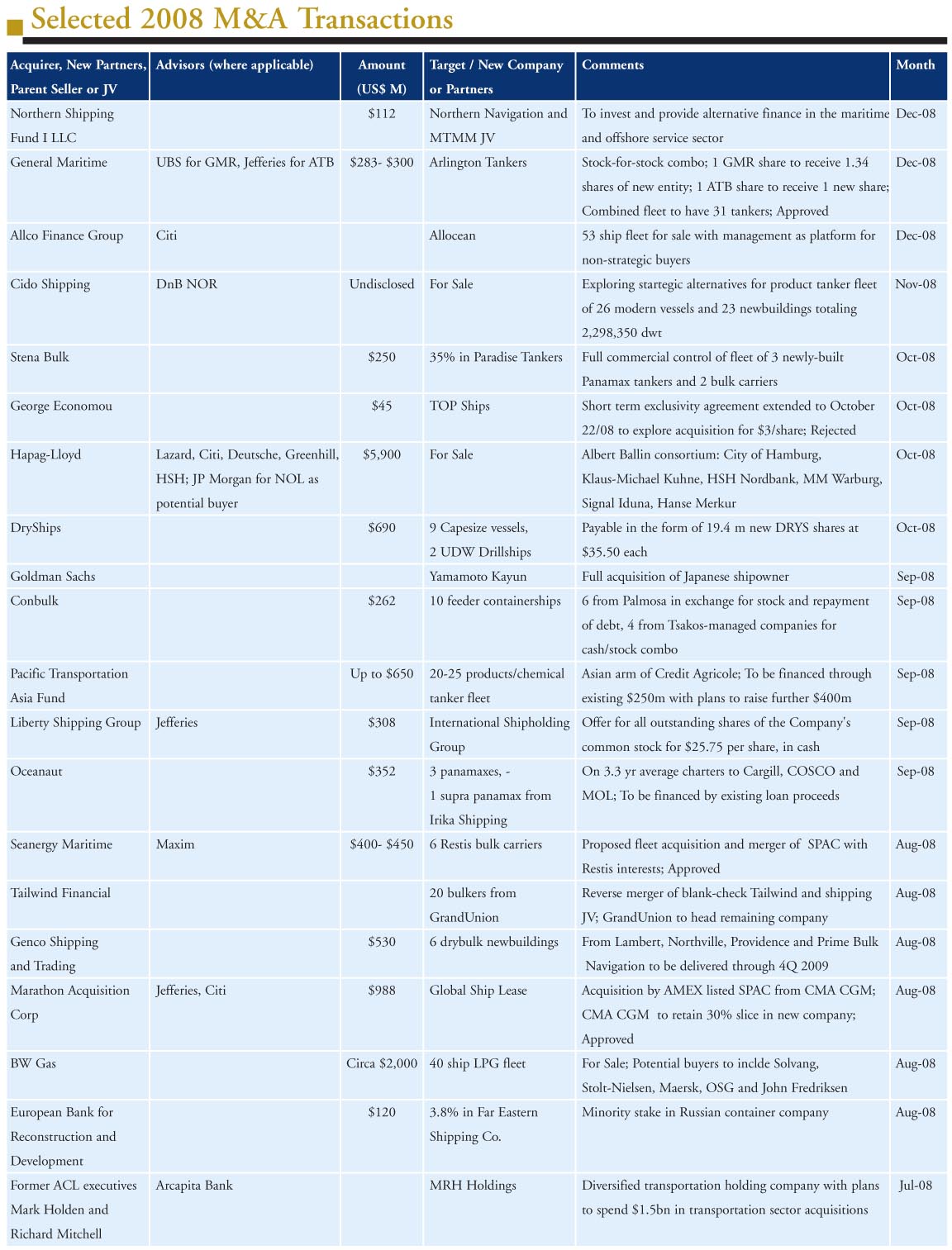

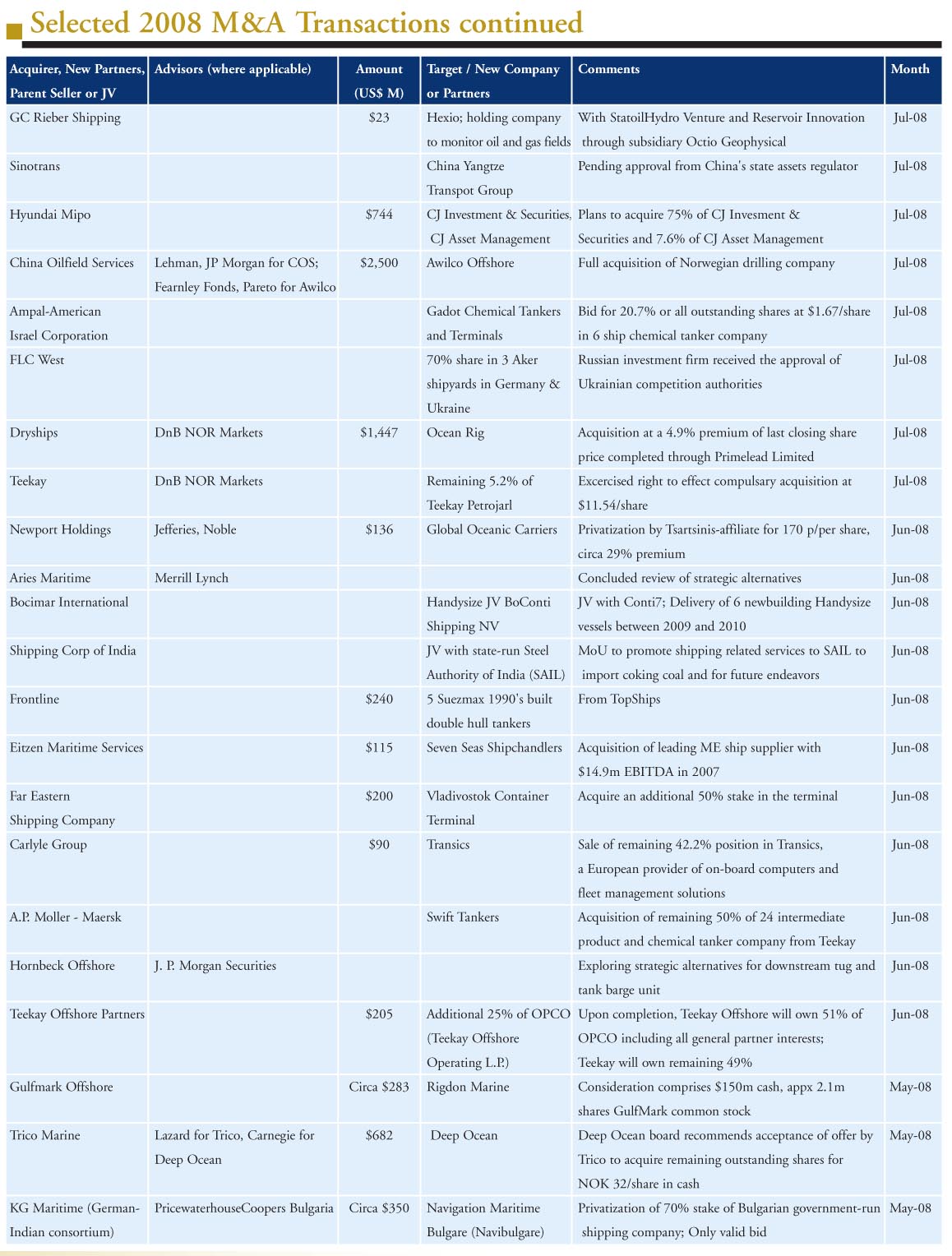

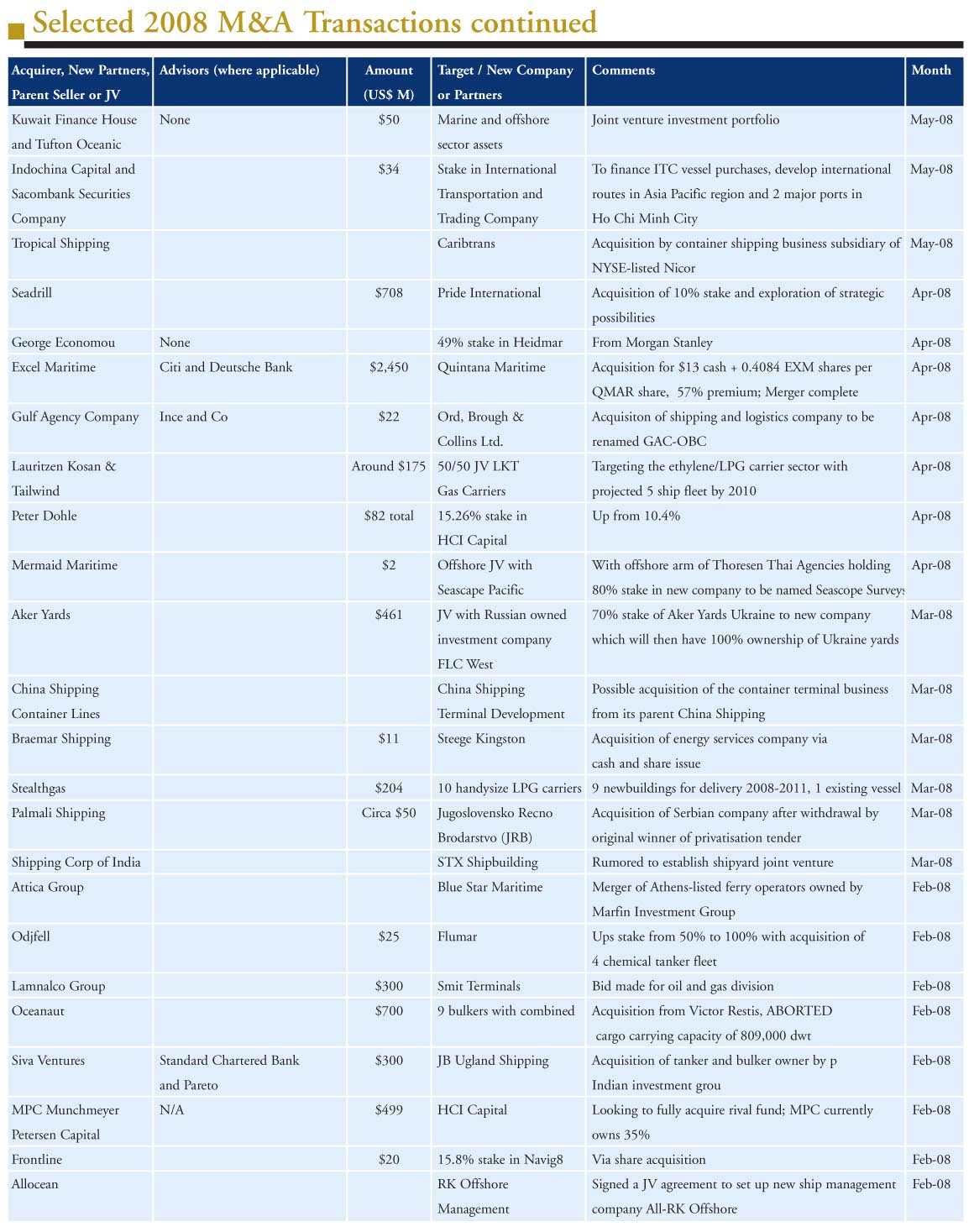

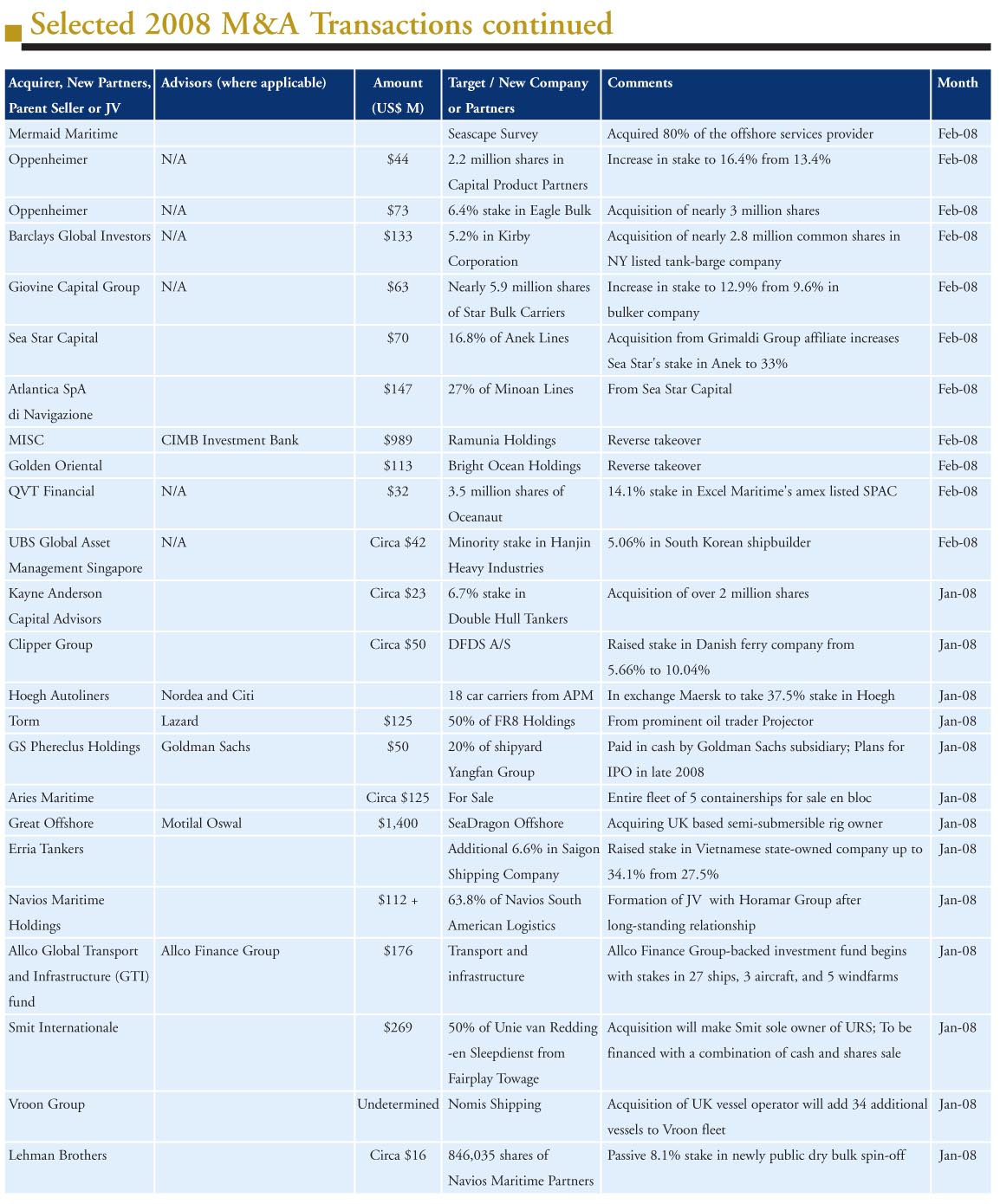

2008 saw a decrease in Merger and Acquisition activity. Prices were high for the first part of the year and then credit collapsed so deals were complex requiring broad participations and superior execution. Just by Marine Money’s own count deal volume was down by nearly half. We think 2009 will be more active and it is with an eye on the future as much as the past that we celebrate the expertise of all who successfully completed an M&A deal in 2008. It was not an easy market.

The universe of deals spanned the globe and our winner exhibited some of the best characteristics of the capital markets and for that alone we acknowledge it. But with the benefit of hindsight, now including 4 months of tough economic times, we think the deal not only reflected good investment banking and advisory services, but the trend setting hallmarks of a transaction among public shipping companies, which the industry needs more of to regain a level of prosperity.

It is out of a universe of interesting deals in a tumultuous year that we salute the Excel Maritime acquisition of Quintana and the excellent work of both Deutsche bank on behalf of Excel and Citi for their advisory of Quintana.

The use of shares, the pure dollar size, the dynamic management personalities, the resulting company and the turbulent history of the transaction are all reasons we selected this deal as our Merger and Acquisition transaction for 2008.

Before we discuss our winners in some detail, as can be seen in the accompanying Deal tables, the selection process was not simple. There are two additional transactions worthy of respectful mention.

Global Ship Lease and Marathon

This fascinating deal deserves special mention before moving on. Innovative, an example of solid execution in an increasingly turbulent environment, important to all participants and just plain big this deal could as easily have won. Jefferies, which advised Marathon, the Special Acquisition (SPAC blank check) company, and Citi, which advised Global Ship Lease did some heavy lifting to bring the deal to a successful vote by the Marathon shareholders.

By acquiring Global Ship Lease the CMA-CGM sponsored containership owning and chartering company, Marathon concluded the largest shipping SPAC and fourth largest SPAC ever, at US$1 .1 billion.

The new venture marries some pretty terrific building blocks. CMA-CGM which retains a 26% interest in the deal is the third largest shipping company in the world, with massive revenues, fleet and teu capacity. GSL has a tried and true management, stable earnings picture, and now access to public equity to fund future growth. For Marathon, an experienced financial manager, which retains a 17% ownership the deal concludes what it had set out to do when it raised its SPAC.

Interestingly it was Citi which had been the sole bookrunner for the Marathon IPO in August 2006.

Genmar Acquisition of Arlington Tankers

Another transaction of note for its successful navigating within the capital markets is the General Maritime acquisition of Arlington Tankers. Both companies have been quality new entrants to the public shipping community and their elegant merger is a still rare Wall Street shipping success story. With strong management at General Maritime and an outstanding pedigree at Arlington through its Stena blood lines, the two are transparent beacons on a sometimes foggy equity ocean.

The transaction concluded for General Maritime shares during difficult share performance times created one of the largest dividend paying shipping companies with a modern, diverse fleet of 31 crude and product tankers. The merger resolved a challenging future for Arlington which despite its charter coverage faced dividend pressure due to expected refinancing of its non-amortizing credit facility with an amortizing facility in early 2011.

Jefferies ran an extensive process exploring numerous alternatives for Arlington before the General Maritime transaction was selected. At the same time UBS advised General Maritime.

For Genmar shareholders the deal provides additional cash flow certainty due to Arlington’s long term charters and as Peter Georgiopoulos noted at the closing “allows us to pursue future growth opportunities and increase shareholder value for the long term.”

We congratulate Citi, which had a great year on the sellside for the two biggest deals, Jefferies and UBS for their good ideas and excellent execution on both these marvelous deals.

Our Winner – Excel Quintana

This was a transformational transaction for Excel. Not only did it create one of the world’s largest bulk owners and operators by DWT, it married two different operating philosophies, providing for an interesting give and take.

A key element of this deal for us was the employment profile that resulted from the combination of a more spot focused company with one that emphasized fixed employment.

From Quintana’s perspective, their goal of unlocking shareholder value was accomplished. In light of a diminished valuation due to the long-term charter contracts, Quintana received a very reasonable.

Executives at both Citi and Deutsche independently praise the structure, valuation, execution and position of the resulting company. Citi was engaged by Quintana to be its financial advisor to lead the company’s strategic alternative process. Citi considered various alternatives and reached out to a broad buyer universe in order to maximize shareholder value. In the end Citi was able to earn a valuation in excess of NAV in a difficult market.

Deutsche was the sole financial advisor to Excel Maritime. Not only did they achieve a splendid balance of Excel shares and cash for the acquisition they also, along with Nordea, led a syndicate of banks that provided the US$1.4 billion in debt. The deal creates the world’s largest US listed dry bulk owner and operator by DWT.

In terms of the combined fleet, the new company operates 47 vessels on the water (3.7 million DWT) and 8 newbuild capsizes (1.4 million DWT) to be delivered between 2008 and 2010. The company now has the capability of offering the full spectrum of dry bulk vessels to its first class customers which include, cargo interests, such as EDF, BHPBilliton, Bunge, Cargill and operators such as COSCO, Oldendorff, and Daeyang. The average age of the fleet is 8.1 years with the capesize and kamsarmax being younger and the panamax and handymax the eldest. The newbuilding capesizes are interesting in that they are ordered from Japanese and Korean yards and the risk is spread, on all but one, through joint ownership with AMCIC, a company controlled by Quintana’s principals.

To finance the transaction, Excel received a $1.4 billion commitment for new secured loans from a syndicate of banks led by Deutsche and Nordea Bank Finland PLC, London Branch. Based upon the size of the transaction and the fact that it was underwritten was according to Mr. Molaris a strong vote of confidence in the industry and the transaction given these turbulent times. Nordea acted as agent for the transaction and together with Deutsche Bank served as joint bookrunners. Members of the bank financing consortium include: Credit Suisse, DVB, Deutsche Bank, GE Capital, National Bank of Greece and Nordea. The balance of the funding came from $350 million in available cash and $225 million in debt rolling with the transaction.

On a pro forma basis, the company at the time the deal was done had $1.625 billion in debt with approximately $100 million in available cash. Based upon fleet appraisals, excluding newbuildings, the debt represents 45% of the combined fleet market value at the closing.

On the legal front, Quintana was represented by Morgan Lewis & Bockius while Excel’s legal team included White & Case and Gr. J. Timagenis.

The Turbulent History of a Billion Dollar Deal Courting Quintana

The process really began on August 3, 2007, when Quintana’s board of directors received an unsolicited, preliminary proposal for a stock-for-stock acquisition at $22.50 per share. This came as the company’s directors had over the course of the year been reviewing Quintana’s strategy and long-term valuation in light of its stock’s price level. The board informally consulted Citi and soon decided that the consideration, business strategy differences and governance issues involved were grounds to turn down the proposal.

When Quintana was again approached, this time by Excel through a phone call to CEO Stamatis Molaris, the board realized it was perhaps time to be more active in exploring strategic alternatives. They engaged Morgan, Lewis & Bockius as legal advisor and Citi and Dahlman Rose as financial advisors. Peter Costalas, Gurpal Sing Grewal and James Nelson were appointed to the Transaction Committee and Corbin Robertson, Jr. was designated liaison between the transaction committee and the board. Citi and Dahlman reached out to 61 potential bidders, 20 of which executed a confidentiality and standstill agreement, including Excel.

Harkening back to Stelmar’s sale process, CEO Stamatis Molaris and chief commercial and operations officer Nikos Frantzeskakis recused themselves as necessary from the process so that management considerations were separated from the goal of maximizing shareholder value. Conflicts also arose for Dahlman Rose, who continued working with Quintana on the sale process until just past Christmas, at which point the firm informed Quintana’s board that it was representing a party selling a fleet of vessels, the purchase of which it viewed as a potential strategic alternative for Quintana. Quintana ultimately considered and passed up the fleet acquisition opportunity, but Dahlman Rose withdrew from the company’s sale process.

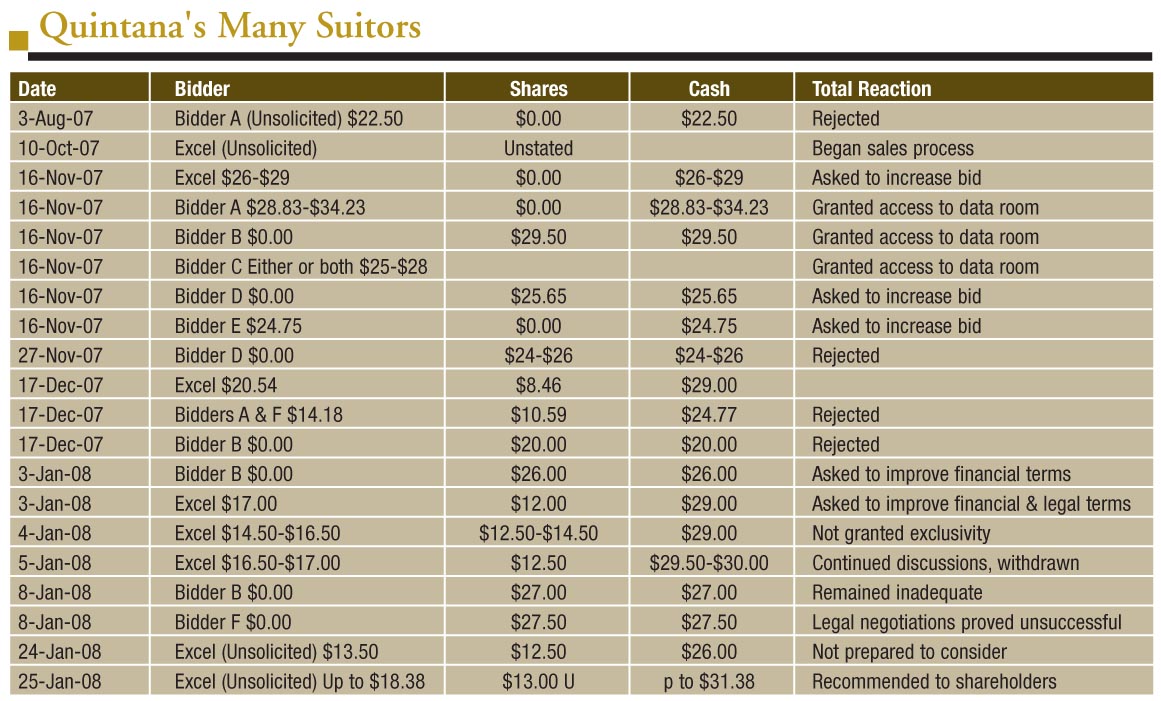

On November 16, 2007, Quintana received bids from six potential acquirors, details of which are shown in the table Quintana’s Many Suitors. The company entered into more in-depth discussions with four of these bidders. Quintana ultimately distributed a draft merger agreement to the bidders and requested that they present improved proposals by December 17, including the best possible price, to maximize the cash portion of the offer, and to remove all conditions from the proposal and minimize comments.

Uncertainty persisted throughout the process. Excel’s proposal presented significant issues on value, certainty of closing, financing and limited recourse. The other proposal being considered at the time raised similar material issues. Excel’s case was however strengthened by the presentation of a commitment letter from a consortium of banks led by Deutsche and Nordea.

In early January 2008 the board agreed to allow Excel to discuss with Mr. Molaris a possible post-transaction employment arrangement. In the meantime another bidder made an attractive $27 cash per share offer. However the bidder also required exclusivity and held that its offer was subject to the receipt of financing commitments that it did not expect for several weeks. Another bidder came back into the game with a $27.50 per share cash bid that included a commitment letter for a bridge loan though did not include comments to the merger agreement. However both cash bids were found to have significant, material deficiencies and the board did not believe the circumstances warranted the granting of exclusivity.

Excel emerged as the frontrunner, but Quintana’s board continued to work with Citi throughout January to develop other possible alternatives if the sale process was unsuccessful, so it was by no means a sure thing. Meanwhile Excel did not reconfirm its offer after its expiration date but engaged Deutsche Bank to advise on the potential acquisition. Things however were not looking good, and on January 22 Quintana’s board announced that it would terminate the sales process.

It was not until Excel came back twice with unsolicited proposals after the official sales process had ended that a deal really began to look likely. By this time the volatility in the global equity and financing markets and the somewhat dramatic decline of dry bulk stock prices had begun to change the playing field. Moreoever, Quintana’s board was cognizant of the dramatic dip its own share price took when the end of the sales process was announced.

Five days after the second offer was made, negotiations were completed and Quintana’s board unanimously declared Excel’s offer to be in the best interest of Quintana’s shareholders and resolved to recommend that Quintana’s shareholders authorize and approve the merger agreement.

A simplified version of pricing and terms of each offer is shown in the table that accompanies this article. The actual agreement included a number of more complicated contingencies to account for the possible trading range of Excel’s shares that were being used as currency. Specifically, under the agreement Quintana’s shareholders would receive up to $31.38 per share of Quintana common stock less the amount of dividends paid by Quintana on or after December 31, 2007, $13.00 of which would be in cash with the remainder in Excel Class A common shares. If the average price of Excel Class A common shares for the fifteen trading days immediately preceding the closing of the proposed merger was equal to or less than $45.00, then Quintana’s shareholders would receive a fixed exchange ratio of 0.4084 Excel Class A common shares per share of Quintana common stock with no downside protection on the value of Excel Class A common shares that Quintana’s shareholders would receive. Under the first option, if such average price of Excel Class A common shares was greater than $45.00, then each share of Quintana common stock would be exchanged for that number of Excel Class A common shares necessary to give (based on such average price and including the cash portion of the proposal) a total value of up to $31.38.

Valuation

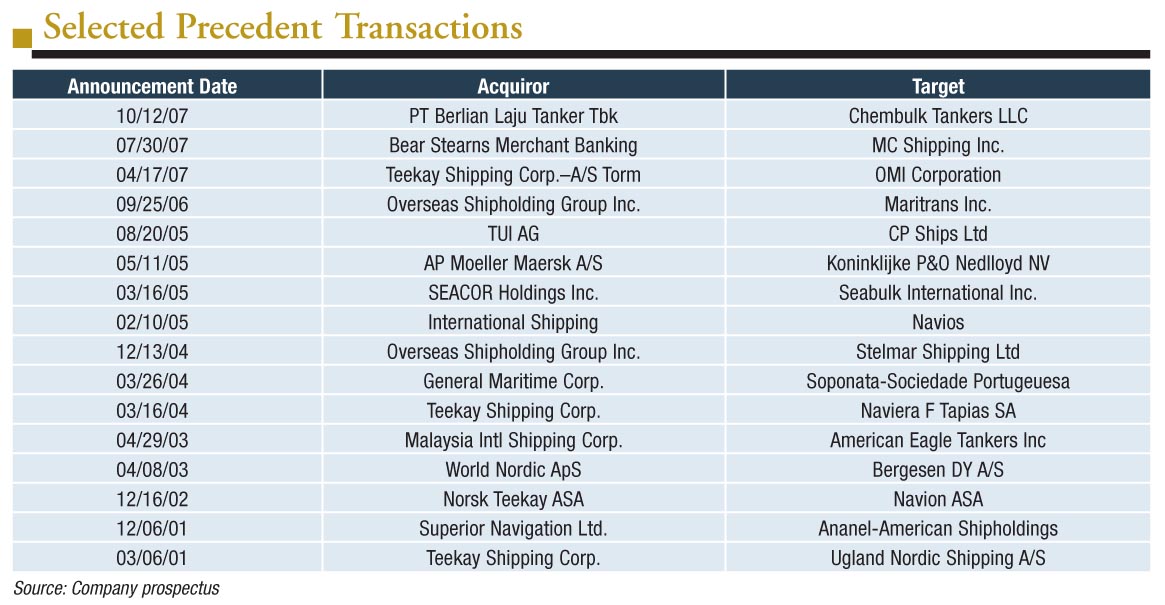

Throughout the process Quintana’s board remained confident in the value of their company and were unwilling to consider bids they believed undervalued its assets and business. A fairness opinion provided by Citi no doubt helped guide their belief in their company’s value. Citi performed analyses based on net asset value and discounted cash flow and also considered precedent transactions in order to arrive at a range of values for Quintana.

To perform the NAV analysis Citi used Clarksons fair market value estimates and arrived at a value of $24.18-$24.50 per share. As shown in the table, the steel NAV numbers were adjusted to reflect the anticipated cash flows over the life of vessels on existing charters, while for leased vessels, discount rates of 8.7% to 10.7% were applied to derive a range of present values of anticipated excess cash flows. Coupled with a $43.43 NAV valuation for Excel and accounting for the $13 cash payment, this implied a reference range of exchange ratios of 0.257x to 0.265x.

Citi performed two DCF analyses, one utilizing an average of forward charter rate estimates published by SSY and GFI, and the other using forward charter rate estimates provided by Quintana and Excel management for their respective fleets. Citi assumed 25- year lives for Quintana’s vessel and 28-year lives for Excel’s vessels, based on respective management estimates. The SSY/GFI estimates implied a per share reference range for the equity value of Quintana’s common stock of $18.49 to $23.13 and for Excel’s Class A common shares of $33.01 to $35.50. Company estimates implied a somewhat higher reference range for equity values, of $22.07 to $26.92 for Quintana and $37.80 to $40.55 for Excel. Again accounting for the $13 cash payment, these implied exchange ratios of 0.155x to 0.307x for the SSY/GFI estimates and 0.224x to 0.268x for the management estimates.

Conclusion

When all is said and done, Quintana’s shareholders may feel confident that the company’s directors put in their best efforts to maximize value. With the active assistance of Citi they explored many options and considered many offers. Their confidence in the company allowed them to hold out for the most enticing possible bid as well as a good strategic fit with their acquiror. Meanwhile, Excel ably assisted by Deutsche, will take a major step towards its goal of being one of the world’s premier full service dry bulk shipping companies, creating a fleet of 47 vessels with a carrying capacity of 3.7 million DWT and an average age of just eight years. The acquisition will also broaden Excel’s client base to include first class names such as Bunge, Cargill and Oldendorff, and synergies including improved purchasing and placing power, enhanced fleet utilization, and lower G&A expenses are expected to yield annual savings between $15 and $20 million.

Our heartiest congratulations to Citi, Deutsche, Excel and Quintana.

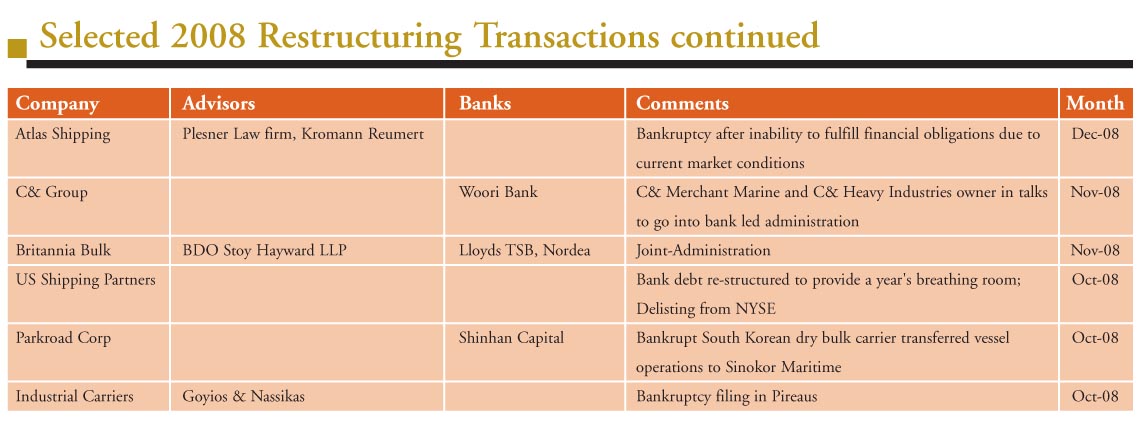

“Who Ya Gonna Call…” – The Re-structuring Award

Re-structuring for us signifies something more than just the mere modification of contract terms. It is something far more reaching. Last year, for instance, the award went to Chiquita Brands and a joint venture of Eastwind and NYKLauritzen for the acquisition of the Great White Fleet together with the assumption of all of Chiquita’s transportation requirements. In this win-win transaction, Chiquita out-sourced its transportation requirement to a more efficient low cost provider, booked a gain and used the proceeds to pay down debt, freed up capital and management time and generated cost savings. Eastwind and NYKLauritzen also benefited. Most importantly, as the strategic supplier to a major fruit company, they gain a long-term profitable relationship that will provide further growth opportunities. Their reefer business is now more diversified by the inclusion of the banana trade and this joining of forces may lead to further industry consolidation. This is a business-changing event and so too is this year’s winning transaction.

The same people who brought us last year’s winner have done it again. It appears that Fortis Merchant Banking (“Fortis”) is the go to bank in this particular category. This year’s transaction involves the approximately USD 500 million management buyout and recapitalization of Harvey Gulf International Marine, LLC (“Harvey”), a 3rd generation family owned and operated provider of Jones Act ocean-going towing vessels (“OTV”) and offshore supply vessels (“OSV”) services in the Gulf of Mexico (“GOM”). The company specializes in towing drilling rigs and providing Offshore Supply and Multi-Purpose Dive Support vessels for deepwater operations in the GOM. Oil majors, drilling contractors, and E&P companies are represented in Harvey’s longstanding customer base.

Harvey, based in New Orleans, Louisiana, operates a current fleet of fifteen vessels, with a primary focus on supplying services to the deepwater and ultra-deepwater oil industry in water depths ranging from 1,000 to 12,000 feet. The Company operates through two divisions: The OTV Segment and the OSV Segment, with the OSV Segment including a Multi Purpose Supply Vessel (“MPSV”). Through its commitment to safety and quality, Harvey has become the clear leader in the GOM OTV market, capturing a majority of deepwater market share. In considering this transaction, Fortis recognized an increasing global trend, and took a market view that the deepwater and ultra-deepwater market represents the future of GOM rig activity and the focus of oil exploration.

In contemplating the transaction, Harvey’s executive management determined that accelerated growth was achievable through a simplification of the ownership structure, and the commitment of a strong private equity investor. The situation was perfectly suited for The Jordan Company (“TJC”), which has, since it’s founding in 1982, become a leading middle-market private equity firm with over $5 billion of assets under management and a successful track record of investing in and growing businesses across a wide range of industries, particularly with family owned companies.

After being awarded the mandate by TJC and Harvey’s Chairman and CEO, Shane J. Guidry, Fortis decided to utilize a fully underwritten USD 260 million multi-tranche, senior debt and mezzanine loan structure. The bespoke facility achieved the arranger’s objectives of securing capital from multiple institutions with differing risk tolerances and asset preferences, while achieving the lowest-cost financing possible for the client.

Despite already tight and deteriorating conditions in the bank market, Fortis determined that a traditional bank syndicate was the best solution. Furthermore, Fortis’ comfort in holding the mezzanine tranche sent a strong signal to the syndicate about the underwriter’s commitment to the transaction (as opposed to an “originate & distribute” model) and allowed for conservative credit metrics to be achieved.

The innovative structure facilitated the transaction’s successful execution. Fortis’ New York based syndication team sought bids from a select group of industry players and ultimately secured commitments from 9 participants. Despite highly challenging market conditions, the transaction closed in August 2008.

The message is quite simple. If you have a requirement for creative structuring as well as a flexible approach to financing non-conventional transactions, “who ya gonna call?” Our suggestion is that give the Fortis team a shout.

Seaspan Preferred Opens a New Chapter in Ship Finance

And then last week, a new form of equity capital made its way into the shipping industry – preferred stock.

Just after the deadline for Freshly Minted closed last week, Seaspan Corporation announced that it had reached an agreement to issue and sell Series A Preferred Stock to the company’s original founders and sponsors: Dennis R. Washington, Kevin L. Washington, Kyle R. Washington and Graham Porter. According to the release, Dennis Washington, perhaps using proceeds generated through the sale of his construction company last year, is investing $160 million with his sons and Graham investing the other $40 million.

Our conclusions up front: this is an elegant deal and clearly demonstrates the value of having a sponsor with substantial resources that is committed to the success of the company. Although this deal was not done on an arm’s length basis, in this case we think the result is better than the company could have achieved working with an opportunistic financial investor.

Continue Reading

An Increasing Cost of Capital

The question, of course, is how does a shipping company raise money when it needs more money than its market capitalization? The answer is: any way they can think of. But unlike the bank market, the equity market, especially in America, is never closed – so long as the terms are right and in today’s market – that means more expensive than the business models of shipping companies had ever imagined.

In recent weeks, we have seen companies use some different strategies to generate liquidity and reduce capex. With equity embedded in its vessels, OSG used outright sales and sale/leasebacks to generate proceeds of about $200 million in 4Q08 – and the company said it plans to do the same in the first quarter of 2009.

DryShips, which doesn’t have the luxury of extracting embedded net asset value, chose to go a different route. After paying related parties hundreds of millions of dollars to cancel contracts, the company has been informed by 2 of its lead lenders that it is in breach of covenants. In what is likely a deal agreed between the company and its banks, Dryships hired Merrill Lynch to sell up to $500 million of additional common stock, significantly more than its current market capitalization of $400 million.