A Satisfactory Marriage

After initially taking a hard line position in negotiations, Fortescue Metals Group and Bocimar announced that they had reached an agreement to settle the dispute that arose when Fortescue cancelled two contracts for the use of two vessels, one for ten years and the other for five years, that were concluded in February 2008. Under the terms of the new agreement, the companies have agreed to establish a shipping joint venture, which will charter three of Bocimar’s Capesize vessels of which two will deliver promptly. The third vessel will delivered in 2010.

The time charters were concluded at market rates for a period of 10 years and include a profit sharing arrangement. In consideration, Bocimar will receive $28 million in Fortescue shares on December 31, 2009 based upon a weighted average market price.

Continue Reading

Seaspan Redux

Last week we published an article on Seaspan’s $200 million preferred issue and were asked to clarify some of the points made in it.

Most importantly, the transaction was internally generated and there was no real or implied pressure from Seaspan’s bankers to do this transaction. The company felt it was prudent in today’s environment to bring on more equity and not hope for better markets to raise public equity as long as it was well priced and favorable to its shareholders. Moreover, the trade off for the dilution five years out made sense.

Proving that they did not need the money today, the deal was done in two tranches and achieved better than market terms.

Continue Reading

Northern Shipping Funds Takes Top Honors for Private Equity

In the spirit of complete and open transparency, which we hope will be a hallmark characteristic of the finance world during the Obama years, we admit up front that our winner for the Award for excellence in Private equity is our next door neighbor in Stamford Connecticut. They win despite the enormous losses of productivity at Marine Money caused by the daily visits of their senior staff to our offices, stopping by in a perpetual search for M&Ms. It is a disturbing addiction to chocolate, facilitated by our own office’s hypoglycemic need for the sweets, which sees our kitchen counter piled high with chocolates instead of bananas and oranges – a sustenance not only better for us but good for the reefer trade as well.

We forgive them those interruptions, because we get to see first hand the disciplined process needed to raise and manage a successful private equity fund in a tumultuous shipping market. It takes no special skill in the midst of financial chaos and market corrections to say that opportunity exists. But it does take skill, discipline and tremendous energy to turn concepts into profit making reality. So we acknowledge for the year 2008 as our Private Equity Award winners – Northern Shipping Funds (Northern), whose ambitions are to become the leading private equity fund focused on investing in the shipping and offshore oil service sectors, for exemplifying those skills.

Summer 2008 was not an easy time to raise funds. The summer rarely is and this past summer with storm clouds gathering was particularly challenging. Unless of course you had a good idea, a talented management, and a superlative track record.

A Bit of History

Northern Navigation and MTMM are the sponsors of Northern Shipping Funds, which closed on September 24, 2008. Each of the sponsors has at least 25 years of shipping and offshore oil service experience. More than that, the Sponsors were previously partners in the successful NFC Shipping Funds, a concept originated by Oivind Lorentzen III Chairman of Northern Navigation, which in a joint venture with DVB Bank managed the NFC Funds. MTMM, controlled by Doug MacShane and Christina Tan, best known for their chemical tanker experience, was originally a client of NFC, but later became an investor in a number of the NFC Shipping Funds.

NFC was formed in 1999 and successfully raised and invested 8 funds. These funds invested a total of US$ 500 million in equity and built a diversified asset portfolio totaling US$3 billion in assets from inception through April 2008. Since its inception NFC concluded 150 separate transactions consisting of 91 acquisitions and 45 exits. Collectively these transactions involved 207 vessels. NFC’s run rate was approximately 20 new transactions a year.

Nothing in shipping though is possible without the support of lending banks and the NFC team cultivated close and successful commercial relationships with 15 banks, with whom they closed more than 80 facilities. Besides DVB, there was Lloyd’s TSB, HVB, Bank of Ireland, Natixis, UOB, BTMU and more.

The NFC Shipping Funds continue today under the control and management of DVB, following a mutually agreeable transaction wherein Northern Navigation sold the majority of its interests to DVB. It must be considered a well-timed sale.

The fact is Northern Shipping Funds has a significant pedigree on which to base their current effort. That, and a few good people, serves the Fund and its investors and customers well.

The People

Because in the end any venture’s success is based upon the talents of its people, it is appropriate to spend a moment acknowledging the experienced and knowledgeable team Northern has put together. Sean Durkin is Northern President and was the initiator and first employee of the NFC funds. Sybren Hoekstra is Senior Investment Manager, but is best known for his years heading up the New York branch of DVB, where he delivered year after year of solid performance responsible for the Western Hemisphere. He will be responsible for the Americas. Mr. Durkin and Mr. Hoekstra are based in Connecticut.

Nikos Stratis is a Senior Investment Manager for the Fund and is based in London. A former officer aboard tankers and tugs, for the past seven years Mr. Stratis worked with NFC. John Hartigan joined Northern as a Senior Investment Manager after a distinguished stint at the Bank of Ireland where he was involved in the establishment of the Maritime Finance Department. Before Bank of Ireland Mr. Hartigan had been with DVB. They both will have primary responsibility for Europe and the Middle East.

Jan Erik Wahl rounds out the senior management. He fills the role of Technical Director, a position he has held for NFC since its inception. Mr. Wahl has a distinguished technical career spanning nearly 50 years. Since the inception of the NFC funds Mr. Wahl oversaw and controlled 150 vessels and newbuildings.

Administration of the Fund will be handled in Stamford Connecticut by a veteran team well disciplined in the accounting and administration of multi-million dollar funds. Together it is a strong yet lean team with a hugely successful track record.

Future Plans

Northern Shipping Fund LLC seeks to become the leading private equity fund focused on investing in the shipping and offshore oil services sectors. Northern looks to acquire assets at attractive valuations, lock in stable revenue streams and protect the downside risk through tailor made transactions with clearly defined exit strategies.

Northern Shipping Fund has an asset-based approach to investing. Therefore the products offered by Northern will be secured by assets and will include such products as:

• Sale and leaseback structures

• Mezzanine structures

• Equity investments in private companies and projects

• Purchase of secured secondary bonds and bank debt

• Distressed debt restructuring with banks

• Residual value positions

As mentioned at the outset asset prices are falling and it takes no particular genius to state that if one has cash there should be opportunities. Northern sees a playing field considerable different that just a year ago, and it is a playing field they intend to dominate. A year ago as a financier you were one of many and the borrower had the upper hand. Now borrowers need to be certain they have capital access.

The global recession, credit crunch and a worldwide acute deleveraging have taken the lending winds out of the sails of most the shipping industry’s historic sources of funding. Banks have neither the appetite or knowledge to maintain assets on their balance sheets. Shipping banks are largely closed. KGs, KS’s, the flotilla of public shipping companies and collection of investment banks are all sitting on the sidelines. That means every door is currently open to Northern.

While they make investment decisions conservatively based on historic values, and rigorous modeling, longer term the team believes that globalization and world trade will continue to grow. Not only that but as a capital intensive industry it will continue to explore and need alternative sources of capital.

The deal flow has been enormous. Management has been looking at more than 50 transactions and conservative as they are expectations are that just 10 might enter the realm of ‘could be done’.

So with a focused and dedicated team and a solid understanding of the shipping industry Northern is well positioned. They have an extensive network built up over decades of providing value. They have established a flat management system that offers no conflicts from competition for commercial or technical management. They are an independent capital provider and as such have no conflicts with banks. In fact as a private entity, whose transactions are off market and strictly private, they are the owner’s and bank’s new best friend.

Most significantly and reason enough alone for the Award, theirs is committed capital, a scarce commodity today. But, that capital without the team would never be enough. They are welcome to eat our chocolate any day, because it is good for us all to look at the faces of success.

A Tale of Two Markets – The Bank Debt Award

By George Weltman

“It was the best of times, it was the worst of times; it was the age of wisdom, it was the age of foolishness; it was the epoch of belief, it was the epoch of incredulity; it was the season of Light, it was the season of Darkness; it was the spring of hope, it was the winter of despair; we had everything before us, we had nothing before us; we were all going directly to Heaven, we were all going the other way.”

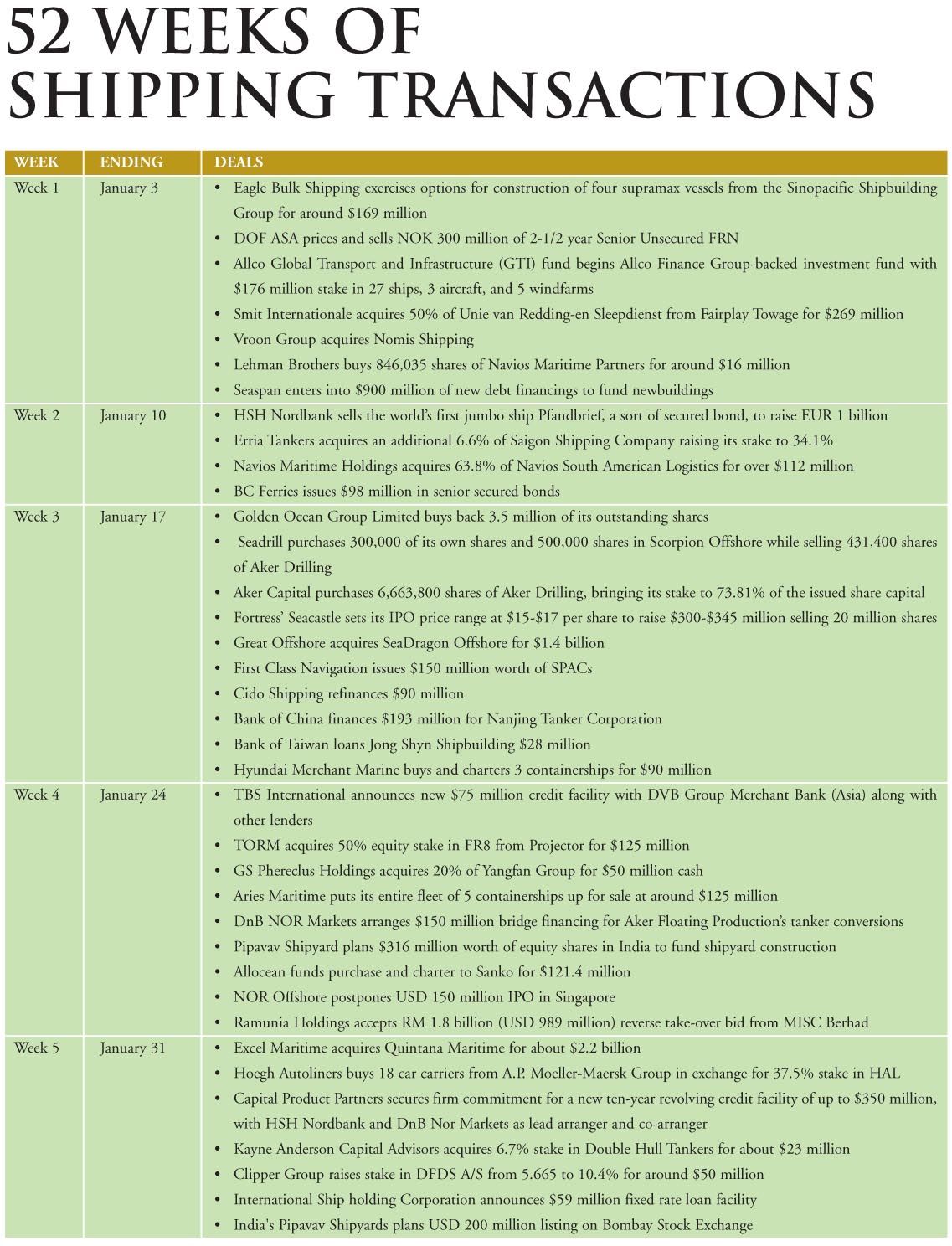

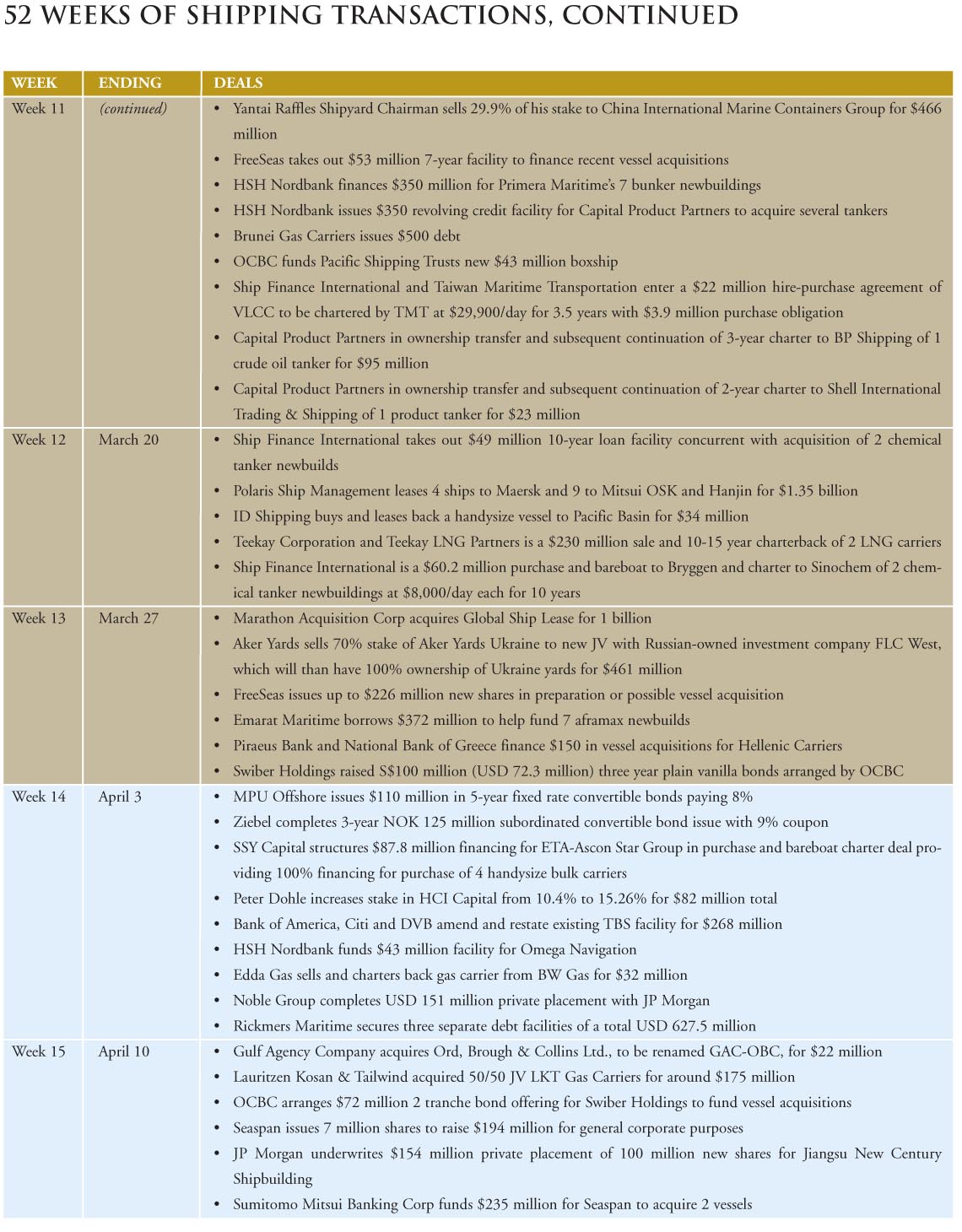

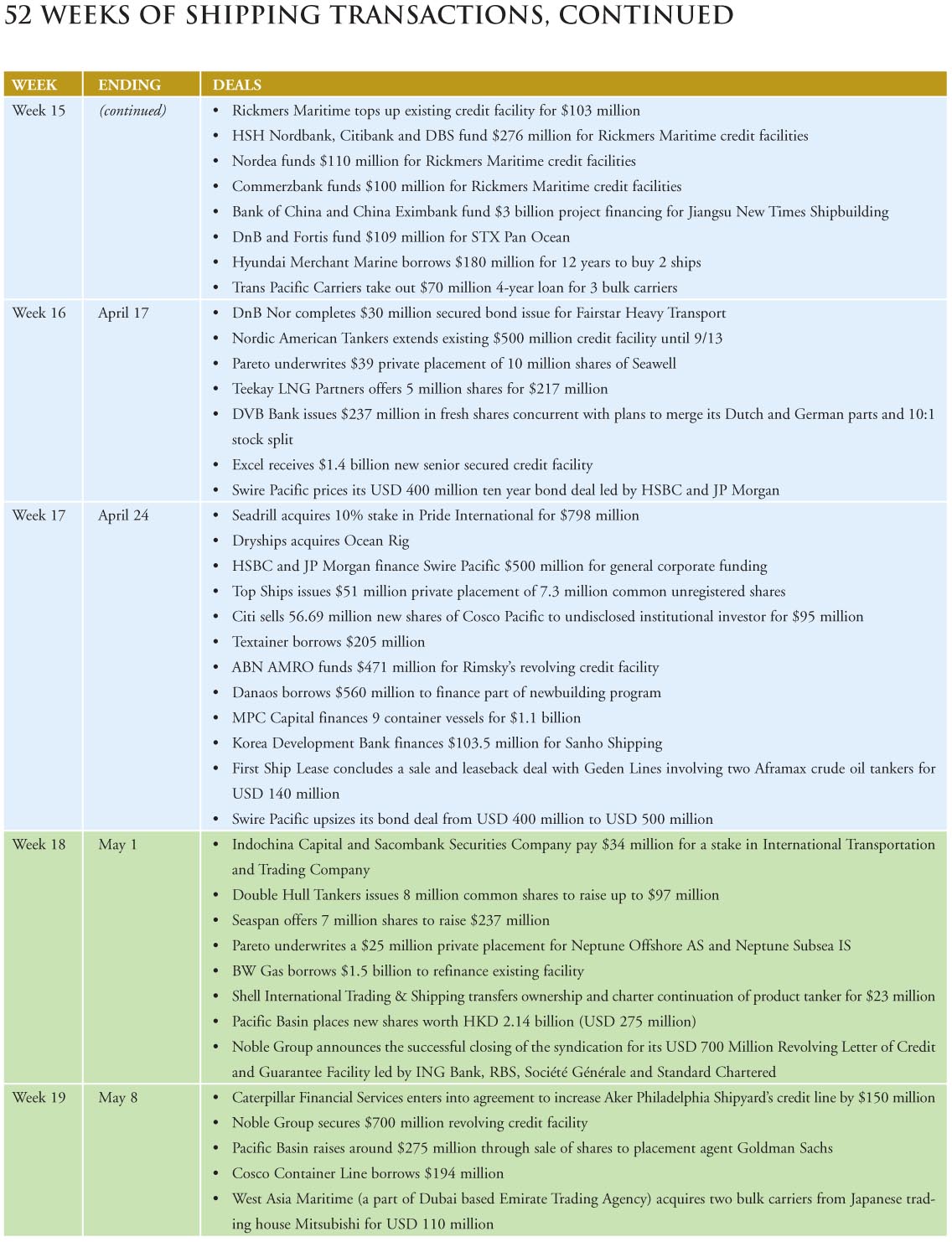

Looking back, this excerpt form Charles Dickens novel, “A Tale of Two Cities” would seem to be a reasonable description of the past year’s boom and bust in shipping. However, looking at the data supplied by Dealogic, lending activity seems to have lagged the full effects of the credit conflagration and posted reasonable numbers for the year. Overall, figure 1, which shows lending activity by semester and annually, is deceptive. Lending activity, in 2007, was generally equally spread over each quarter. In contrast, in 2008, lending was low in the first quarter and collapsed in the fourth quarter. In between, there was substantial volume. It was almost as if someone new the world was coming to an end. For the entire year (figure 2), the decline from the prior year is visible but still less than expected given what was going on in the credit markets. Certainly, 2009 will be a telling year as it is painfully obvious that shipping will catch up with the rest of the credit markets.

We can honestly say that there was no shortage of nominees, which covered a full range of sectors, debt suppliers and borrowers. There were many worthy transactions deserving of consideration, some of which received multiple nominations. Among the standouts was the Deutsche Bank and Dexia Credit $1.2 billion facility for DryShips to finance two ultra deepwater drillships. The transaction involved construction and permanent financing and involved export credits. Although size and complexity were factors, a key consideration was the fact that the drill ships had yet to receive contracts at closing. Another oft-mentioned transaction was the $1.4 billion credit facility arranged by Nordea and Deutsche Bank to fund Excel’s acquisition of Quintana. The key challenge here was achieving the valuation of the Capesize vessels, which at the time had below market charters. DnB Nor’s $221 million term loan facility to HCI Hammonia AG demonstrated that perseverance pays off. This was the first transaction in the German market fully underwritten by a non-German bank and then syndicated solely to German banks. Then there was a $285 million secured revolver arranged by Citi to assist in the recapitalization of Golar LNG. Another unusual deal was a EUR133 million bridge loan provided by BNP Paribas to Navigazione Montanari to take the company private. The interesting feature in this deal was that it was convertible into a secured term loan on unencumbered vessels in the fleet. Despite all this worthy competition, once again a single loan stood out, as it did in the case of our Asian awards.

Continue Reading

The Full Monty – The Dealmaker of the Year Award

By George Weltman

Now that we have your attention, we would note that the usage of the phrase in this instance relates to its original meaning of “the whole lot or everything” and has nothing to do with nudity. There is nothing “R” rated in these pages. All will soon become clear or should we say transparent.

For us, Angeliki Frangou and dealmaker have been synonymous. Having the vision to form the initial blank check company or SPAC in 2004, that purchased what was then the original Navios, this woman has become the energizer bunny of dealmakers. The acquisition of Navios provided Ms. Frangou with a platform for building a large operational shipping company with the assistance of a world-class management team that remained post-closing. This management team not only possessed maritime operational experience, but also understood transactional opportunities and learned to integrate businesses. To that team she added outside advisors (bankers, lawyers and investment bankers) that provided the intellectual capital and access to the actual capital necessary to fund the rapid growth of this company.

Given the plethora of deals completed, you might ask what took us so long. The answer quite simply is that with Navios’ last deal, a SPAC, we have come full circle. And there is beauty in symmetry.

Continue Reading

Introducing the Winners

By George Weltman & Jim Lawrence

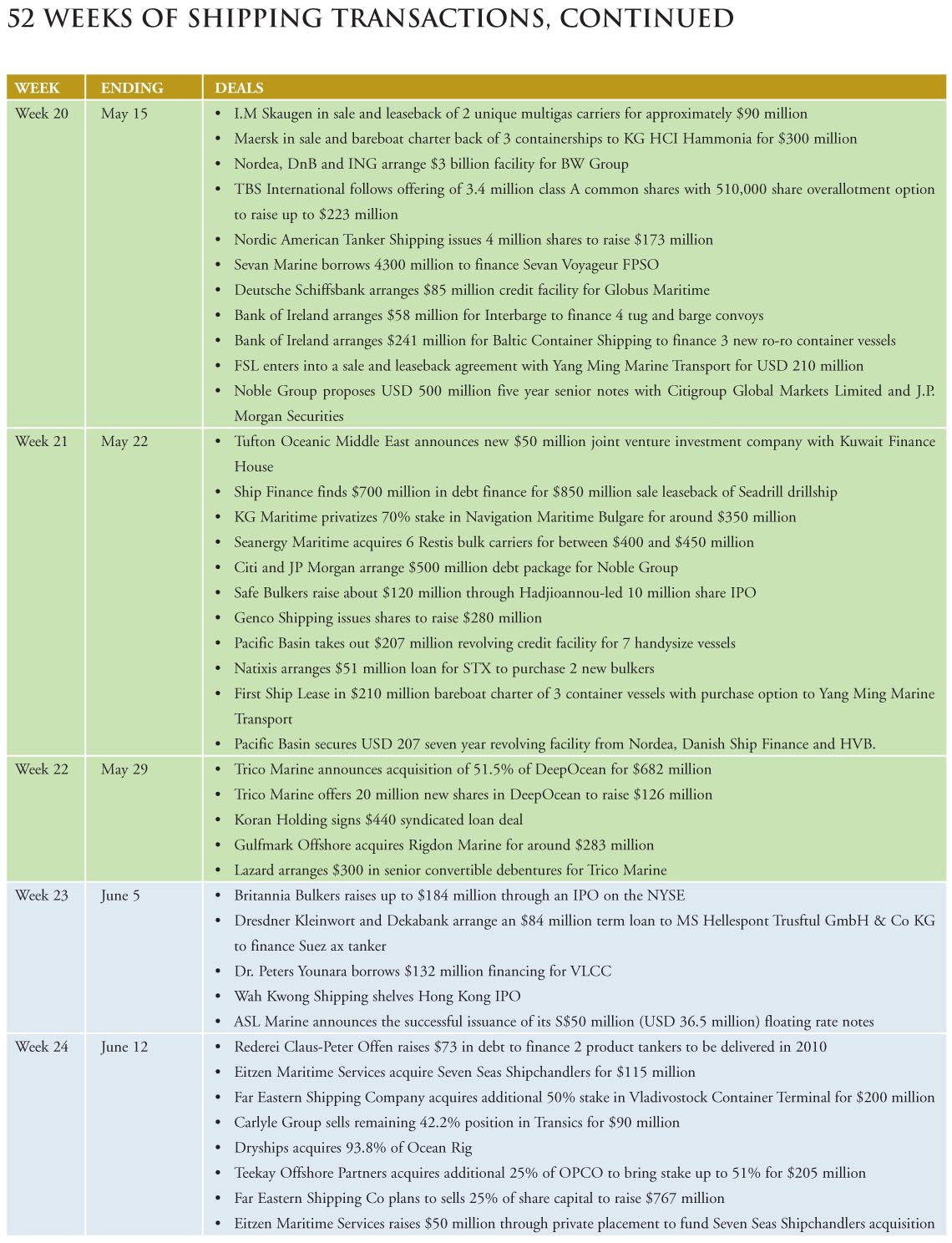

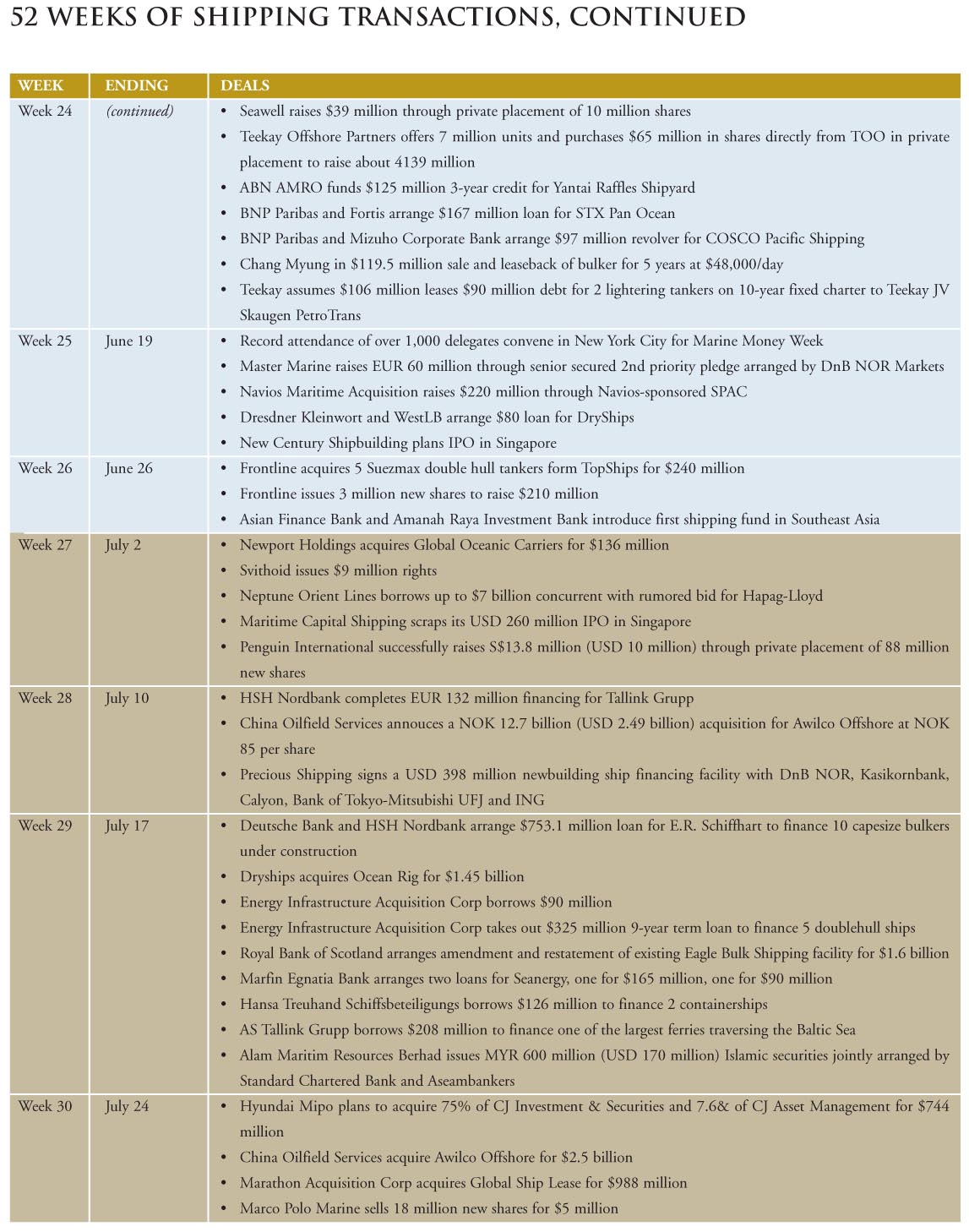

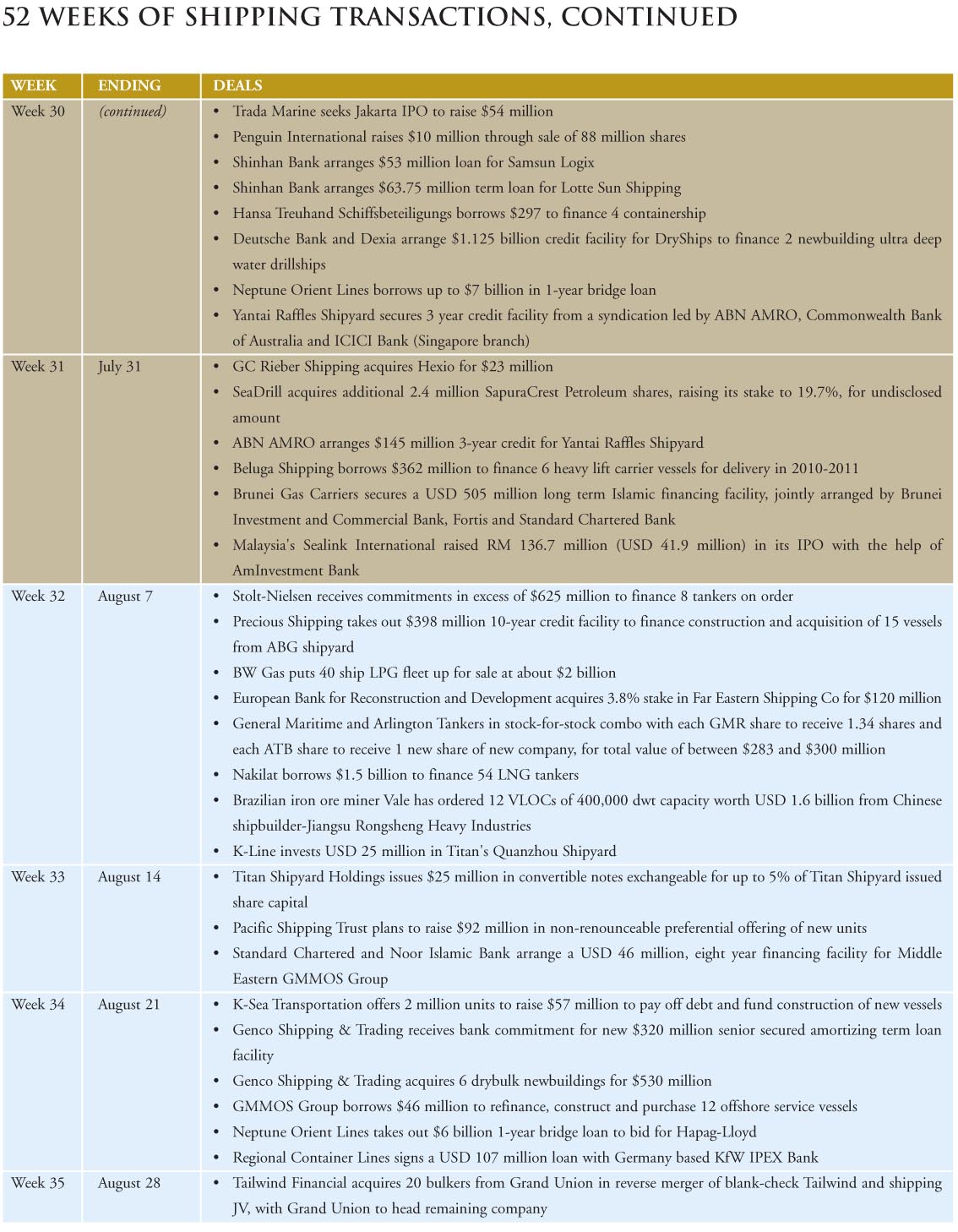

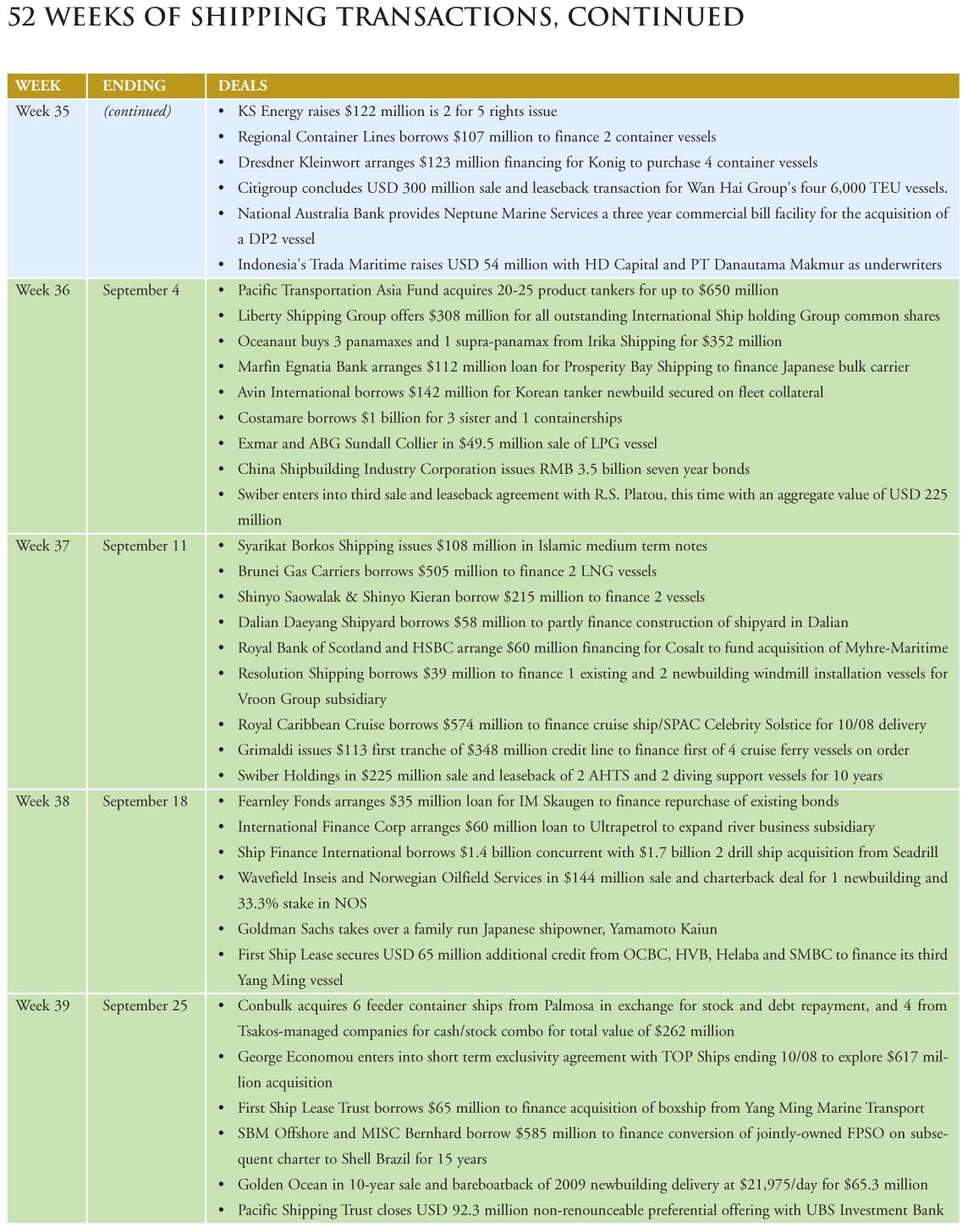

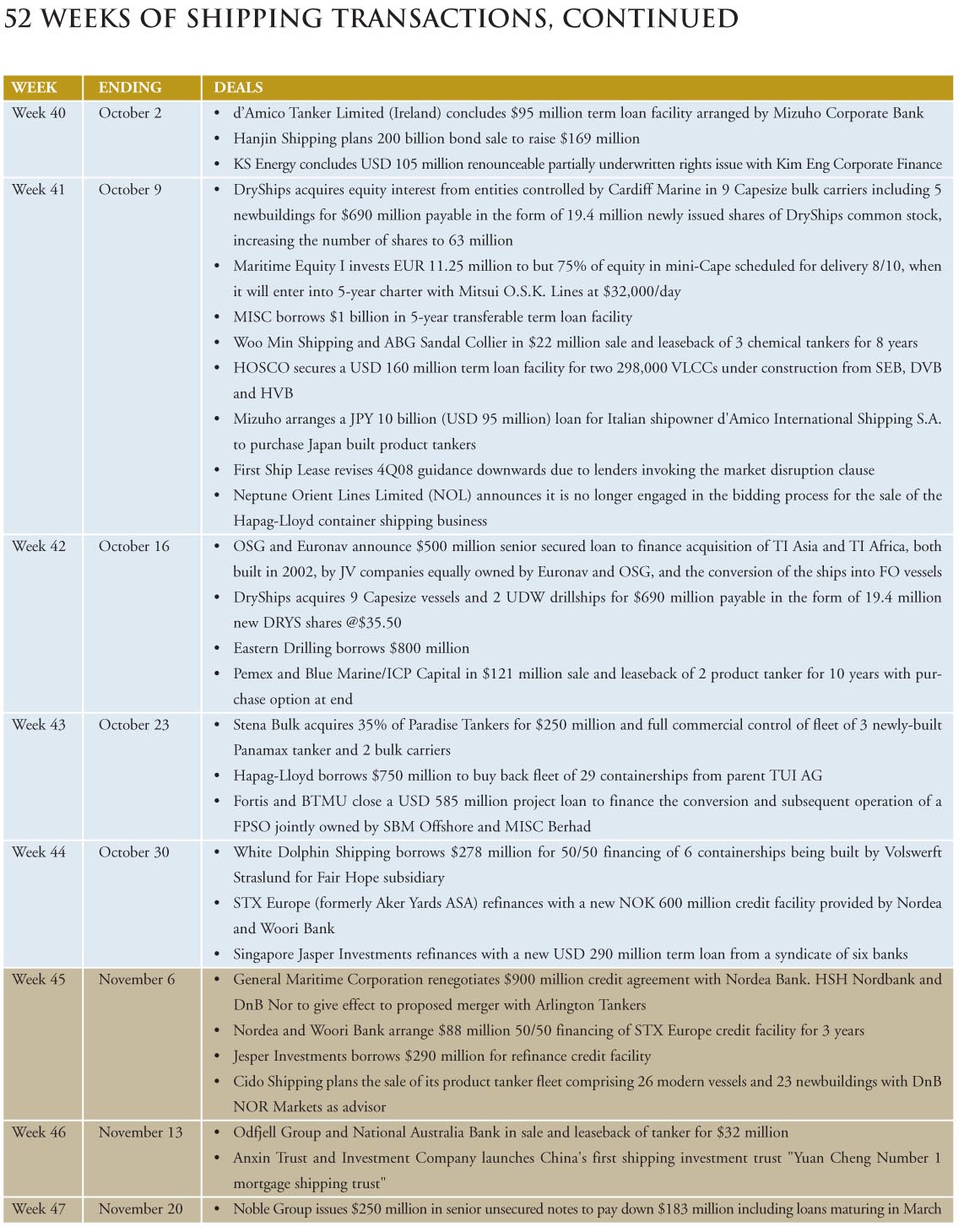

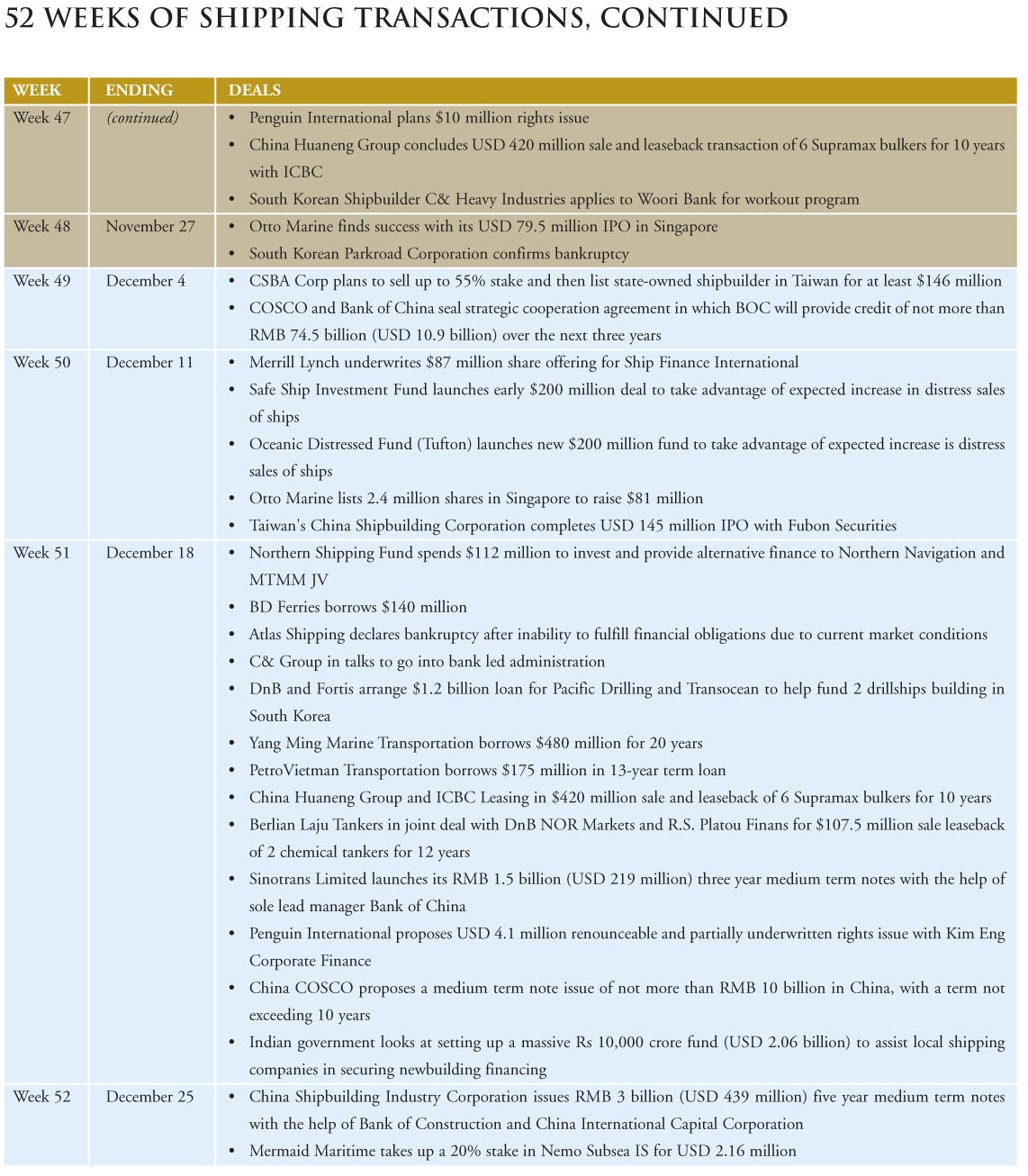

Time is fleeting and change is ever present. It has been a year since this same issue was published last year. As we all know, much as changed in our world and that change came faster than anyone might have contemplated. Credit has dried up and markets have collapsed. Sitting here in February 2009, one might question even giving awards for last year. And looking at the transactions in hindsight, one might easily argue that they might not appear to be worthy of an award. We ask you instead to look at them in the context of last year and all that happened. Despite a worldwide shutdown in the credit markets, shipping deals, both debt and equity were done. Shipping banks were doing new business as well as honoring commitments. And Wall Street was raising equity for IPOs and follow-on offerings. Yes, there was a slowdown in activity in the last quarter but look at the “52 Weeks of Shipping Transactions” to get a sense of your accomplishments. It was a good, if not great year. As is well known, our Chairman is renown for finding reasons to celebrate and this curmudgeon cannot disagree with him. You should be proud of yourselves and take a moment even in these difficult times to celebrate your accomplishments.

Continue Reading

Contribution to Ship Finance – Dagfinn Lunde and the Team at DVB

20 years ago in London at the Waldorf Hotel a young banker stood at an overhead projector swapping slides explaining the Norwegian K/S system to a room filled with shipowners and financiers at the first Marine Money ship finance conference. The young man spoke confidently, however he did not garner the headlines from that conference. The headlines that day were grabbed by a young Guy Morel who proclaimed the industry would need $200 billion to finance the fleet over the coming decade and by a Yugoslavian lawyer, with a thick eastern European accent who chose to talk about the use of debt swaps at Yugoslavian shipyards. That $150 million now seems a paltry figure and Fairplay magazine had some fun calling the Yugoslavian structure a Death Swab, which given the status of Yugoslavian yards today may have been an appropriate malapropism.

The K/S expert was overlooked by the press, but his body of work then and since, on behalf of shipowners and ship financiers, leaves an indelible impression, one which the industry is the better for having. While the institution he currently directs serves the market with confidence and consistency.

We are talking about Dagfinn Lunde and the success of the team he and Chairman Wolfgang Driese have assembled at DVB Bank. While the galaxy of ship lenders at banks around the world suffer largely from the sins of other bank departments, DVB employed a strategy that enabled them to avoid the ravages of the sub-prime orgy. Thoughtfully and strategically DVB has chosen to follow a focus on transportation assets, air, land transport and of course shipping. As their mission statement says: We are the leading specialist in international transport finance.

This focus combined with remarkable internal systems has enabled the Bank to profit and prosper in a frightening banking landscape.

That is not to say that DVB too didn’t feast a bit, and maybe a few times excessively as the assets of shipping companies skyrocketed, but rigorous credit practices supported by a terrific research team and experienced on the ground management served the interests of the bank and its clients and shareholders through the asset boom well. So while many banks have had to retrench from ship lending, DVB is profiting and continuing their ship lending business.

For the year 2008 we salute Dagfinn Lunde and DVB Bank for their Contribution to Ship Finance. The strength and success of the bank could not be more appreciated or needed by a credit-constrained industry.

A Bit of History

It was in May of 2000 that DVB Bank purchased the venerable specialist Dutch ship lending bank Nedship. Dagfinn Lunde joined in August of that same year. Over the intervening 8 years the bank has gone from profit to profit by increasingly focusing on transportation. During those years the local German banking business was sold. It has been this focus in fact that enabled DVB to avoid the problems other banks have had with toxic sub-prime loans. In fact in their 2008 first quarter report they state “thanks to this business model, the DVB Group is not directly affected by the financial markets crisis. The indirect impact – specifically, the increase in refinancing costs – is passed on in full when originating new business.” This is of course aided by the fact that their competitors have reduced their transport finance activities as they are forced to focus on internal problems.

DVB meanwhile remains a reliable partner to its shipping clients throughout the transport markets’ economic cycle.

It is a bit too easy to simply ascribe DVB’s success to ‘focus’ without looking a bit more closely at the moving parts that achieve that goal. For it is in the establishment of corporate disciplines, the recruitment of good people and the development and maintenance of superior credit practices and entrepreneurial spark that results are really achieved. And all those are much, much easier said than done.

Conservative Foundations and Entrepreneurial Vision

Land in almost any maritime center and attend a shipping function and you will run into a representative of DVB Bank’s shipping group. It’s not that it is extra large but the corporate ethic is to get out and see the clients, listen to what’s going on in the markets and explore what’s out there. This market participation is one hallmark of the bank’s superior credit discipline. Its bankers around the world are the first line of credit check and they know their markets.

You just don’t take any deal to the DVB credit committee, the deals you take are well understood, terms and conditions technically very disciplined. Every deal is like that, no exceptions. The bank’s list of questions each borrower must answer is the longest in the business. As a result a deal taken to the weekly Friday credit committee meeting has been exhaustively considered and modeled, ensuring the efficient decision making process.

For much of the recent past while credit flowed like wine this credit process and lending level discipline drove DVB bankers to look into the more obscure corners of the industry. If everyone was lending to a panamax bulker at 65 basis points, DVB bankers would look at a Mexican Flag transaction or an accommodation vessel financing, confident that they could both understand the credit, risks and values but also secure a better return and what’s more a loyal client for the future.

“Sectoral – ization” – Huh?

A year ago Dagfinn Lunde instituted a broad management restructuring. Why fix what is not broken observers mused, of the transition to a Sector Specific client service strategy. Where previously offices had a geographic client focus, now individuals within geographic offices would follow specific industry sectors: Container, drybulk, offshore. Ten sector groups in all, seven new sectors added to the three which had existed and which had tested the model. We will not mince words there were some grumbles around the world as individuals found their jobs, relationships and travel scrambled. But a year later the degree of client service based on global sector knowledge has resulted in yet another year of strong growth and profits.

The new sector groups are global, with sector experts scattered around the world in DVB offices. These global teams provide a near seemless 24/7 specialized competence and sectoral knowledge directly to DVB clients. DVB bankers understand their clients business model and the assets they employ. The result, better service for clients and enhanced profitability for the bank through enhanced portfolio management.

People

Instituting such a major change, pulling even the most mature professional away from an established comfort zone is not without risks. But here again a special characteristic of DVB becomes apparent. It is a skill Dagfinn Lunde has employed before during his banking days in NY with the old Den Norske Bank and then a bit later when he revivified Intertanko. Both times he found ways to get more out of his people, overcoming initial hesitation to find great energy.

The DVB environment is extraordinarily collegial. The management is extremely flat. One has access to everyone right up to Dagfinn Lunde at any time. The feel in the offices is the same worldwide. They are happy to see you, exuding a laid back feel and quick with a laugh which belies the extraordinarily hardworking corp. The contrast today with other lenders is striking as anxiety grips the corridors and friends look over their shoulders to see who’s left. For Dagfinn Lunde and team it may be a sore subject, it is never fun losing someone, but the fact is well trained DVB people now populate many of the most important positions in ship finance.

Dagfinn has built up a strong experienced management team, and directed his people towards the bank’s success and to becoming a prominent player in shipfinance. He empowers his people to think out of the box, to develop new business, to take responsibility, to find solutions for the bank’s customers.

The Business – Client Service and Profits

Over the years the bank has been able to implement stringent risk management systems, carefully and frequently monitoring their portfolio. This is all supported by their research activities and has delivered significant profits. But it is not all just lending. Dagfinn Lunde’s entrepreneurial spirit and his encouragement of ‘outside the box’ thinking helped the bank to develop various new businesses, including successes like investment management, mergers and acquisitions, and a strong syndications platform.

Client service and profits mix handily at DVB. DVB’s shipping loan portfolio in 2006 stood at 6.7 billion Euro. By the end of 2007 they reported a shipping loan portfolio of 8.3 billion Euro. 2007 was a record breaking year for the shipping division. Through September 30, 2008 the shipping loan portfolio stood at 9.7 billion Euro. Shipping accounts for the largest part of the overall portfolio, followed by aviation at 4.77 billion Euro and Land Transport at 1.44 billion Euro as at September 30th, 2008. At the end of 2007 more than 84% of the lending portfolio under 60% loan to value.

The disciplined approach to a sector stands them in good stead within the syndication market as well. The size of recent deals mandates that some deals be syndicated and a DVB led deal or a DVB participation is considered a seal of approval. If DVB is in we are too, sort of thing. The tight syndication market at the moment demands close bank to bank relationships, but credit quality and a fierce attention to detail, again DVB strengths, matter too. Before the financial malaise DVB’s syndications team raised a total volume of US$ 1.37 billion from 28 transactions from the shipping and aviation sectors in 2007. Shipping accounted for 86% of that.

While the bank may be best known for its asset lending practice, under the Lunde and Driese leadership they have capitalized by pushing the envelope of financial services provided to their core markets. Thus the Group’s Advisory and M&A unit which provides strategic and general corporate advice to clients from balance sheet optimization to restructuring to M&A to equity and debt raising. In 2007 M&A was mandated on twelve assignments. In addition DVB Capital markets LLC in New York is a licensed broker dealer.

DVB takes pride in being able to provide customized boutique like services with the resources of a global bank behind them. But it may be in the even more entrepreneurial niches like NFC, their wildly successful equity investment finance unit, formed initially as a joint venture with Northern Navigation and a small group of investors, that the creativity of management may be seen. The focus at NFC, which in 2008 became a wholly owned DVB business unit is on preferred asset-based investments.

The bank also hired in talent to launch a Container Box Finance specialty unit. That team acquired from ING brought personnel expertise and shipping market knowledge which combined with a healthy dose of the Banks already extant discipline, prospered. The Box unit proved highly successful putting both equity and debt to work. The Unit even purchased an entire Box fleet.

DVB also dove headlong into the cruise sector creating a specialized cruise finance unit. That unit like its Box and NFC brethren became a major success as well by becoming one of the cruise sectors major financiers. Once again specialist knowledge and deep familiarity with the sector distinguished the DVB group from other banks.

Entrepreneurial and niche markets proved a viable and valuable strategy and created stable cash flows for its investors with considerable upside as the shipping markets prospered.

Conclusion

Marine Money is fortunate to have a great many friends in this business, but it is a distinct pleasure to give the Award for Contribution to Ship Finance to a good friend of long standing, Dagfinn Lunde and his colleagues at DVB. You deserve it and the industry is the better for your service.

The Herb Cohen Award – More Commonly Known as the Wild Card Award

Sometimes a transaction does not fit any award category but is meritorious in its own right and is therefore worthy of recognition. In this instance, our judgment was affirmed when an extremely knowledgeable and respected investment banker nominated this transaction even though neither he nor his competitors had any involvement in the transaction, which was, in fact, all done in-house.

The transaction to which we refer is Eagle Bulk Shipping’s (“Eagle”) remarkable re-negotiation of its bank loan and shipyard liabilities. In the current environment where “too big to fail” is the standard negotiating stance, this win-win negotiation stands out as an example of how all the players in this industry, through cooperation and understanding, can resolve the difficult situation we find ourselves in.

Although some might argue that this transaction is a restructuring, in our view it is too temporal to fit in that category. And so this year we rename the wild card award after Herb Cohen, the world-renowned negotiator who is the famous author of “You Can Negotiate Anything.”

Among his many insights, Mr. Cohen observes that “weakness itself can even result in negotiating leverage”1 Messrs. Zoullas and Ginsberg had a clear vision of their position and what was necessary to rectify it.

These two gentlemen are a force to be reckoned with as they spanned the world negotiating with the Yanghzou Dayang Shipyard as well as its lenders to put Eagle on sound footing. Although all the parties shared in the give and take, in our view the miracle lies in how little it cost them in real terms given the overall risk exposure.

In their dealings with the shipyard, Eagle was able to reduce its current capital expenditure obligations by $363 million. They accomplished this by converting eight charter-free Supramax newbuildings into options. The cost of conversion for the eight contracts is $440 thousand in total. The progress payments previously made on account of these eight vessels is being applied to payments in respect of other vessels being constructed by the builder for Eagle. Finally, the delivery date for a vessel under construction has been rescheduled from September 2009 to November 2010. Given the yard’s flexibility, we expect them to be long-term suppliers to Eagle.

Contemporaneously, Eagle amended its $1.6 billion credit facility with the Royal Bank of Scotland (“RBS”). The amendment reduces the amount of the facility to $1.35 billion from $1.6 billion. Interestingly, the reduction is less than the savings in capex obtained from the shipyard providing incremental liquidity to Eagle.

Critical amendments were also made to the minimum-security value clause. First, the numerator was modified to include not only the market value of the vessels but also the deposits on newbuilding contracts. Then the ratio required was reduced from 130% to 100% of the aggregate principal amount outstanding.

Finally, the minimum net worth clause was reduced from $300 million to $75 million for 2009 subject to annual review.

The maturity of the credit facility remains July 2017 with availability declining pro rata from July 2012 to a balloon payment of $717.2 million at maturity.

And what was the price? The interest margin was increased to 1.75% over LIBOR and no dividends can be paid unless the minimum-security value is 130%. On an accounting basis, Eagle expects to incur a one-time cash expenditure of approximately $0.5 million and a one-time non-cash write-off of approximately $5.5 million to 4th quarter earnings.

With this transaction, Eagle has set the bar for those that follow. But truly this is not an award for negotiating skills; it ultimately represents instead the successful positioning of the company for the future. This may be best expressed by a quote from Tacitus, a senator and historian of the Roman Empire:

“He that fights and runs away, may turn and fight another day; but he that is in battle slain, will never rise to fight again.”

Many other owners have subsequently come to terms with their bankers and shipyards and we expect there are others who are in the process of negotiating their own solutions. The outcomes we have seen thus far suggest that rationality will prevail and the industry as a whole will be left on a sufficiently sound footing to turn the corner. Hopefully, lessons ignored have been re-learned. There is no new paradigm and supply is at the root of all that is evil.

1 Cohen, Herb. You Can Negotiate Anything. New York: Bantam Books 1980. Page 4