KG Numbers

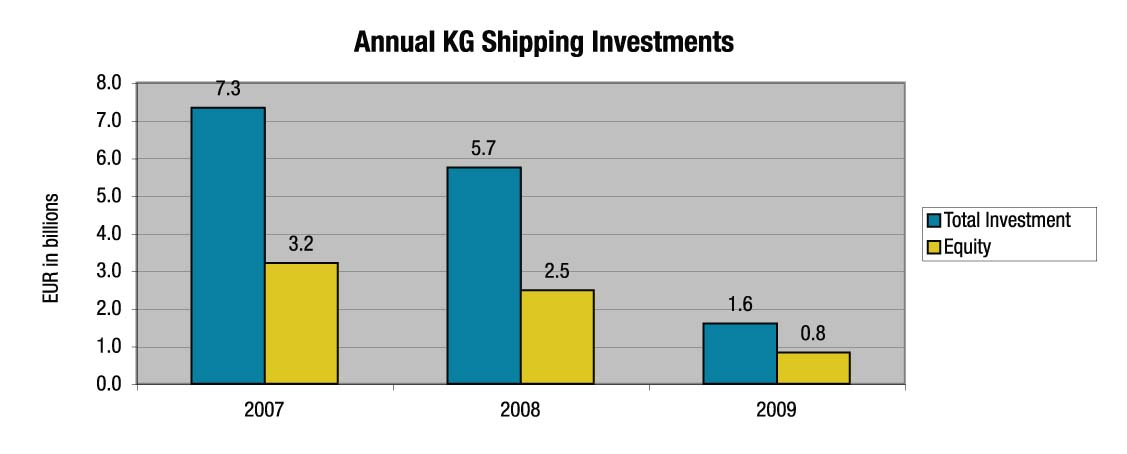

While anecdotally we know that the KG market has virtually collapsed, we were able to gather some empirical data that evidences the decline over time. The following graph is limited to shipping funds and needs to be put in the context of the entire KG market, which in 2009 raised EUR 9.46 billion in total investment including equity of EUR 5.23 billion.

Understanding a Leading Indicator

Last week, we were privileged to sit in on TAL International Container Corporation’s (“TAL”) Analyst and Investor Day. Having spent part of our career in container leasing, we remain fascinated by the intricacies of what on the surface appears to be a very simple business. Leasing containers for pennies, if done correctly, can be a multi-million dollar business as TAL demonstrates. There are a number of reasons as to why container leasing is an attractive business. Historically, the industry has demonstrated long-term growth of 2x to 3x global GDP with less risk than other equipment types. And, most importantly, margins are sustainable.

One of the world’s oldest and largest container companies (ranked 3rd with an 11% market share), TAL operates a fleet of 1.2 million TEU and owns 95% of its containers. It’s fleet is diverse and includes dry, reefer and special containers. Its lease portfolio has evolved over time and now emphasizes long-term operating and finance leases at the expense of short-term leases. And, finally, serving as both a barrier to entry as well as a competitive advantage, is the scale of the company’s global operating infrastructure, which includes 18 offices in 11 countries and 201 third party depots in 37 countries. The cost of replicating this is enormous and likely impractical and the advantage is not simply operational, they are, as a consequence, closer to their customers.

Continue Reading

High Yield Report Card

We love to borrow the work of others particularly when they have insights we lack. This week “Professor” Ethan Ram of DVB Bank shared with us the presentation he made at the University of Piraeus last month on the high yield bond market. While it is in fact a primer on the market, what piqued our interest were his slides on how that market had performed.

Beginning in the 2Q 2009, high yield issuance grew significantly, as investor risk appetite returned and corporations required funding in the absence of bank debt or were in fact coerced by their lenders to issue bonds to pay down existing bank debt in order to reduce the bank’s exposure.

Continue Reading

Discretion Is the Better Part of Valor

When it comes to dealing with shareholder activism, management has to quantify the costs as well as the time and energy consumed in its response. In all these respects, it is unlikely that management can win. It is spending money on lawyers and advisors and remains distracted from the day-to-day running of the company. And so at the end of the day, it generally succumbs to the minority shareholder’s gentle coercion, in polite terms, but what is, in essence, blackmail, in order to do what is best for the company or at least move on. A small company, in particular is doomed to this fate.

This is the position DHT Maritime found itself back in March, when MMI, owners of 9.7% of DHT’s outstanding shares, let its feelings about the quality of management and its decisions be known. All would be well, in their mind, if their expert, Bob Cowen, with his 25 years of maritime experience, were to be added to the board and thus a proxy contest ensued. The issue was resolved this week with DHT relenting by agreeing to expand the board from four to five directors and appointing Mr. Cowen to that new seat, which term expires in 2011. In addition, MMI has the right to nominate an additional director at DHT’s 2011 annual meeting for a term expiring in 2014 and DHT has agreed to support that nomination. In exchange, MMI has agreed to a standstill and will not solicit proxies for or participate in a contested election relating to DHT directors or submit any proposals at shareholder meetings through the completion of the 2011 annual meeting. Importantly, should MMI’s shareholding fall under 5% of the issued and outstanding shares as of the date of the agreement, the board seat will be terminated. And finally coming under the guise of adding insult to injury, DHT has indemnified MMI for its fees and expenses incurred with respect to the proxy contest up to $150,000.

Continue Reading

Public Equity: Paying Retail in the S&P Market

A funny thing happened on the way to the shipping crisis; the United States stock and bond market provided more than $24 billion of liquidity and saved the day – at least for those who benefitted directly. The substantial quantity of subordinated capital, which came in the form of unsecured high yield bonds, convertible bonds, common and preferred equity not only placated nervous banks, it actually spawned an entirely new chapter in the history of ship finance and marked the return of unlevered structures. But the infusion of so much outside capital has produced an unintended consequence: there is now appetite for modern, high quality asset values that those private owners looking for discounted ships have to face a stark reality: if they want quality, modern vessels they are going to have to pay the “retail” price.

And the competition for vessels is increasing. Preaching a “fresh start” and a “clean piece of paper without the entanglements of legacy loans and charters,” an entirely new crop of “freshman” public shipping companies have emerged and made themselves more attractive than some of the industry’s most experienced veterans in terms of valuation. Using tools like third party pools, third party technical managers and third party capital, the barriers to entry are low, even though long term success remains much more elusive. Although industry veterans are starting to push back on these new entrants, the fact is that they will keep coming.

Continue Reading

Founder Sells Down

On Monday, Aegean Marine Petroleum Network announced that its founding shareholder, Dimitris Melisanidis, acting through Leveret International, intends to offer 4 million shares of the company’s common shares in an underwritten public offering using an existing shelf registration. As of year-end, Mr. Melisanidis controlled 15,178,031 shares representing 31.8% of the company’s outstanding shares. Of the total amount being offered, Leveret is selling 400,000 shares to Peter Georgiopoulos, the Chairman of the Board, which will increase his holdings to approximately 4.8 million shares, and a further 1 million to the company. The balance will be purchased by Jefferies, which is acting as the sole book-running manager of the offering.

The offering was priced on Tuesday at $25.50, a discount of 4.9% from Monday’s closing price of $26.80. The selling shareholder will receive the entire net proceeds of $98.72 million.

On Your Mark, Get Set…

On Wednesday, DHT Holdings, Inc. filed a shelf registration to be in position to sell up to $200 million of its common stock, preferred stock and debt securities in one or more offerings. Under the terms of the preliminary prospectus, net proceeds will be used for general corporate purposes, which may include, without limitation, vessel acquisitions, business acquisitions or other strategic alliances, reduction of outstanding borrowings, capital expenditures and working capital. A specific prospectus supplement at the time of sale may amend the use of proceeds.

Continue Reading

Promises Kept

There are lots of things you can say about Seaspan, but one thing that stands out is the fact that they stay on message. But perhaps even more importantly they walk the talk. While there is more than enough debt to complete the newbuilding program, there has been an equity gap ranging from $180 to $240 million which was to be filled by “common or other equity and/or other forms of capital over the period from the second quarter of 2011 to the second quarter of 2012.” One would say, in these days of readily available equity, no problem. However, the company had one self-imposed condition. Dilution of the existing shareholders was to be avoided.

Last year, the founding shareholders purchased preferred shares. This year, a wholly owned subsidiary of the company entered into a sale-leaseback transaction with an affiliate of a leading publicly traded Chinese bank. Seaspan sold the bank one of its 13,100 TEU vessels it had contracted to build at Hyundai for up to $150 million and, upon delivery its subsidiary will charter it back from the Chinese bank/owner. This can be viewed as a “head lease” and is in all likelihood a bareboat charter. The original 12-year time charter between Seaspan and COSCO Container Line will remain in place with its terms unchanged. This sub-lease, if you will, provided “Chinese content” as well as substantial credit support to the transaction for the Chinese bank/owner. The transaction is non-recourse to Seaspan and therefore is from a legal/commercial perspective an operating lease. However as the subsidiary is 100% owned it will be capitalized on Seaspan’s consolidated balance sheet for accounting purposes. The terms of the charter-back are undisclosed, but the economics, due to lower borrowing costs today as opposed to when the deal was done, may have improved.

Continue Reading

Formula for Success

Last week, we reported on Alterna Capital Partners’ first shipping transaction, which was their joint venture with Western Bulk Carriers. We subsequently spoke with one of the principals to understand the fund’s philosophy. There is no secret sauce here, just the application of sound lending/investing principles.

With over 20 years experience in investing in capital assets, including prior investments in many different shipping sectors, the partners integrate industry and asset knowledge with structuring and financial expertise. Clearly this perspective helps them overcome the hurdle of residual risk, which has been a stumbling block for many competitors. Such an asset focus is easily transferable to shipping as evidenced by their ability to close the Western Bulk joint venture in 6 weeks from start to finish. The fact that they have all worked together for many years also simplifies the decision-making process.

Continue Reading

Groda Reneges on FSL

The true risk in shipping trusts is the creditworthiness or counterparty risk. On Tuesday, First Ship Lease (“FSL”) announced that Groda Shipping has requested to re-deliver two product tankers, each currently under a seven year base term bareboat charter contract with FSL until November 2014. Employed under long term COAs with Russian energy firm Rosneft Oil Company, the two vessels contribute 15% out of FSL’s annualised revenue of USD 101 million and the pre-mature termination of the contracts will impact cash flow and distributions negatively.

FSL disclosed that Groda Shipping is required to pay lease rental on a monthly basis in advance and has made payment for only one vessel in May. Groda Shipping will no longer make full payments for either vessel from June 2010 onwards. On the brighter side, FSL pointed out that it has the assignment of the long term COAs between Groda Shipping and Rosneft and a cash security deposit of USD 3 million per vessel, which works out to be close to 5 months of charter hire. All eyes are now on the approach the trustee manager will be adopting towards the lessee who had made a clear intention to renege on the contracts. FSL says it is currently in discussions with Groda Shipping and exploring available legal and commercial options.