By Matt McCleery

Looking over the list of Rankings winners for 2005 presented in Figure One, one thing is perfectly clear: the dry bulk business was the place to be in 2004.

Of the ten highest scoring companies, an overwhelming number trade dry. But to say that alone would not be completely fair to what was another staggeringly good year of overall performance by the international shipping industry. Crude tankers, product tankers, proximity to China, old ships and new ships all contributed to the mix. With the benefit of 20/20 hindsight, it doesn’t take a rocket scientist to know shipping in general was the place to be for public equity punters in 2004.

But the confluence of market forces which delivered the perfect storm of economic, trade and commodity opportunities in 2004 takes nothing at all away from the magnificent performance of our Rankings winners – companies that went above and beyond the still impressive returns of many of their peers.

We celebrate with everyone the terrific results. We applaud the equity market makers for their investment in our shipping business. We note with confidence good signs for the future, demonstrated by the motivated attitude well-evidenced by what one public company Chairman said to us when told his company did well in our Rankings, “Why should I be excited by placing anything other than first?” Continue Reading

Categories:

Marine Money | June 1st, 2005 |

Add a Comment

By Sean Huang

Once again, we have selected a group of companies for our annual rankings based upon our traditional criteria: the companies must be publicly listed corporations, the companies’ major income must come from shipping or other marine operations and the companies must provide audited financial information for the year 2004.

However, to reflect the expanding public shipping universe, we have also expanded the number of companies included by 28%, from 58 last year to 74 this year. The new companies are shown in Figure 16.

We compute the financial ratios, stock prices and exchange rates based on the results ending at companies’ fiscal year. In the interest of being inclusive, we have ranked a very small number of companies that have only provided unaudited financial information for 2004, but we consider their inclusion a useful exercise for comparative purposes. However, in large part we have not been able to include companies for which FY 2004 data is not available until May 2005 or later, including a number of companies in the Far East and India with fiscal year end in June. Figure 17 shows a complete list of this year’s 74 contenders, ranked according to market capitalization as of December 31, 2004. Continue Reading

Categories:

Uncategorized | June 1st, 2005 |

Add a Comment

By Carleen Lyden-Kluss

The only constant is change, but the way in which it has so completely envelops the maritime world is an ongoing phenomenon. The latest change has been brought about by record and sustained rates combined with the increasing proliferation of publicly traded shipping companies and has caused the sector to receive increased investor interest.

Shipping is no longer immediately associated with UPS’ brown trucks and uniforms Although a recent Wall Street Journal article may have disappointed when a headline reading “Shipping News” was about delivering coffins by air, Yahoo! Finance has at long last upgraded the industry from the more industrial “Water Transportation” to the more familiar “Shipping.” Nor do we read about the sector only in trade magazines and newspapers. Whether due to its record profitability, a record number of shipping offerings, or a flight from other investments, shipping is hitting the mainstream investing arena. Once overlooked by investors, the maritime industry is now on the radar screen of Wall Street.

This increased visibility of the sector, in combination with augmented regulatory demands (Reg G and Sarbanes-Oxley Act sections 302 and 404), has placed greater responsibilities on public companies for more understanding, planning and execution of corporate communications and investor relations strategies than ever before. It is transforming how public companies are treating these areas, and how they value investor opinion in corporate policy and decision-making activities. Continue Reading

Categories:

Marine Money | June 1st, 2005 |

Add a Comment

Last Friday, Moscow, Russia was the center of the international ship finance industry with Sovcomflot’s annual banker meeting on Thursday – with over 80 international and domestic ship finance bankers – and Marine Money’s ship finance forum the following day attracting over 160 delegates. Not to forget the energy minister of Norway’s visit to the Kremlin and the U.S. Minister of Energy’s visit to Russia this week in an effort to explore the opportunities of Russia’s promising energy industry.

Following Sovcomflot’s banker meeting and cultural session, Marine Money and Sovcomflot had their joint dinner for over 100 speakers and bankers at the new Gorki restaurant, making it one of the best speakers’ dinners in a long time. Music lover and CEO of Sovcomflot Mr. Sergey Frank had organized the music entertainment with live music from one of Russia’s most popular groups, setting the stage for a great night filled with Russian food and vodka.

The forum was the first of its kind in Russia, and comes as a result of the increasing interest from the international banks to finance Russian shipping companies. Today the four big Russian shipping companies – Sovcomflot, Novoship, FESCO and Primorsk – all have access to the international banks, but there are still another 50-60 Russian shipping companies who do not get international financing. The forum was established largely to investigate if this can be done in the future. The answer is that came out was “Yes, but…” The but specified that as a prerequisite, the Russian companies need to acknowledge the following:

• Vessels must be non-Russian flag to ease the banks concern in case of default

• Shipping companies should have an offshore structure

• Vessels should have long-term employment with international, or preferably known Russian, charterers

This doesn’t leave a lot of Russian aside from the management and the seafarers handling the ships. Then again, Russians are known for their skilled and loyal maritime management and the maritime skills of their seafarers, the result of several hundred years of shipping tradition.

At the forum, the commercial bankers’ panel admitted that this is why they are comfortable and happy to do business with the four big shipping companies who adhere to the noted conditions, and it is clear that it is attention to these that is needed for the other smaller companies if they wish to attract international finance.

In addition to this, we must remember that the country risk of Russia has improved substantially, and down the road the international banks might even be comfortable financing Russian flag vessels, granted that the Russian state reduces the well-known complexity of its tax laws. We learned that Russia is contemplating setting up a Russian International Ship Registry similar to that of Norway and Denmark, so the process is in motion, but how long it will take is yet to be seen.

Overall, the forum was a great start for what is expected to be a great opportunity for ship finance deals to come. The co-chairman, Mr. Ivar Hansson Myklebust of Nordea Bank, drew a comparison to Brazil and how the oil majors have not only attracted international finance for themselves, but also introduced the banks to the local shipping companies. Not too long ago, there were very few international banks comfortable doing business there, but today, as we know, this picture looks very different. With Russia sitting on an estimated 1/4 of the world’s oil and gas reserves, the establishment of solid companies such as Gazprom, Lukoil, Rosneft, and Transneft, and the credibility of the larger Russian shipping companies, we hope the way can be shown for the other Russian shipping companies to attract the international finance many need grow take their businesses to the next level. We look forward to next time, when we can see how this has developed.

FM understands that former GE Capital shipping banker Kevin Kennedy, who has been involved with Great Circle Capital in recent years, has joined Vancouver-based Seaspan as CFO. The combination seems like an absolutely perfect fit for both sides. While at GE, Kennedy was active in doing structured financing and leasing for marine assets – which is exactly what Seaspan does through its long-term charters of container vessels to China Shipping and CP Ships. Now everyone who knows us knows we hate to speculate, but when we see a company like Seaspan hire a CFO like Kevin Kennedy at a time like this, we cannot help but wonder if they aren’t considering a major corporate transaction such as an IPO or major acquisition.

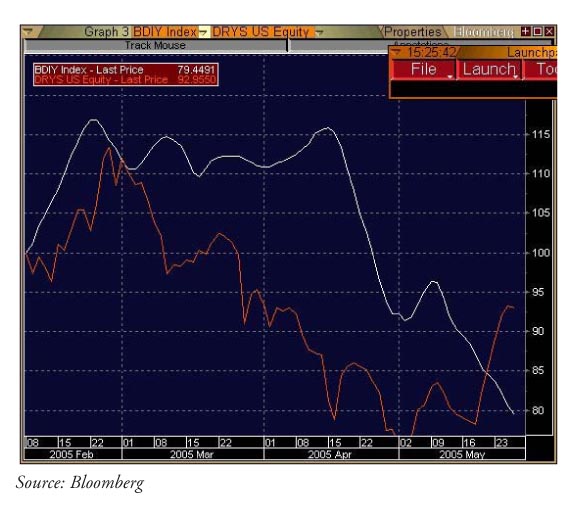

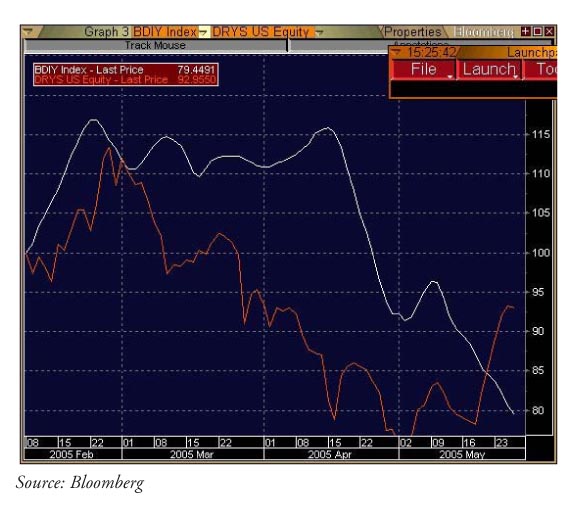

The accompanying graph should appear in the pitch book of every investor relations firm that is marketing services to the shipping industry. As you can see from the graph, DRYS shares have largely followed the pattern exhibited by the underlying Baltic Index – until last week when George Econmou and CFO Chris Thomas were out on the road seeing investors and appearing CNBC’s Squawk Box, Bloomberg TV and MarketWatch.

The shipping team of DVB Bank AG and Riaz Khan, Head of Research, gave Greek shipowners a presentation on market outlook. Although each market sector was covered, the relief was clear when the comments on the dry market showed cautious optimism due to expected continued demand from China over the next few years.The current decline we are experiencing is put down to a technical correction which is China-related because of stock piling. Once stocks start running down, the “just in time” import regime will put more orders out to market and rates will go up again. That said, owners must be wary of substantial volatility in the market over the next 3 / 4 year as a result of China managing her own economic growth. Prior to lunch, Wolfgang F. Driese, CEO of DVB Bank AG and Chairman of the Board of Directors commented on a successful year for the bank, the first as a pure transportation bank, and his continued support for Greek shipping.

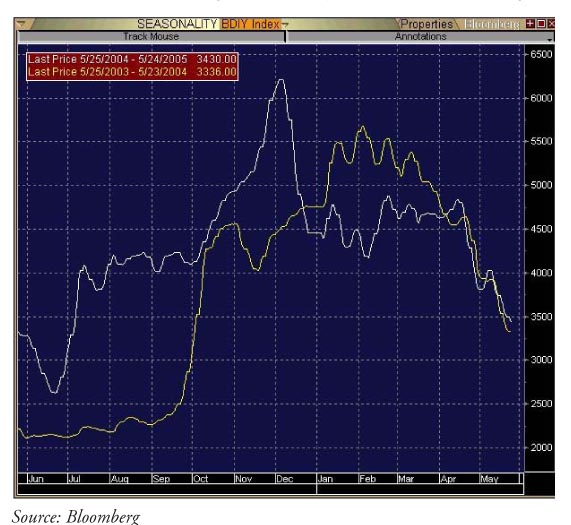

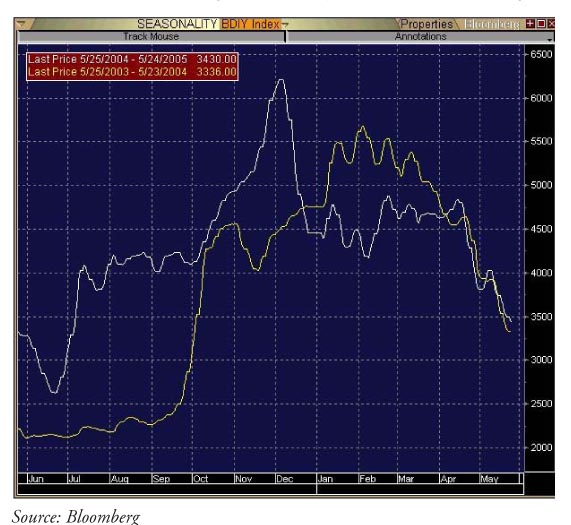

There is loads of chatter in the market these days about the fact that sharp declines we have seen in the BIFFEX are a pure repeat of what we’ve seen in previous years. The subject is particularly relevant for the many dry cargo companies, such as Wexford, Genco Shipping, Quintana, TBS and Eagle, that are planning to do IPOs in the coming months and would benefit from the dry markets regaining lost momentum.

As you can see from the accompanying graph, the decline in the Baltic Freight Index has been a seasonable phenomenon for the last couple of years. The question is when the market will come back. If this year is like 2003, the market will not come up until September, but if this year is like 2004, the market should start to turn back up in mid June.

Such bullish sentiment has been echoed through the market in recent weeks. At the Macquarie Metals & Mining conference in Beijing, the “overwhelming message from all the speakers so far is that underlying growth is still firm and there is minimal risk that government initiatives will lead to an imminent slow down.” Macquarie’s equities research also noted that “The current soft patch is simple inventory adjustment that may take a few months and impact some spot prices, but the overall dynamics of shortages remains unchanged.”

Of course, not everyone shares this view, which is what makes the market a market. Philippe van den Abeele, managing director Clarkson Securities, told the Bimco meeting in Copenhagen today, “If panamaxes go below $20,000 per day in the next two to three weeks, then I fear we can kiss the bull market goodbye.”

Lloyds TSB Leasing has emerged as the counter-party behind the Malaysia Bulk Carriers Bhd (MBC) $140 million lease for three post-panamax bulk carriers and two MR product tankers, which are currently under construction. TSB specialises in the lease financing of ships, said the company in an announcement to Bursa Malaysia Securities on Thursday. MBC said the three post-panamax ships are part of a series of five newbuildings, which were contracted about two years ago, and the MR tankers were more recent newbuilding contracts. The transaction will affect the existing shipbuilding contracts with regard to Lloyds TSB Leasing Ltd, it said, adding that the transaction enabled the group to secure 100 percent of the vessel costs at favorable rates. MBC enjoyed results that more than trebled results in the first quarter for a total of about $95 million, thanks to the sale of four panamaxes. Without the gains on vessel sales, results were about flat year-on-year.

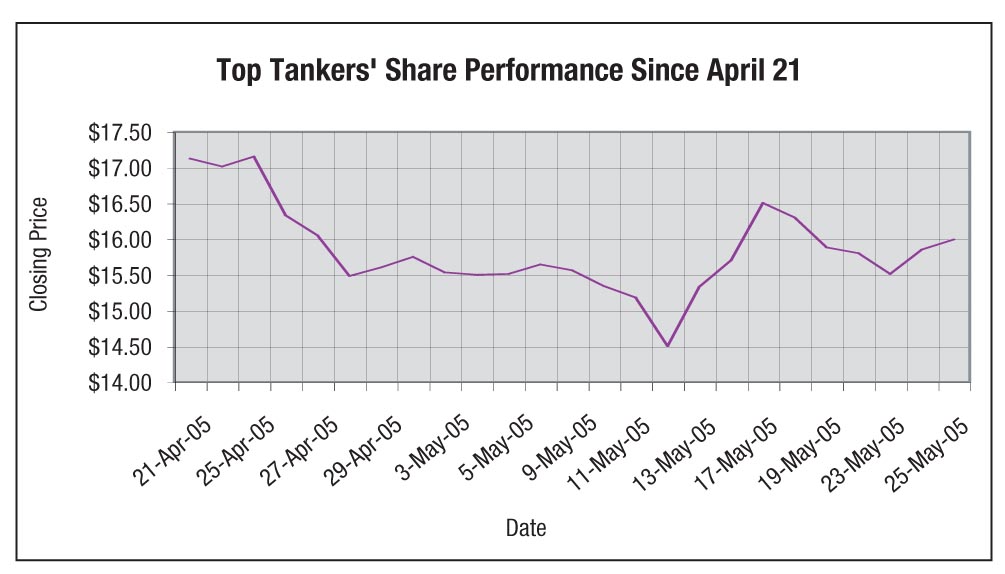

After nearly a month in the market, a change of underwriters and several changes to pricing, Top Tankers officially withdrew its $300 million convertible preferred stock deal this week citing market conditions. Proceeds of the offering were to be used to acquire the 15-vessel bulk carrier fleet of Greek owner AM Nomikos, and the deal has since been called off as a result of the failed offering.

No matter what you think of the company or the deal, one thing is for sure – both Top and its advisors clearly worked tirelessly to make this deal happen.

So what happened? Like most unfortunate outcomes, the inability of Top to conclude its deal resulted from a combination of factors that are both specific to the deal and general to the markets. First off, there was the shipping market. Although most investors and analysts we speak to agree that the drop in dry cargo freight rates is little more than a temporary blip, Top’s plan to acquire a fleet of dry cargo ships was not ideally timed to say the least – especially as charter rates have declined while ship values have remained the same or even firmed for some vessel classes.

The second factor that went against the deal regarded the underlying market for convertible securities. As some readers may know, the convertible market has tipped in favor of issuers in recent years, with transactions for companies like OMI and Seacor pricing at thin yields of 2.75% and lofty conversion strike prices of about 45%. This imbalance of supply and demand for convertible products has resulted from the growing number of hedge funds that use the structure to create “riskless” returns. For those who aren’t familiar with this form of black box investing, the way it works is that funds go long the convert and short an equal quantity of the stock so that they are effectively insulated from any change in the underlying stock price. In this scenario, funds earn their return by collecting the coupon on the debt and often leveraging their capital to enhance that yield. Issuers like the market because it either very cheap debt (if the stock doesn’t reach its conversion price) that is non-dilutive or fully priced equity (if the stock does convert).

Although Top had already been marketing the deal for a couple of weeks, the hedge fund community was stunned when GM and Ford’s debt fell in value when it was downgraded to junk status at the same time the company’s stock rose thanks to a Dutch auction bid from Kirk Kerkorian. What this meant was that hedge funds that were long the bonds and short the stock, a logical hedge strategy for a deteriorating credit, were punished when the company’s equity value rose as its debt sank. The losses incurred from the unusual scenario forced many funds onto the sidelines just as Top was trying to price.

The structure itself may have presented another challenge. When the deal was initially brought to market, we understand the yield was 5.75%. Although this is a relatively high yield, one challenge may have been that Top itself pays a dividend of about 5%. This means that the difference between what investors would have to pay on the stock they are short and what they would earn on the convertible was pretty small. In response to market push back, sources tell us that Top improved the economics to 6.75% with a conversion price up 20%, but perhaps by that time the market had gotten too choppy.

Another potentially problematic issue may have been the size. As we go to press, Top Tankers has a $450 million market cap, and it was in the market for a $300 million convertible in a market that generally sees convertibles that are around 25% of the issuing company’s size.

Nothing Ventured, Nothing Gained

Although we imagine that the company, its advisors and AM Nomikos are disappointed with the outcome, shareholders are none the worse. According to a statement made by the company, Top will not forfeit any deposits that may have been lodged when the MOA was signed, and the so the only major cost here was that of opportunity.

President and CEO Evangelos Pistiolis stated, “We carefully considered the possible acquisition in light of various financing alternatives available in the market, but concluded that proceeding with the acquisition of this fleet would not be in the best interests of our shareholders at this time.” Reading between the lines, Pistiolis probably feels that the net asset value of the company’s stock is in excess of its current $16 share price – something that should give investors comfort at current levels.