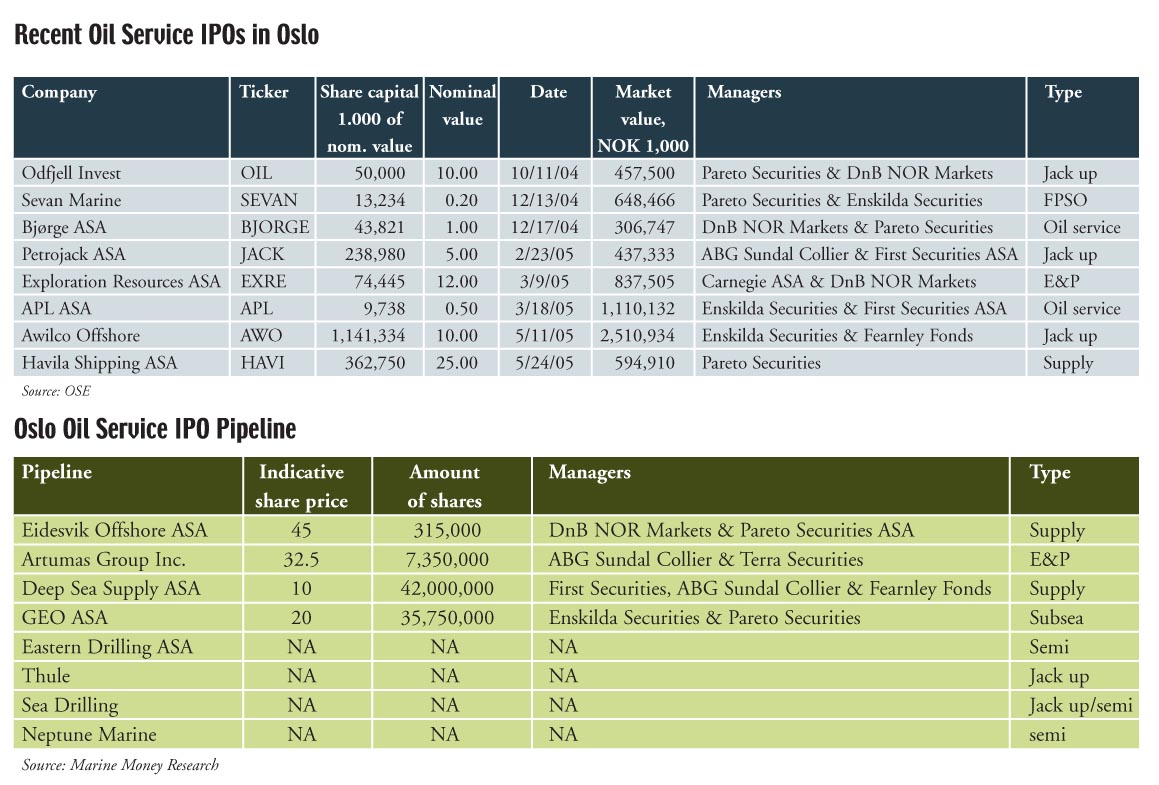

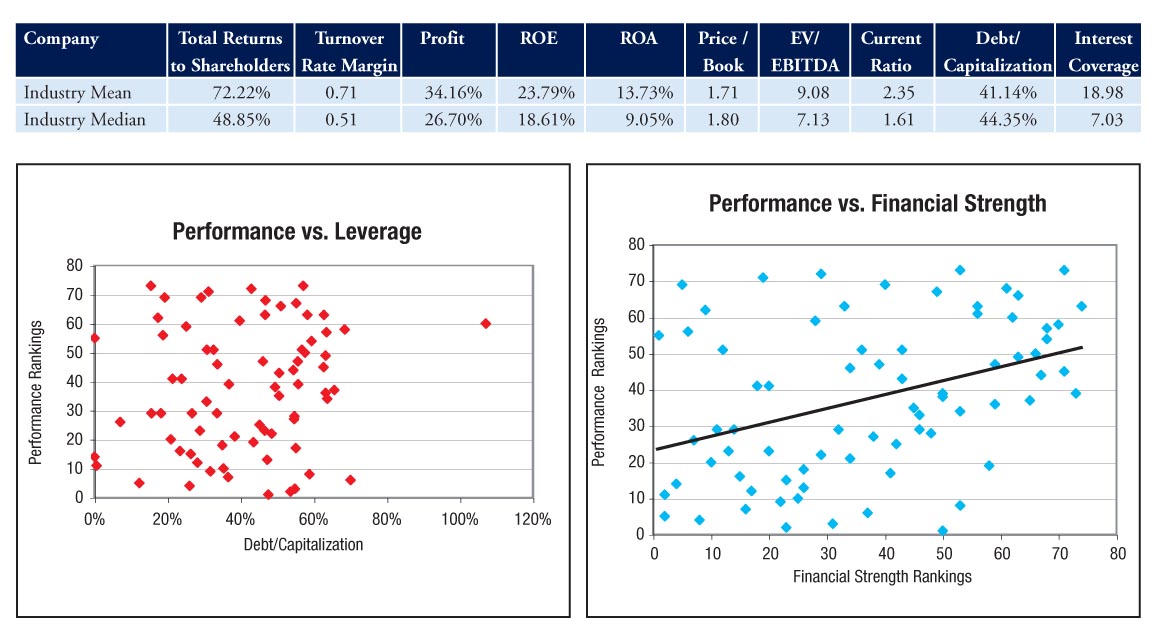

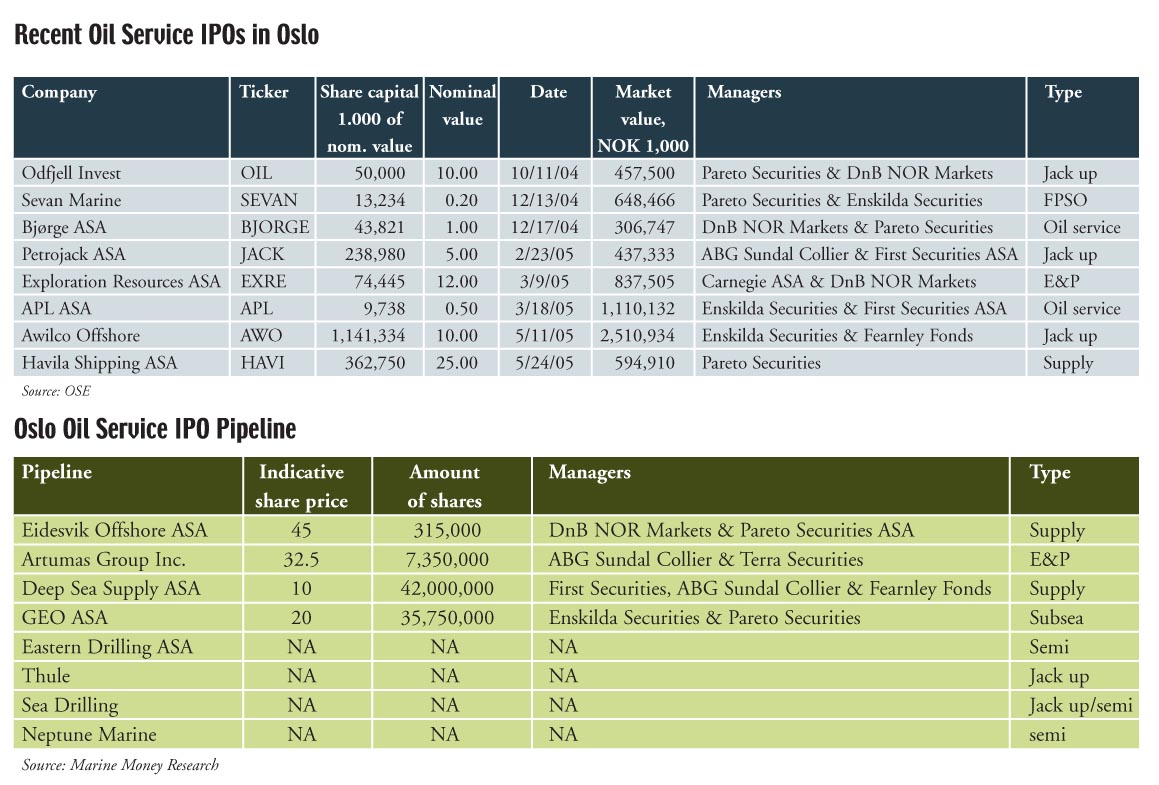

As many see blue water shipping as having reached its peak, the oil service industry is becoming a new favorite pick for investors, particularly in Norway. Oslo has shown over the past months that it is by far the most popular place to list an oil service company, be its focus in drilling rigs, supply vessels, subsea development or E&P. As the accompanying table shows, the last six months have seen eight companies raise equity and list on the Oslo Stock Exchange, and there are another eight preparing to do this, of which four have already raised the equity, filed for an application and expect to list from now until 3Q.

So, why is Oslo the center for this industry?

• Norway is a major oil producer and has the entire industry represented

• It offers one of the best sets of analyst coverage of the industry

• More importantly, Oslo offers risk capital with the knowledge and willingness to invest in the companies

• A majority of the new jack-up and semi-submersible rigs have been ordered by Norwegian interests

• Appearance of consolidators in the rig industry (John Fredriksen)

What is interesting is that the majority of issuers also include foreign and U.S.-based investors, which is a testament to the quality of the deals. However, with a lack of U.S. rig companies participating in the orderbook, one can argue that when the Norwegian-ordered rigs get closer to delivery, they could become a very attractive target for U.S. companies, which get punished in their share price every time they order a rig on spec. What is evident for the oil industry is that there is:

• Need for upgrade of the jack up rig fleet

• Increasing development on deep sea levels requiring more semi submersibles and FPSO

• Large supply ship orderbook to cope with the expected delivery of rigs

• U.S. opening for E&P in their own territories (Senate getting approval)

• Barents Sea expected to provide oil and gas as a major supplier to the market

As many of the rigs being ordered will not be delivered for another 12-36 months, there are investment opportunities to be had, convincingly demonstrated by the current oil service IPO boom.

Categories:

Equity,

Freshly Minted | June 23rd, 2005 |

Add a Comment

Following suit with Eagle and Aries, TBS International has cut the estimated price of its initial public offering to $11-$12 per share, down from $15-$17 per share, and maintained the volume at 8.5 million shares, 7 million of which are primary shares and 1.5 million of which are secondary shares. At the midpoint of the new price range, the IPO would raise $98 million. Joint bookrunners on the deal are Merrill Lynch and Jefferies & Company.

Although at first glance this might look like a bloodletting, we think the deal is still attractive to both the issuer and the investors. Here’s why: for the issuer, using a blend of the company 2004 and 1Q2005 EBITDA of $51 million on an annualized basis, a price of $11 per share values TBS at an attractive 5.2 times top-of-the-market EBITDA. For investors, from a cashflow valuation standpoint TBS’s planned vessel acquisitions amount to a purchase of more EBITDA that would nearly half the relevant valuation multiple. In the resulting neighborhood of 2-3x EBITDA, TBS post-acquisitions is set to represent a very good value vis-à-vis its shipping comparables, particularly considering the added value of the company’s established franchise, an item that many of the pure dry bulk plays making their foray into the U.S. equity markets do not offer.

Categories:

Equity,

Freshly Minted | June 23rd, 2005 |

Add a Comment

Don’t be misled by the trade press articles and the fact that recent shipping issuers have priced IPOs at the low end of already lowered price ranges; the fact remains that based on our valuations of these companies, issuers are continuing to do U.S. capital markets deals at very attractive valuations. Moreover, we are seeing deals with single hull tankers (Capital), older vessels (TBS) and secondary share sales (Eagle), as well as related party management companies (various). Despite claims to the contrary, the fact remains that the American equity markets are wide open for all kinds of shipping deals. As we see dry cargo rates begin to bounce in recent days, we would not be at all surprised to see this sector regain momentum and enjoy another run.

As one of the 150 investors at Marine Money Week said over coffee, “just because we aren’t paying the retail price that investment banks put on the prospectus doesn’t mean that sellers aren’t getting a premium.” We would concur with that. The message being telegraphed back to the industry from Wall Street and Main Street investors is that the market is open for shipping IPOs even though the heady days of 2x net asset value are gone – at least until rates begin to gather momentum in the coming months.

That said, we should acknowledge the two companies currently engaged in roadshows in the U.S. Capital Maritime & Trading Corp filed an F-1 today for the issuance of 16.67 million shares at $14-$16 per share on the NYSE. We will discuss this deal further next week, when it is expected to price. Cosco has also traveled a long way to bring its roadshow to New York this week.

Eagle Bulk – Don’t Believe What You See

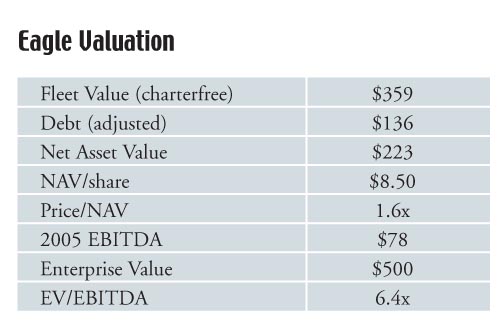

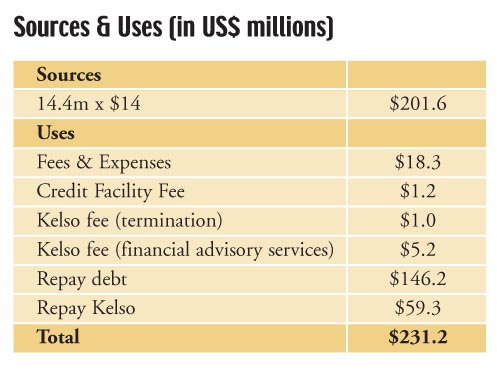

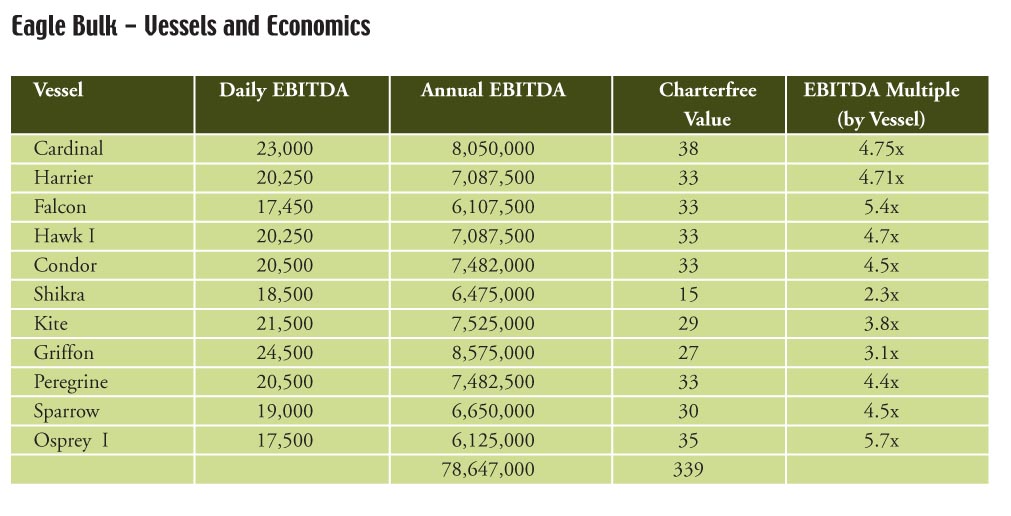

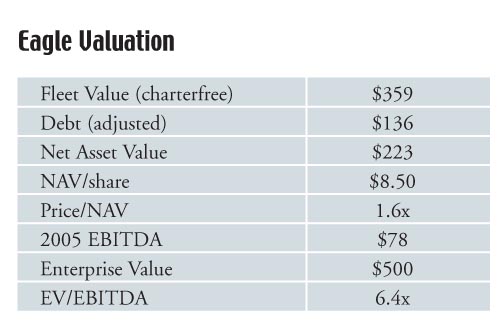

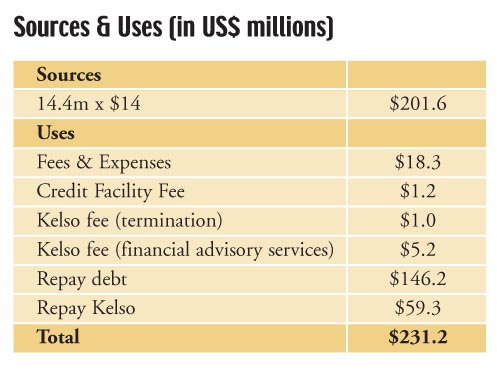

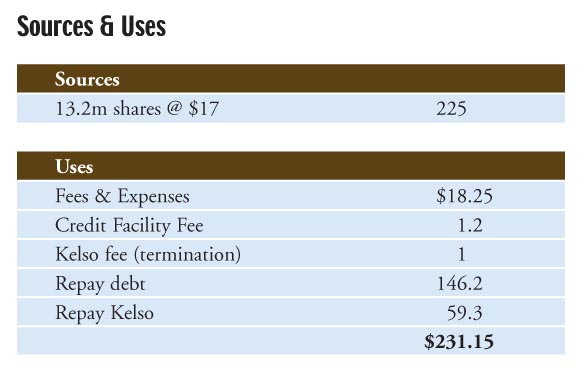

But deals still in the market do little to demonstrate investor appetite. Let’s take Eagle Bulk as our first in-depth example of why the U.S. equity markets are still open, and yes even attractive, to shipowners. The U.S.-based handymax owner Eagle cut the estimated price of its initial public offering to $14-$15 a share from the planned $16-$18 a share, but the company increased the size of the IPO to 14.4 million shares from 13.25 million to make up for the shortfall. The deal priced at $14 per share, which we estimate to be around 1.6x a net asset value that is already high, especially in light of declining charter rates. This is a phenomenal execution that gives start-up Eagle a better valuation than Teekay or OSG. As mentioned above, despite the fact that investors have supposedly rejected issuer’s attempts to sell secondary shares, private equity fund Kelso, which is the financial sponsor behind the Eagle deal, was able to extract about $70 million through fees and debt repayment, which represents almost the fund’s entire investment in Eagle, even while it still retained about half of the equity.

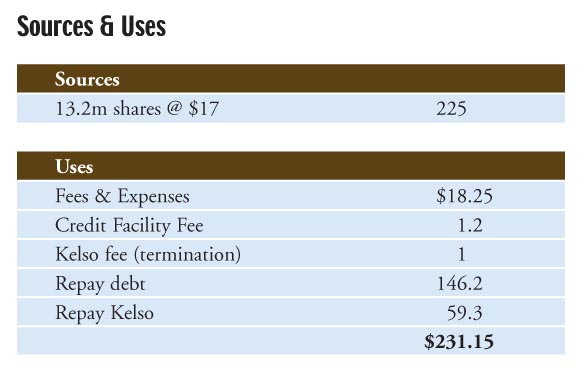

Soft Aftermarket Trading for Eagle

As we saw with Diana Shipping, Eagle has sagged in early aftermarket trading as the stock immediately sank to $13.50. As we understand it, Citigroup’s Smith Barney and UBS’s Paine Webber sold about 65% of the deal to retail investors while the joint bookrunners, which include the names above plus Bear Stearns, sold the balance of the deal to institutional investors. Although this type of sales technique resulted in solid pricing, as it did in the Diana deal, the aftermarket performance prevents “flippers” from immediately selling their stock for a gain. We do not know whether the underwriters exercised the green shoe or are willing to offer support by buying stock to stabilize the pricing. If they have already used their dry power to support the stock, however, we would not be surprised to see continued soft price performance, at least until we run into some sort of market upturn.

Are Dividends Losing Effectiveness?

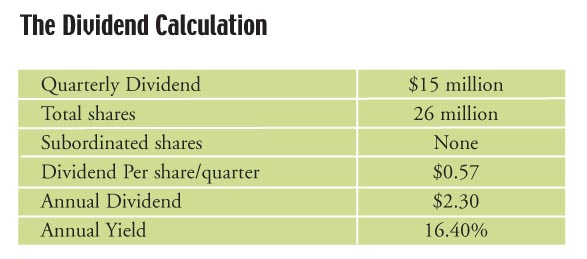

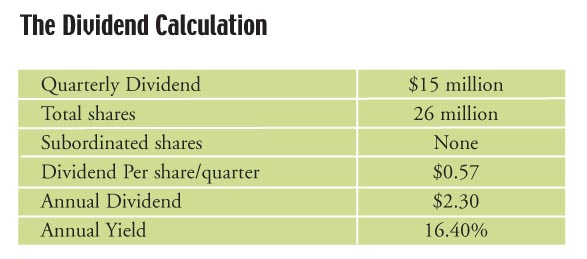

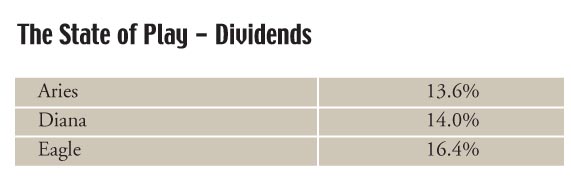

One question we’ve been asked lately relates to yields. Specifically, how are investors looking at them? The answer, in our view anyway, is that yield can be used to increase valuation among certain fringe buyers of these stocks such as retail, but most experienced institutional investors clearly are looking at net asset value because issuers like Eagle do not have the long-term contracted cash flows required to meet the dividend in question over a sustained period.

In fact, investors that we spoke with at Marine Money Week seem to like growth stories and are discounting the real value of the dividend over the long-term. They are, however, looking at dividends as a way for them to lower their cost basis by receiving their deprecation and earnings in cash. As one Eagle investor said, “Do I think the 16% dividend is a guaranteed? No. But based on the company’s charters, I know I can get more than 30% of my money back over the first two years, meaning that I am really buying this company at closer to net asset value. That is the trade.”

This logic, although tempting, neglects to embrace the potential loss of principal that would result if rates and values return to historically normal levels. In our view, companies that seek to pay dividends and do not have long-term employment to back them up should just be careful to set them at realistic levels that do not stress the company’s liquidity and leave enough cash to take advantage of growth opportunities. It follows from this that Eagle priced at a quite respectable valuation, indicative more that investors have sobered a bit since January than that they have lost interest in dry cargo equity.

Categories:

Equity,

Freshly Minted | June 23rd, 2005 |

Add a Comment

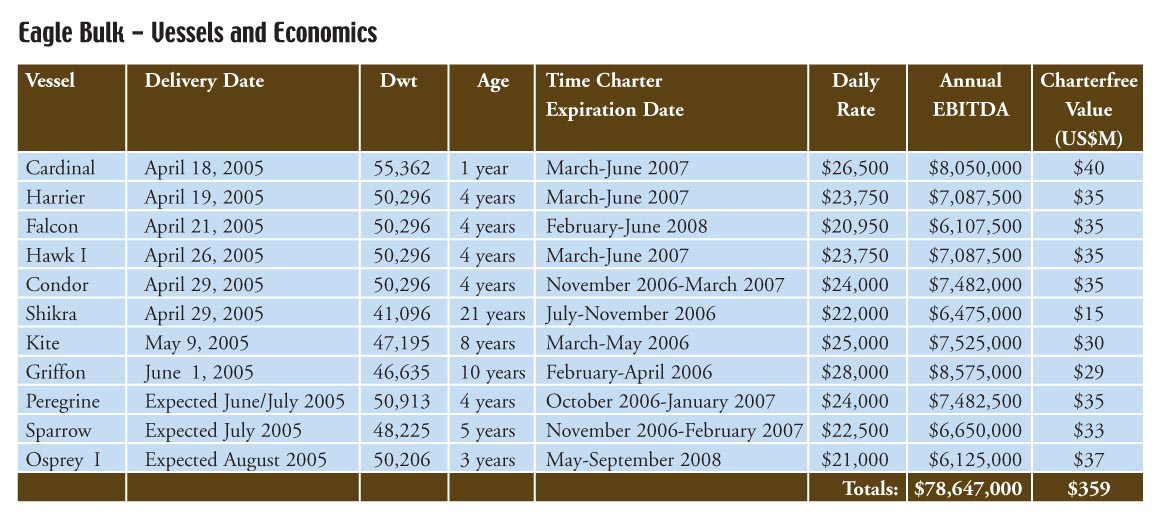

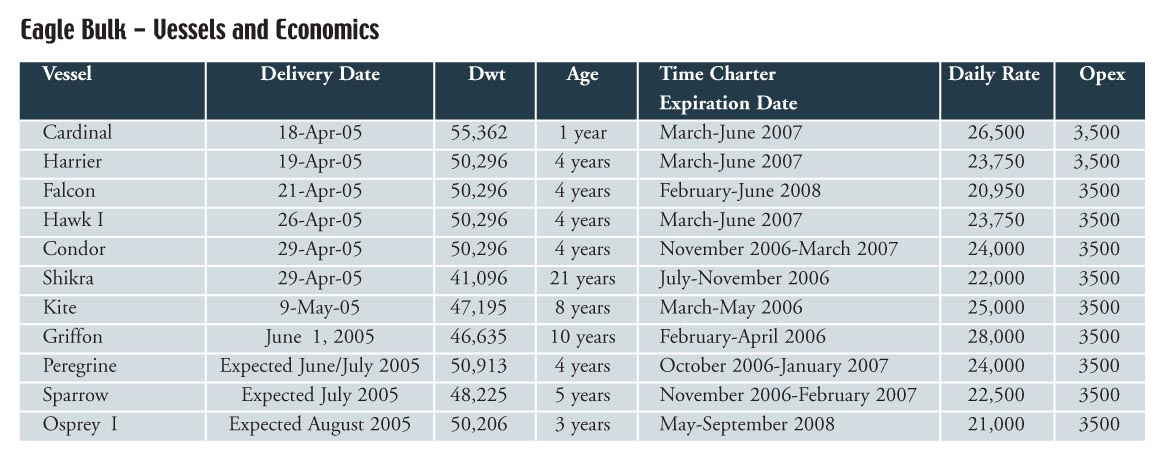

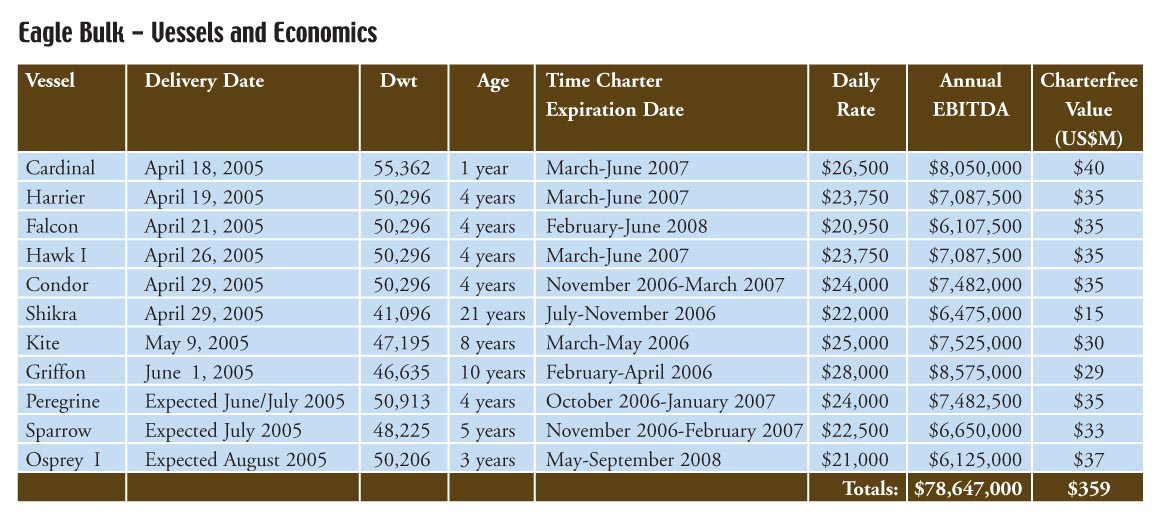

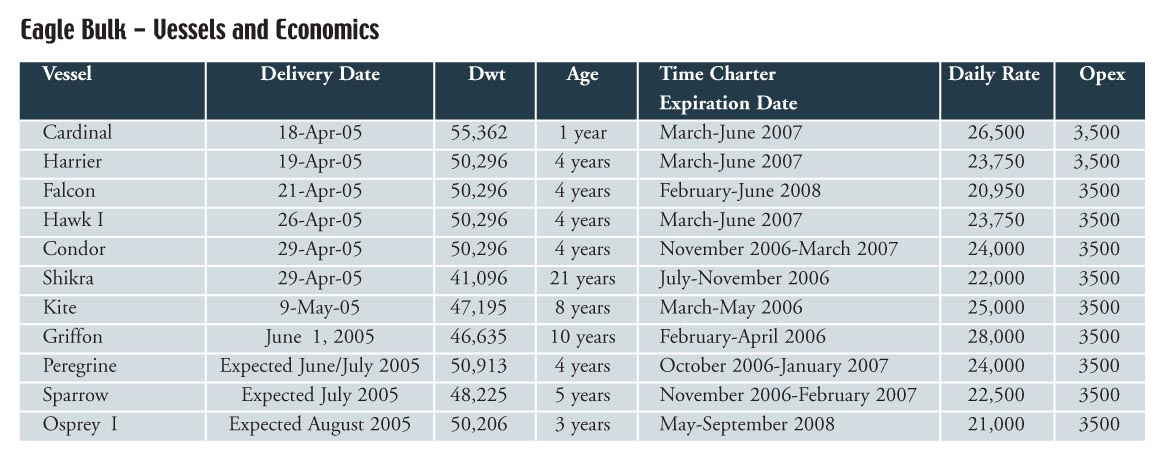

In what we think is a truly defining moment in history of shipping and the capital markets, Eagle Bulk Shipping began its roadshow this week to raise approximately $255 million of equity against a fleet of 11 handymax bulk carriers. We don’t mean to be histrionic here, but we think the valuation of Eagle will strongly influence the dozen other dry bulk deals queued up to come to market.

What we find fascinating about the deal is that Eagle Bulk is using its circa 14% dividend to come to market at approximately 2x net asset value at a time when the comparables are trading closer to 1x net asset value.

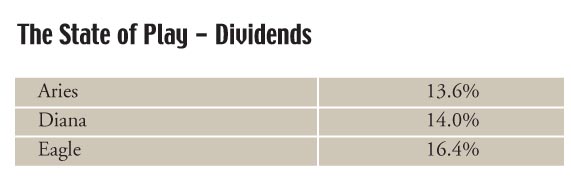

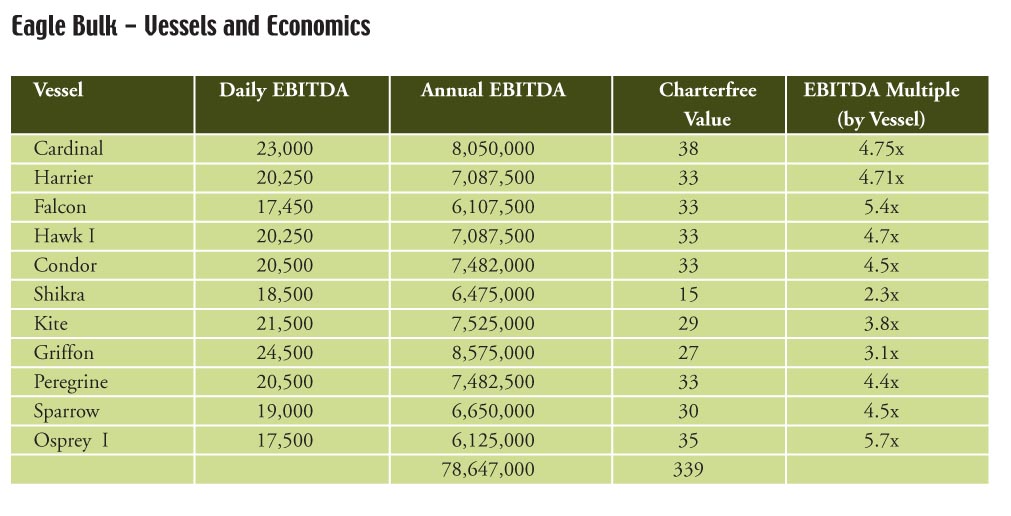

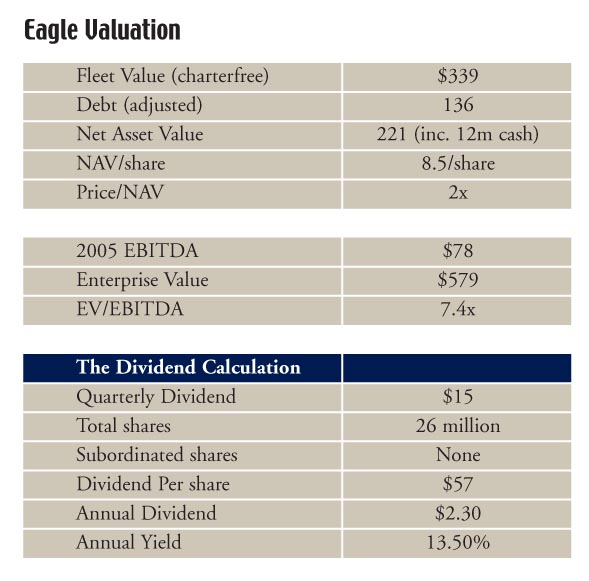

According to our calculations, the net asset value of the fleet is about $221 million. We arrive at this figure using our fleet value of $339 million (which includes 3 vessel to be acquired) against liabilities of about $130 million (which includes $97 million on those 3 new vessels and $30 million drawn from the company’s credit facility) and cash of $12 million. Based on the 26 million fully diluted shares (by which we mean the 13.25 million sold to the public and the balance allocated for the green shoe and retained by the sponsor) Eagle Bulk has a net asset value of $221 million, or $8.50/share versus an offering price of $16-$18 per share.

With the serious institutional shipping buyers very savvy in their ability to value shipping companies these days, we can only assume this deal will be sold into the retail market where buyers will be attracted to the yield. Another possibility is that the underwriters have put a very high number of the cover of the prospectus knowing that it will be negotiated down by the investors in today’s choppy IPO market. Eagle Bulk could effectively price its offering more than 50% below the mid price of the range and still capture a premium.

The Opportunity

Aside from the high valuation, small enterprise value and lack of vessel diversification, we think the Eagle Bulk deal provides a well-structured opportunity for investors to participate in the handymax dry cargo market. We say it’s well structured because commercial management is inside and technical management is in the hands of third party V Ships. Moreover, the charters are good, the ships are modern, the company has a large credit facility and the vessels operate in the handymax sector – which enjoys the best supply/demand fundamentals of all the dry cargo markets.

If this deal is successful, the real credit goes to whoever at Eagle (or, perhaps, credit facility provider Royal Bank of Scotland!) decided to put medium term charters on the ships while the market was still strong. Although charter default risk exists in a weakening market, as you can see from our calculations the cash flows generated by these vessels for the next 18 months are presently higher than what could be achieved in the market today and will improve the EBITDA and net asset valuation of the company.

The Challenges – Overcoming Diana

The successful execution of the Eagle Shipping IPO will not be without some challenges, at least if it is sold to institutions. For one thing, the deal is being brought to market by the same pair of bookrunners that brought out the similarly structured Diana Shipping – UBS and Bear Stearns. Citigroup was also added on the cover recently (they did not appear on the original S-1 filing), perhaps to broaden the distribution, and CSFB is the sole co-manager.

Although the high dividend yield structure has created extraordinary premium valuations for tankers companies such as Nordic American Tankers, Knightsbridge Tankers and Arlington Tankers and has clearly inspired replicas in other sectors, the model has not yet successfully translated into dry cargo. Take for example, Diana Shipping, a first rate, high quality company that was the first deal of this sort in the dry bulk space, which has suffered mightily since it began trading in March. It trades at a premium of about 1.3x net asset value and was priced at about 1.4x net asset value before falling in the aftermarket.

Market sources indicate that there were some mistakes made with the execution of Diana, such as who it was sold to, high pricing and a premature exercise of the green shoe, but to be fair to everyone involved the fact that the dry cargo market began falling immediately after the offering was probably the underlying culprit. That said, the unpleasant fact remains that buyers of the Diana IPO have suffered losses – which is why we assume from the high pricing on this deal that it will sold into a new market that puts a greater emphasis on yield than underlying value – retail. Although many within the shipping industry have been astounded by the valuation of companies like Nordic American Tankers, the fact remains that they have delivered very good returns to investors who bought them and held the, over the years.

The Valuation

As is our editorial policy, we will not tell you what we think Eagle Bulk is worth. We will, however, attempt to help you make sense of the information that is presented in the prospectus. As mentioned earlier and outlined in the accompanying figures, the Price/Net Asset Value appears to be high relative to comparables. The key to achieving this high valuation will derive from the healthy dividend that the company is able to pay from free cash flow. As you can see from our calculations, Eagle will generate close to $80 million of EBITDA per year of which about $60 million will be returned to shareholders through a dividend, which will equate to 13.5% yield.

Categories:

Equity,

Freshly Minted | June 9th, 2005 |

Add a Comment

Last week it was dry bulk. This week, all the fuss seems to be revolving around the tanker market. A Wall Street Journal “Money & Investing” section cover story on the popularity of shorting tanker stocks drew some attention. As did a bearish report from R.S. Platou, a much-talked-about, products-focused IPO from Aries Maritime, positive reports form Jefferies and Banc of America and tanker stock coverage initiations from First Albany. So what, exactly, are the arguments going around, and of what should tanker market players and their financiers be aware? It’s still impossible to predict the future, but we can tell you what some of the competing arguments are.

R.S. Platou analyst Erik Andersen drew a lot of attention with his bearish report on shipping, particularly tankers. According to Mr. Andersen, the seasonality justification for low spot rates – which brokers say have dropped into the upper teens for VLCCs on some routes – is badly overblown. He notes that from 1997-2004, the average second quarter rate was about 37.5% lower than the average fourth quarter rate, completely out of order with the drop in rates from $147,000 in the fourth quarter of 2004 to $41,000 so far in the second quarter of 2005. However, this is still above the 8-year average second quarter rate of $35,000 – albeit with higher bunker prices – suggesting that perhaps the $147,000 was more of an anomaly than the $41,000 is a sign of a crash. Still, tanker fleet annualized growth figures of 6-7% compared to a comparable rate of 1% annually over the decade from 1993-2003 are somewhat ominous. Citigroup Smith Barney analyst Charles de Trenck noted how the current weak rates are making the tanker market the first among the shipping sectors to experience the pricing pressures derived from growing capacity. But on the bright side, Mr. Andersen did write that he does not believe tanker markets will weaken so much as to create a weak year for owners.

Analysts Magnus Fyhr and Douglas Mavrinac at Jefferies & Company have a much different take on the current market situation. They said in a report issued to reiterate their buy rating on Ship Finance International that they expect tanker demand to be firm on increasing OPEC production. Importantly, the analysts believe that incremental fleet growth of 21 MMdwt scheduled through the end of the year is likely to be absorbed by increased tanker demand.

Evincing similarly positive sentiments, analysts Daniel Barcelo, Philippe Lanier and Pierre Sargeant of Banc of America Securities issued a report on oil tankers optimistically titled “Hold On for the Summer Heat.” They note that a 5% tanker stock pullback over the past two weeks has been related more to Arabian Gulf VLCC market conditions than to the tanker industry as a whole, much of which has remained fairly strong. Additionally, they point out that the 450 vessel global VLCC fleet has grown by only two vessels so far in 2005, implying that softened rates could not be explained by supply buildup, but rather are a product of a reduction in Arabian Gulf export volume and a temporary buildup of available tonnage in the gulf. Analyst Craig Irwin of First Albany appears to agree, having this week initiated coverage on General Maritime, OMI and Arlington Tankers with a Buy rating. And a group of Asian investors that market sources say recently put their money into a very expensive $140 million VLCC newbuilding have put their money where their mouth is when it comes to predicting a strong VLCC market for years to come.

Much of Wall Street, however, seems to have sided with R.S. Platou on the more bearish side of the debate, as a widely disseminated article titled “Shorts Expect Tankers to Take On More Water” strongly suggests. Teekay, OMI, Knightsbridge and General Maritime are all being subjected to this phenomenon, with Frontline leading the pack. Investors are brazenly betting that tanker stocks will keep falling. Whether or not this will happen is hard to tell, though the practice certainly is not encouraging for those hoping to see their tanker investments appreciate.

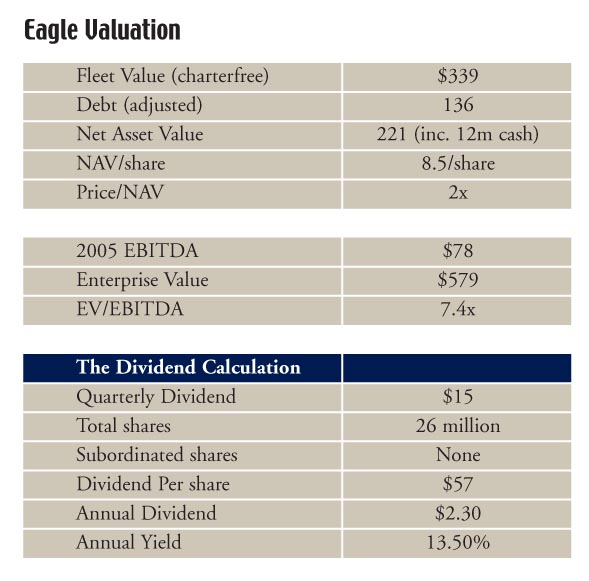

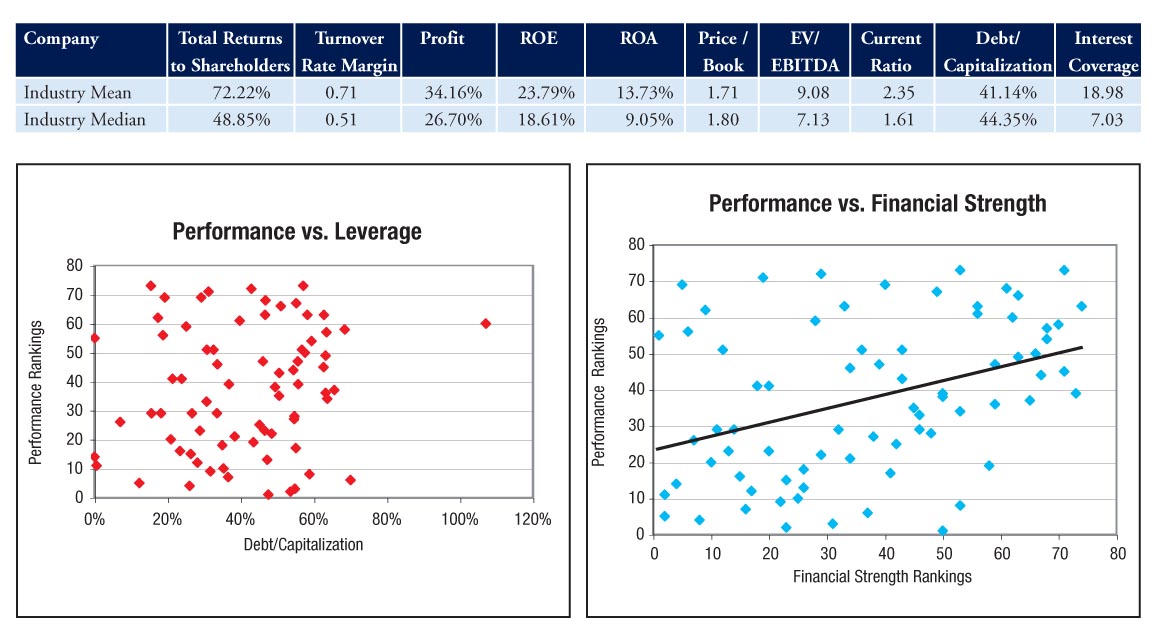

The results of our 2004 Rankings are coming quickly together, and while we can’t announce the winners until the Rankings Awards Luncheon on June 16th during Marine Money Week, there is nothing to stop us from whetting your appetite with some of multitude of industry-wide data. In particular, information on standard ROE, ROA, TRS, EV/EBITDA and others in our universe of 74 public shipping companies provide a very interesting basis for comparison, while the two correlation graphs shown show somewhat surprising results. Financial performance over the past year, it turns out, shows no significant correlation with leverage –in other words, even in a good market, where debt payments are not typically a problem, statistically there is no tangible benefit to taking out extra debt to grow your company. Likewise, financial performance for our universe in 2004 correlated positively with financial strength. We still remember when Tor Olav Troim told delegates at last year’s Marine Money Week that a strong balance sheet is a sign of lazy management. That could still be, but it is now apparent that a strong balance sheet does not limit the potential for financial performance, nor does a thinly-stretched balance sheet necessarily dictate higher returns.

Categories:

Market Commentary | June 2nd, 2005 |

Add a Comment

In a sure sign the shipping industry is continuing to come into its own, a growing number of non-investing professionals have good reason to follow the markets, as firms providing key corporate services such as law and accounting develop both their overall shipping expertise and the talent of their staff. Latest in this trend is the British accounting firm Moore Stephens, who in addition to their other activities provide us with very valuable vessel operating expense benchmarks. In the past week, Moore Stephens appointed leading shipping accountants Richard Greiner and Michael Sims as new partners. Shipping group head Chris Chasty commented: “Shipping is booming, and Moore Stephens has never been so busy, handling audit, consultancy, tax and corporate governance work for every level of shipping across the globe.”

STX Pan Ocean Co. Ltd. plans to raise up to $400 million in a Singapore initial public offering. It currently operates a fleet of 57 owned vessels and about 200 chartered vessels, including the world’s largest break bulk fleet.

The issue, lead managed by Goldman Sachs, will comprise vendor and new shares. No other financial details were available. Pre-marketing is expected to start in the third week of June.

STX, ranked among the top 10 in the world in terms of tonnage capacity of its owned dry bulk fleet, started out as Pan Ocean Bulk Carriers Ltd. in 1966. It went into court receivership in 1993 after merging with several other firms at the government’s behest, before emerging from a court-approved corporate reorganisation when STX Corp. bought a 67% share for about KRW450 billion ($449 million) last November.

The company reported 2004 net profit of $163.6 m, more than seven times the $22.9 million it made in 2003. For the quarter to March 31, 2005, net profit rose 14% from a year earlier to $83.5 million.

Categories:

Equity,

Freshly Minted | June 2nd, 2005 |

Add a Comment

At press time, Aries Maritime Transport is in the process of pricing its IPO. We will refrain from commenting on this deal until the pricing is finalized and the company has made an official statement.

Categories:

Equity,

Freshly Minted | June 2nd, 2005 |

Add a Comment

By Nicolas Bornozis, President, Capital Link, Inc.

In light of the last articles’ focus on the potential for investor relations to add tangible value to public companies, we hope that you find this article detailing the public relations strategy of DryShips that led to remarkable success with regard to share price and valuation particularly compelling.

DryShips listed on the Nasdaq on February 3rd, 2005, following one of the most successful IPOs in shipping. The initial plan was to offer 7.1 million shares priced between $16 and $18 and raise $113.6 to $127.7 million. But the IPO was oversubscribed 8.1 times, and DryShips ultimately offered 14.95 million shares (including the green shoe clause) at $18 per share raising $269.1 million. The success of the DryShips IPO paved the road for a multitude of other offerings and planned offerings in the shipping industry, especially in the dry bulk sector.

From the very beginning, the DryShips committed itself to proactive and consistent investor relations. Several challenges first had to be addressed. Taking advantage of the additional capital raised through the IPO, DryShips embarked on a series of rapidly staged acquisitions, expanding its fleet within the first quarter of 2005 from six ships pre- IPO to a total of 27 vessel, in contrast to the 17 vessels initially envisioned. All this made it more complicated for investors and analysts to follow the company’s development and the earnings progression associated with such rapid growth. Continue Reading

Categories:

Marine Money | June 2nd, 2005 |

Add a Comment