Cosco Hits Choppy Seas in Hong Kong

The Hong Kong equity market has proved itself to be at least as choppy as the U.S. equity market with the pricing and ensuing disappointing share performance of Cosco. The shares priced at the low end of the HK$4.25-HK$5.75 per share range, but even so the company raised an amount approximately equivalent to U.S. $1.2 billion. While this is not as much as they had hoped, many have commented that China’s lack of sensitivity to market timing in its push towards privatization negatively impacts the performance of a number of companies. Keeping in mind this factor and recent U.S. equity results, a bottom-end price resulting in over one billion dollars raised is not bad, though the company’s 10% drop in the aftermarket could not have left a good taste in investors’ mouths.

A.P. Moller-Maersk Gets Discount on 25% Stake in PONL

A.P. Moller-Maersk received the first definitive word on its offer to purchase Royal P&O Nedlloyd this week with P&O’s early sale of its 25% stake in the company at Euro 56.25 per share – a Euro 0.75 discount to the offer price – through Nordea and Danske banks. This brings A.P. Moller’s stake in the conglomerate up to 45%.

TAL International Brings New Twist to Shipping IPOs

TAL International Group, Inc. late Thursday evening became the latest shipping equity deal to hit the market, sort of. In a new twist, the company’s business is actually containers – the boxes themselves, not the ships, and according to the prospectus TAL holds a market share equivalent to about 11% of the world’s leased container fleet and is also active in container sales. The proposed maximum aggregate offering price is $201.25 million, and joint book-running managers on the deal are Credit Suisse First Boston, Deutsche Bank Securities and Jefferies & Company, while UBS Investment Bank is to serve as lead-manager. The company said it plans to use the net proceeds to pay the entire outstanding principal and interest due on its existing credit agreement and for working capital and general corporate purposes.

Seacor to Take Effective Ownership of Seabulk July First

Seabulk International shareholders approved the pending merger with Seacor this week. Seabulk holders will receive approximately 0.27 shares and $4 in cash for each Seabulk share they hold in a deal for $532 million in equity and the assumption of approximately $471 million in debt. In return, Seacor will take control of the company, including its U.S. Jones Act tankers, offshore supply vessels and tug division, effective July 1st.

Quintana Maritime: Shipping Deals Sober Up

In light of the pricing pressure we have seen on Capital and other recent IPOs, we thought it would be interesting to dig into the valuation of Quintana Maritime, which began its roadshow and filed an updated red herring today.

Where it seems that Eagle Bulk attempted to ensure a premium by aiming for a price range that would value the company around twice NAV and an EBITDA valuation that would put it at a premium to comparables DryShips and Diana, Quintana has taken a different approach and is instead looking to come to market right around where comparables Diana and DryShips are currently trading. Today’s dry bulk market is widely acknowledged to be at a low, and as a result comparables – and correspondingly Quintana if it prices in its range – hope it will spring back over the next few months, leaving some meaningful potential value for investors to capture. It is a fairly pragmatic approach at this point in time, enabling increasingly savvy investors an opportunity to buy into dry bulk while its bull run cools in the hopes that another is yet to come, and at the same time offering a substantial, if not particularly high, dividend yield in the realm of 8% with the long-term contracts necessary to support it.

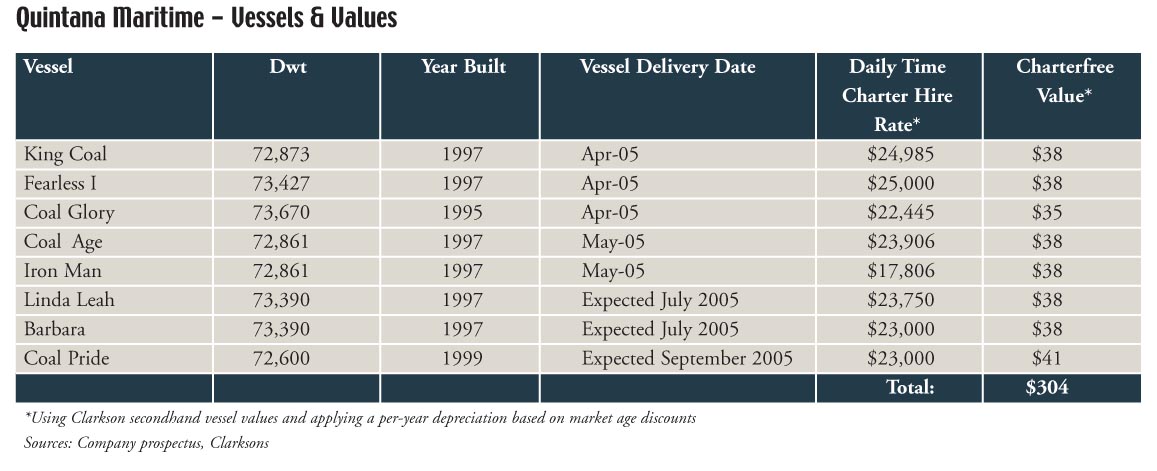

Upon the consummation of its offering and delivery of all identified vessels, the newly-formed panamax company will have a fleet of eight modern to middle-aged panamax carriers, which have market value we estimate to be around $304 million, as shown in Quintana Maritime – Vessels & Values. From this we subtracted total liabilities, which the prospectus anticipates to be under $43 million post-offering, and add then add back cash and cash equivalents of $6.2 million. These calculations lead to a net asset value for Quintana post-offering of approximately $268 million.

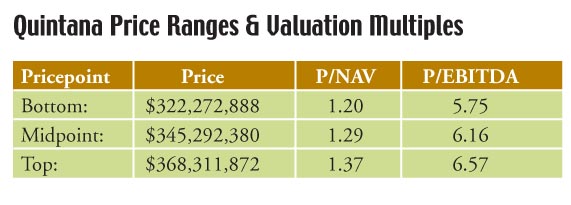

Based on a total number of 23,019,492 shares, 16,700,000 million of which are to be publicly offered, this translates to a healthy net asset value per share of $12.00. This in turn implies that the targeted price range of $14.00-$16.00 is hardly outrageous but neither is it overly conservative. Rather, the bottom of the range would put Quintana at a price to NAV ratio of 120%, which is inline with comparables DryShips and Diana, who analysts now widely consider substantially undervalued. Even so, a bottom-of-the-range pricing would still mean a 20% premium for the selling shareholders, assuming they bought the vessels at current market prices. But the important thing is that if Quintana can price within its stated range, it will be capturing a premium at the same time that it leaves something on the table for investors.

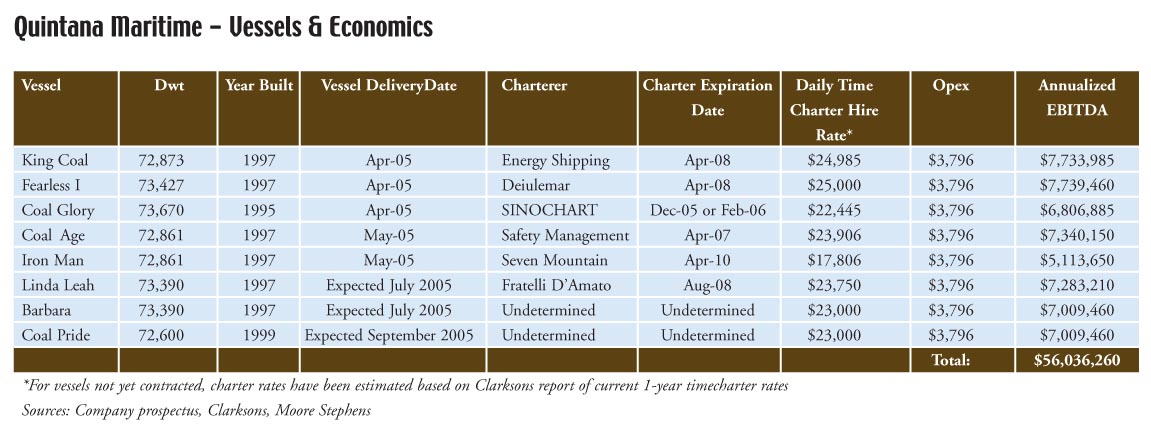

Added to a reasonable valuation is the allure of a reasonable dividend. The prospectus states that the company intends to pay out quarterly dividends at a rate of 65% of available cash less any cash reserves for capital expenditures, working capital and debt service. Making the assumption that another 15% of available cash will be used to fulfill such needs and based on annualized EBITDA of around $56 million and pricing at the midpoint of the anticipated range, this would translate into a dividend yield of around 8.1%. What’s more, we calculate the EBITDA number based on fixed contracts for the six vessels that Quintana already has in its possession. We have assumed market 1-year timecharter rates as reported by Clarksons for the remaining two vessels, which are very similar to the rates at which Quintana has contracted out several of its other vessels. These are of course vulnerable to be lower if markets deteriorate further, but, equally, if the market picks up by the time the ships are delivered there is hope for rate improvement.

After running these calculations, we took a look at a cashflow-based valuation. Nothing particularly out of the ordinary here. $56 million annualized EBITDA, as is better explained by Quintana Maritime – Vessels & Economics, and pricing at the midpoint of the stated range would translate to a Price to EBITDA ratio of 6.16x, which falls approximately inline with comparables, though is higher than the ill-fated Capital.

Although shipping deals are clearly coming to market at lower valuations, deals such as this one are still very good valuations for selling shareholders in light of where we are in the cycle. And with the bulk market poised for another rebound, transactions coming to market now with more reasonable terms offer real upside for investors and the issuers who still control the majority of the stock after the offering and will benefit from capital appreciation. The fact remains that for serious companies committed to going public, the window is still wide open.

Why Capital Maritime Pulled its IPO – What it Means

Evangelos Marinakis had the world of shipping and capital markets contemplating and strategizing after Capital Maritime’s decision to withdraw its 16.7 million share IPO during pricing on Monday night. Goldman led the deal while Bear Stearns and Jefferies played supporting roles as co-managers. With deals for Genco, Quintana, Wexford, and others confidentially filed by foreign issuers in the process of coming to market, Capital’s decision to pull has been a reality check for both issuers and underwriters that valuations are coming under increasing pressure with every new deal that comes to market, irrespective of the quality of the fleet and corporate structure.

Dissecting the Deal – Lessons Learned

Ironically, the factors that most influenced the pulling of this deal were determined before the company jumped on the first private jet out of Teterboro: the price range and the corporate structure. As we understand it, a solid group of blue chip institutional investors liked the Capital deal, especially in light of the fundamentals for the product tankers that Capital has on order. However, they became very focused on the price relative to the range.

Set the Range High and Negotiate Down

Unlike Eagle, which went to market at about 180% of net asset value and therefore had a lot of room to negotiate with investors, Capital was boxed in from the start. Goldman advised the company to put a very reasonable price on the cover of the red herring at $14-$16 (5.3x-5.8x EBITDA), hoping that investors would place enough market orders (which do not specify the price) to push the stock to the high end of the range or above it.

Unfortunately, since investors recently had their way with Aries, TBS and Eagle, they put in limit orders (which state a firm price) at $13 – or $2 below the range. The problem was that with a net asset value of about $15/share, Capital had little room to be negotiated down. This inflexibility was compounded by the fact that Evangelos Marinakis put his entire family fleet and management company into the public vehicle, making the impact of a dilutive deal even greater.

Don’t Offer Newbuildings If You Won’t Get Valuation Credit

Yield deals like Diana, Aries and Eagle were able to tap an investor community that focuses on valuations such as Price/EBITDA and dividend yield. However, Capital had much of its net worth in newbuilding contracts (which produce negative cash flow until the ships deliver) and therefore put the company squarely into the world of value – net asset value in this case – which allowed investors to feel they possessed the upper hand. This is not a new phenomenon; TEN has also struggled to have its fantastic newbuilding program assigned a fair value.

Keep It Simple

As superficial and shallow as it sounds, valuing the Capital fleet may have been more time consuming for investors than expected. As of June 3, 2005, the company’s existing fleet was comprised of 39 vessels of which twenty-six are product tankers, four are OBOs and nine are bulk carriers. In addition, Capital currently has 16 Ice Class 1A MR product tanker newbuildings on firm order, which are scheduled for delivery in January 2006 through November 2007. These tanker newbuildings have an aggregate carrying capacity of 665,500 deadweight tons and currently comprise the largest fleet of this type and size on order in the world. As sad as it sounds, valuing Capital’s fleet, which has a wide range of ages and types, may have required more of a commitment than the average value investor wanted to make.

Like many good deals, the sellers didn’t need the money, and indeed may have been disgusted by the way future partners valued the company after the efforts made to construct a first class investment opportunity. All in all, this was a good deal and it is a disappointment that it didn’t get completed. In the end, we think it is the investors who have lost out here. Although every deal seems to influence the next one, we do not think the pulling of this deal will have a major impact on future shipping IPOs – so long as issuers go into the market with reasonable expectations. The fact remains that at today’s high net asset values, issuing a minority interest in equity at even a slight premium is a very attractive proposition.

China Shipping Preparing for Bulk Spin-off

China Shipping Group is readying to spin off its bulk operations as a separate company on the Hong Kong Stock Exchange by the end of the year. One of the primary drivers of the company has been domestic coal shipments. FM understands that there are about 200 million tonnes shipped annually on Chinese waterways and China Shipping handles about half of these, primarily on the North South trades. Beijing has been trying to improve the water borne domestic cargo to take some pressure off the rails, which are choking on coal shipments and unable to handle the mountains of ore imports.

The bulk side of the business is partially contained inside of Hong Kong-listed China Shipping Development. The idea is to convert the identity of China Shipping Development into a wet-cargo focused China Shipping Tanker, while the new bulk company is to be called China Shipping Bulk. The company has 110 bulk carriers, with new tonnage mostly focused on the handymax sector, where it has acquired tonnage a competitive prices at Chinese shipyards.

The company was dedicated to the cabotage trades until 1997, when it was restructured to allow for the emergence of a second major Chinese fleet trading the international markets. It has tripled in tonnage size since Captain Li Kelin took over management. We understand that the IPO is mandated again to BNP Paribas Peregrine, last year’s IPO for China Shipping Container Line notwithstanding.

Indonesian Investors Give Warm Welcome to PT Arpeni Pratama

The equity bug doesn’t end in New York. And it doesn’t end in Norway either. PT Arpeni Pratama Ocean Line kicked into a $32 million initial public offering on Monday, selling 500 million shares at a price of Rp 625 per share in its listing on the Jakarta Stock Exchange.

In addition to the new shares, there will be an option for co-owner PT Mandiri Sanni Pratama to divest its 50 million shares for any over-allotments. If the option is fully exercised, the public would own 36.68%, while Mandiri Sanni’s stake would be diluted to 27.34%. APOL plans to use the funds both to repay debt to PT Bank DBS Indonesia and to add 14 additional vessels to its fleet in order to take advantage of the country’s new cabotage laws.

PT Mandiri Sekuritas and PT DBS Vickers Securities Indonesia are the lead underwriters of the IPO. While the issue priced near the bottom of the 600-1,200 rupiah range, it jumped a robust 12% in its first day of trading.

Bergesen Back to Oslo Stock Exchange

Worldwide Shipping has mandated UBS and Carnegie to manage the planned flotation of 50% of their LNG/LPG assets in a listing on the Oslo Stock Exchange. The company will own 20 LNG vessels and is expected to use the Teekay LNG Partners MLP structure. The new company is to be managed out of Norway by CEO Jan Haakon Pettersen.

Aker American Shipping Starts Roadshow

After a week of pre-marketing and U.S. government approval, managers DnB NOR Markets and Enskilda Securities yesterday started their roadshow to raise $100 million in a private placement for the Aker/Kværner affiliate Aker American Shipping, which will acquire the Kværner Philadelphia Shipyard and the 10 Veteran MT-46 class Jones Act product tankers they are building for a bareboat deal to OSG. The ships will cost around $1 billion altogether, and a long-term financing commitment has already been received from DnB NOR for the first five. Aker American is expected to file for a listing on the OSE in 3Q05 to be followed by a public offering and a secondary offering

With a great charterer, a great deal, Kjell Inge Røkke and Morten Arntzen, the investor meeting in Oslo yesterday removed any doubts that may have remained among investors, and the response was more than positive. Aker American has set the indicative price range at NOK 55-65, valuing the new company at $125-150 million.