Tanker Consolidation Spreads into Smaller Sizes

In the ocean shipping industry, there is a theory that consolidation moves from the largest size vessels to the smallest ones because of the capital required to reach commercial, technical and regulatory critical mass.

Starting in the late 1990s, we saw numerous transactions involving VLCCs with fleets such as N+T, Argonaut, Osprey and Golden Ocean changing hands in a relatively short period of time. In the intervening years came major ownership consolidation in the suezmax, aframax, panamax and even MR sizes when ambitious owners like Frontline, OMI, Teekay, Torm, OSG and others picked their market sectors of choice and began rolling up individual ships and entire companies.

The theory of trickle down appears to be holding true, and 2006 marks the year that ownership consolidation has officially moved into the realm of ships in the sub-25,000 dwt size category that carry chemicals and petroleum products. Continue Reading

U.S. EXPORT-IMPORT BANK FINANCING FOR DRILLING EQUIPMENT

Shipowners around the world have long used export credit agencies (“ECAs”) of various countries to aid in financing vessels constructed in those countries. ECAs have also been used to finance major vessel components exported to be incorporated in vessels constructed in other countries. Of course, the United States has its own export credit agency, the Export-Import Bank of the United States (“Ex-Im Bank”). Although Ex-Im Bank has always had the ability to finance the export of ships and drilling rigs, historically, the U.S. Maritime Administration (“MarAd”) was more active in this financing through its Title XI program. That program, now seldom used for a variety of reasons, provides financing for vessels constructed in the United States. Although originally restricted to U.S. flagged vessels, the United States made a valiant effort in the mid- 1990s to export the Title XI program. In 1994, the statute was amended to permit MarAd to finance U.S.-constructed vessels for export. At that time, Title XI was attractive for its very long maturities: up to 20 years for tankers and 25 years for dry cargo ships. The effort created the opportunity to build the so-called double eagle tankers at Newport News, which are part of today’s Seacor fleet. Eventually, Newport News proved unable to construct the vessels at a profit and withdrew from the business of building commercial ships. Other shipyards were unable to seize this opportunity since they could not produce suitable ships for the international markets at cost-effective prices. Unfortunately, no company in the United States dominates the oceans the way Boeing dominates, or at least competes effectively, in the skies. Continue Reading

Accounting for Profit Share Arrangements in Charter Parties

By David Anstis, Shipping Partner, Moore Stephens London

Traditionally charter parties have split into time charters, voyage charters and bareboat charters. There may have been variations on each but essentially they were of these three basic types. Which type the owner entered into would depend upon what his customers wanted and what risk profile he wanted to have – did he want the steady, known income of a time charter or the less certain but potentially more lucrative voyage charters? Increasingly, especially where complex leasing finance structures are involved, we are seeing a number of cases where these traditional boundaries are being blurred, creating risk-sharing charters that contain profitrelated elements. How do the owner and charterer agree on the varying income and then account for it?A common form is where a time charter contains an element whereby the owner can share in the potential upside of a voyage charter. He might accept a lower time charter rate in exchange for a share of the voyage profits – he gets a steady income but can benefit from upswings in the market that might not have been evident when he entered his 3-year time charter. As well as the normal clauses covering daily rates, offhire etc provision is made in the time charter for the owner to share in the trading results of the vessel. Continue Reading

Tidbits from TAL – A Potentially Relevant Business Model

By George Weltman

Being the new kid on the block, I thought I would take a chance and try to expand our space, in investment banking parlance, beyond just ship finance into closely related activities. Although I have spent most of my career in ship finance, most recently I have been involved in container and port financing. Taking advantage of old friendships (in the interest of full disclosure, it did cost me lunch), I had the opportunity to sit down with Brian Sondey, President and CEO, and Adrian Dunner, Vice President of Fleet Operations, of TAL International Group, Inc (“TAL”), currently the one of the world’s largest container operating lessors. The conversation was wide-ranging, and I struggled on how to write a coherent article. But as I thought about it, each piece was an informative nugget that had a useful lesson and which might have meaning to our readers. In short, I cheated but here goes. Continue Reading

The New UK Leasing Regime

Since December 2004, the UK tax authorities (“HMRC”) have been reviewing the tax treatment of lessors in relation to leases of plant and machinery – including ships. The expressed aim of the reform was to harmonise the accounting and tax treatment of leasing transactions by awarding UK tax depreciation (capital allow-ances) to the economic owner of the asset and taxing the “lender” under a finance lease on its interest return only. However, as a sub-text, there were concerns that the former UK regime breached the requirements of the European Union “freedoms”, in that capital allowances were limited or prohibited if the lessee did not carry on activities which were taxable in the UK, thus treating UK taxpayers more favourably than persons based in other EU member states, something generally prohibited under the rules of the EU.

The review is now complete, and the legislation introducing the new regime was enacted on 19 July 2006 and has taken effect, although subject to a complex set of transitional provisions. The end result is that whilst capital allowances are now available to a UK lessor in a more restricted range of transactions, the class of potential lessees is greatly widened, as the UK’s notorious “overseas leasing” rules have been abolished. In addition, capital allowances can now be available in the UK to a person who has no ownership interest in the asset. Non-UK residents can now access the UK lease market without needing to establish a UK place of business, and UK lessors can lease to non-residents without suffering a penal tax regime, under which they were taxed on gross rents but with no tax relief for the cost of the asset. This is good news in an environment where the number of tax-favoured financing structures available internationally is diminishing. Continue Reading

Ireland – More than Guinness for the Ship Owner and Financier

Cross Border Asset Financing

Leasing From the Singapore Public

In its effort to tap into the ship financing sector, driven by an estimated $300 billion worth of financing for newbuildings and acquisition, the Maritime and Port Authority of Singapore (MPA) instituted a generous Maritime Finance Incentive (MFI) scheme. Possibly the most important feature of this scheme is the tax exemption on qualifying income for the entire life of any vessel acquired by an Approved Ship Investment Vehicle (ASIV) within its incentive period. In addition, for Appoved Ship Investment Managers (ASIM) the corporate tax rate is reduced from 20% to 10% The intention was to increase the attractiveness of such investments to potential investors and spur ship investment management companies to set up such investments in Singapore.The target audience for the MFI scheme are ship leasing companies, shipping funds or shipping business trusts that provide financing for all types of vessels, with tax exemptions on qualifying income derived by ASIVs from ship leasing activities to non-tax residents of Singapore, the leasing of vessels registered with the Singapore Registry of Ships, and the leasing of foreign-flagged vessels operated by companies under the Approved International Shipping Enterprise Scheme.

Needless to say, such incentives combined with Singapore’s business friendly infrastructure and reasonably developed capital markets and investment community make the tiny island-state an equity-sourcing venue well worth considering. Sensing the auspicious environment of the area, such intentions of the government there were certainly not lost on Philip Clausius, who in the past year moved the headquarters of First Ship Lease from New York to Singapore. We at Marine Money like to think we also are keeping pace, having set up our Singapore office this past winter. Continue Reading

Who’s Who and What’s What in Leasing

In putting together this issue and, in particular, this section on leasing, it became apparent that leasing means so many different things to both the suppliers and consumers of this financial product that a roadmap might be useful. After talking to various industry participants, we thought a chart that outlined the basic parameters that the lessor world looks at would provide a helpful means for distinguishing the various offerings of the suppliers. The standard criteria were easy and included lease type, transaction size, term, employment and vessel type and age. Credit criteria was a critical element that needed definition as the 100% financing that leasing provides generally lends itself to only rather strong credits, whether directly through the lessee or indirectly through a chartering structure. Also from the standpoint of an indemnity, a strong credit is also desirable when financing tankers. We also looked at the various risks, including currency, tax and interest rates, to see how they would be handled. The beginning and end of the lease were also considered. Is construction financing available and at the end are purchase options available? Finally, we asked for information on deal volume done to give the consumers an idea of the level of experience of each of the providers. We then develstrucoped a questionnaire based upon these criteria and sent it to those institutions that indicated in the 2006 issue of the “Marine Money Official Guide to Marine Finance Providers” they provide or arrange lease financing. What follows is a compendium of the replies we received. The majority of the responses were complete and detailed while others were less so. Interestingly, a number of institutions declined to answer as they felt they did not want to publicize their activities.A review of the responses elicited the following broad generalizations but we encourage each potential lessee to review all of the lessor’s offerings carefully and then contact them: Continue Reading

Why Lease?

By George Weltman

As part of this special issue on alternative sources of equity, we thought it appropriate to bring up that old stand-by – leasing. In the simplest accounting definition, a lease is the contract under which property is rented. The owner of the property, the lessor, grants a lease to a person, the lessee, who secures the right to possess and use the property. The forms of leases are multitudinous with structural variations to cover almost any customer need. However, at the macro level there are basically two generic types: finance leases and operating leases. Before we get into specifics, we need to stress that in many cases and depending on who is using them, leasing terms are at times interchangeable. For the moment, we will ignore the tax and accounting definitions and treatment and focus instead on the nature of the transaction. The main difference is simply whether the lease is being used as a financing vehicle or just a form of rental agreement. Continue Reading

A Private Equity Success

By Jim Lawrence

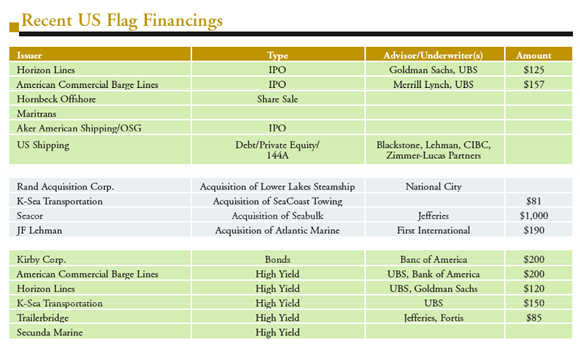

The US energy transportation segment is a fragmented community with tank ships owned by the likes of OSG and Seacor at the one end and small barge companies serving local energy distribution needs at the other end. In between companies like Bouchard, Maritrans, Penn, Moran, K-Sea and others serve the thirsts of fairly large communities. Many in the mid to small size range are still private family businesses, but financing fleet replacement and modernization appears no problem. Is the K-Sea MBO model likely to be replicated, or was it just one of those special moments in time? Continue Reading