Marine Money Dubai: One slide is enough

On the whole, the faces were smiling at the Marine Money Gulf conference on 8th March at the Grand Hyatt in Dubai. Not that shipping’s problems are a thing of the past. Far from it, there are critical issues still to be overcome. But the banks and the owners are still here, still in business and still determined to get to the light, that appears to be getting just that bit brighter at the end of the tunnel.

Continue Reading

Norway Awakens

Although there remain strong expectations for strong growth in the Norwegian bond market, in fact, issuance is down on a year-to-year comparison thus far, although high yield makes up a goodly portion of what has been issued.

Despite the lull, this week STX Europe AS, one of the world’s largest shipbuilders with 15 shipyards located in Norway, Finland, France, Romania, Brazil and Vietnam went to market. The group’s activities are niche focused and concentrated around cruise & ferries, and offshore & specialized vessels. STX Europe is wholly owned by STX Norway AS and is now a private company majority controlled by the Korean STX Group.

Continue Reading

It’s Not All About Equity

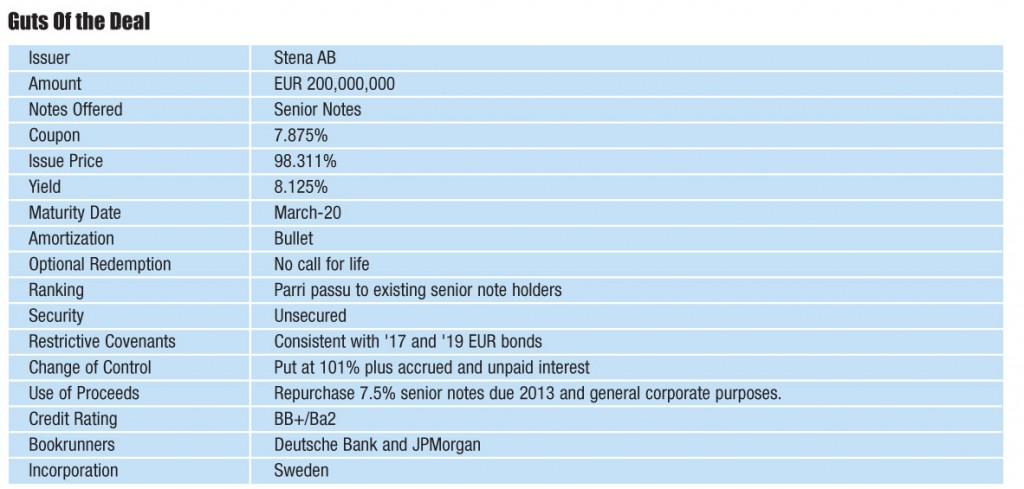

This week, Stena AB, a family owned company with diversified interests in international passenger and freight services, drilling rigs, Roll-on/Roll-off vessels, and crude oil and product tankers, issued privately EUR 200 million in 7.875% senior notes due in 2020. With its strong credit and regular presence in the bond market, Stena was able to access the capital markets as soon as a market window presented itself. The original deal was upsized from EUR 150 million to EUR 200 million due to strong appetite. The bond was priced to yield 8.125%, a 10 bps premium to the pre-announcement level of the existing 2019 bonds and was placed with a mixture of traditional high yield investors, together with some crossover accounts. Further details on the transaction are shown in the Guts of the Deal.

The bookrunners on the transaction were Deutsche Bank, for the third consecutive issuance, and JPMorgan.

Other News from the Street

The Baltic Trading IPO successfully launched and priced at $14/share, which was at the low end of expectations, but still within range, which is the first time that has occurred since January according to the WSJ. The shares traded flat on the first day of trading. Total proceeds raised, exclusive of the over-allotment was $228.2 million. We understand that the issue was well oversubscribed with both good retail and institutional interest. Reflecting a continuing belief in the China story and the benefits of being more market-levered, investment banks were swapping people out of Drys and Eagle into BALT. Peter G now serves as Chairman of four publicly traded entities, clearly deserving an entry in the Guinness Book of World Records.

Less inspiring was the news that Marinakis’ Crude Carriers Corp. offering appears to be struggling.

Memories and a Miscalculation

The Good News

We wonder whether in preparing his keynote address for our Hamburg conference entitled Memories, a view of what happened to and where the industry is heading, Mr. Arntzen had a memory of his own and thought, “Wasn’t there a time when OSG accessed the capital markets?” Seizing on the thought and the opportunity, Mr. Arntzen jumped on the Lexington Avenue Express and headed down to Wall Street to arrange a follow-on offering of OSG’s shares. Given the high repute and credit standing of his company, Mr. Arntzen knew the investment banks were hungry and would compete heavily for his deal. There was no need for an overnight or marketed transaction so he simply arranged an auction among the banks (more than 5 but less than 10) for 3.5 million of OSG shares.

Continue Reading

Corporate Machinations

Last week, DHT Maritime Inc. (“DHT”) reorganized itself into a new holding company structure in order to provide the DHT business greater flexibility to grow and access capital. Through a series of transactions, the shareholders’ interests in DHT were transferred to DHT Holdings Inc., which becomes the successor issuer, according to SEC regulations with DHT as its wholly owned subsidiary. The new company holds all of the voting and economic interests of DHT and the existing fleet will continue to be owned by DHT. The shareholders received one share of DHT Holdings for each share of DHT it held and it is now the Holdings shares which trade on the NYSE using the original symbol. Finally, the directors and management of DHT assumed the same positions at DHT Holdings. While this appears on the surface to be mere paper shuffling, in fact, it was a significant and brilliant step to achieving operational freedom.

Continue Reading

Shareholder Activism

Last December, we wrote about MMI Investments L.P.’s investment in DHT Maritime. At that time this activist shareholder had purchased approximately 3.95 million shares, representing approximately 8.1% of the outstanding shares for $15.6 million. At the conclusion of our article, we presciently suggested that the company should soon expect a call. This week, with its ownership stake increased to 4.325 million shares now representing 8.9%, MMI fired its broadside.

We have always believed that criticism should always welcome as long as it is given constructively and thoughtfully. Second-guessing from the cheap seats in our estimation is at best unproductive and at worst detrimental to the party it is directed at. In this light, we believe in the role played by shareholder activists, but often wish it were directed in a positive constructive manner in the long-term interests of the shareholders as opposed to an attempt to hike the share price for a quick and profitable exit. We cannot paint all activists with the same brush but do distinguish a Calpers from a Carl Icahn. And in the same vain, there is both good and bad management, necessitating a role for these activists. For the moment, we will withhold our judgment of MMI but their first run at DHT leaves us decidedly unimpressed.

Continue Reading

A Scent of Spring

Ever proactive, as one must be these days, Ole Hjertaker and the Ship Finance team recently tackled the refinancing of its syndicated loan related to the 26 vessels on charter to Frontline. The timing was propitious as the loan matures in February 2011 meaning that the outstanding amount would become a current liability as of this month. Although it had received underwritten offers, Ship Finance chose to go directly to its lenders. This gave them the opportunity to not only meet directly with all 30 of its active banks and, in particular the credit people who have the final say, as well as avoid the premium associated with an underwritten transaction.

Continue Reading

Here Come the IPOs

This week two IPOs, one dry and one wet, hit the road with well-known sponsors. First was the Genco inspired BDI play, Baltic Trading Limited, which was followed by Mr. Marinakis’, of Capital Products Partners fame, large tanker vehicle, Crude Carriers Corp. These followed quickly on the heels of the recent Scorpio offering.

BDI Proxy

This was one of the first opportunities we had to watch a road show presentation on the great equalizer, “RetailRoadshow” (http://www.retailroadshow.com/index.asp), a website designed to put retail investors on a level playing field with the institutions. The presentation of Baltic Trading Limited was expertly handled, as one would expect, by Peter G. and John Wobensmith, who will respectively fill the positions of Chairman and President of the new company.

Continue Reading

In Conversation With DVB

CEO of DVB Bank, Mr Wolfgang Driese and Member of the Board of DVB Bank and Head of Shipping Division, Mr Dagfinn Lunde were in Singapore last month and we were very happy to have the opportunity to spend some time with the two affable gentlemen, who shared with us their take on the turmoil that the shipping industry has been through.

Mr Driese is credited with transforming DVB from an unknown generalist domestic German bank into a global player with a specialisation in international transport finance, staying true to its name Deutsche VerkehrsBank AG. Mr Lunde carried out a successful reorganisation of DVB’s shipping division in January 2008, and “sectorised” the previous regional sales team into ten groups focusing on key shipping sectors: Container Box Group, Cruise & Ferry Group, Crude Oil & LNG Tanker Group, Chemical & LPG Tanker Group, Container Vessel Group, Dry Bulk Group, Floating Production Group, Offshore Drilling Group, Offshore Support Group and Product Tanker Group. Ship financing now makes up a substantial chunk of 54.2% in DVB’s lending portfolio, with a total value of USD 13.88 billion as at 30 September 2009. Continue Reading