Competitive Financing Opportunities Emerge in Italy

Editor’s Note: As the market for Italian ship finance becomes increasingly important, we spoke with Efibanca, the first Italian shipping investment bank, to learn more about its impression of the modern Italian ship finance industry, its aspirations, and its new shipping and logistics fund.

Q. – What is the relationship like between banks and shipowners in Italy, and there is a shift in the style of banking as the younger shipowning generation enters the market?

A. – Due to the particularity and the complexity of the industry, the relationships between banks and Italian shipowners are based, more than in other industries, on personal and mutual trust, – Fabrizio Vettosi Head of M&A Advisory of Efibanca says: ” my best friends are also my best clients ” – especially for the new generations of shipowners. They are more “smart” and many of them graduated from primary business school or have an MBA, and thus the approach is changing because many of the “young” shipowners are much more demanding in terms of more sophisticated and structured financial services (structured and tailor made loans, mezzanine, IPOs, private equity, etc.).

Q. – What do modern Italian shipowners require from their banks? Continue Reading

The Turkish Shipping Miracle

Shipping as an industry has been booming over the past three years. Who would have expected that China’s entry into the WTO and Beijing’s winning bid for the 2008 Olympic Games would have been the stimulus for these golden years for shipping? Not only this, it has coincided with a period of historically low interest rates and a deluge of liquidity in the world’s financial markets. Put together a surge in demand for raw materials and energy and cheap money and that spells jackpot for ship-owners.

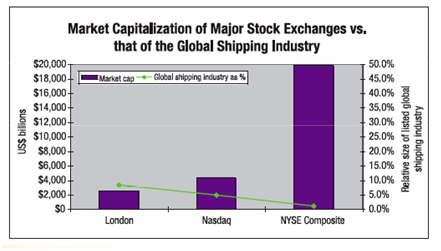

Additionally the amount and types of financial structures available to ship-owners has grown substantially. As has the number of finance providers. Bank debt, always the cornerstone of shipping finance, is more abundant than ever and pricing and terms have been squeezed as transaction sizes increase and credit quality improves, particularly in respect of vessel ages and corporate structures. In some markets, Greece in particular comes to mind, many larger owners, and smaller owners who wanted to expand rapidly, have been lured by the capital markets. A number of shipping companies listed on the NASDAQ and NYSE from end 2004 and through 2006. Companies were able to price at a premium, even to the already high asset values, and there was plenty appetite from shipping investors. Shipping listings were also successfully completed in London, Singapore and last year in Dubai. Other structures also became prevalent with German KG and Norwegian KS structures (similar structures which are in essence tax breaks to high net worth individuals investing in shipping) enabling ship owners to do off-balance sheet structures involving the exclusive use of vessels without ownership obligations. Continue Reading

Coverage Galore – Financial Analysts’ Ship Comes In

By Jim Lawrence

Independent research only shops have opened as well. Helane Becker, one of the great airline research analysts of the mid-1980s, is now covering shipping at The Benchmark Company. Continue Reading

Scrutinizing Salaries

By Ben Padilla

The change in SEC rules come in the spirit of simply providing investors with more information, in this case clear and complete information about executive pay, at the time of making an investment decision.

The change in SEC rules come in the spirit of simply providing investors with more information, in this case clear and complete information about executive pay, at the time of making an investment decision.

Not surprisingly, some people are always willing to take things one step further. Marine Money recently spoke with Congressman Barney Frank’s office, D-Mass., chair of the House Committee on Financial Services, and was told that the Congressman from Massachusetts will be holding hearings with regards to proposing legislation that would allow shareholders to vote on executive pay packages. Judging from a recent interview in Forbes magazine, Congressman Frank seems to be motivated by the macroeconomic effect large compensation packages might have and the growing “inequality in society as a whole.”

There are those who side with the Congressman and believe that a non-binding shareholder vote on executive pay will hold public companies more accountable in the sense that the threat of public censure by the stockholders would limit executive pay packages and at the very least increase communication between the Board of Directors and the shareholders. An interesting point…however, let’s keep in mind that the SEC has changed its policy and is already forcing companies to release all details on executive pay. Continue Reading

Bottom of the Barrel – The Bunker Business

In the interests of expanding our knowledge of the industry, we thought we would take a closer look into the bottom of the barrel to understand the bunker business by providing some background, courtesy of Beth Wilson-Jordan and an invaluable text, Neil Cockett on Bunkers, and then put these abstractions into context by viewing Aegean Marine Petroleum Network Inc. (“AMP”) as an investment opportunity.

Bunkers 101 Bunkers – The What?

Produced from oil fields, petroleum crude oil is processed in a refinery that manufactures oil products, any one of which is referred to generically as an oil fuel. The two main oil fuels that the bunker industry utilizes are residual fuel oils, which as the name suggests are residues of the crude oil refining process, and distillates. The former accounts for roughly 85% of the total bunker fuel off take while the latter, which is more specifically categorized as marine gas oil or marine diesel oil, makes up the balance. As the latter are used to power the main engines of small vessels, our primary focus will be on residual oil, which has been the principal source of power at sea for 50 years.

Residual oil is the heaviest viscosity oil fraction of a refinery. Viscosity is a measure of a liquid’s internal resistance to flow at 50 degrees Celsius and is measured in centistokes or cSt. Its viscosity will depend on the refiner and the grade of oil being processed and may vary depending on the refinery, the port and time. Residual oil can be used as is, in which case it is known as “bunker C” and is often referred to as heavy fuel oil or No. 6 oil. Alternatively, the fuel oil can be blended to the viscosity needed by “cutting back” with distillate oils or cutter stock. Blended fuels are known as intermediate fuel oils. The majority of commercial marine vessels use marine fuel oil (IFO) with viscosity ranging between 180 cSt, 380 cSt and 500 cSt with the most common being 380 cSt. Continue Reading

Market Commentary – 03/29/2007

“Invest in Shipping”

Thanks to Capital Link and Fortis Bank, investors were treated last Friday to presentations from a myriad of publicly traded shipping companies covering the container, gas, tanker and dry bulk segments. Adding insights to the company presentations were the equity analysts and brokers together with a lunch presentation by Guy Verberne of Fortis on Shipping and the Global Economy Today.

Some of the more interesting take-aways for us included the following:

Mr. Pittas of Euroseas, Dr. Coustas of Danaos and Mr. Molaris of Quintana all had interesting comments on ship management. Mr. Pittas believes an affiliated ship manager cares more about your vessels than a fee-based third party manager. Dr. Coustas spoke about his company’s policy of separating ownership from management. Not only does this provide better control of costs but also limits liability. As an example of the latter, Dr. Coustas pointed out that if OSG had an affiliated rather than an in-house manager, the responsibility for the pollution incident would have stopped legally (but perhaps not ethically) with the manager. Finally Mr. Molaris spoke in terms of the impact on G&A expense of the in-house management. He reiterated the benefits of an affiliate including a vested interest and the separation of risk versus a third party, which has no vested interest in the vessels. Naturally no one spoke about the inherent potential conflicts of interest resulting from using an affiliate, which is a significant concern in the public markets that demand transparency. Continue Reading

Company News – 03/29/2007

Svithoid Tankers AB “Tap” Issue

Last week, Nordea Bank announced the issuance of a tap or second tranche (NOK 25 million) of the Svithoid Tankers June 2009 bond issue. Nicolai Friis, who led the origination, described the “tap” as a means of quickly and efficiently raising additional capital in the high yield market. A tap issue is when an already existing bond is enlarged. In this case, Svithoid, with the help of Nordea raised the amount of the original bond, which had a borrowing limit of NOK 200 million, by NOK 25 million to NOK 175 million in total. With an existing loan agreement and the trustee already in place, all that was needed was a one-page addendum. A description of the key features of the transaction is included in the Guts of the Deal.

Svithoid Tankers is a Swedish shipping company which focuses on smaller modern product and chemical markets that operate in Northern Europe within the two sub-markets of 1,800 to 5,000 DWT (Northern European coastal tankers) and 5,000 to 10,000 DWT (distribution of petroleum products in the Baltic region). At present, the fleet consists of seven vessels in regular service and seven newbuildings with expected delivery during 2007 and 2008. All the vessels, including the newbuildings, are employed on long-term contracts, typically averaging five years, to industrial customers.

A classic start-up, the company began operations in the 4th quarter of 2005 and has since expanded gradually as it takes delivery of additional newbuildings. Continue Reading

People & Places – 03/22/2007

CMA Shipping 2007 Draws Maritime Industry to Stamford

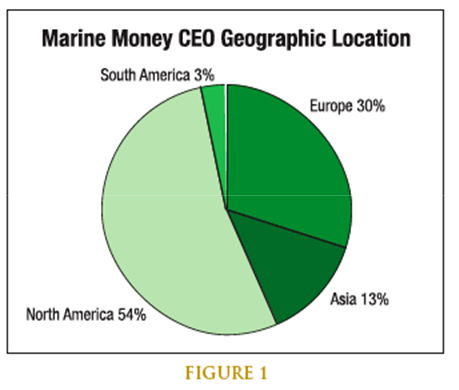

This third week is an incredibly exciting one near Marine Money’s headquarters in Stamford, Connecticut. It is the one time all year when the nexus of the global maritime industry shifts for three days to our very own neighborhood. More than 1600 participants hailed from around the world for three days of vibrant discussions competing with friendly vendors and an incredible array of lunches, dinners, and cocktail parties. Continue Reading