People & Places – 04/12/2007

Turkish Delight

With a record audience of 250 including an influential Member of Parliament, shipowners, financiers, and professionals from around the world, Metin Kalkavan, Chairman of the Executive Committee of the Turkish Chamber of Shipping opened marine Money’s 4th annual Istanbul Ship Finance Forum with an inspiring report on the dramatic growth and health of the Turkish shipping scene.

The Minister of Transport and the Undersecretary of Maritime Affairs, while regretting they could not attend, sent five Deputies.

With an ebullient shipping market generally and a steady stream of vessels transiting the Bosporus outside the conference venue, it would be hard to have been more dramatic than the newbuilding statistics Mr Kalkavan delivered to the audience. Forty-five days ago the Turkish shipyard orderbook stood at 423 vessels. Today not even two months later that order book stands at 528! Ninety-one come from foreign owners, 215 from Turkish owners alone, with a further 222 speculative orders, which enable yard construction regularity and may be sold or operated. Two hundred twenty-seven are tankers, and the total value reaches seven billion dollars. Continue Reading

Bank Debt – 04/12/2007

Risk Indicator?

Everyone who studies markets has a favorite indicator of market direction or risk. Based upon a recent loan syndication, we may have a new one. It is our understanding that AIG Commercial Equipment Finance Inc. (“AIG”) went up-market and participated in the Fortis-run $770 million Senior Secured Credit Facility for Aker American Shipping to the tune of $50 million. This facility provided the permanent financing for the company’s ownership of the first ten vessels, which are bareboat chartered to OSG and then long-term sub-chartered to major oil companies for use in the Jones Act trade. Based upon the OSG bareboats, we also understand that pricing was in the range of LIBOR + 150 bps which was then swapped out. Continue Reading

Equity – 04/12/2007

New Kid (but Experienced Parents) on the Block

Last week, GE Transportation Finance (“GE”) and Peter Dohle Schiffahrts – KG (“Peter Dohle”), one of the leading non-liner containership owners in the world, announced the formation of a joint venture to acquire and charter container vessels. This venture is the successful fruition of two years of study by GE to determine how to grow the transportation business. As a consequence of its size and the competitive marketplace, organic growth was difficult and acquisitions pricey. The focus on the containership segment probably had some roots in the container leasing business acquired from Transamerica a few years ago and was given further impetus as a consequence of a successful equity investment in containerships in the recent past. Finally and most importantly, GE knows and is comfortable with the operating lease business model being at the forefront of the airline, railcar and container leasing businesses. This is a replication of that model. Continue Reading

Bonds – 04/12/2007

Last Call – 2007 Marine Money Shipping Banker Survey

Many thanks to all who have responded – so far this year we’ve had a record response and some brilliant commentary. The survey closes at the end of this week, so if you’re a shipping banker and have had time yet, please go to http://www.surveymonkey.com/s.asp?u=124673616644 and fill out the brief, anonymous, multiple choice survey – or just leave your comments. Thank you as always for your support! Continue Reading

Market Commentary – 04/05/2007

Yet Another Perspective…..

In discussing the Capital Product Partners deal with various analysts last week, it was pointed out that investors were in effect buying a BP/Morgan Stanley bond with very attractive pricing given the investment grade counter parties. We thought this was pretty perceptive given the average charter term of 6.3 years with a 7% yield at the offering price. However unlike a bond there is operating risk as well as some perceived but unlikely counter party risk, as the obligors under the charters are not likely to be the corporate parents themselves. Given the belief that the investment grade ratings of the parents passes through, these units were priced on the basis of providing a high current return, without giving consideration to the additional potential yield available under profit sharing arrangements. It is no surprise, therefore that the units priced at $21.50, above the high end of the proposed range, and traded up to $26.75 on the first day of trading. Given the current yield of the Teekay MLPs, perhaps the closest comparable, at 5%, there is more room to go. The risk here is that the new vessels be accretive and maintain the yield. Continue Reading

Bonds – 04/05/2007

Odfjell Re-finances

Briefly, Odfjell ASA is one of the key companies involved in the global market of transporting chemicals and other specialty bulk liquids as well as providing other logistical services. The company owns and operates a specialized parcel tanker fleet that consists of 123 ships and newbuildings with a total capacity of about 3.4 million dwt. In addition, Odfjell owns a network of tank terminals. Continue Reading

Equity – 04/05/2007

Calling All Shipping Bankers

Spring has sprung at our North American headquarters, and that means that it’s time for our annual Marine Money Banker Survey. If you are a shipping banker of any description, we ask that you take just a few minutes and go to http://www.surveymonkey.com/s.asp?u=124673616644 to take our brief, completely anonymous, multiple choice survey.

You may answer as many or as few questions as you like. All results will be collected on Friday, April 13 and published in the May 2007 issue of Marine Money magazine.

Ultrapetrol – Worth the Wait

Lately we’ve seen shipping companies and their private equity backers alike proving that apparent rejection or unsatisfactory price levels at the outset of an IPO can really be a sign of future opportunity – for investors as well as sponsors. For Marinakis’ Capital Product Partners, this opportunity would come through walking away from poor pricing and returning with a more structured deal that put cash flow in an attractive package for investors while selling only a small portion of his overall business. For the Menendez family and the AIG-GE Capital Latin American Infrastructure Fund in Ultrapetrol, the answer came in persevering through extended delays and ultimately below range pricing in order to get an IPO done. Ultrapetrol originally filed its F-1 in March of 2006 – signifying the deal was ready to go – but had to wait until September to approach investors with its price range of $13-$16, only to ultimately price in October at $11, or 15% below the bottom of the target range. Continue Reading

Changing Ship Finance Landscape in Japan

By Rodricks Wong

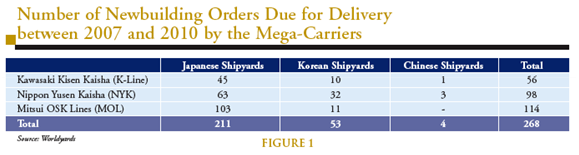

We estimate the funding requirements of these mega carriers to be about $16 billion, and half of this financing will be borne by the mega carriers themselves. This leaves other shipowners, foreign and local, a financing need of $8 billion. The large appetite for financing due to the mega carriers’ massive fleet expansion plans will have a significant impact on the Japanese ship financing landscape as we begin to question the ability of the Japanese banks to provide this huge amount of funds needed in the coming years. Already, MOL has highlighted their concerns regarding the sustainability of the Shikoku shipowners, many whom they charter in their vessels from, in securing cheap financing for their vessels from their banks after year 2010.And if we tally up our figures to include orders placed by other Japanese shipowners and operators at the Japanese yards, we see in Figure 2 an amazing cumulative orderbook of 495 vessels scheduled to be delivered from 2007 till 2010. The real size of the orderbook is expected to be even larger given that supply side statistics in shipbuilding are well known to be patchy. Continue Reading