SMBC – Like a Phoenix from the Ashes

By Rodricks Wong

Tough times remain for the shipping financiers in Asia. Although companies in Asia tend to reply on bank borrowings to raise capital, the global liquidity glut especially in this region has not only intensified competition among the usual players but has also attracted new entrants to the ship finance arena particularly in debt financing amid the current buoyant shipping market. Margins have been going down the slope and in order to stay on top of the game, banks are on their toes and rethinking their strategies.

To increase their profit margins, some banks choose to focus on the emerging markets and do businesses with lesser-known clients. Others set sights on top tier shipping companies, working hard to come up with products tailored to their needs while identifying cross selling opportunities. Some are all out to underbid their competitors to build brand awareness and increase market share. Others are simply out of the market, waiting for the conditions to improve. Continue Reading

Norwegian High Yield – A Cheap Bridge

By George Weltman

As of late, reports on the Norwegian High Yield Bond market have filled the pages of our publications. This is only natural as this market provides capital with flexible terms at competitive rates. It has become the market of choice for the Scandinavian offshore industry, particularly for newer ventures. And shipowners, including one foreign issuer, have also seen the opportunity. Looking at the tenors and the bullet amortizations of these transactions, it appears that borrowers are using them mainly as bridge financing or, alternatively, as a way of playing the yield curve. On the buy side, European hedge funds have been major purchasers attracted by the yields as well as the possibilities offered by the carry trade. Fortunately, Nordea Markets prepared an excellent presentation on the current state of the market from which the following is derived. We have largely used the data and information supplied by Nordea and inserted some of our own thoughts and opinions that naturally are solely ours.

Morten Heiner Pedersen, writing on the credit markets, saw that, during this period, demand for credit remained intact despite the repercussions from the sub-prime concerns here in the United States. It is a very strange market with some issuers giving concessions on spreads while others were renegotiating lower spreads due to strong demand for leveraged loans and others were issuing “cov lite” loans. Nevertheless the correction was much smaller than occurred with the GM downgrade in May 2005 and high yield has surprised positively with the CCC segment relatively unaffected. Although there were only minor changes in the curves steepness, indicating a longer term view of credit spreads remaining unchanged, Mr. Pedersen believes the crisis in the US housing market will continue to affect markets by prolonging the housing downturn. Continue Reading

The Lending Scene in Hong Kong

By Rodricks Wong

In the midst of all the excitement surrounding the global equity markets and assorted alternative financing instruments, it is easy for us to overlook the predominant role debt finance plays in the shipping industry, particularly in Asia. The shipping players in these highly fragmented markets are predominantly the small and medium size private owners who rely mostly on bilateral loans for their funding needs.

As the leading financial hub with close proximity to the major global shipping players China, Japan and Korea, Hong Kong is home to many financial institutions involved in shipping. It is hardly surprising that most syndicated and club deals in the Asia-Pacific region are executed out from Hong Kong. With this in mind, Marine Money Asia visits this vibrant city to take market temperature of the lending scene over there. Continue Reading

What makes a successful banker?

Enough talk about basis points and amortization periods and what makes for a successful firm. Now we turn to a few minutes to the characteristics that make a successful shipping banker.

The shipping banker, needless to say, is a unique breed of human being with striking tendencies that are displayed across countries of origin. Well he or she might share such characteristics. But what is the typical banker like – does it matter whether they are born a Leo or a Gemini? Do they adapt their eating and exercise habits to the market? How much vacation does a shipping banker take and what does that banker like to do with the free time?

Each year we ask these questions but in the crunch of publishing deadlines the answers are rarely addressed, seeming less relevant to the business of ship finance than other more pressing matters. But this year, while we will refrain from psychoanalyzing the common traits, we at least present the data so you can see what your bankers or your competitors do with their free time – and how comfortable they were on that NY to London flight. It’s also a people business, so needless to say it’s important what people do, what they have in common, and how they differ. But enough said. We walk only briefly through the accompanying figures and leave you to view the results on your own. Continue Reading

Going the Way of Dinosaurs?

By George Weltman

This clearly is an exaggeration; however the juxtaposition of recent news raises interesting questions about the role of lending these days and where it may be going. Please bear with us as we go through the litany of reports that hopefully will provide some clues.

First, Deutsche Bank’s maritime division reported net income of EUR 51 million, a decline of EUR 2 million from that reported last year. It was the first time in a long while that the bank reported a profit decline in shipping. The reduction in profitability was attributed to pricing pressures resulting from intense competition as well as the bank’s strategy to focus on top tier owners who require razor thin pricing. Nevertheless even with the reduced nominal profit, the ship lending activity met the bank’s minimum pre-tax ROE target of 25%.

Reflecting this evolving market, the company’s executives downplayed the performance in light of the bank’s strategy to crosssell other more profitable products to shipowners beyond mortgages, which get the client in the door. Although the associated revenue may not appear in the shipping division’s books it benefits the bank as a whole and is clearly identifiable with the lending activity. There is nothing new in this trend, which was not a well kept secret, but simply unspoken. Nor had it ever been an avowed strategy. Continue Reading

Bank Debt – 04/26/2007

It’s All About Yield

In contrast to our musings on Ultrapetrol, the importance of yield cropped up in Jefferies’ review of Arlington Tanker’s first quarter. Mr. Douglas Mavrinac writes, “…we expect the increased investor interest in well-protected yield instruments to continue given the inverted yield curve and collapse of the sub-prime mortgage sector. Consequently, we believe well-secured tanker yield names such as Arlington should continue to trade higher given the relative attractiveness of the projected yields compared to other yield-orientated investment instruments, such as MLPs which are currently offering less attractive yields.” Continue Reading

Equity – 04/26/2007

It’s been a great week for shipping and the capital markets. The markets are up, Oceanfreight’s IPO was successful, Ultrapetrol and Seaspan’s follow-ons were successful, and Greek shipping was even featured on CNBC Fast Money (http://www.cnbc.com/id/15840232/video/268793370). Perhaps it’s just a coincidence, but the sun even came out at long last here in the northeastern United States.

Before getting too carried away, however, we’d like to start with one minor housekeeping detail. Marine Money is currently compiling a shipping loan portfolio “league table” of sorts. The intent is to complement the loan syndications data compiled by Dealogic in order to account for the very important role of bilateral loans (and the banks that provide them) in the ship-lending market. This provides some insight into the size of the global market for ship finance while also identifying many of the major capital providers. Continue Reading

The Week in Review – 04/19/2007

Please Pardon our Appearance

We are short one graphic designer this week and unfortunately as such are highly limited in our design capabilities. Please excuse the look of Freshly Minted this week and the appearance of last week’s tables and rest assured that the quality of the graphics are not indicative of the content and that next week everything will be back to normal. Thank you as always for your support and understanding.

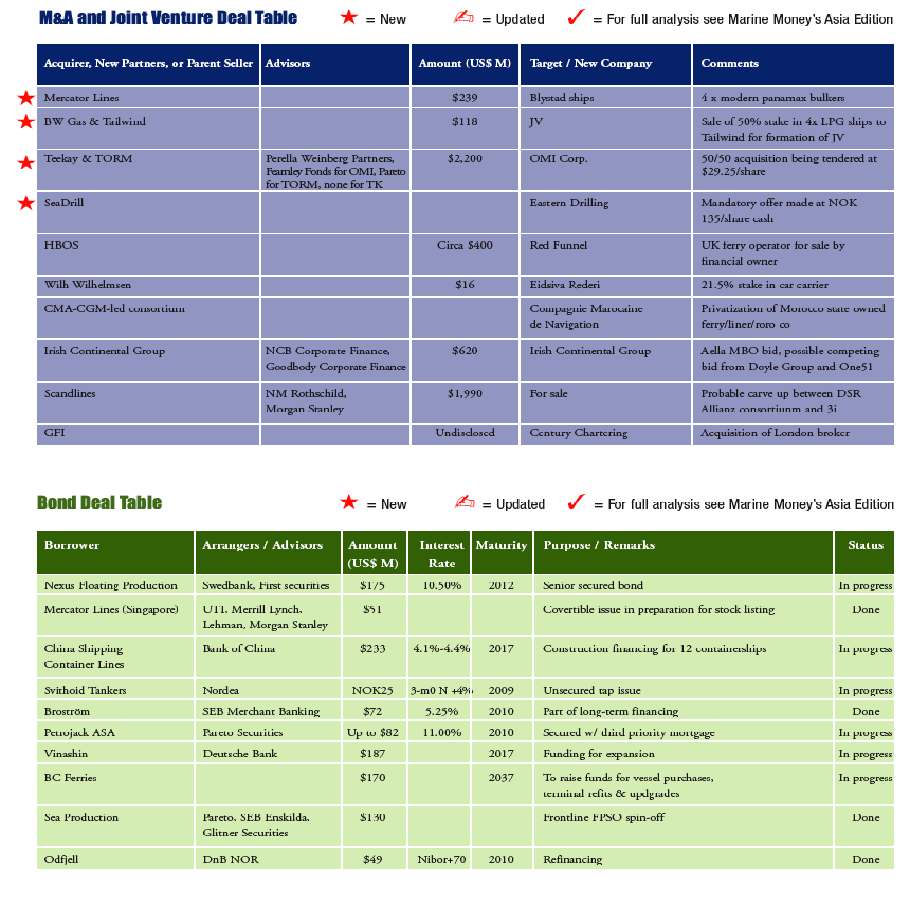

It Takes Two

As is widely known, OMI this week recommended to its shareholders that they accept a $29.25 per share cash bid proffered by a company 50% owned by Vancouver-based Teekay Shipping and 50% by Copenhagen-based A/S TORM. The offer values OMI at around $2.2 billion and would result in Teekay taking OMI’s suezmax fleet along with 8 product tankers and TORM taking OMI’s other 26 product tankers. A formal tender offer is to be commenced to OMI’s shareholders no later than April 27, 2007. Continue Reading