People & Places – 05/17/2007

Tom Kjeldsberg Joins Double Hull Tankers – What it Means

FM understands that our friend Tom Kjeldsberg has recently departed DnB Nor in Oslo to join NYSE-listed Double Hull Tankers. We think this is a great hire by DHT, which, like Arlington Tankers, has not achieved any fleet growth since going public more than two years ago. Continue Reading

Debt – 05/17/2007

What Do The US Government And Seaspan Have In Common? Answer: Each Owns A Navy.

It was a busy Monday for Seaspan Corporation. First the company announced the amendment of its original credit facility entered into at the time of its initial public offering. Not only did they increase the borrowing limit from $1 billion to $1.3 billion (funny how trivialized these amounts have become), they converted what was originally a term loan to a more flexible revolving credit that will allow them to borrow, re-pay and re-borrow.

Somewhat atypically, the loan is collateralized by the original 23 vessels in Seaspan’s initial fleet as well as the four vessels purchased from A.P. Moller-Maersk last year. The company has full availability until August 2012 provided the loan to value is below 70% of the pledged vessels. Subsequently, the borrowing limit is reduced by $32.5 million per quarter until May 2014 at which time the balance will be due and payable. Should the company wish to maintain access to the full commitment, it has the option of adding collateral vessels.

Reflecting their performance as well as the collateral, Seaspan was able to replace the grid pricing formula, based upon loan to values, with a single competitive rate of LIBOR + 0.70% for the term of the loan. In addition the company has entered into interest rate hedges for approximately $750 million of the total exposure.

The bank line-up consisted of Citigroup and Fortis as joint arrangers while Citigroup, Fortis, Credit Suisse, DnB Nor and Landesbank Hessen-Thuringen were mandated lead arrangers.

Later that day, Gerry Wang, Seaspan’s CEO, announced the fruition of its latest Asian networking efforts. Having worked closely with Hyundai Heavy Industries earlier, Seaspan was able to secure eight slots for 8,500 teu container ships, which were in turn offered to COSCO Container Lines Co. Ltd. (“COSCO”) for time charter. At the end of the day, contracts for the newbuildings were signed for the eight vessels with deliveries between the 4th quarter 2009 and the 1st quarter 2010 at a cost per vessel of $132.5 million or about $1.06 billion in total. COSCO agreed to 12-year charters, with three one-year options at a rate of $42,900 per day increasing by $500 per day for the option periods. Based upon the size of these vessels and the magnitude of the investment, Seaspan judiciously reverted to their historic longer-term charter formula rather than the recent shortening to seek higher rates. Based upon the initial locked-in operating expense of $6,000 per day through 2011, the vessels are expected to contribute in total approximately $106 million in incremental EBITDA, approximately a 38% increase from the steady state. Together with this new order, Seaspan’s fleet now consists of 55 vessels of which 26 are on the water.

According to Kevin Kennedy, the CFO, the funding for the 20% down payment will be sourced from the proceeds of the recent equity offering, cash from operations and the new credit facility. For the permanent financing, the company is exploring various debt and leasing possibilities.

Seeing a conspiracy in everything, we can only view Seaspan’s expanding relationship with the two major Chinese carriers as an effort foster the Chinese invasion of our homes by ensuring everyone in the world has a flat screen TV.

I.M. Skaugen in new Bond Issue with irst Securities, Swedbank Markets

I.M. Skaugen this week announced that it had completed a NOK 600 (circa $99) million bond issue managed by First Securities and Swedbank Markets. The NOK 600 million comprises the first tranche while the maximum amount under the loan is NOK 1,000 million. The five-year unsecured floating rate note is to pay a coupon of NIBOR + 2.40% per annum. Proceeds are to be used for general corporate purposes, including refinancing through the repurchase of existing bonds and the financing of additional growth. At year-end 2006, IMSK had $147.6 million in bonds outstanding in addition to $44.5 million in liabilities to financial institutions. The company had issued $100 million in unsecured bonds in 2005 due 2010 that are priced at 3-month LIBOR + 2.80% in a transaction arranged by Fearnley Fonds. These bonds are not callable until December of 2007 so we imagine this is not the issue IMSK hopes to pay down.

In 2006 the company issued another $100 million in bonds due 2009 at 3-month LIBOR + 1.90% in deal led by Nordea. This issue was assigned a shadow rating of BB- by Nordea versus a BB rating assigned to IMSK, and the issue callable as of June 19, 2007. Due to the call date we would imagine it is these shorter term but less expensive bonds IMSK will most likely be repaying in part with proceeds of the current issue.

Commensurate with the strength of the Norwegian bond market over the past year, we can see a shift back to more “Norwegian” bonds for IMSK as LIBOR pricing goes to NIBOR and dollar denominated bonds yield to NOK-denominated bonds. This is somewhat interesting as it was just in May 2006 that IMSK had completed two USD bond programs and redeemed both NOK bonds that had previously been outstanding.Whether and if so how exactly the company is playing the two currency markets would most likely be an exceptionally interesting topic but is beyond the purview of this present article.

Beyond that, however, the issue is consistent with IMSK’s financing strategy, which has tended to rely on a wide array of options rather than focusing on traditional bank debt. The remaining portion of a 2001 NOK 124 million convertible bond was converted into shares last year, while the company looked to the leasing market in December of 2006 when it announced that it had entered into an agreement “in principle” to sell three of its ships under construction in China to Teekay LNG for $87 million en bloc. The deal was an effective financing for IMSK, which is to take the vessels back for 15 years with two five-year extension options and fixed price purchase options at the end of each of the lease periods. Teekay LNG essentially contributed the capital it can raise at very attractive rates discussed earlier in this newsletter, while IMSK assumes the near to medium-term risk.

Equity – 05/17/2007

“SPAC” to the Well

Using its recent shelf registration, Navios Maritime, after a number of forays into the debt market, has decided to return to the equity markets with a follow-on offering of 11.5 million common shares. J.P. Morgan and Merrill Lynch will act as joint book running managers. As of today, the deal had not yet been priced. We would anticipate some minor discount to today’s closing price.

As was the case in the original SPAC, the company is rather close-mouthed about the use of proceeds stating only that the funds will be used to fund growth or for general corporate purposes. Intuitively, we would expect a portion to be used as the equity piece for the exercise of purchase options. But this leaves a whole lot more for the next Kleimar as Ms. Frangou continues her role as an industry consolidator. Although this is a company that after all likes and utilizes debt, the timing of re-entering the equity market is excellent given the continued strong performance of the dry bulk markets, the expectations that it will continue and the warm reception for these stocks on the street.

Based upon the March 31st financials sheet, the equity issuance will have a positive effect on the balance sheet with the net debt to capitalization ratio going from 56% to 51%. This is conservative as we assume the deal is priced at $8.50, a slight discount to yesterday’s close, and the shoe is not exercised. Continue Reading

Market Commentary – 05/10/2007

Surgeon General’s Warning

In a world where investors are betting on China’s continually growing GDP, with its concomitant need for commodities, and forecasters assuring them it is inevitable, we welcomed this pithy warning about forecasting and event risk from Natasha Boyden of Cantor Fitzgerald:

“While analysis of commodity supply and demand factors can help provide near-term guidance, market conditions are difficult to predict and single events often affect the price, demand, production, and transport of commodities. As such, dry bulk rates can fluctuate dramatically over short periods of time.”

Like the warning on cigarettes, this reminder should be well placed as a reality check for the industry and its prognosticators. But like the Surgeon General’s warning, it will likely be ignored with a plea of addiction. Continue Reading

The Week in Review – 05/10/2007

As the dry bulk market continues to hit new highs, even company CEO’s are beginning to warn that it could be defying gravity, while sentiment in the tanker sector is considerably more mixed. However that tension among the belief of market players provides fertile ground for deals, and the markets for shipping finance have been in a global blur of activity.

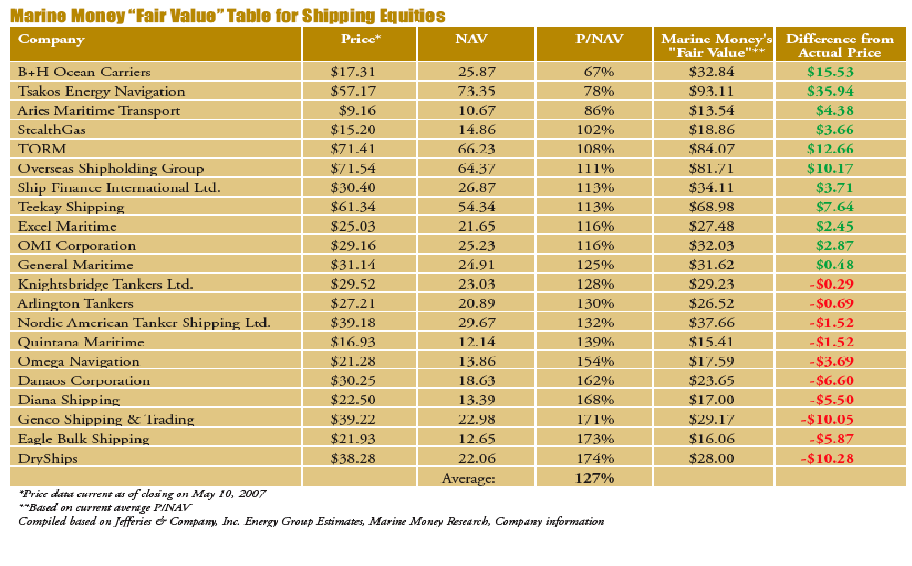

In the midst of all this investment banks are posturing and positioning themselves in the shipping playing field, with Jefferies taking Hamish Norton from Bear Stearns to replace John Sinders as head of shipping, Mr. Sinders having got into the very glamorous-sounding business of owning Aston Martin. Credit Suisse has signaled its intention to be a serious player in the sector with the taking of prolific shipping analyst Gregory Lewis from industry stalwart Fortis. Continue Reading

The Week in Review – 05/03/2007

Conference season is in full swing by now, and the selection available in the world of shipping conferences continues to attain new levels. While excitement builds for Norshipping, during which Marine Money will be hosting an Oslo Ship and Offshore Finance Forum on June 14, and Marine Money Week in New York from June 19 to 21, we are particularly excited about our Japan Ship Finance Forum to be held in Tokyo on May 17. Our second annual Japan forum, 150 delegates have already registered, 65% of them owners. As the Japanese market continues to be one of the world’s most important but grows ever-more open, this conference presents a particularly unique set of opportunities to get acquainted with the market for Japanese ship finance and get to know the important players.

Dockwise Merger Shows Genius on Many Levels

The Dockwise Sealift merger makes sense on many levels. Financially it enables 3i to take some cash off the table from their late 2006 purchase of the company, while giving it a majority stake in the merged company going forward. It gives Sealift, a company with 6 ships on order and a small staff of just 12 or 13, instant management, market credibility, and a powerful global presence, addresses a Dockwise challenge of bringing in new tonnage, furthers the consolidation in a very specialized sector and gives investors an opportunity to participate in a market with attractive dynamics. Continue Reading

Finding a Way out of the Environmental Enforcement Wilderness

By Austin P. Olney 1

Partner, LeBoeuf, Lamb, Greene & MacRae LLP

Executive Summary

The shipping industry appears to be under siege on several environmental fronts. The US continues its MARPOL sting operations with eye-popping fines and court ordered environmental compliance plans. Europe and California are targeting ships as major sources of air pollutants. The emerging scientific and political consensus to drastically reduce greenhouse gases is leading to sweeping new pollution reduction targets in Europe. Major financial institutions are embracing standards that condition investments on greater corporate transparency, accountability, and environmental sustainability. Major manufacturing companies are adopting “reduce, reuse, recycle” practices, not just to the “products at the end of their life, but to the materials and methods that created them.” 2 Continue Reading

“Secured Equity?”

By George Weltman

Although no longer as major a factor as it once was in ship finance in the US capital markets, where equity reigns, high yield debt remains a major force in Norway as discussed in this issue. In fact we noticed that the recent Norwegian bonds are highly structured and when secured use 2nd and even 3rd priority mortgages. So, although not au courant, we thought that with the future always uncertain, it might be useful to review this financing structure that bridges the gap between equity and debt. As the source of information for this article we utilized a Latham & Watkins presentation entitled, “Everything You Always Wanted To Know About Second Lien Financings.” We found it extremely enlightening and hope we did it justice. Continue Reading