The Rich Get Richer

It was certainly obvious that when the banks decided to re-engage in their main activity of lending, they would be even more discriminating. A stronger credit with higher pricing translates to higher returns with less risk, a no brainer. Last week, Ship Finance International found itself the beneficiary of this thinking. While negotiating the refinancing of the loan on the Frontline fleet, Ship Finance found itself in the midst of hungry bankers clamoring for a piece of the loan, this led to a significant oversubscription problem (sic). Given the conservative leverage on the fleet, it agreed with the banking syndicate to upsize the loan by $50 million to $725 million providing even further capacity to take advantage of opportunities that might arise.

Continue Reading

OSG Goes the High Yield Route

Following its recent equity offering, OSG announced on Monday its plans to issue $300 million of unsecured senior notes due in 2018. Proceeds will be used to pay down the balance on the company’s $1.8 billion senior revolver due in February 2013 that bears interest at LIBOR + 70 bps. As of year-end, the revolver balance was $654 million and under its terms the facility steps down $150 million annually in 2011 and 2012 before the final maturity in 2013.

Continue Reading

From Micro to Macro

Can you, in fact, look at the trees and see a forest? An answer might be gleaned from Seabury Cargo Advisory’s (“SCA”) new global ocean database, which provides insights into global ocean trade volumes per commodity type, in weight and number of TEU. The uniqueness of the Global Ocean Database, which is updated monthly, lies in the combination of exceptionally up-to-date information on all global country-to-country flows, and the split of containerized, bulk and liquid cargo. Furthermore, the type of cargo can further be analyzed through the use of 2,000 different commodity descriptions.

Continue Reading

Return of the DIS

As arranger, Cleaves Marine Finance AS is in the process of marketing the equity for Seacor Grant DIS, a silent partnership that will purchase the Seacor Grant, a 2008 built AHTS/ROV support vessel from Seacor Marine for $35 million. The vessel is chartered to a subsidiary of Sonangol, the national oil company of Angola, for 4 years at a rate of $31,770 net per day.

Continue Reading

The Little Company That Could!

Small companies also do interesting deals and, despite a rumored illiquid credit market, the deal we highlight below was done with bank financing together with an interesting twist. The company renewed their fleet both through the simultaneous acquisition of assets and the sale of an older inefficient vessel. And, it is clearly evident from the press release that for this company transparency is the order of the day.

Continue Reading

Market Play

If you like a little more risk in your equity investments, Jan Hakon Pettersen and Garup Meidell, formerly of Bergesen Worldwide, have formed Gaia Maritime AS, as a pure asset play on the recovery of container shipping asset values. Through a private placement, led by DnB NOR, Fearnley Fonds, and Pareto Private Equity, the company hopes to raise NOK 300 million to NOK 600 million (approximately$50 to $100 million). The founders will invest $1 million themselves. Proceeds will be used to purchase new containerships and for working capital. Following the offering, the company intends to list the shares in June on the Oslo Axess.

Continue Reading

Crude Prices

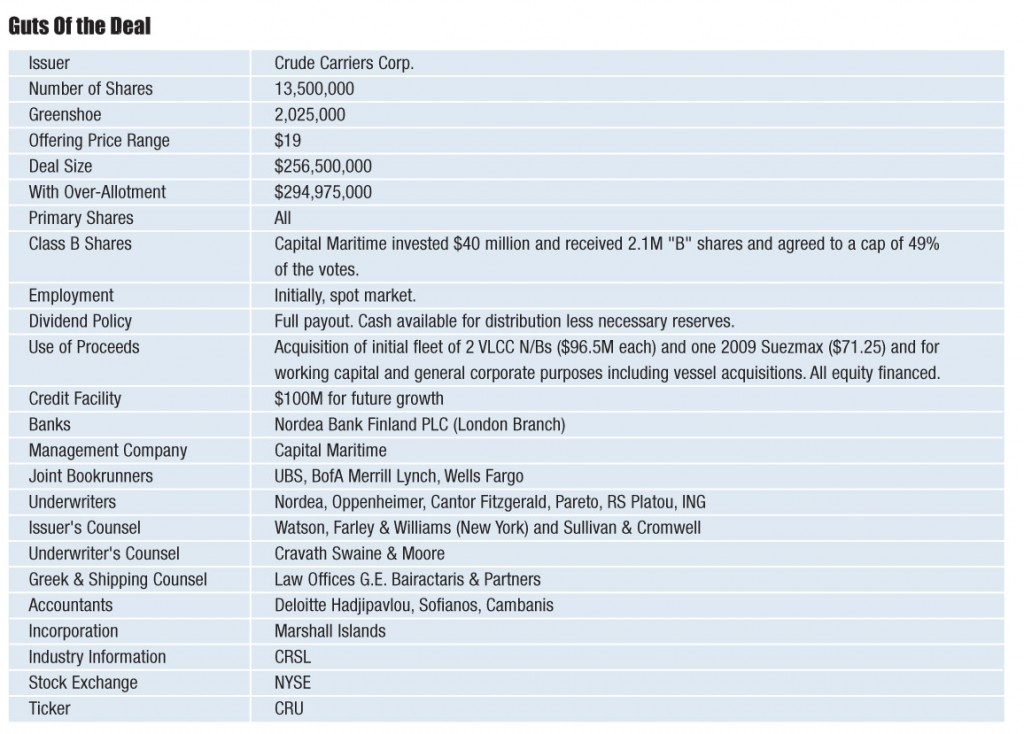

Last week, following on the footsteps of Baltic Trading, Crude Carriers Corp. also priced its offering at the low end of its range at $19 per share, raising net proceeds of $238.5 million. The company has also granted the underwriters a 30-day option to purchase up to 1.35 million shares to cover overallotments. A final version of the Guts of the Deal is shown below.

Me TOO

On Tuesday, Teekay Offshore Partners L.P. announced that it too intended to raise equity by selling 4.4 million common units, while giving the underwriters an option to purchase a further 0.66 million shares to cover over-allotments. The deal priced the next day at $19.48/ unit, a discount of 4.98% from the prior day’s close. Gross proceeds of the offering will be $85.7 million.

Continue Reading

Ravenous Equity Appetite for Follow-ons Continues

Safe Bulkers Inc. joined the long line of recent issuers announcing last week that it would utilize its existing shelf registration and offer 9 million shares of it common stock in a follow-on offering. The offering will provide a green shoe of a further 1.35 million shares to cover overallotments. And, in order to minimize dilution, Vorini Holdings, Inc., the controlling shareholder (82%) of the company, has agreed to purchase 1 million shares at the offering price. Net proceeds will be used for vessel acquisitions, capex and for other general corporate purposes, including debt repayment.

Continue Reading

Mr. Molaris Returns with Alma – A Mixed Fleet and Fixed Dividend Option

Last week, Stamatis Molaris staged his return to the public markets by joining forces with Hans Mende, the President of American Metals & Coal International, and Mass Capital Investments, a private equity firm affiliated with Fortis Bank Nederland, with the filing for an IPO of their new venture, Alma Maritime Limited. Avoiding the historic trend of a pure play in order to provide diversification, Alma will be a mixed fleet with mixed employment including spot, short-term, medium term and long-term charters. The strategy is to take advantage of attractive opportunities presented by current low vessel prices in both the wet and dry sectors with the goal of maximizing shareholder returns through the shipping cycle.

Continue Reading