Market Commentary – 07/07/2007

Ocean Freight Inc. Offers Exposure to Robust Dry Bulk Sector

Bank of America’s analyst team comprised of Daniel L. Barcelo, Ilya Balabnovsky, Joshua D. Kramer, and Thomas D. Sturges enlightened us this week on newly public OceanFreight Inc. and the rebirth of the dynamic dry bulk sector. (It’s worth noting that Philippe Lanier’s name has come off Bank of America’s shipping roster, and we will be sure to keep you posted if he is to resurface.) Bank of America initiated coverage of OceanFreight’s stock with a BUY rating and a $23/share target. OceanFreight’s stock currently trades at 8.2x 2008E EV/EBITDA, marginally below the sector average of 8.7x. Priced at $23/per share, the company trades among peers after an adjustment for the survey expense basis, as is the norm within peers, and which Bank of America warrants due to the company’s fleet profile, dividend strategy, management experience and homogeneity of the sector. Continue Reading

Legal Matters – 07/05/2007

Law Firm Merger – Maritime Expertise

St. Louis-based law firm Thompson Coburn LLP and Chicagobased law firm Fagel Haber LLC have merged, creating one of the Midwest United State’s leading law firms. The combined firm has more than 330 attorneys with offices in St. Louis and Chicago – two of the mid-west region’s major business centers – and additional offices in Washington, D.C. and Southern Illinois.

US IRS Publishes Rules on Tax Exemptions

We re-print an informative email from Derek Betts, Partner at Seward & Kissel in New York and a leading tax attorney relied upon by the international shipping community. “This is to alert you to the fact that final and temporary IRS regulations, modifying the currently existing section 883 regulations that were published in final form in August of 2003, were published earlier this week on June 25, 2007. Section 883 is the U.S. code provision upon which most foreign shipping companies rely to claim exemption from tax in respect of their U.S. source shipping earnings. An IRS notice of public hearing was also concurrently published requesting written comments on the regulation changes by September 24, 2007 and setting a public hearing date of October 24, 2007 for comments to be presented. Continue Reading

Market View – 07/05/2007

The Pendulum Swings and….

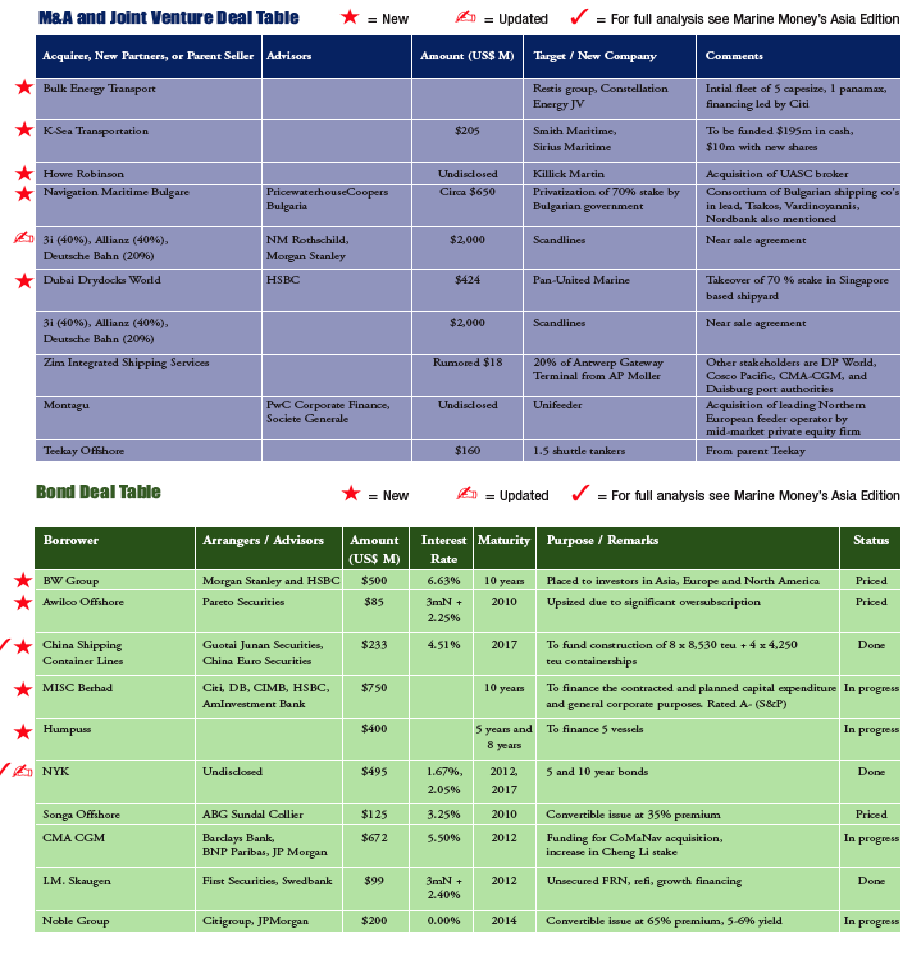

The ripples will be felt by all. Bond investors have finally woken up, seen risk and pushed back. Whether it is the volatile interest rate market, the subprime mess or just the terms of the deals, investors have balked at the recent bond offerings for U.S. Foodservice while others including a $750 million bond offering by the Indonesian shipping company, MISC Bhd. have been put on hold.

Factors cited include the realization that lenders have demanded little in return for the risk they are taking, as well as the cov-lite loans that offer little in the way of protection and finally the inclusion of PIK toggle notes in the structure. The latter of course offers the borrower the ability to issue more debt in lieu of cash when its cash flow is insufficient to meet its debt obligations. Genius. If you can’t pay your debt, borrow more! Continue Reading

A Look Behind the Metrics

Once again, we have carried over our universe of companies, with some modification, for our annual rankings based upon our traditional criteria: the companies must be publicly listed corporations, the companies’ major income must come from shipping or other marine operations and the companies must provide audited or, at least publicly issued, financial information for the year 2006.

We continue to focus the Rankings on a core universe of commodity and offshore shipping to which we added, as promised, the robust class of 2005 IPO successes. It was not feasible last year to include these in the overall 2005 Rankings for the simple reason that most reported only stump figures, which greatly skew the results of the larger established universe. We said that last year and we warned also to watch out that given a full year their performance would dazzle, and they do. This year we had to leave 2006′s new entrants aside for the same reason. They will make their mainstream debut next year. In the meantime, we have included a sneak preview, in the next article, of the 2006 IPO companies. Continue Reading

The Class of 2006

By Sofia Vassilakis

For most of the past 40 years, shipping IPOs have been a rarity. Being by nature private, shipowners preferred to keep their activities away from the public eye and were therefore reluctant to move forward with public offerings. These entrepreneurs operated in secret and could well afford to. In fact, it was about 20 years ago when a real estate entrepreneur named Mike Hudner created the B+H companies which are the forerunners of today’s IPOs. The market was subsequently fallow for a period, but times have changed, and with those changes, so have the models for raising capital. Shipping is now stylish and the younger generation is far more receptive than its forbearers to capital market opportunities.

2005′s graduating class contained 18 newly public companies, a sizeable sum, but of even greater interest was the fact that five members of this class finished in the top ten in this year’s formal rankings. Last year for these rankings we received a slightly smaller class of 14 graduates and of some significance was the fact that the New York exchanges were not dominant. Companies this year decided to file in London, Dubai, Germany and Luxembourg. We look forward to including them in our Rankings next year and have high expectations for their performance. As a precursor to next year’s competition and for fun, we have decided to rank this group on the basis of total return to shareholders for the shortened period between going public and the end of May. But before we get to the results, here is the class of 2006. Continue Reading

Interesting Data Points or Fun with Numbers

By George Weltman

This year we decided to take a birds-eye view of the numbers to determine if there was any significance to them, inferences to be drawn or perhaps even trends apparent. In the chart contained herein we looked at our universe of 86 shipping companies and toted up the numbers for perspective. In addition, we calculated an average EV/EBITDA in order for our readers to have a perspective when looking at this category.

Looking at the numbers themselves, we were most impressed by the group’s market capitalization of $202 billion as well as the total cash and cash equivalents of $17.8 billion, and the latter does not even include short-investments which would have significantly ballooned this number. Continue Reading

Market Commentary – 06/28/2007

Nordea Initiates Disparate Coverage

Now with the very long days in Norway and the conclusion of festivities at Nor-Shipping ’07 andMarineMoneyWeek it appears that the analysts at Nordea are back at work initiating coverage on a number stocks with their usual in-depth analysis. The stocks covered are a mixed bag and include reefer, gas and offshore companies. Ingolf Gillesdal began by initiating coverage on Awilco Offshore ASA with a twelve-month target price of NOK 86 suggesting a potential return of 16% over the current price. The company is extremely well positioned with a fleet of 11 offshore drilling units which will not only generate significant revenues going forward but are significantly under-valued having been ordered ahead of the competition in 2005. Continue Reading