US Listed Shipping Companies in a SubPrime Summer

By Greg Chase, Watson, Farley & Williams

As credit markets tighten, the ability of US listed shipping companies to borrow on favorable terms will say a great deal about the relative strength of public companies in the industry. Despite the surge of shipping company IPO activity in the last several years, it has never been hard to find pundits who are ready to remind investors of the historical cycles in the industry and to suggest that the current success of the public companies may not last forever.

But events in the credit markets this summer may shed additional light on the relative strengths of the listed company model. As aptly demonstrated by the widening interest rate spreads following the subprime meltdown began in June, financial markets are never static. Sooner or later, new structural developments, both foreseen and emergent, will challenge the market standing of the U.S. listed shipping companies. Perhaps it is early to know for sure, but changes in the credit markets this year could provide listed shipping companies with a new opportunity to distinguish themselves from their privately-held competition. If listed companies can continue to borrow on favorable terms, even in a down market, it will be all that much harder to argue that listed companies do no represent the long-term future in shipping. Continue Reading

Market Commentary – 07/26/2007

Synthetic or Real, It Makes No Difference

How do you finance a newbuilding that is contracted at today’s high prices for delivery in 12 to 18 months? No lender in his right mind is going to lend at a reasonable level against future delivery without a firm known income stream and no charterer is going to fix forward for that period particularly in these frothy times. The answer is to call Douglas Garnsey, Head of Corporate Risk Solutions at The Royal Bank of Scotland (“RBS”) who has structured transactions to bridge this risk by creating synthetic time charters using FFAs with Alex Gray of Clarkson Securities Limited.

Historically, borrowers knew that to leverage up a transaction they had to provide a long-term charter of say five years, at a sufficiently high rate with a first-class name attached. In entering into such a transaction, the owner not only gave up operational control of the vessel but also the upside. With FFAs, this is no longer the case. In the simplest case, these transactions were done as swaps and are hybrids of these original time charter transactions. Continue Reading

The Week in Review – 07/26/2007

How Eagle Spent Its Summer Vacation

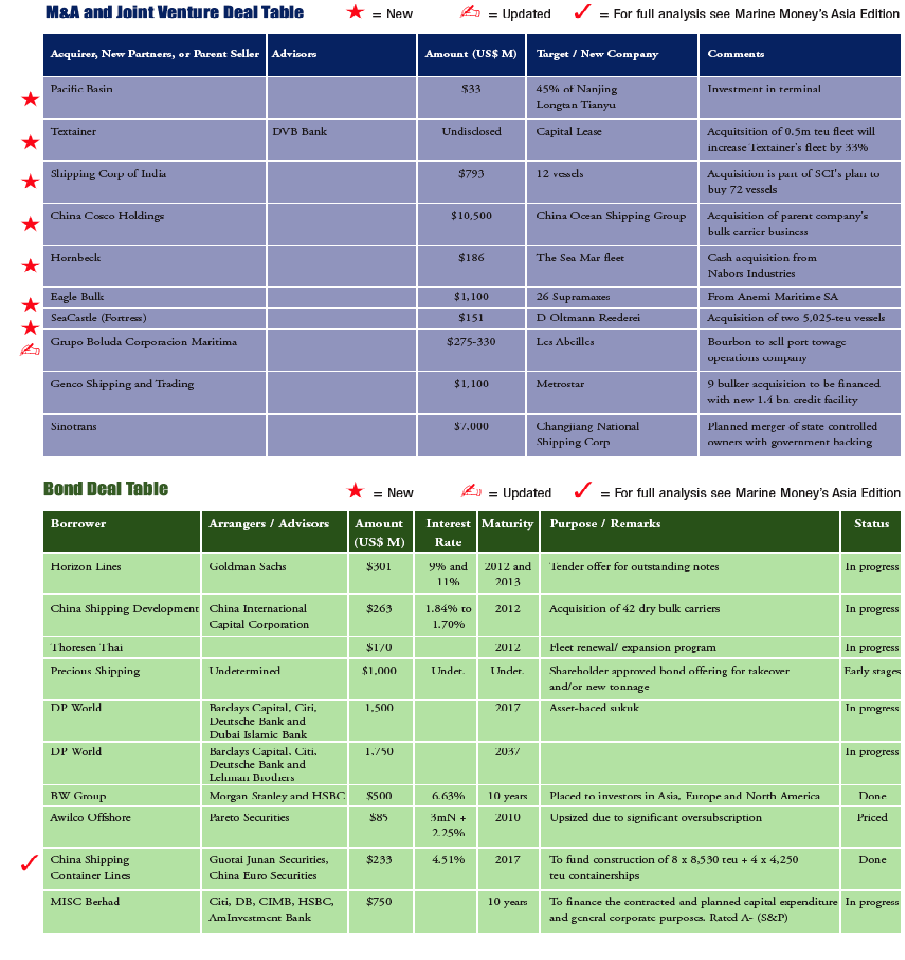

Following quickly on the heels of Genco’s “transforming” transaction, Eagle Bulk Shipping announced yesterday the acquisition of 26 Supramax vessels for $1.1 billion or an average price of approximately $42 million each. Is “transforming” an adequate description of an acquisition that more than doubles the fleet size to 49 ships but more importantly provides substantial firm fixed contracted revenues of approximately $1 billion through 2018? How does “wow” sound? The vessels were purchased from Anemi Maritime Services in a private off-market deal. And, although by appearances, it was a substantial sell-off, we understand that Anemi had over 40 vessels on order.

This serial acquirer and affirmed industry consolidator provided the basics of the deal in a press release and conference call yesterday. The fleet consists of 5 vessels of 53,100 dwt and 21 vessels of 58,000 dwt, which will be delivered between 2008 and 2012. Of the 26 vessels, 21 are secured by long-term time charters running through 2018 and of these 17 have an uncapped profit-sharing component. In round numbers and presuming the vessels are re-delivered at the end of their respective charter periods, the tenors from delivery vary with nine vessels fixed for about 10 years, four fixed for about 7 years, eight fixed for approximately 3 years and five as yet unfixed. It is important also to note that these charters were fixed for ward from periods ranging from a minimum of one to as long as five years out if not longer. A clearer picture of the impact of this deal on the visibility of revenues is shown in the graph, which plots owned days versus contracted revenues. Continue Reading

Market Commentary – 07/19/2007

A Snapshot of the Dry Cargo Freight Market

In light of all the excitement surrounding the dry bulk market, we thought we would include a few words from our in-house dry bulk expert…please enjoy.

Notwithstanding the holiday inspired reduced cargo inquiry in the dry cargo charter markets over the last few weeks, and the continuing stream of newly built vessels joining the fleet, rates have not really fallen much (on a few routes they have actually firmed). Somehow the supply-demand equation has been altered and it seems that this can be traced to two factors.

Voyage charterers in the ore and coal sectors seem to have dug their heels in and taken the position that they should not have to pay spot rates for forward positions (“backwardation”). As a result Owners have adopted the strategy of running their ships spot and are generally rewarded for it. While this seems to be more prevalent in Panamax and smaller sizes in the Atlantic, it seems it work in Capes as well in the Pacific-Rim market. Continue Reading

The Week in Review – 07/19/2007

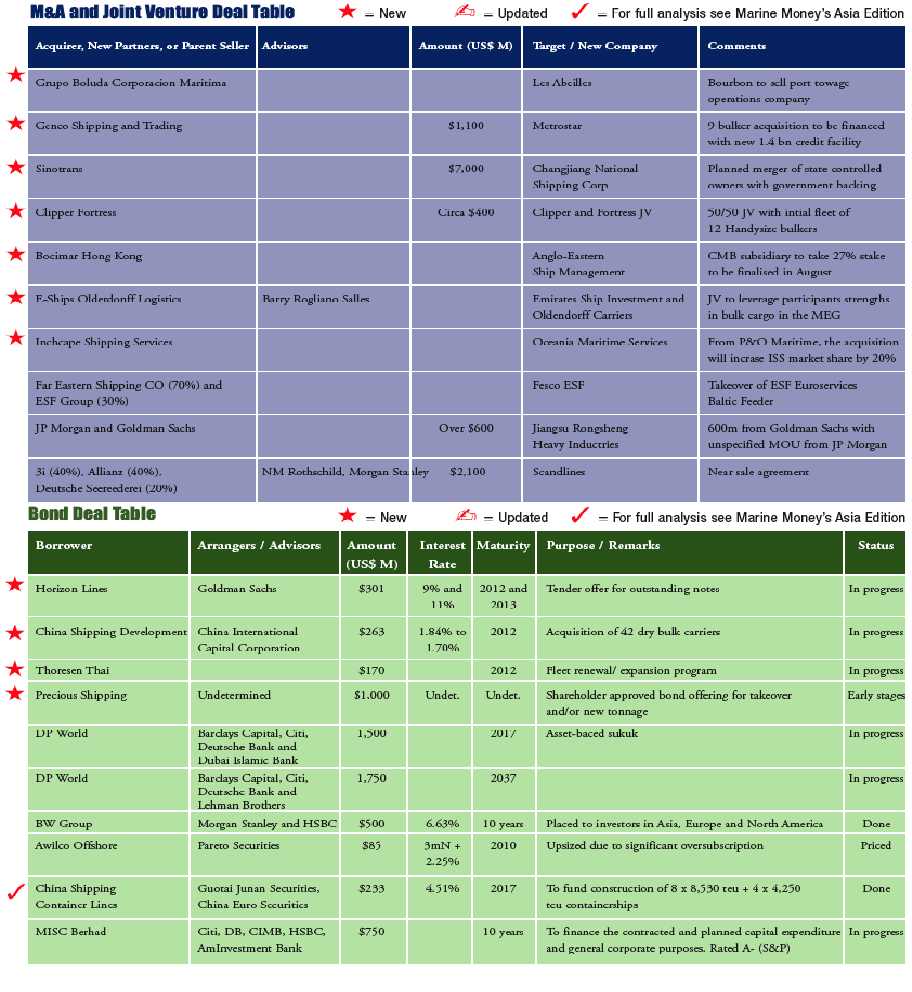

It’s been an exciting week in the ship financing markets, with the confirmation of Genco’s $1.1 billion acquisition the highlight but followed closely by a sizeable joint venture set up by Fortress and Clipper. Following soon after the Quintana/Glitnir and Tufton/Oldendorff sale leaseback deals it appears that global ship finance activity is presently focused around the dry bulk markets, which have left behind all expectations for where their peak would be. However certain deals have rounded down market values for vessels, suggesting that some key players are expecting that the market has peaked but will land softly and profitably. There is therefore great excitement about Peter Georgiopoulos-led Genco’s decision to invest in the capesize sector at an average price of around $122 million per vessel and this has led to a rally in the dry bulk equity market in the US. Continue Reading

Market Commentary – 07/12/2007

The View from Below

When a deal gets done most of the press and kudos go the arrangers, bookrunners and syndicate leaders. Forgotten by everyone, including us, are the participants, often referred to in the pejorative as “stuffees”, without whom the system would fail, as no single financial institution can provide all the capital needed or take on the amount of risk involved. We sat down with market participants to understand how and why the system works. So the discussion could be more frank, we spoke on background.

The primary motivations to be a participant are manpower, overhead and risk. To be an arranger or bookrunner requires an organization with sourcing, syndication and agency capabilities. There is a minimum critical mass required. To go with scale it must also be willing to put its balance sheet at risk. Ultimately, if the small guy wants to enjoy the economics of underwriting he has to be aggressive on price thus further spoiling pricing and losing access to future business from the major players. It is therefore easier for many to partner up with the main banks that do the bulk of the business anyway. Continue Reading

The Week in Review – 07/12/2007

Looking Closer at Quintana, Glitnir & their $250 million Deal

Traditionally the use of sale leasebacks in shipping was limited at least in part by owners’ desire to keep free exciting and sometimes very profitable asset play opportunities. As more shipping companies are public, however, the value added by asset play has become more limited. Investors value stocks based on their expectations, and it is entirely unrealistic to think that the average public shipping equity investor will be able to anticipate how a shipowner will anticipate the unpredictable shipping markets and be able to assign a fair and reasonable value to the prospects of asset play and windfall profits.

As such it’s hardly surprising that we continue to see a divergence between the business of owning ships and the business of profitably operating ships. Quintana Maritime was the latest public company to get in on the game, with the seven-vessel sale leaseback done with Glitnir Finance it announced last week. In the transaction Quintana will sell seven of its oldest panamax for a price of $250 million vessels and take them back on 8-year bareboat charters at an average rate of $12,700 per vessel per day. Continue Reading