Marine Money Asia Prepares for Asia’s Largest Ship & Offshore Finance Forum

We are pleased to inform you that our Singapore team is working full speed ahead to bring Asia its largest finance forum for the shipping and offshore sector. The event will be named “Marine Money – Asia Week” and will build upon the established Singapore Ship Finance Forum that we have organised the past 6 years every September. This year the event will span over two full days with plenty of networking and educational opportunities so assist your company’s financing needs. Continue Reading

People & Places: Pacific Shipping Trust Appoints New Chief Financial Officer

Pacific Shipping Trust (PST) has appointed Ms Ivy Lim Faye Yik as its new Chief Financial Officer. Ms Lim is responsible for the shipping trust’s finance and treasury management functions, including matters relating to debt and equity fund raising, the formulation of strategic plans as well as managing investor communication with the unitholders. Continue Reading

Market Commentary: Credit Suisse Remains Upbeat on Asian Dry Bulk

The upcycle in dry bulk freight rates will peak at the earliest in the second half of 2009, according to the latest market report by Credit Suisse. The investment bank anticipates the current dry bulk boom will run harder and longer than previous ones, with the freight rates rising 5 percent in 2008 before staying stagnant in 2009 due to robust demand and supply constraints at the shipyards.

The report, written by HungBin Toh, Sam Lee and Karen Chan, maintains an optimistic global economic outlook and expects the effective dry bulk demand growth to be boosted by China’s accelerating food stuff imports and longer travel distances. Credit Suisse economists predict global GDP growth to be 5.2 percent this year and 5.3 percent in 2008 and expect global industrial production to expand between 6 and 7 percent in 2007-08. Continue Reading

Spotlight Korean Shipbuilding Productivity

Shipbuilding these days is like a box of chocolates; you never know what you are going to get. Once again, demand for new ships, in this case mega containerships, has surprised the market and South Korean shipbuilders are showing us that there are plenty of chocolates left in the box.

Today’s news of a tenth dry-dock at Hyundai Heavy’s Ulsan shipyard (640m X 92m, January 2009 completion) underlines the acceleration of capacity of South Korean shipbuilders. It is clear that we are in supply super cycle with a doubling of capacity through to 2010. Demand has been vigorous for most of 2007 in the bulk arena while a surge of mega containership contracting has added an unexpected dimension to the newbuilding juggernaut. Unlike the multi-pronged demand of last year with owners chasing bulkers, tankers, containers and LNG, this summer’s hunger in the newbuilding market has clearly been for big containerships. Continue Reading

In Conversation with Brian Chang – Chairman of Yantai Raffles Shipyard

“The way semi-submersible drilling rigs are being built today is still largely based on small block assembly and has not progressed much over the past 50 years. The rigs are typically constructed 40 metres above ground which require significant manpower resources and at the same time pose safety concerns for the workers. We will be revolutionising the rig building method when our new 20,000-tonne gantry crane becomes operationally ready in the next couple of months,” explains Mr Brian Chang, chairman of Yantai Raffles Shipyard (YRS) in a video conference call from Yantai in China’s Shandong province. Continue Reading

Equity: Uni-Asia Prices Singapore IPO Amid Market Volatility

As Asia joins the global rout amid US sub-prime worries, Uni-Asia Finance Corporation is pushing ahead with its plans to list on the Singapore Exchange despite the market volatility. The Hong Kong based structured finance arranger is offering 65.4 million new shares priced at SGD 0.55 (USD 0.36) a piece to raise net proceeds of SGD 32.2 (USD 21.0) million. The IPO, which includes a placement tranche of 62.1 million shares and a public tranche of 3.3 million shares, was launched on August 8 and would have been concluded at press time. Continue Reading

US Credit Worries Cast Dark Clouds Over Asian Bourses

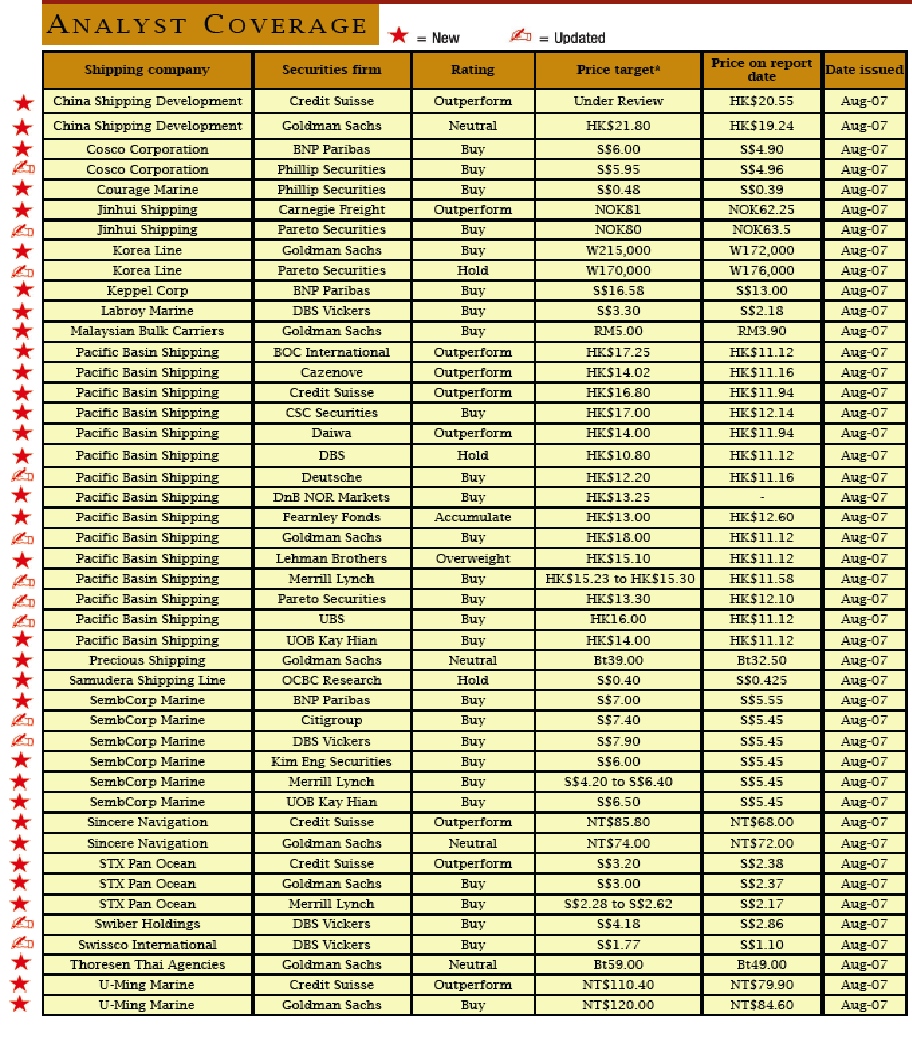

Ripples from the US sub prime lending fiasco have sparked off a heavy selldown on Asian markets as investors shun mortgage-backed securities and other risky investments. Shipping companies in the Asia are certainly not spared from the financial turmoil and we thought it would be interesting to give our readers the latest update on their share performances. The accompanying tables highlight the current and the beginning-of-the-month prices of 40 shipping counters in the region.

To place things into perspective, shipping and related shares in Asia have rallied sharply since the beginning of 2007 with the exception of Indonesia. At the extreme end, shares of Nanjing Water Transport Industry, Ningbo Marine, Tianjin Marine Shipping and Changjiang Shipping Group Phoenix have risen on an average of 209 percent since the beginning of the year and none of them appears to be significantly affected by the present market anxieties. Continue Reading

Market News & Commentary – 08/09/2007

Storm Insurance or Eagle’s Umbrella

Today in its 2nd Quarter conference call, Mr. Zoullas disclosed that Eagle Bulk had arranged credit insurance, through Seacurus Limited, which secured the company’s charter revenue stream for three years, through July 2010 with a credit risk underwriter, rated A by S&P and A2 by Moodys. The agreement is confidential however we have extracted from an article that Nick Maddalena, a Director of Seacurus, wrote for us last autumn an explanation of this product for our readers, which we hope was the inspiration for Mr. Zoullas: Continue Reading