Korea Stock Exchange Q&A

Contributed by Yulchon, Attorneys at Law

1. What are your exchange’s basic listing requirements (market capitalization, operating history, revenue, income, etc.)?

The KRX consists of the Stock Market Division and the KOSDAQ Market Division. For reference, we set forth below in Figures 1 and 2 important listing requirements for the Stock Market Division and the KOSDAQ Market Division of the KRX. There are some other listing requirements in addition to those set forth below. Also, the relevant listing regulations contain certain detailed rules or provisions regarding, and exceptions to, those requirements set forth below.

Please note that the Stock Market Division has certain different listing requirements for holding companies. The listing requirements set forth below regarding the Stock Market Division are for regular companies (i.e., companies that are not holding companies). Please also note that with respect to the KOSDAQ Market Division, certain lenient listing requirements or exceptions are applied to “venture companies.” Continue Reading

Shipping IPOs on the London Stock Exchange

By Ioannis Kariofyllidis, Business Information Manager, V.Holdings

Shipping is a highly fragmented and capital intensive sector that has traditionally been served by debt financing. Up to 1995, initial public offerings (IPOs) had been an alternative financing solution only for big shipping companies that were familiar with the concept of corporate structure and ownership. Family owned shipping companies used to see debt as the most efficient vehicle for vessel acquisition.

IPOs have been used an alternative way of financing for vessel acquisition or debt repayment. Their main advantage is that liquidity is increased without inflating balance sheet liabilities while diversifying ownership structure. From a credit perspective, IPOs also increase equity and lower the debt to capital ratio that is the main metric of a company’s financial leverage. An IPO is a solution for ambitious shipowners with confidence in their management skills. Management is transparent since the companies are audited and obliged to publish their financial statements. Continue Reading

The First Five Years: 1950-1954 Mr. Yardstick’s Operational Review

Welcome ladies & gentlemen to the Benchmarkco Ltd presentation to discuss the company 1950-1954 five-year results. Starting with the customary disclaimers, time travelers should be aware that in today’s presentation we will be making certain backward looking statements that discuss past events and performance. These statements are subject to risk and uncertainties that could cause results of real companies to deviate from the computations of our virtual operation.

With me today is our CFO Mr Fair Squareview. During today’s meeting I will firstly review our operating performance over the last five years as well as industry trends before I pass on the presentation to Mr Squareview, who shall take you through our financial figures. Continue Reading

Going Public, Sort of!

By George Weltman

Having made the decision to access fresh capital for growth here in the United States, private companies can choose between two avenues, an IPO or a Section 144A offering. Each offers advantages and disadvantages that will become clearer as we explain, for those who don’t know, what a 144A offering is.

Under SEC Rule 144A, a company can sell its shares in a private placement with registration rights to qualified institutional buyers (“QIB”), which are defined as investors with at least $100 million in assets under management. This rule allows for the sales to take place among QIBs without requiring registration of the shares with the SEC and compliance with U.S. GAAP unlike a normal IPO. Therefore the shares are not subject to the same regulation as ’34 Act registered shares including but not limited to Sarbanes-Oxley. By filing under 144A, the company gains the benefits of speed to market and limited disclosure. The downside is liquidity, which is constrained by the limit of 499 QIBs to retain its status as a private company. On the other hand, how many institutional investors do you want? Also private stock cannot be used for acquisitions or as part of a remuneration package. Continue Reading

NASDAQ Q&A

By Gary Wolfe, Partner, Seward & Kissel

1. What are your exchanges basic listing requirements (market capitalization, operating history, revenue, income, etc.)?

The NASDAQ comprises the NASDAQ Global Select Market, the NASDAQ Global Market and the NASDAQ Capital Market. Consequently, the listing requirements for the NASDAQ are far too extensive to list here particularly since each market has three different standards.

2. What is the average market capitalization of companies listed on your exchange? What is the total market capitalization? Continue Reading

New York Stock Exchange Q&A

By Gary Wolfe, Partner, Seward & Kissel

1. What are your exchange’s basic listing requirements (market capitalization, operating history, revenue, income, etc.)?

The listing requirements for the NYSE are far too extensive to list here. There are different requirements for domestic companies and non-U.S. companies. To add to the confusion, the exchange offers two sets of standards – worldwide and domestic – under which non-U.S. companies may qualify for listing. Generally, the tests or standards relate to distribution and size requirements and financial standards. A full description of the requirements is available from the NYSE website (www.nyse.com) in Sections 102.00 and 103.00 of the Listed Company Manual. These can be found from the main page by navigating to the section providing information about Listing on the NYSE and clicking on the link for the Listed Company Manual under the Related Information section. Continue Reading

The Week in Review – 08/30/2007

It is the last week of August, with Labor Day upon us, and the focus is on enjoying the last week of summer while getting the children ready for school. Surprisingly, it almost feels as though the financial markets have thankfully taken a breather. Of course, this is not the case for the shipping markets based upon the interesting fixture our eagle-eyed observer of the markets has reported on below.

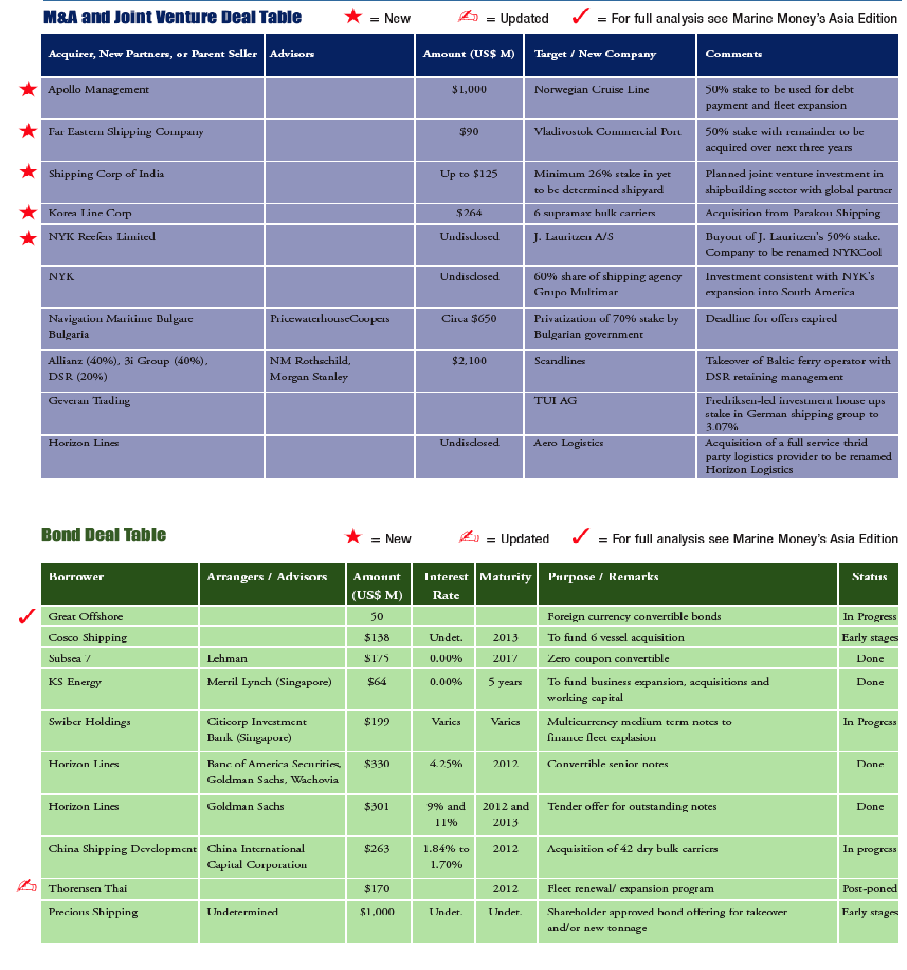

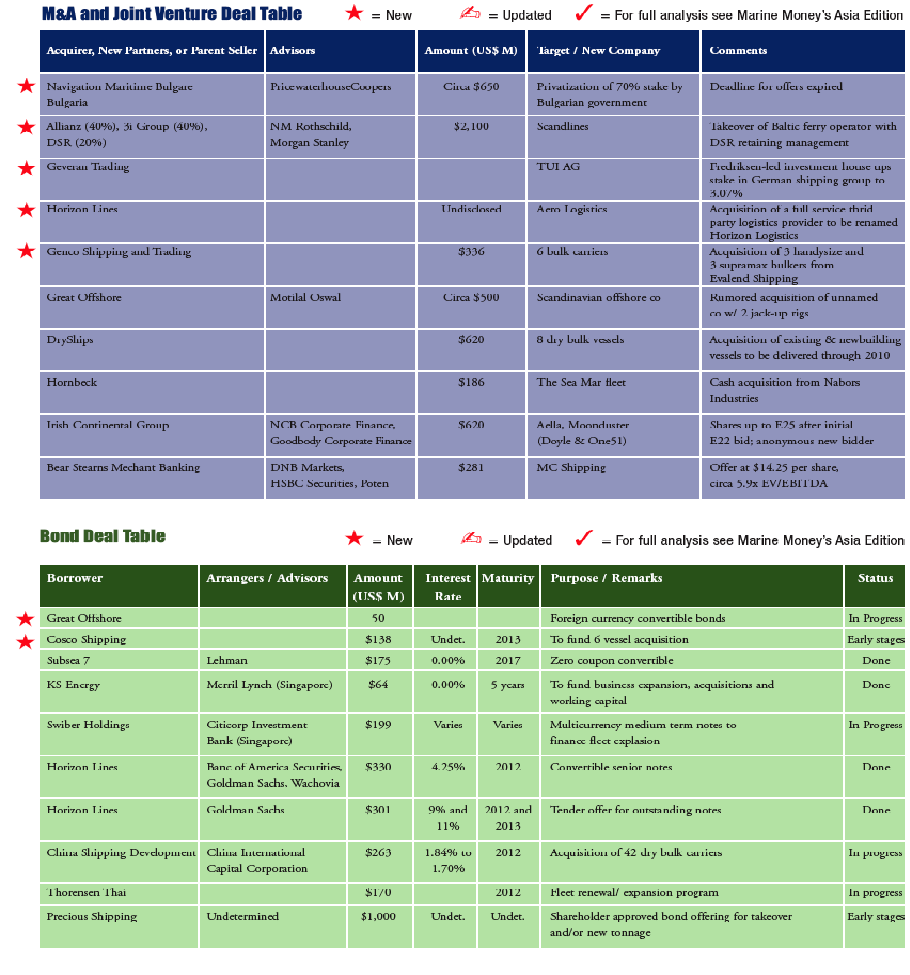

This week’s coverage is heavily weighted towards data while hopefully minimizing verbiage. With thanks to LoliWu of Citi, we provide a perspective on the capital markets by showing the incredible growth in the equity markets led by follow-on offerings. We fill in the details on two transactions we covered briefly last month. And finally, we have some very interesting insights into ship lending from the banker’s perspective. We have taken to heart the admonition that a picture is worth a thousand words so if the weather does not cooperate and you are stuck indoors kick up your feet, grab a beer and have a gander between sets at the US Open. Continue Reading

The Week in Review – 08/23/2007

If you read the mainstream financial news headlines, you might think we were living in turbulent times. And yet, the ship finance market is far from scathed. Some deals are struggling more than they might have a couple months back, but not inordinately so. The strength of the dry bulk market is certainly helping to buttress this position, but cannot be the sole factor. The reality is that good deals are getting done despite the credit market hiccups that have been driving stock market volatility. This is at least in part because industry can claim an international following of banks – and of equity investors.

Over the past two weeks, Navios and Genco continued to expand in the booming dry bulk industry, as has Seaspan in its containership leasing business. All find the debt and equity they need to be accessible, and it shows as they move confidently when they see an attractive acquisition, knowing financing will not stand in their way. Paragon was right on target with its IPO, OSG America has officially entered the fray, and Chembulk obtained the credit facility its been looking for. Continue Reading