Coming Full Circle

Having originally set its sights on raising $150 million, Scorpio Tankers Inc. subsequently raised its expectations midstream hoping to sell 14.375 million shares at $15 to generate $230 million in gross proceeds. However, when it came to pricing on Wednesday, there was both good and bad news. The good news was that, unlike Alma Maritime, the deal got done but only 12.5 million shares were sold at $13, below the expected $14 to $16 range. Net proceeds of the offering were $151.1 million, which the company intends to use to pay down debt and for vessel acquisitions.

The shares showed weakness on the first day of trading closing at $12.56 per share, down 3.4%, on volume of approximately 3 million shares.

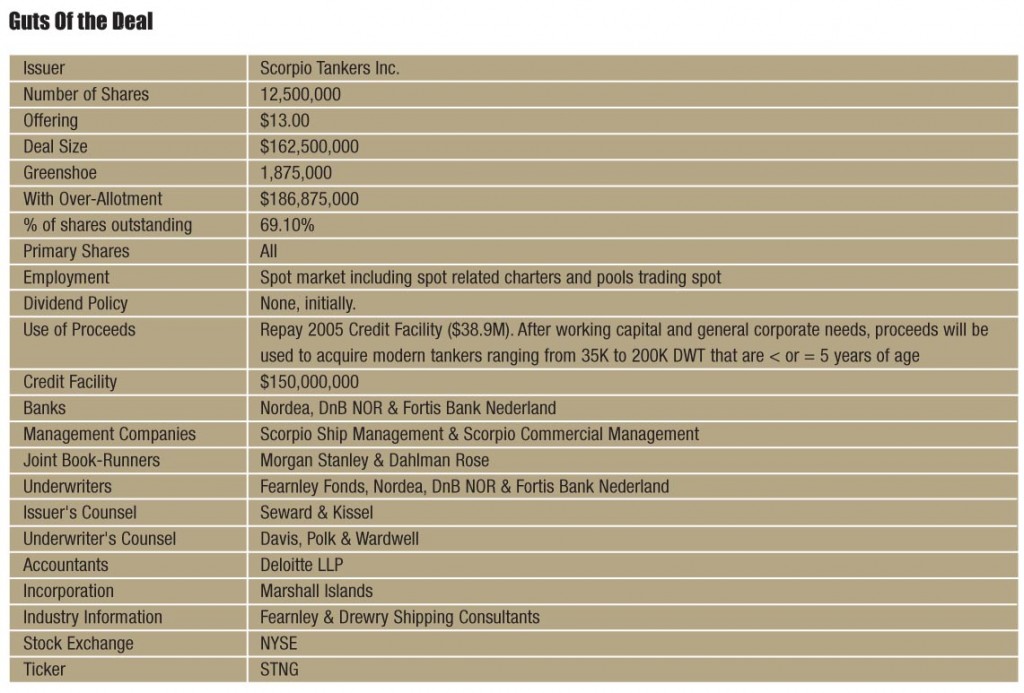

The final Guts of the Deal is shown herein.

“Gone in 60 Seconds”

Like the movie highlighted in the title, it comes as no surprise that people work better under pressure. Last week’s $225 million convertible bond offering by Frontline Ltd. evidences that fact. In a matter of two days, Frontline’s bankers, led by joint book-runners ABG Sundal Collier and Deutsche Bank, successfully structured and executed the company’s debut convertible bond issue. And when it came to market, the transaction was fully covered within 1.5 hours and priced within 3 hours of launch. With strong demand across a broad spectrum of investors and geographies, the deal was upsized from the originals $200 million to $225 million.

Continue Reading

Seacastle Redux Or Fortress’ 2nd Attempt to Exit

Stripping off the baggage of its container ships and chassis, both unattractive businesses today, Seacastle Inc. has offered the public the opportunity to invest this time in its container leasing subsidiary through an initial public offering of that business, which they have named SeaCube Container Leasing Ltd. This is another example of a part that might be worth more than a whole as management recognized the recent outperformance of the publicly traded container leasing companies, Textainer and TAL International due to operating leverage. Trade has begun to resume which equates to more boxes coming on line, higher utilization and hence more revenue, with little incremental cost. In addition, given the financial constraints of the liner companies due to a very difficult 2009, it is likely that the lines will increase the portion of leased rather than owned containers in their fleet. From that standpoint, timing could not be better.

Continue Reading

Capital Link

Following on the heels of CMA, today was the 4th Annual Capital Link Shipping Forum in New York. As always it was well attended with a full schedule of presentations and panels. The most intriguing for us was the bankers’ panel which was moderated by George Cambanis of Deloite Hadjipavlou Sofianos & Cambanis and included Robin Das of HSH Nordbank, Gust Biesbroeck of Fortis Bank Nederland and Brett Esber of Blank Rome. The good news was that panelists all agreed that bank lending has picked up this year. Mr. Biesbroeck talked of pockets of liquidity, noting in particular the increase in Asian lending to locals. The common characteristics of the loans were the involvement of strong credits with whom the bankers had long-standing relationships. Echoing the same idea, but humorously, Mr. Das affirmed there was a bifurcated market with the banks willing to lend to those who don’t need the money. The niche owner is being left behind.

Continue Reading

OceanFreight Fix

Last week, to fix its share price issue with respect to the NASDAQ, OceanFreight announced that at its annual meeting it intended to propose a 3:1 reverse stock split in order to bring it in compliance with the $1 minimum bid requirement.

Continue Reading

If You Can’t Find a Banker

Also, this week, OceanFreight Inc. announced that it had entered into an agreement to build three new VLOC’s of 206,000 DWT at Shanghai Waigaichao Shipbuilding. The contract price for the three vessels is $204 million, with deliveries scheduled for the 2nd and 4th quarter of 2012 and the 1st quarter of 2013.

The vessels are fixed for staggered terms with two of them including profit sharing. The first vessel is fixed for 3 years at a gross rate of $25,000 per day. Upon its delivery, the second vessel commences a 5-year charter at a gross rate of $25,000 per day, with a 50% profit sharing up to $40,000 per day. Lastly, the third vessel, upon delivery, will commence a 7-year time charter at $21,500 per day, also with a 50% profit sharing up to $38,000 per day. The vessels are fixed to charterers with whom OceanFreight has an existing relationship.

Continue Reading

You Gotta Believe!

While the shares of Crude Carriers traded down from the selling price of $19, this did not dissuade company insiders from what in their view might be considered bargain hunting. In two open market purchases, Mr. Marinakis, the Chairman and CEO, has purchased 100,000 shares at an average price of $16.34. Mr. Lazaridis, the President and Mr. Kalogiratos, the CFO, also purchased respectively 5,000 ($16.25) and 3,000 ($16.21) shares respectively. The shares closed Thursday at $16.95.

We understand that part of the price pressure was the large proportion of retail buyers (45%) in this instance who tend to buy looking to flip the shares for a quick return.

Also Having a Tough Time

Alma Maritime was expected to price on Wednesday, but we understand that the underwriters postponed it to today. Pricing was also the issue as bids were well below the asking range of $19-$21 per share.

Done, But at a Price

Safe Bulkers successfully sold its offering of 9 million shares last week. After a four day road show, the deal was priced Thursday at $7, a discount of 15% from the last closing price before the announcement and 4.89% from Wednesday’s closing price.

Like most things in life timing is everything. It has been a very busy few weeks in the shipping equity markets, with investors possibly suffering from deal fatigue. According to FBR’s calculations, thus far in this first quarter, shipping companies have raised approximately $1.05 billion in equity, of which $485 million was related to IPOs and $561 million to follow-on offerings. Among the many new deals circulating in the market were the Diana Container Company, a private placement by Univan, Baltic Trading, Crude Carriers, Alma Maritime and Scorpio Tankers. Then there were the follow-on offerings that included Teekay Offshore and OSG. Thrown into that mix, Safe Bulkers may have gotten short shrift. But we also believe that buyers demanded a deep discount reflecting the high portion of shares owned by insiders (82%) and the commensurate low float.

Continue Reading

Bite the Bullet?

Showing the resilience of its model, Seaspan Corporation last week reported its 4th quarter and year-end results, which were generally in line with consensus and given the unprecedented conditions in container shipping, the credit markets and the economy quite good in our estimation. But our focus is on capital and, as of year-end, the estimated remaining installments of the 26 remaining contracted vessels that have not been delivered amounts to approximately $1.7 billion. While the company has successfully reduced its equity capital needs through deferral of vessel deliveries, it was temporary and now it must now face the issue of raising approximately $180 to $240 million in equity or other forms of capital to finance the remaining portion of the purchase price of vessels on order. In terms of timing, it is likely that the need will commence in Q1 2011and extend through Q2 2012 as deferrals remain a possibility. However, the good news is that Seaspan has secured long-term credit facilities to fund the vessels and has no facilities maturing until 2015.

Continue Reading