Market Commentary – 11/28/2007

Good News, Not So Bad News

We read in the Hellenic Shipping News that Soros Fund Management (“Soros”), the investment vehicle of one of the premier investors of our times, George Soros, purchased 600,000 common units of Navios Maritime Partners and now controls 5.71% of its shares. In it’s filing which was submitted as a “passive investor,” Soros disclaims any intention to change or take part in any decisionmaking processes within a company’s board of directors. More importantly, they do not have to disclose their trading activity. On the other hand, having Mr. Soros looking over your shoulder does provide a certain focus. Continue Reading

Conference Coverage – 11/28/2007

Our conference season has come to a close and we report herein on our last highly successful conferences including our latest addition, Italy.

The Neapolitan Sun Rises

This past Tuesday one hundred delegates gathered in an intimate setting at the Hotel Vesuvio in Naples Italy to discuss issues pertaining to Italian ship finance. The elegant hotel overlooks the infamous Mount Vesuvius, the Castle Dell’Ovo and a picturesque marina. But there was a lot more than scenic vistas and delectable cuisine waiting to greet delegates who made the trip to Napoli. The were met with a firsthand look at the changing financial culture of Italian shipping, while the Italian shipping industry was met with first-rate providers of a full range of ship finance products. The day would be filled with interesting insights, observations and case studies, only a handful of which are outlined below. The level of sophistication in the Italian market was made clear, and the changes taking place to make the market more open to international finance were palpable. Continue Reading

The Week in Review – 11/28/2007

Calm Amidst the Tumult?

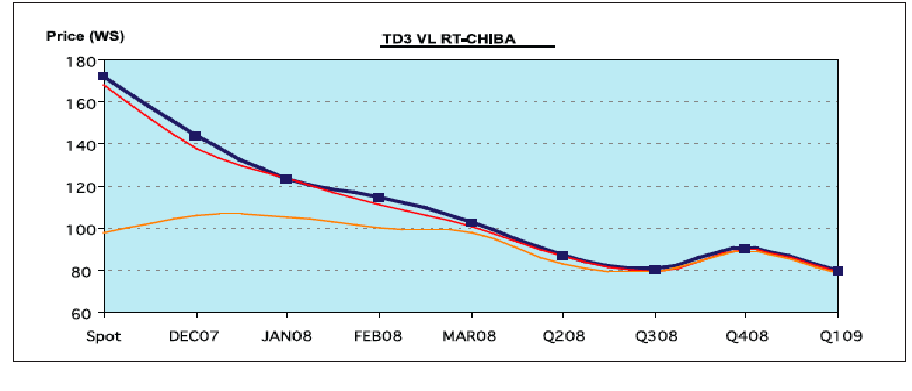

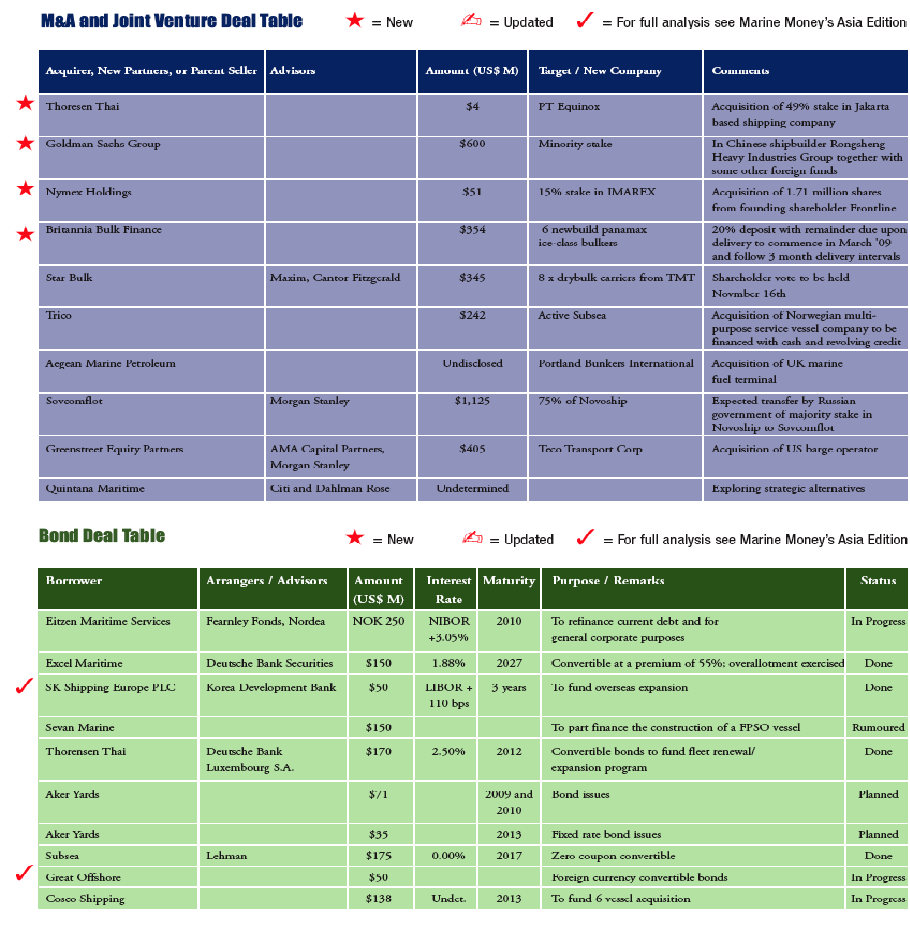

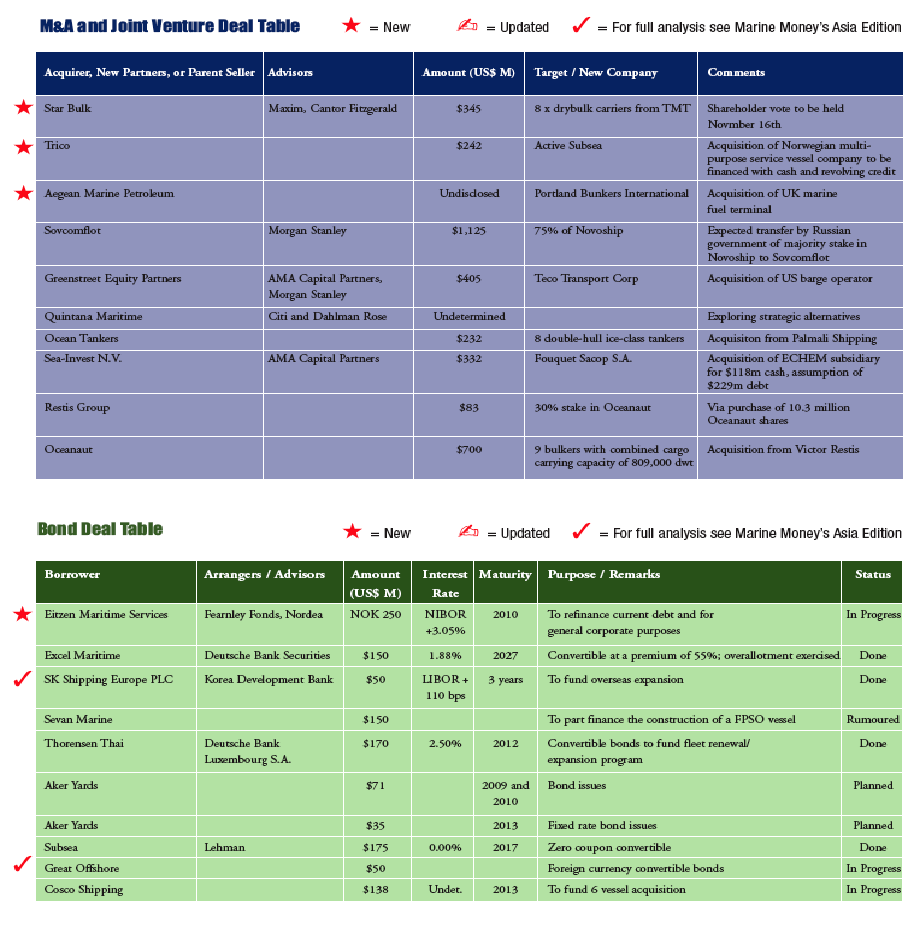

It’s been a crazy week. The credit crisis continued! But Abu Dhabi bailed out Citi. After being depressed for ages, the tanker market not only showed signs of life, it actually experienced a boomlet. And the dry bulk market coasts along showing no signs of abatement while the iron ore contract continues to be negotiated. Vessel prices remain high but hey what me worry. Someone will pay more for immediate delivery. The stock market “corrected” but then rose over 300 points, its largest gain in five years. Who would be crazy enough to try and get a deal done in this environment? Well, as you can see below quite a few and they may have found a window of opportunity. Would you rather be lucky or smart? In this case it may have been a fortuitous joining of both. Read on! Continue Reading

Market Commentary – 11/15/2007

Dawn at Goldman Sachs

Despite the uncivilized hour, the Goldman Sachs 4th Annual Shipping Conference opened to a packed auditorium this past Tuesday. This is a testament to Justine Fisher’s organizing an excellent and diverse group of panelists, covering the broad range of markets, together with her in-house experts to discuss market drivers.

The conference provided a wealth of information both in terms of presentations but even more so due to the lively panel discussions with carefully crafted questions from Goldman Sachs’ astute analysts. Given both the quality and quantity of information as well as space limitations, we have opted to give you the highlights as we saw them and are thus somewhat slanted. Continue Reading

The Week in Review – 11/15/2007

As we approach the start of the holiday season, the shipping markets remain firm but the international finance markets continue to behave skittishly. But there is certainly no shortage of deals. Dry bulk owner and operator Hellenic Carriers has announced its intention to follow in the footsteps of Globus Maritime and GO Carriers and list its shares on London’s AIM market. The company is seeking to raise $60 million and has signed on Jefferies as its advisor. Davie Yards is seeking listings on the Toronto Stock Exchange and Oslo Axess to raise $110 million. And Finaval has received the necessary approval to raise up to $60 million in a Milan IPO led by Banca Caboto and Unipol Merchant. Continue Reading

The Week in Review – 11/08/2007

Breaking News: OSG America Prices at $19 per Share

In the midst of gun-shy investors and a Dow that had just fallen by 400 points, OSG America priced at the low end of its range to raise $142.5 million. Retail demand was very strong and institutional demand was solid, though somewhat price sensitive due to the more general stock market jitters. OSG retained a 75% stake in the company and will be able to extract more equity over time as it drops in new vessels. Comparables traded down over the marketing period – Capital Product Partners by 12%, Teekay LNG by 7% and Seaspan and Danaos by around 11%, leading to price sensitivity among investors but also allowing for upside in early trading. Meanwhile OSG successfully illuminated the value in its Jones Act assets, improving its cost of capital. The success of the deal is a testament to the strength of the company’s story and management team, led by Maritrans management alum Jonathan Whitworth, and the underwriters, Citi and UBS, together Merrill Lynch, Raymond James and DnB NOR Markets. Continue Reading