Depends on your Point of View

We have a disconnect between the global psychology associated with public equities and the freight market, which for anyone older than 40, or anyone owning ships privately must be somewhat amusing. Fundamentally the freight markets (wet and dry) are good now and, allowing for some increased volatility, will be for some time. One public owner shared with us the fact that January will have been one of the company’s best ever.

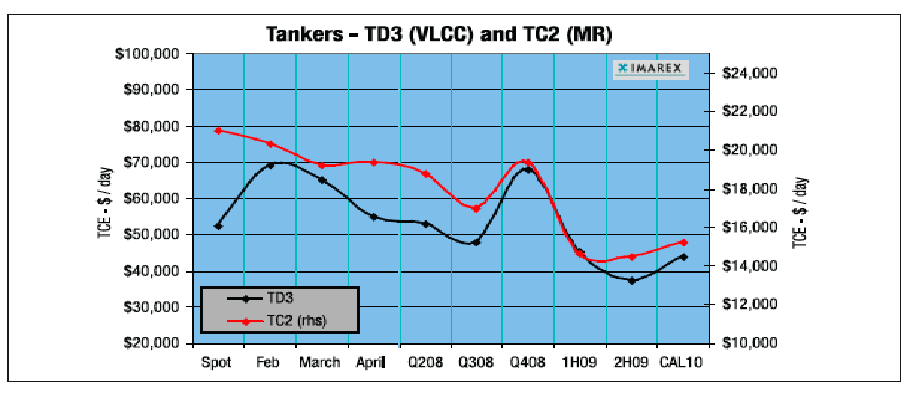

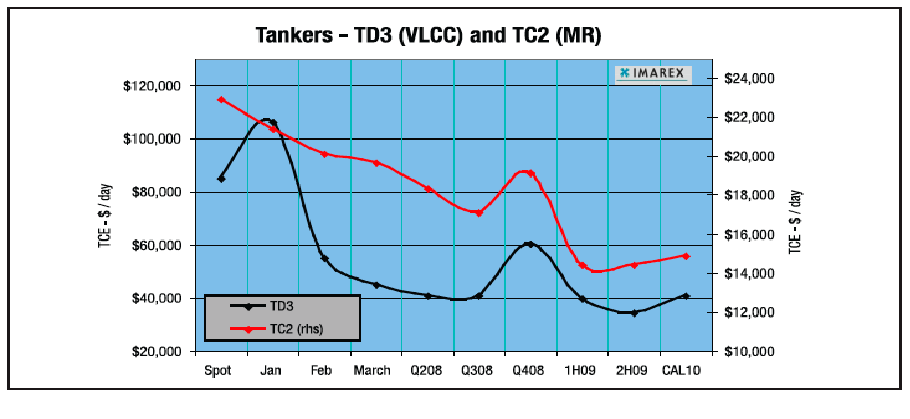

Despite background fears of economic decline, real and over imagined, the underlying fundamentals of the industry remain unchanged.While rates for both spot cargoes and period time charters have declined, most of the fleet (dry and wet) is already employed at 2007 rates for the next 12-30 months.What the financial community has been depending upon is the ever upward slant in rates that everyone knew would end. The momentum is not there now, but the ships are making money – a lot of money. Those ships that are playing the spot market will continue to enjoy profits at today’s levels and, if we believe the cargo interests to whom we have spoken, may enjoy periodic spikes back to the 2007 highs in the next 12-15 months. Continue Reading

Shipping Loan Issuance Hits $94 billion in 2007

The numbers are in. Credit problems aside, syndicated shipping loan issuance in 2007 topped out at $93.9 billion, beating the previous year’s record $76.4 billion. While we did see a fall-off in volume of 17% in the third quarter, 4Q07 and 2H07 issuance were both up, by 23% and 10% respectively. This compares reasonably to global leveraged loan volume, which was up 38% in 2007 to $1.77 trillion. However that rise was almost entirely accounted for by the first half of the year, with global 2H07 issuance down by 38% over 2006.

So shipping, it would appear, has thus far been weathering tight credit markets better than the economy at large. No doubt it is helped out by the fact that the shipping markets themselves have by and large remained at healthy, profitable levels even after coming off the dry bulk boom in the autumn. If you said five years ago that investments were safer in a foreign ship than in a major international bank, people would likely have questioned your sanity. But it couldn’t have turned out to be more true.

Advisory & Consulting Services

Marine Money has a proven track record of assisting shipowners and capital providers in originating and executing marine financing transactions. Whether you are a finance provider interested in developing deal flow, a shipowner/charterer looking for vessel financing or a private or public equity investor considering making an investment in the marine sector Continue Reading

Market Commentary – January 17, 2008

Vessel Values & Stock Prices: A Sticky Situation

While the merit of NAV as a measure of shipping company value is often debated, the metric at the least provides a benchmark for how much a company would theoretically be worth if it were to instantaneously dissolve. That said the fall from an average shipping NAV in our weekly “Fair Value” table of 113% in mid-October to 68% today is worthy at least of comment. That said the same time period saw capesize values rise from $135 million to $151 million (11.9%) and VLCC values rise from $132 million to $138 million (4.5%). This however is not enough to explain the over 30% discount at which public shipping companies are trading, on average, to their liquidation value. Part of it, no doubt, is a lag factor as stocks are considerably more liquid than vessels. Part is momentum. But part makes one wonder if the shipowners sense something the investors don’t, or vice versa.

Sign of the Times

DryShips announced yesterday that shareholders approved an amendment to the company’s Articles of Incorporation increasing the authorized shares of common stock to 1 billion and the authorized shares of preferred stock to 500 million. The increase in the number of shares was effected to accommodate a proposed 3:1 share split in the form of a special dividend. Continue Reading

The Week in Review – January 17, 2008

True Believers

In the midst of the carnage that is Wall Street these days, Golden Ocean Group Limited (“GOGL”) stands out as a true believer. With its share price declining along with the market and sector in general, they believe the market is discounting their shares below their intrinsic value and created a bargain. Not willing to let a bargain go by, the directors of the company acted on Monday and approved the purchase of up to a total of 27.2 million shares (10% of total outstanding shares). Acting under this authority, the company immediately purchased 2.5 million shares at an average price of NOK 25.75 per share. On Tuesday, it acquired a further 1 million shares under the buyback plan at an average price of NOK 24.63. All told, the Company holds, as treasury shares, a total of 3.5 million shares out of a total of 271.8 million outstanding or approximately 1.3%. Continue Reading

Mr. John Fredriksen Named Connecticut Maritime Association 2008 Commodore

Stamford, Connecticut – Mr. John Fredriksen, chairman, chief executive, president and director of Frontline Ltd., has been named as the Connecticut Maritime Association (CMA) Commodore for the year 2008.Mr. Fredriksen follows a long succession of influential maritime industry leaders as Commodore. Continue Reading

Shipping 2008

JOIN the shipping community at the 23rd Annual Shipping Conference and Exhibition. Shipping 2008 continues a tradition of bringing the international shipping community together in North America’s leading shipping center, for two and a half days of business and market oriented activity.