First Romance, Then Marriage

In February 2007, the A.P. Moller – Maersk Group (“APM”) entered into a co-operation agreement with Hoegh Autoliners (“HAL”) whereby APM entered its fleet of twelve car carriers into a commercial operation controlled by HAL. Yesterday, the companies took the next step and jointly announced that APM has sold its 18 car carriers, including six newbuildings, to HAL in exchange for a 37.5% shareholding in HAL. The transaction moves APM from being a tonnage provider in the car carrier market to a shareholder in a leading car carrier operator. Leif Hoegh & Co. Limited will retain their position as majority shareholder in the company.

HAL will commercially manage the combined fleet of 67 vessels globally from Oslo and about 30 locations worldwide under the HAL brand. When combined with existing newbuilding orders in place, HAL will grow it carrying capacity by 45% to 85 ships by 2012. HAL started its Ro/Ro car carrier operations in 1969. Its main customers include major manufacturers of new cars, heavy machinery and rolling goods. Last year it carried about 1.9 million car equivalent units.

Market Commentary – January 31, 2008

The confluence of a credit squeeze, fallen charter rates and ailing equity markets appears to have set off a wave of consolidation. While many have been enjoying the good times, there has been no shortage of market players looking forward to the day when vessel values would reach their peak and begin to descend. This makes vessel acquisitions more attractive, while stock prices that have fallen below NAV almost across the board are making public companies look like increasingly attractive targets.

Even brokers have been getting in on the game, as ICAP Hyde acquires Capital Shipbrokers, together with its 37 staff in London and representative and associated offices in Dubai and Beijing. Rumors also continue to swirl regarding the future of Stamfordbased MJLF. Continue Reading

Defensive Acquisition with Upside

On Tuesday, just a week after Quintana‘s press release announcing the termination of the sale process, Excel and Quintana jointly announced that Excel had, over the weekend, agreed to acquire Quintana pursuant to a definitive merger agreement whereby Quintana would become a wholly owned subsidiary of Excel. The purchase price will be approximately $2.2 billion (based upon Excel’s closing price of $33.00), including net debt of Quintana and other costs.

Under the terms of the agreement, Quintana shareholders will receive a combination of cash and stock. Each Quintana share will receive $13.00 in cash and 0.4084 shares of Class A common stock in Excel. Based upon Monday’s closing price, the offer represents a total value of $26.48 per share, representing a 57% premium to Quintana’s closing price on that day of $16.89 and a 34% premium to Quintana’s 30-day average price. The agreement provides for a cap of $31.38 based upon an Excel share price of $45.00 as well as price adjustments for dividend payments. Continue Reading

Corrections

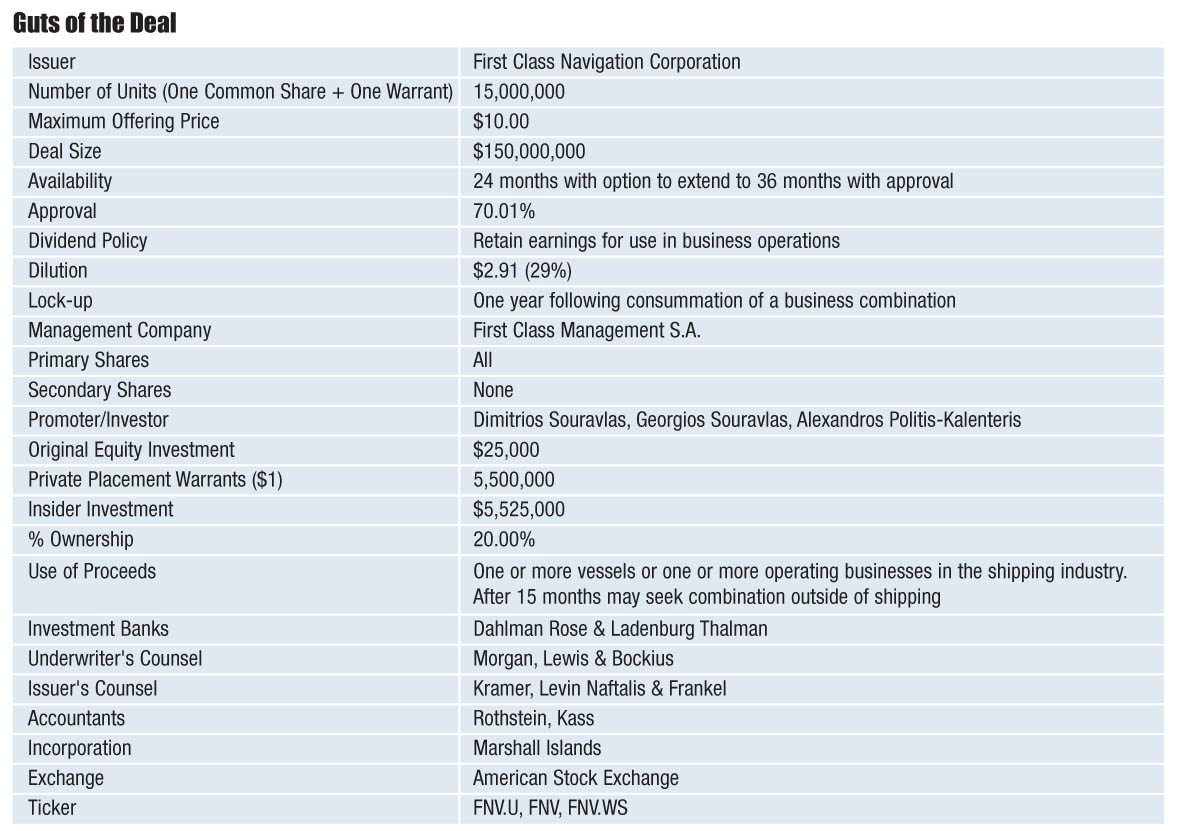

We were taken to task by Mr. Alexandros Pistiolis, First Class Navigation’s CFO for errors in last week’s issue. First, the correct spelling of the surname of the two lead principals is Souravlas. We have also revised our chart to correctly identify the sponsors. We apologize for these errors.

Certainly Not Built of Sand

According to Wikipedia, “a castle is a defensive structure seen as one of the main symbols of the Middle Ages. The term has a history of scholarly debate surrounding its exact meaning, but it is usually regarded as being distinct from the general terms fort or fortress in that it describes a building which serves as a residence of a monarch or noble and commands a specific territory.”

Investors will soon have the opportunity to invest alongside Fortress Investment Group in their commanding intermodal leasing business, as Seacastle Inc. readies itself for its initial public offering. With the assistance of joint bookrunning managers, Citi, Bear Stearns, Deutsche Bank and Merrill Lynch, the company is preparing to sell 20 million shares at a price between $15 and $17 per share. See our Guts of the Deal table (Figure 1) for the main parameters of the transaction.

Navig8 Attracts Investment from Touradji Capital

Meanwhile, Navig8 is growing and has just announced an equity investment by NY-based hedge fund Touradji Capital Management. As noted, Navig8 was founded in March of 2007 by Modi Mano and the rest of FR8’s initial management team. The company started life with an initial equity injection of approximately $50 million and currently controls a fleet of approximately 1.4 million dwt including its newbuilding program. In addition Navig8 operates across the shipping value chain, with its core expertise being in the oil products sector. It actively trades a timecharter fleet, owns and invests in tonnage, commercially and technically manages vessels for third parties and trades in the freight derivates market.

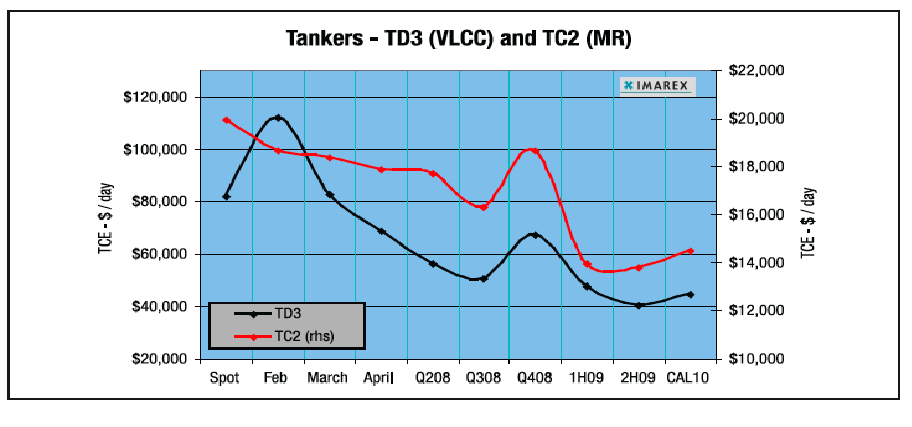

Navig8 views Touradji as a “highly-synergetic partner”. According to Group Chairman Gary Brocklesby, the fund has over $3 billion in assets under management invested in commodities and commodity-related equities. It has an office in Singapore and an important connection to Navig8 – Mark Lyons, recently a partner at Navig8, joined the investment firm to grow its Asia-based shipping and oil investing activities. Navig8 has also been in discussions with other strategic investors and is gearing up towards further expansion in the tanker and related shipping sectors.

TORM Takes Half of FR8

Some people are better than others at sharing, and TORM seems to be right at the top of the list. After purchasing OMI jointly with Teekay this past spring and splitting the assets, TORM announced this week that it had acquired a 50% equity stake in FR8 from Projector for $125 million. The FR8 Group controls 25 vessels including three LR2 newbuildings for delivery in 2008. It owns six modern product tankers, comprising four MR and two LR1 vessels and has long-term charters on three LR2, four LR1 and 11 MR product tankers, with purchase options on three of these vessels. The group also commercially manages one LR2 vessel and has about 30 staff worldwide in Singapore, London and Veracruz. The full fleet list is shown on the next page.